Economic Activity: Bank of Russia Index

In periods of considerable and drastic changes in economic conditions, it is essential to consider large amounts of information when analysing economic activity. In this situation, the demands for the timeliness of this information also increase. One of the most important sources of information about the economic situation and the expectations of the non-financial sector is surveys of enterprises, and therefore many central banks (link in Russian), including the Bank of Russia, conduct them: these surveys supplement the official statistics and demonstrate higher frequency and timeliness.

The Bank of Russia’s survey of enterprises is quite unique in terms of coverage: around 13,000–14,000 enterprises from all constituent territories of Russia representing various industries participate in it every month (with the exception of the financial sector, which does not take part in the survey in order not to violate the principle of voluntary participation and to rule out any conflict of interest owing to the fact that companies in the financial sector are regulated by the Bank of Russia). Despite its large size, this sample remains representative by region and economic activity. Enterprises predominantly provide qualitative assessments of current key performance indicators and the changes they expect in them; in so doing, they do not need to consult their reporting forms or make additional calculations. The monitoring of enterprises is fast: it takes merely 7–10 business days to collect the responses after the end of each month.

In addition to their considerable coverage, these monitoring data have a long history: surveys have been conducted since 2000. However, earlier, only data on businesses’ price expectations were published. In May 2022, the Bank of Russia began to publish the Business Climate Index (BCI) based on its survey data. The index is a consolidated assessment of current economic activity and enterprises’ expectations of changes in it over a three-month horizon.

Every month, participants in the survey answer questions, including about their estimates of changes in demand for their products and volume of output in the past month, and about expectations of how these indices will change in the next three months. The index is derived from answers to four questions (to see the wording of all questions and types of questionnaires, please see the website (link in Russian)).

As is traditional for this type of survey, respondents are asked to choose the most suitable answer: increased, remained unchanged, or decreased. Data on the answers to each question are consolidated in a single balance: a positive balance indicates a predominance of answers for growth, a negative balance – for decline. The BCI values range from -100 to 100, representing all respondents answering ‘decreased’ or ‘increased’ to all questions, respectively.

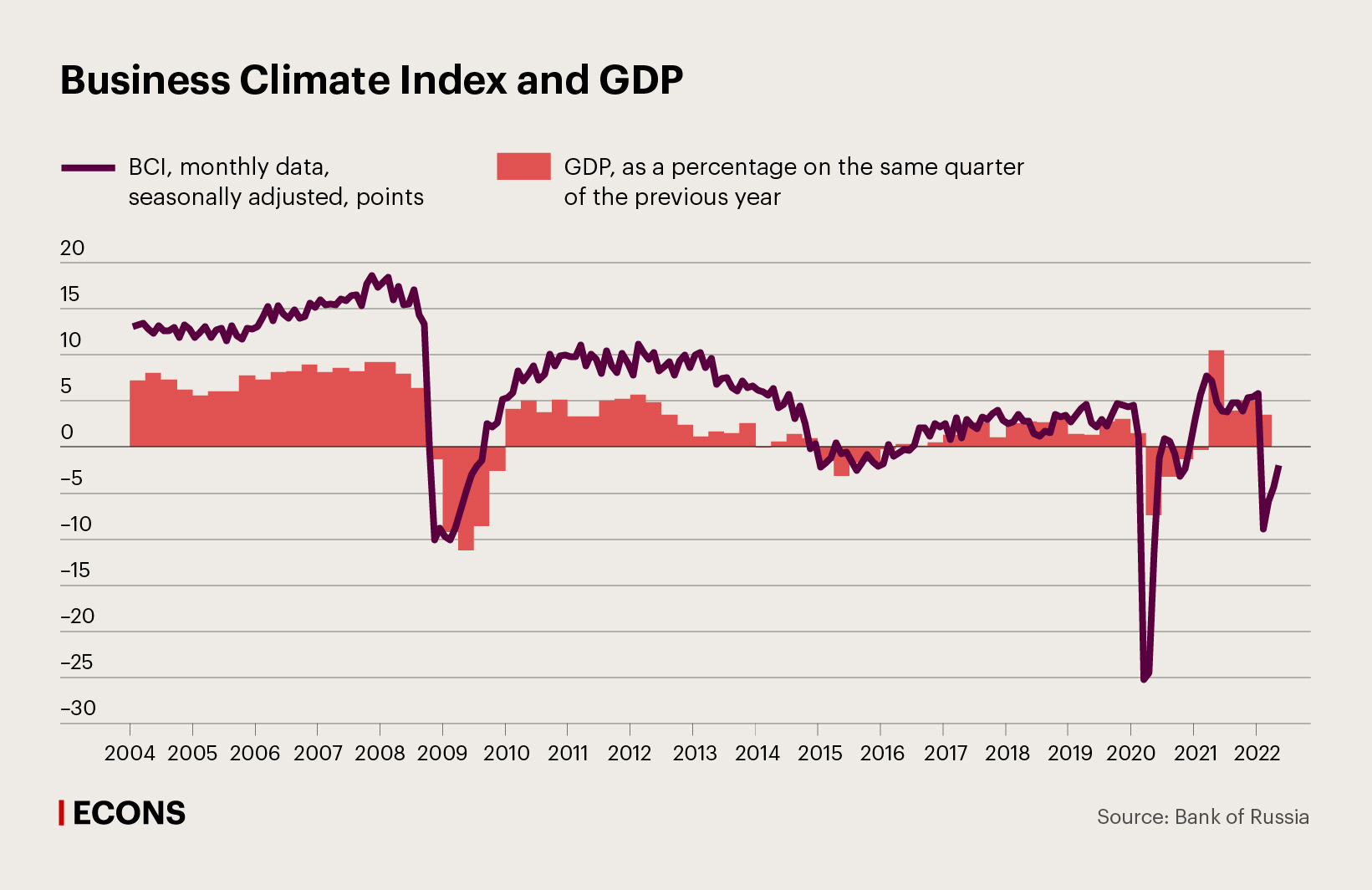

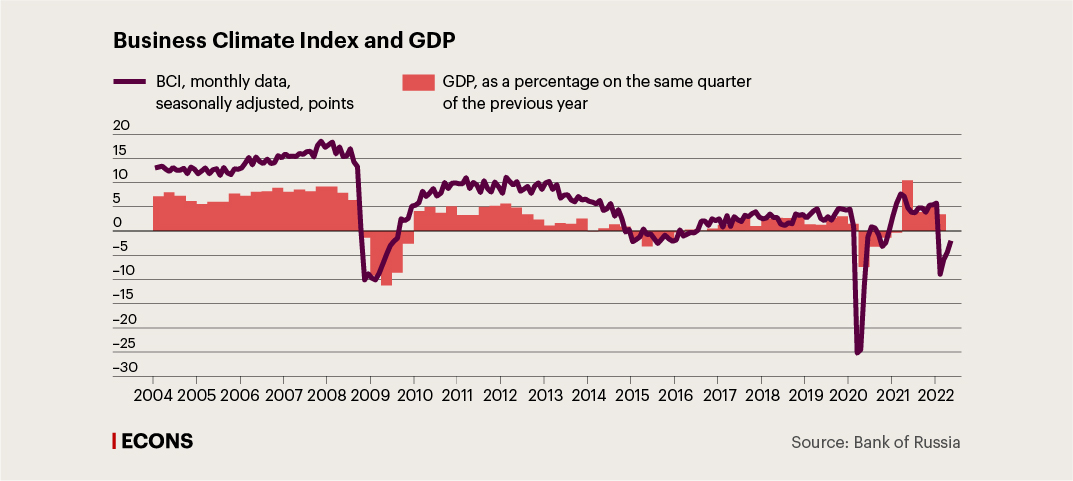

The BCI can be used as an indicator of the current situation in the Russian economy and as a leading indicator of economic activity: with a one-month lead, it displays a sufficiently high (link in Russian) correlation with GDP. It is not fully synchronised and manifests itself predominantly at the turning points in the trend, but nonetheless, this index makes it possible to assess the changes in economic activity in Russia fairly accurately (and, quite importantly, much earlier than the release of GDP data). Moreover, the representativeness of the sample at the sectoral level allows the construction of individual sectoral subindices, i.e., for manufacturing, construction, trade, services, etc.

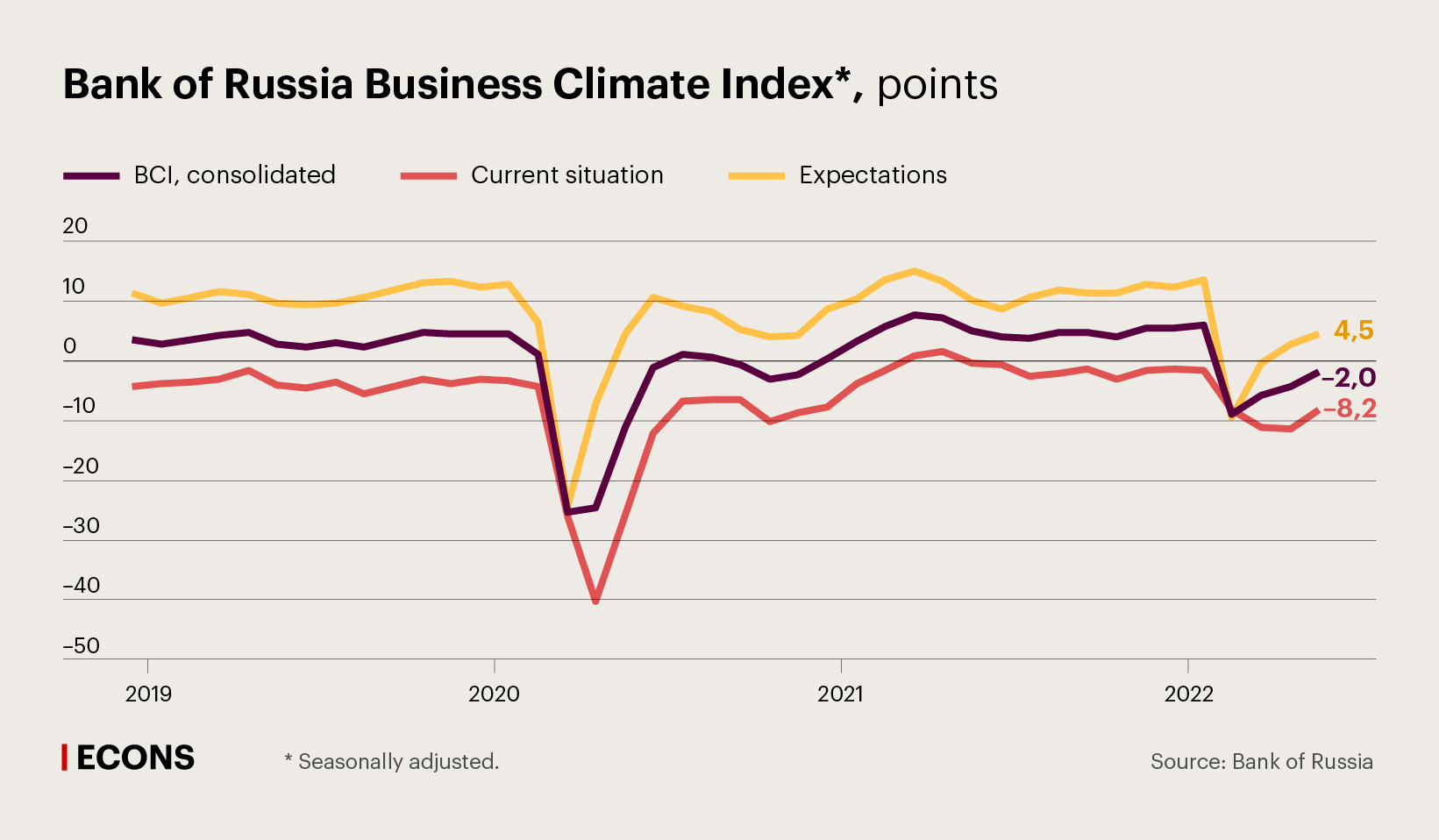

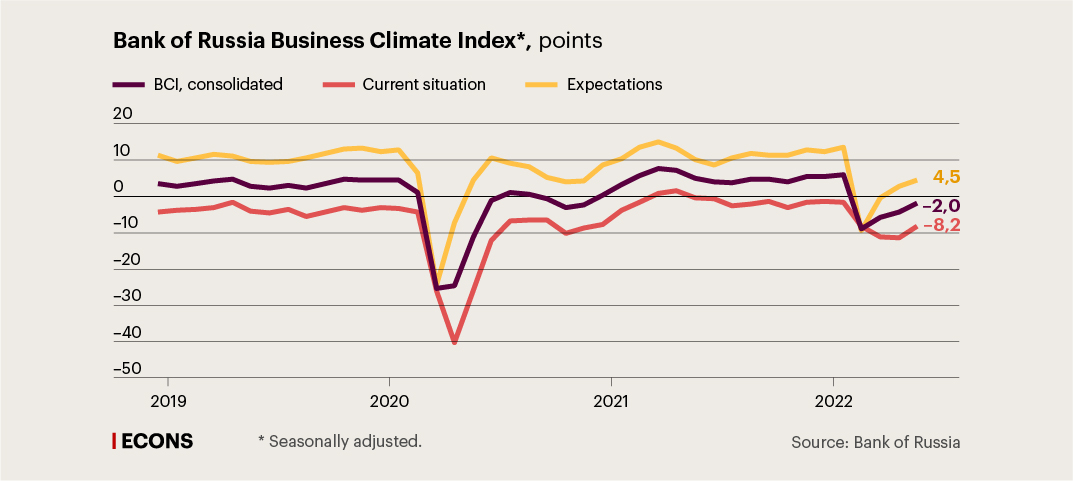

In May, the BCI continued to grow (link in Russian) (up by 2.4 points) and equalled -2.0 points. Remaining in negative territory, the BCI suggests a negative trend in economic activity, while the increase in the index implies that the pace of the economic slump is slowing.

At the same time, whereas in March and April, the BCI grew only due to companies’ expectations, in May, their assessments of current activity also improved. The current Business Climate Index rose by 3.2 points to –8.2, and the expectations index increased by 1.7 points to 4.5 points. In their comments to the survey, business representatives tended to associate the change in sentiment with a gradual adaptation to the new economic conditions and the partial elimination of certain logistical bottlenecks.

The BCI grew in the majority of activity types, most considerably in the services sector. This sector is generally characterised by a smaller enterprise size and a greater focus on the domestic market, as a result of which it has been less affected by the external sanctions and has been able to adapt quickly to operating amid the restrictions.

The BCI declined only in mining and quarrying. In May, compared to April, enterprises demonstrated a downturn in their assessments of the current situation in the industry: both output and demand for their products declined. The most positive business climate in an industry is reported by agricultural enterprises: 13.9 points. Their assessments and expectations of the economic situation are consistent with the average for the past two years.

The expectation index remains in negative territory in two business areas: in car sales, in transportation and storage. Although assessments of both the current and future situations in these areas improved compared to April, enterprises expect demand and output in their areas to continue to decrease over the next three months.

.jpg)