Еconomic uncertainty is the absence of complete information on the future path of economic activity and the economic policy stance. There is vast body of literature analysing uncertainty and quantifying its impact on the economy. Overall, according to their findings, there are three key transmission mechanisms by which an increase in economic uncertainty slows down economic activity.

- Real options channel: amid growing economic uncertainty, firms may change or postpone their employment and investment decisions and thereby reduce aggregate supply in the short run (1, 2, 3).

- Precautionary savings channel: uncertainty makes households save more to smooth their consumption over time. Lower consumption reduces aggregate demand in the short term, and this, in turn, reduces incentives to invest (1).

- Channel of imperfect financial markets: investors want to be compensated for higher risks under uncertainty. This, in turn, increases risk premiums, credit spreads, and the cost of corporate financing. Moreover, uncertainty raises the probability of default, the cost of credit default swaps, and the aggregate irrecoverable losses from bankruptcy. The role of uncertainty in the higher cost of borrowing may weigh on firms’ productivity and economic growth (1, 2).

Economic uncertainty may be caused both by economic events, such as financial market panics, aggregate supply shocks (oil shocks, bad harvests, or natural disaster shocks, such as earthquakes, floods, etc.), or by political events, including election campaigns, military conflicts, and so forth. Also, uncertainty can increase due to decisions of economic policy makers and their responses (or non-responses) to crisis events.

However, since the need to make such decisions increases in periods of uncertainty, it is almost impossible to separate economic uncertainty from economic policy uncertainty due to the endogeneity problem.

In 2016 the authors of the key academic research devoted to the impact of economic policy uncertainty on economic activity, economists Steven Davis, Nicholas Bloom and Scott Baker proposed (link in Russian) to measure uncertainty using a special Economic Policy Uncertainty Index, EPU (also known as the Baker-Bloom-Davis Index). The index is calculated for 28 advanced and developing economies, including Russia, on the basis of a textual analysis of news articles of local Internet publications

An analysis of macroeconomic indicators for 12 countries, including Russia and the US, from January 1985 through January 2015 by Baker, Bloom and Davis has shown that higher economic policy uncertainty causes drops in the industrial output index, GDP, investment, and employment. Similar findings of the effect of economic uncertainty were reached by other researchers who analysed the data of eurozone and other countries, such as Japan, Australia and Russia. For example, having analysed data for Russia for the period from October 1997 to February 2018, researchers from Vistula University in Warsaw found out that an increase in economic policy uncertainty leads to a decrease in industrial output within 1-2 months. Using data from 2009–2015 economists from the Higher School of Economics calculated that a rise in economic policy uncertainty causes a decline in investment.

Advantage of news-based analysis

Research says (link in Russian) that estimates of the increase in economic uncertainty on news-based analysis may capture changes in economic conditions that are not yet contained in other economic and financial variables. Moreover, a news-based economic policy uncertainty index is more efficient, as EPU can be measured on a real-time basis at a minimum cost for the collection and processing of the data, and it can be updated with a minimal time lag in comparison to survey- or model-based economic uncertainty indicators.

However, the Baker-Bloom-Davis Index has several disadvantages when applied to Russia. First, the news-based index is calculated using data from only one news source – the newspaper Kommersant – which may make its dynamics noisy. Second, the ‘uncertainty’ keyword category includes only the words ‘uncertainty’ and ‘uncertain’, disregarding the fact that the Russian media use terms such as ‘crisis’, ‘unpredictability’, ‘sanctions’, etc. to describe periods of economic policy uncertainty.

Given that economic policy uncertainty is usually much higher in emerging market economies than it is in advanced economies, it is crucial for Russia to have an index which identifies periods of economic fluctuations.

We have created a modified version of the Baker-Bloom-Davis Index taking Russian specifics into account. A detailed description of the methodology and the research itself were published in the latest September 2023 issue of Money & Finance Journal.

Modified index

To build our uncertainty index, we expanded the number of news sources to four: in addition to Kommersant, the index is based on an analysis of news items from Lenta.ru, RBC and Interfax published from September 1999 to February 2023 inclusive. The ‘economy’ category includes relevant word stems, enabling us to identify articles containing the words ‘economy’, ‘economic’, etc. The ‘uncertainty’ category is complemented by the keywords ‘unpredictability’, ‘instability’, ‘risk’, ‘volatility’, ‘crisis’, and ‘sanctions’. The ‘policy’ category includes two additional keywords: ‘central bank’ and ‘key rate’. All other terms related to economic policy are taken from the Baker–Bloom–Davis index: ‘policy’, ‘tax’, ‘expenditure’, ‘budget’, ‘regulation’, ‘central bank of Russia’, ‘monetary policy’, ‘CB’ (abbreviation for the central bank), ‘interest rate’, ‘law’, ‘State Duma’ (‘Duma’), ‘Kremlin’, and ‘trade policy’.

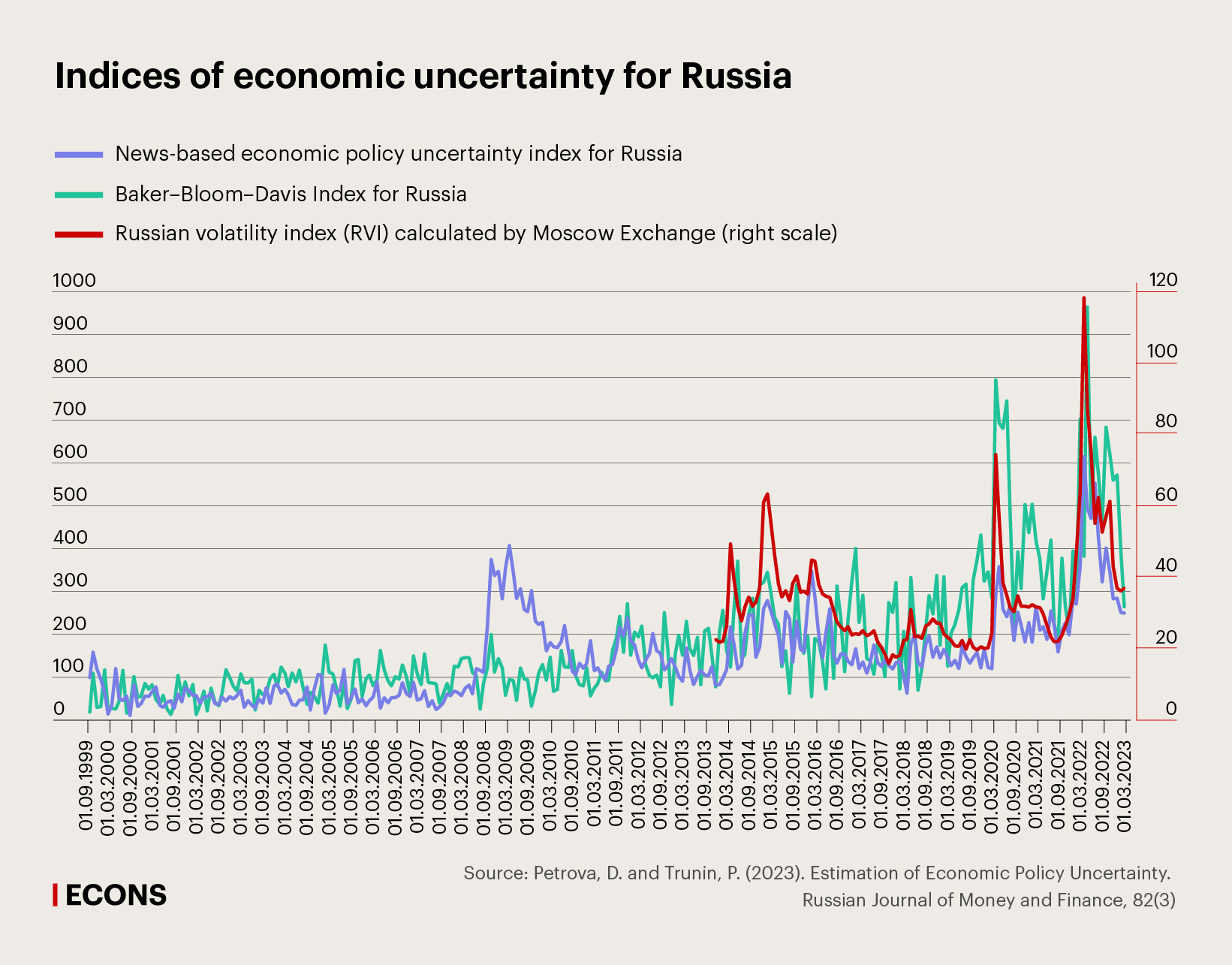

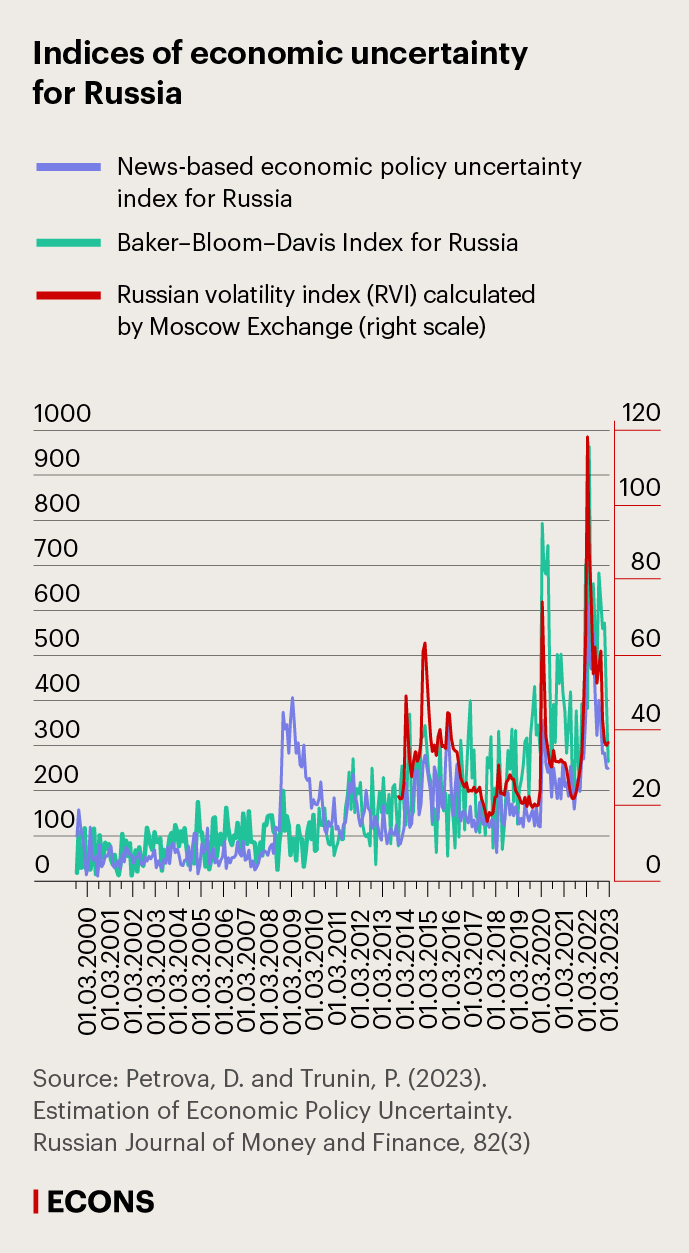

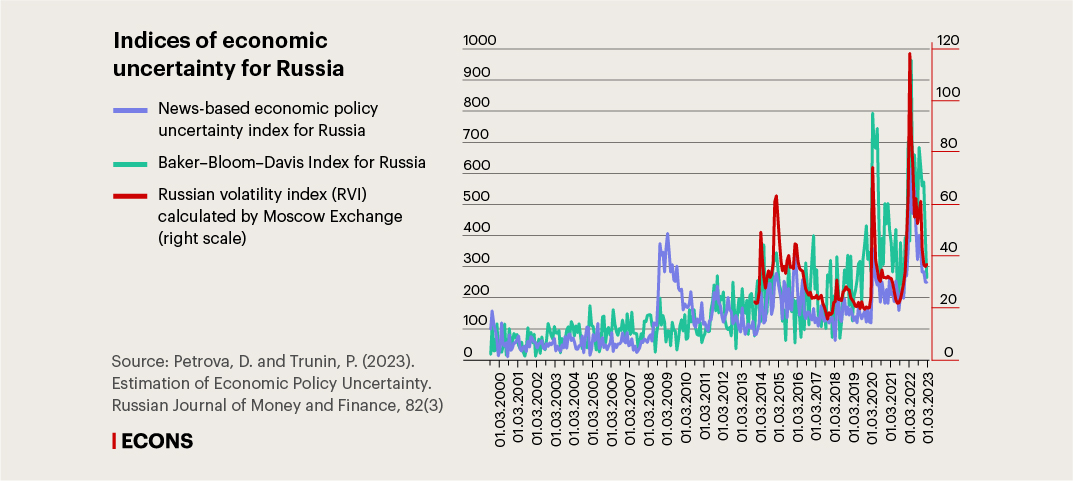

Our modified index correlates to the Baker–Bloom–Davis index, but it better captures periods of economic uncertainty (see the graph below).

The analysis revealed that the Baker–Bloom–Davis index is more sensitive to periods of political uncertainty. For example, at the start of the Russian special military operation in February 2022 the Baker–Bloom–Davis index was almost two times higher than our uncertainty index (the calculations were made on February 28, 2022), but went back down in March and only overtook our index again in April 2022. The increase in Baker–Bloom–Davis index was more significant than the increase of our new index in other periods of political instability, including the terrorist attacks on 11 September 2001 in the US and in October 2005 in the city of Nalchik, the Second Chechen War from August 1999 to May 2000, the political crisis in Ukraine in 2004–2005, before the Presidential elections in Russia in 2000, 2004, and 2012, during the armed conflict in the Donbas in April 2014. This may be due to the use of only one news source in the calculation of the Baker-Bloom-Davis index. In this regard, we believe that our index is better adapted to analyze economic uncertainty in Russia.

Based on the results of econometric analysis we have received for models with GDP and investment, including our news-based economic policy uncertainty index, it is possible to draw the conclusion that economic policy uncertainty is an important factor in economic performance. Higher economic uncertainty leads to the abandonment of new investment projects and a drop in employment, reducing aggregate supply in the short run. This conclusion is in line with the outcomes of the theoretical framework on the impact of economic policy uncertainty on the behaviour of economic agents, i.e., the real options channel.