‘Macrotelegram’: Bank of Russia Perception Index

People usually learn about decisions made by central banks through the mass media (link in Russian), rather than directly. However, news is no longer associated with television or newspapers. More and more often, people learn about world developments when scrolling through their social media feeds. The trend is global. While social media were a secondary source of news just ten years ago, they are displacing traditional media now.

In the US, for example, in 2025, social media surpassed television as the leading source of news for the first time: 54% vs 50%. A similar trend is observed in the UK. In Russia, this shift happened in 2022, with a surge in Telegram’s popularity. While its monthly reach was around 42% of the population in 2021, it went up to 74% (link in Russian) in 2025. According to MTS AdTech, in 2025Q2, Telegram was the first messenger in Russia to pass the mark of 100 million unique users per month (link in Russian). The key feature of Telegram is that it is both a messenger and a news feed, with about 70% of users not only exchanging messages, but also reading channels (link in Russian). Furthermore, according to data from Mediascope (link in Russian), 21 channels from the top 30 are about news and politics.

As a result, Telegram has become one of the largest platforms for shaping economic narratives in Russia, giving rise to the phenomenon of the so-called ‘macrotelegram’, as described by Alexey Zabotkin, Deputy Governor of the Bank of Russia, in an open discussion at the New Economic School (NES). ‘Macrotelegram’ is an information space of Telegram channels run by professional academic economists, investment strategists, macroeconomists from investment banks, and brokers. They often take differing positions, thus presenting a wide range of opinions in real time, including with regard to monetary policy. Consequently, the media space around the Bank of Russia is increasingly shaped by social media and opinion leaders.

To understand how this information space works, as well as what sentiments prevail in it and how they change, we studied 1,400 Telegram channels that write about the Bank of Russia. To determine the sentiment, we employed a range of AI methods – from basic machine learning models to transformers and LLMs (for more details on the research methodology, see our study in the new issue of the Russian Journal of Money and Finance). Understanding the structure of the information space around the Bank of Russia could help make the regulator’s communication more targeted and efficient, thus strengthening households’ confidence in monetary policy pursued and promoting a more transparent and predictable environment for all economic agents.

‘Macrotelegram’: sentiment index

Most studies on central bank communication assess the tone of messages based on the general emotional charge of the text. However, they do not usually take into account the very object of this emotional charge. We focus specifically on what is said about the Bank of Russia and how it is said, which requires more complex methods of tone assessment.

For example, during periods of economic shock, concern in the media space typically intensifies, but this does not always mean a poorer attitude towards the regulator. Thus, a message about accelerating inflation does not necessarily signify declining confidence in the Bank of Russia – what matters is how its decisions are evaluated. For instance, the news that inflation has accelerated but the Bank of Russia is taking measures to bring it back to the target is positive in terms of the perception of the Bank of Russia in the media space.

According to our estimates, neutral news without judgements prevail in the ‘macrotelegram’, accounting for around 76% of the training sample, while 15% may be regarded as negative and 9% as positive. The predominance of neutral news is a positive finding, since strong emotional distortions in the information space could give people wrong ideas about the situation in the economy.

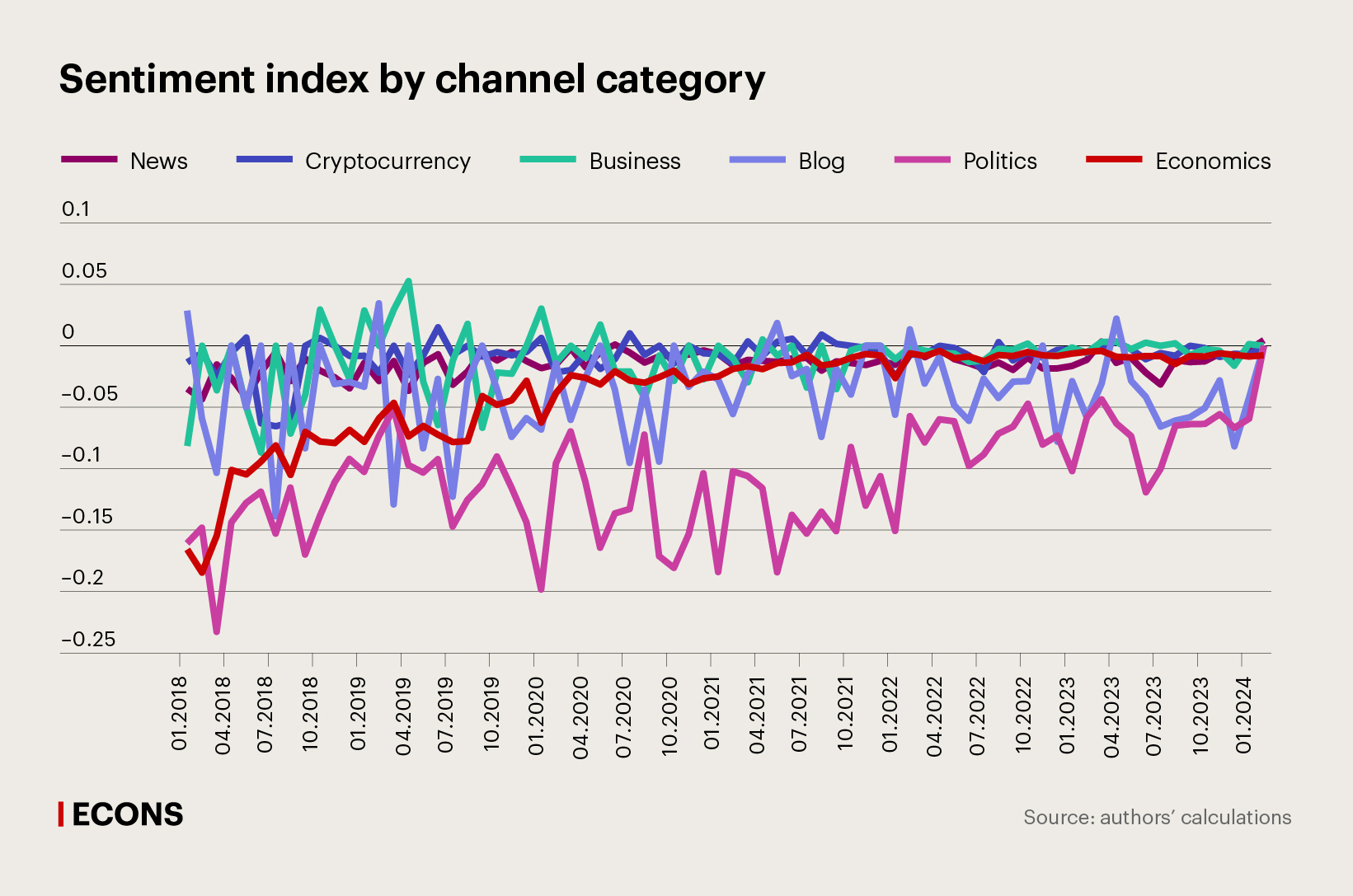

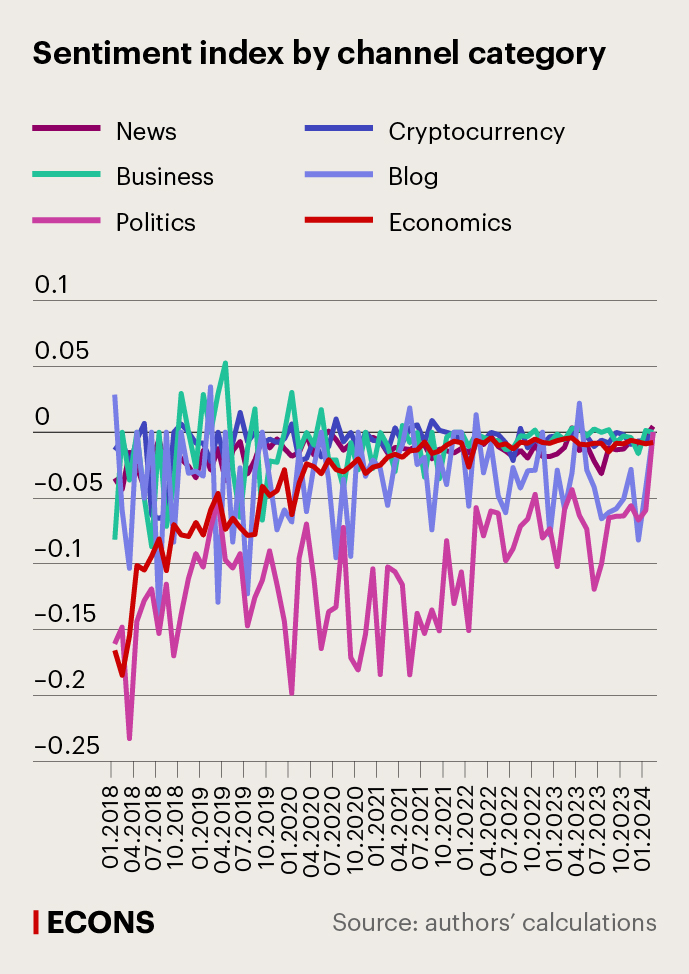

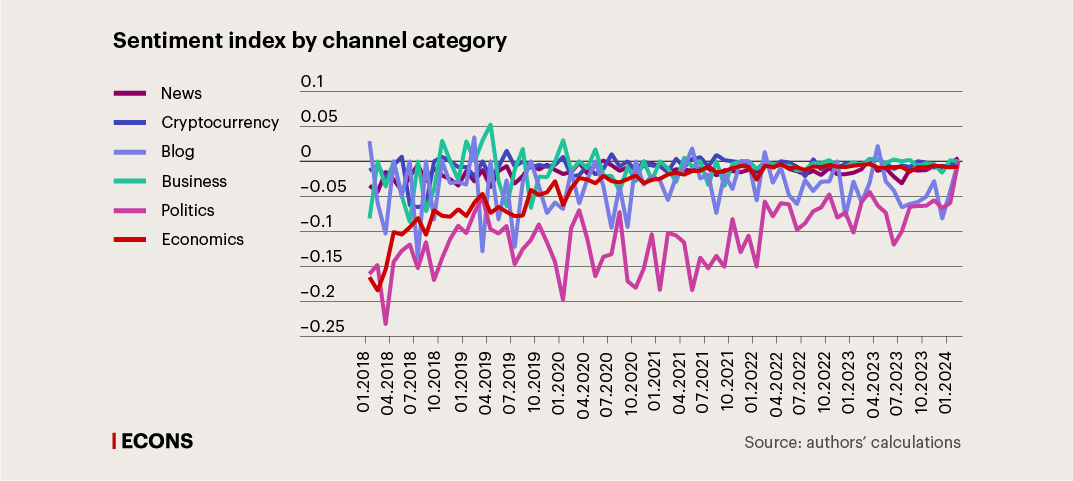

However, the background is heterogeneous, as political channels, for example, are on average more critical than economic ones. Author blogs are the most volatile group of channels in terms of their stance towards the Bank of Russia, probably because they are personalised and authors’ opinions can be more flexible. The sentiment index for economic channels is relatively stable and shows a positive trend, indicating an improvement in the perception of the Bank of Russia on Telegram in this category (see chart).

Channels’ tone can change over time. However, the stability of their attitude towards the Bank of Russia affects the efficiency of communication with them. The regulator needs to know the extent to which different channels are open to dialogue and how ready they are to revise their opinion on the policy pursued.

For example, more critical channels, which we classify into the ‘negative’ cluster, are less inclined to revise their position. Nevertheless, more than 30% of them do improve their attitude over the course of the year, becoming neutral or even positive.

Contrastingly, the ‘positive’ cluster is more volatile: only a third of the channels remain there throughout the year, with the rest primarily moving to the ‘neutral’ cluster and a small part (11–18%) even becoming negative.

This suggests a possibility of efficient communication with the ‘negative’ cluster and the need to enhance communication with those who have doubts to make the ‘positive’ cluster less changeable.

After 2022, the tone of the ‘macrotelegram’ has become more volatile. In general, however, the perception of the Bank of Russia on Telegram improved during the period under review (2018–2024).

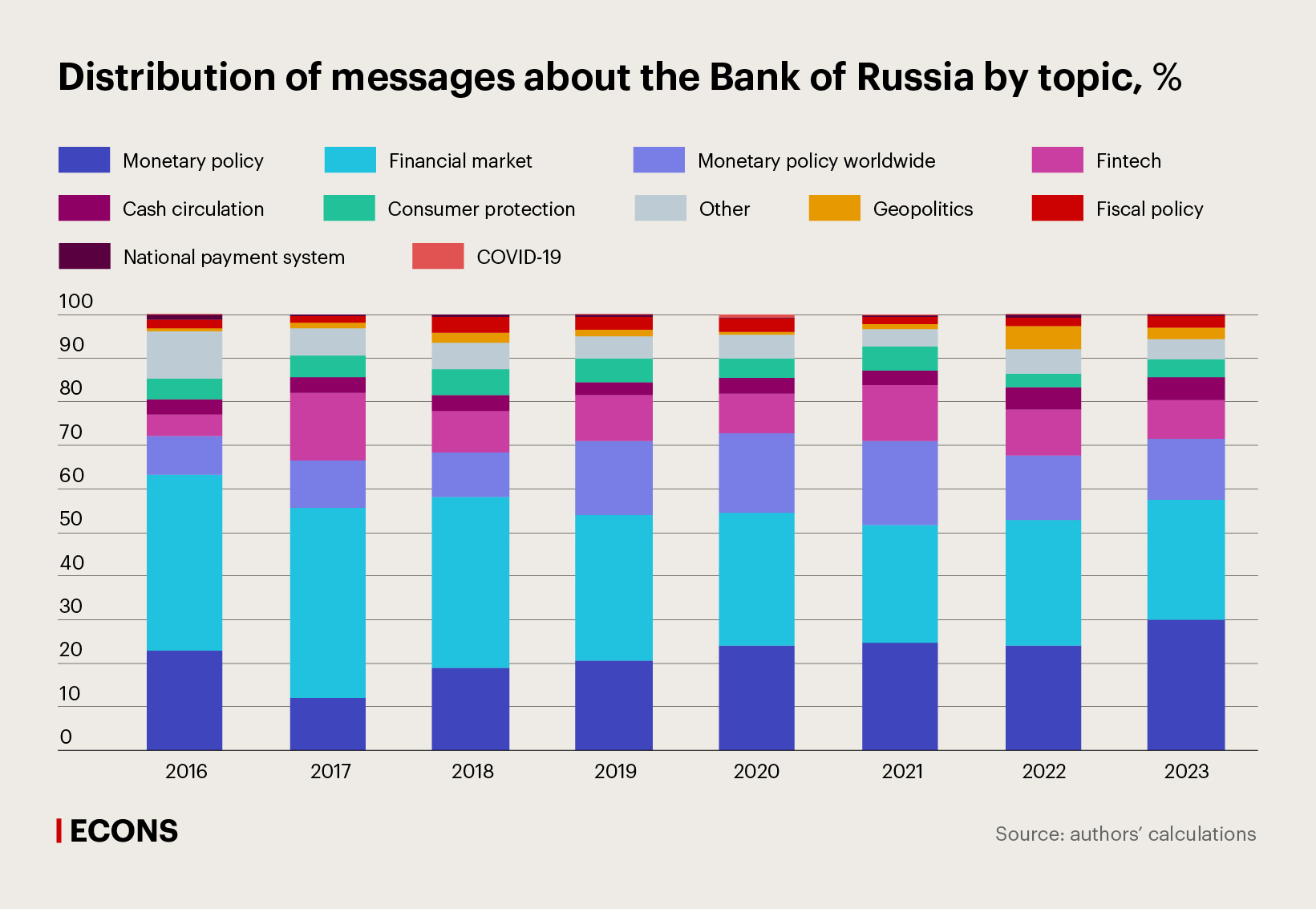

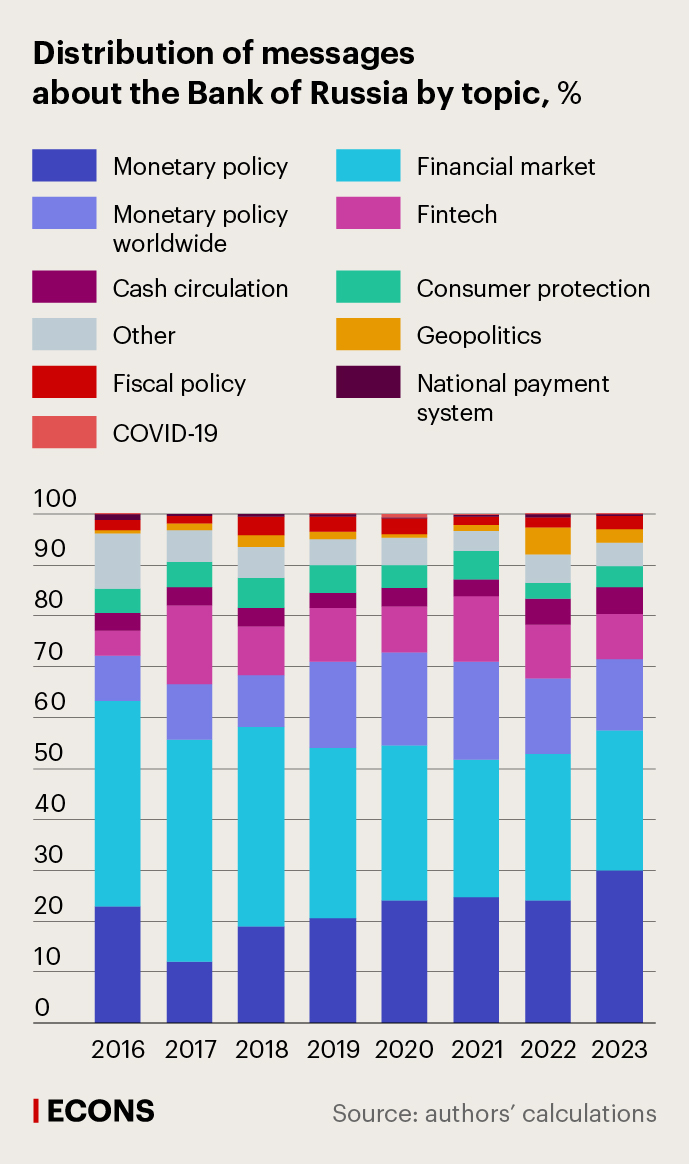

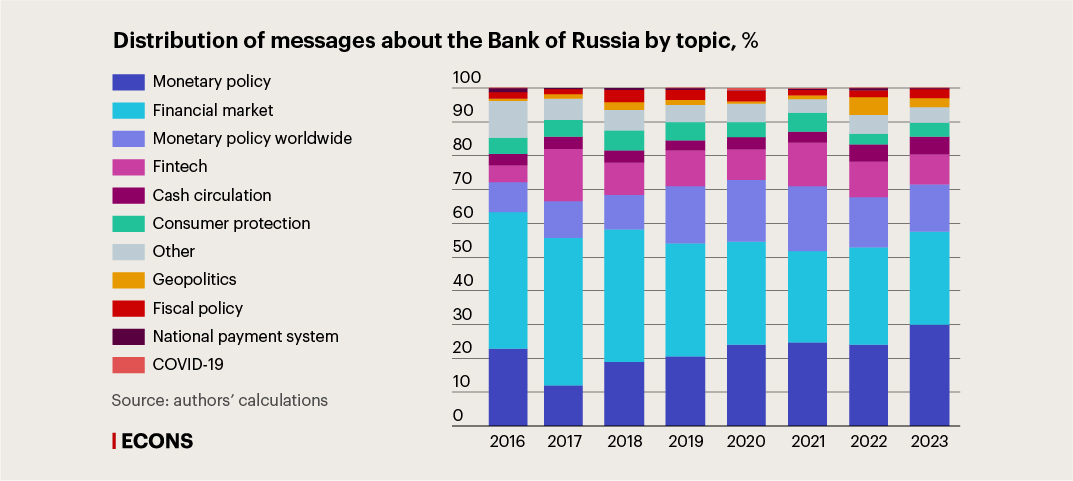

By contrast, the topic preferences barely changed, with the news about the Bank of Russia being primarily centred on two topics – monetary policy and the financial market (see chart).

We also analysed how consolidated the information space is on Telegram by calculating the reach of each channel in our sample (the ratio of views of news about the Bank of Russia in this channel to the total number of views of news on the topic of the Bank of Russia in all channels for the period under review).

It turned out that while the number of channels writing about the Bank of Russia is growing every year, in 2023, only 30 Telegram channels accounted for half of all views of news about the Bank of Russia (although, by comparison, there were only ten of them in 2020). This suggests that the Telegram information space relating to the Bank of Russia’s activity is still very concentrated, with general trends shaped by a small group of channels.

Communication: reducing the distance

Why is the audience abandoning traditional media and what does it mean for central banks?

First, the speed has changed. Smartphones have made news instantaneous: a notification from a Telegram channel pops up faster than any story appears on TV or in a newspaper.

For regulators, this is an opportunity to receive feedback in real time. Our research demonstrates how this might work in practice. Namely, we built a frequency-based trust index, which acts as a kind of ‘thermometer’, showing how channels evaluate the Bank of Russia’s actions. The annual index correlates well with inFOM’s confidence surveys (link in Russian), while offering a multi-dimensional breakdown by channel type and topic, requiring no field surveys, and providing fast results. One of the indices, calculated with a monthly frequency, correlates with businesses’ price expectations and households’ inflation expectations. The development of such tools based on social media data is one of the main areas in the high-frequency assessment of the communication effect.

Second, recommendation algorithms. With social media, it is the news that finds you, even if you had no idea you needed to know it a minute ago. This is changing consumption patterns.

Most people have never visited central bank websites before or typed ‘monetary policy’ into a search engine. Today, effective communication requires the regulator to further reduce the distance between a person and a complicated topic. For this purpose, the ideal scenario would be for the news to pop up on a smartphone screen on its own, e.g. via a blogger. Yuriy Gorodnichenko and his co-authors came to similar conclusions in a study analysing the US Federal Reserve’s communication on social media. Using Twitter (now X) as an example, they demonstrated that posts go viral owing to reposts by major accounts, subsequently spreading among their readers in a ‘second wave’.

Third, trust. Increasingly, it is put with specific individuals who are closer and more relatable to their audience than faceless media.

This is why, for regulators, integrations with bloggers are not only about expanding reach, but also about building trust capital. For example, when inflation was high in the UK after the COVID-19 pandemic, confidence in the Bank of England plummeted, particularly among young people. One response to this challenge was that the Bank of England started collaborating with financial bloggers. A TikTok video featuring Bank of England Governor Andrew Bailey with a financial blogger, where they discussed inflation and Taylor Swift, went viral. The Bank of Russia is also experimenting with this format, releasing ‘What is the Bank of Russia doing?’ podcasts (1, 2) (links in Russian), in which top bloggers ask the Bank of Russia senior managers direct questions that concern people (from ‘Why doesn’t the Bank of Russia just print more money?’ and ‘Who is to blame for the rise in cucumber prices?’ to ‘When will the key rate be lowered?’).

However, there is a flip side of the coin: opinion leaders can be wrong, distort the logic, or give bad financial advice. In the current environment where Telegram channels are the main source of information for making investment decisions (link in Russian), the presence of the original source – the Bank of Russia – in the information space is not an option, but a necessity. As we mentioned above, according to our estimates, the ‘macrotelegram’ agenda is shaped by a very small group comprising only 30 Telegram channels. The good news is that the Bank of Russia’s official channel is in this top 30. As of September 2025, it had more than 233,000 subscribers. Among other things, the channel publishes the regulator’s answers to people’s questions and launches a live discussion chat once a week with over 6,000 participants. This is an example of direct and open communication that allows people to obtain information from the original source.

For central banks, the ongoing global shifts in how people receive information mean that, first, it is time for them to start communicating differently, and, second, that there is now a powerful tool for receiving instant feedback. We can learn about how well they are responding to this challenge from social media.