Instability Problems in Efficient Companies

According to research, Russia's most efficient companies are less resilient and are more likely to leave the market than low-performing ones, which stay on the market longer than other companies. This could be because, among other things, performance leaders face a high risk of becoming less competitive (link in Russian) due to insufficient investment in long-term growth factors such as innovation, new technologies, and human capital. In turn, the lack of investment may be due to the chosen competitive strategy: typically, companies choose a strategy to maximise expected profit while taking existing constraints and opportunity costs into account.

Economic conditions and the competitive environment have an influence on the choice of strategy; based on these conditions, companies may choose 1) a defensive strategy aimed at maintaining its market position through cost competition, or 2) a more aggressive strategy aimed at increasing demand for their products due to intensive factors (new products, new markets). Another, third option could be a survival strategy; these companies are usually characterised by low profitability and lack of technological modernisation, but they may continue to exist (link in Russian) in the market. As for those that choose a defensive strategy, these companies may also be leaders in their industry, distinguished by higher performance. However, their priority of cutting costs over investing in new technologies undermines their competitiveness over time.

The strategies that companies follow to increase competitiveness and performance are of particular interest to monetary policy, as they affect potential growth, i.e. the speed of economic development without increasing inflationary pressure.

Based on a survey of Russian industrial enterprises conducted by the Bank of Russia, we tried to understand (link in Russian) the extent to which companies focused on intensive growth factors in their strategies and the influence of the competitive environment and economic conditions on them. The study covers 2017–2019 and does not take into account the impact of shocks caused by the pandemic and pressure from sanctions. However, the results of the survey allow us to assess the possibilities of overcoming the problems posed in this regard for Russian industry.

Features of efficient companies

The study was based on two surveys of manufacturing companies conducted by the Bank of Russia in September 2019 and May 2020 (of 468 and 490 companies, respectively). In the preliminary stage, we grouped enterprises according to the level of productivity (calculated as the ratio of annual gross revenue to the annual average number of employees).

We ranked the 20% of companies with the highest labor productivity as leaders. The laggards (or outsiders) included 40% of companies with the lowest productivity in their industry.

Efficient Russian companies have a number of external differences from outsiders. They are on average larger, more often integrated into holding companies, more export-oriented and less state-oriented. These results are consistent with manufacturing companies’ characteristics in academic literature.

According to research in Russia (link in Russian) and abroad, one of the main factors for high labor productivity is company size, with larger companies tending to be more efficient. This is explained by the fact that large firms have better access to finance, infrastructure, and production factors and are more resilient to various shocks. Our findings also show that 78% of the top performers are large companies, while only 56% of the least efficient are.

Participation in a holding structure can also lead to higher levels of productivity due to easier access to investment funding and infrastructure, greater attention to human capital development and strategic planning, and more participation in export activities (although some studies do not confirm (link in Russian) the higher competitiveness of integrated business groups). Our research found that the share of companies consolidated into holdings among the leading firms was higher by a third (62% vs 42% among the least efficient ones).

The survey data also confirmed the findings of many empirical studies (1, 2, 3, 4, 5, 6, and 7) on the notable differences in productivity levels between exporters and non-exporters. On the one hand, only the most efficient companies can overcome the costs of entering foreign markets. On the other hand, export activities often entail companies learning and gaining access to the world's best technologies, increasing their productivity. According to our research, among the leaders in terms of productivity, 64% supplied their products in 2019 to CIS countries, 41% to non-CIS countries, compared to 55% and 25%, respectively, among low-productivity firms.

However, the scale of exports of both leaders and outsiders is small – for the majority of companies (81%) supplying abroad share of exports does not exceed 10% of the revenue. Overall, about 39% of all the surveyed companies in 2019 were focused exclusively on the domestic market.

Participation in public procurement helps the least efficient companies remain on the market. Such companies are in a less competitive environment with less incentive to improve their performance. The survey data correlate with these findings: low-productivity companies are 1.6 times more likely to be involved in public procurement (40% compared to 25% in the group of leaders). This may be partly due to the fact that the state contracts set prices low, minimising profitability. Consequently, firms have fewer economic opportunities for intensive growth (to hire more expensive qualified staff and introduce innovation), resulting in lower productivity. Combined with cost pressure, this can lead to losses.

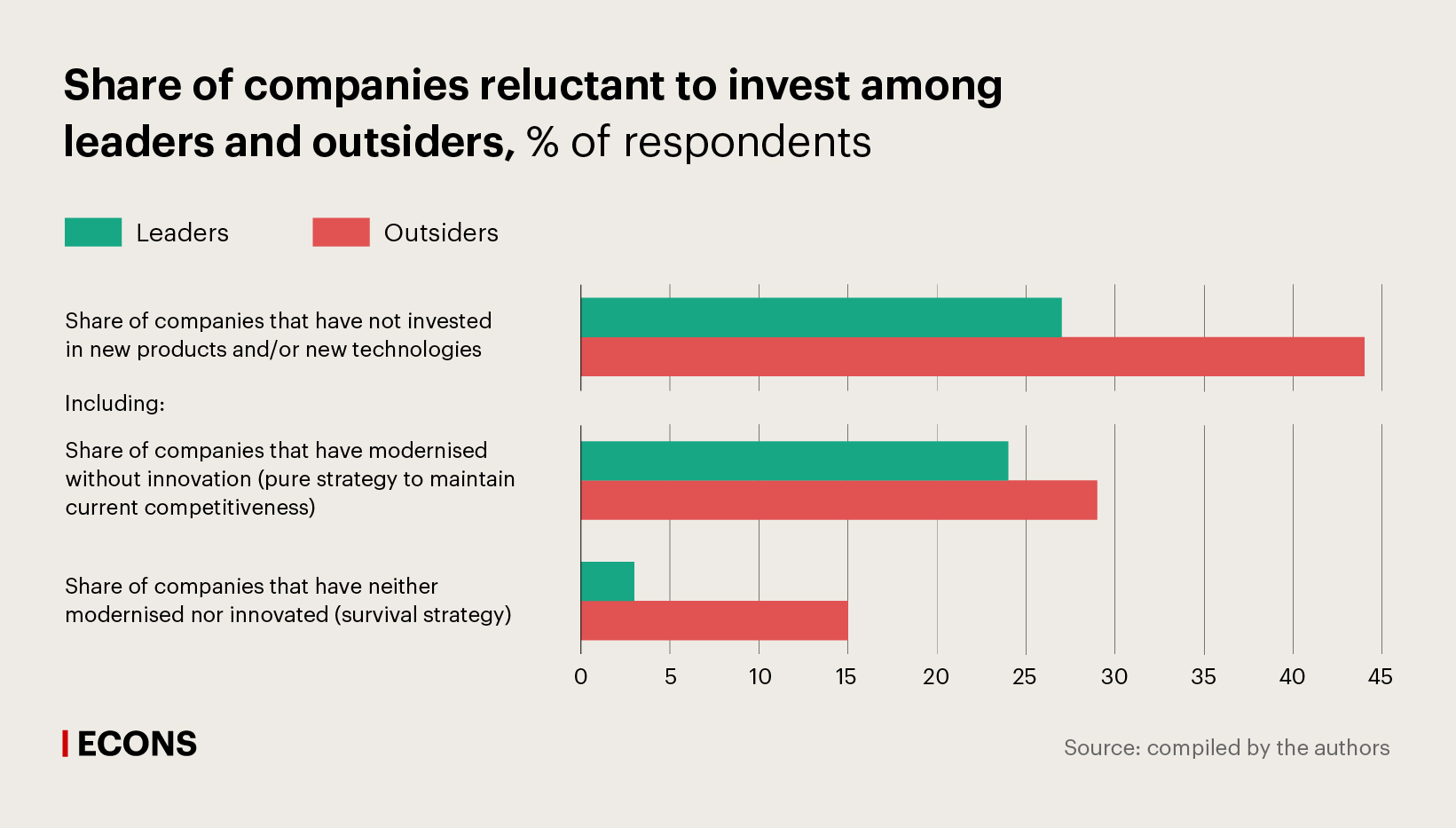

Productivity leaders and underperforming firms showed varying levels of commitment to innovation and organisational transformation (both of which provide a sustained competitive advantage). Overall, less than half of the companies surveyed invested in developing and launching new or improved products, and just over a third invested in developing and implementing new or improved technologies. However, in general, between 2017 and 2019, about 73% of high-performing companies were involved in innovation (technologies, products) compared to 56% of low-performing companies. But the fact that more than a quarter (27%) of top performers are reluctant to innovate poses a risk to their future competitive viability. About 24% of these companies postponed long-term investments in innovation, preferring to maintain their current market position. The remaining 3% lacked innovation as well as modernisation costs at all.

The scale of investment in innovation matters, but the survey does not provide this data. Results from other studies show (link in Russian) that funding for R&D must be high in order to impact labour productivity dynamics.

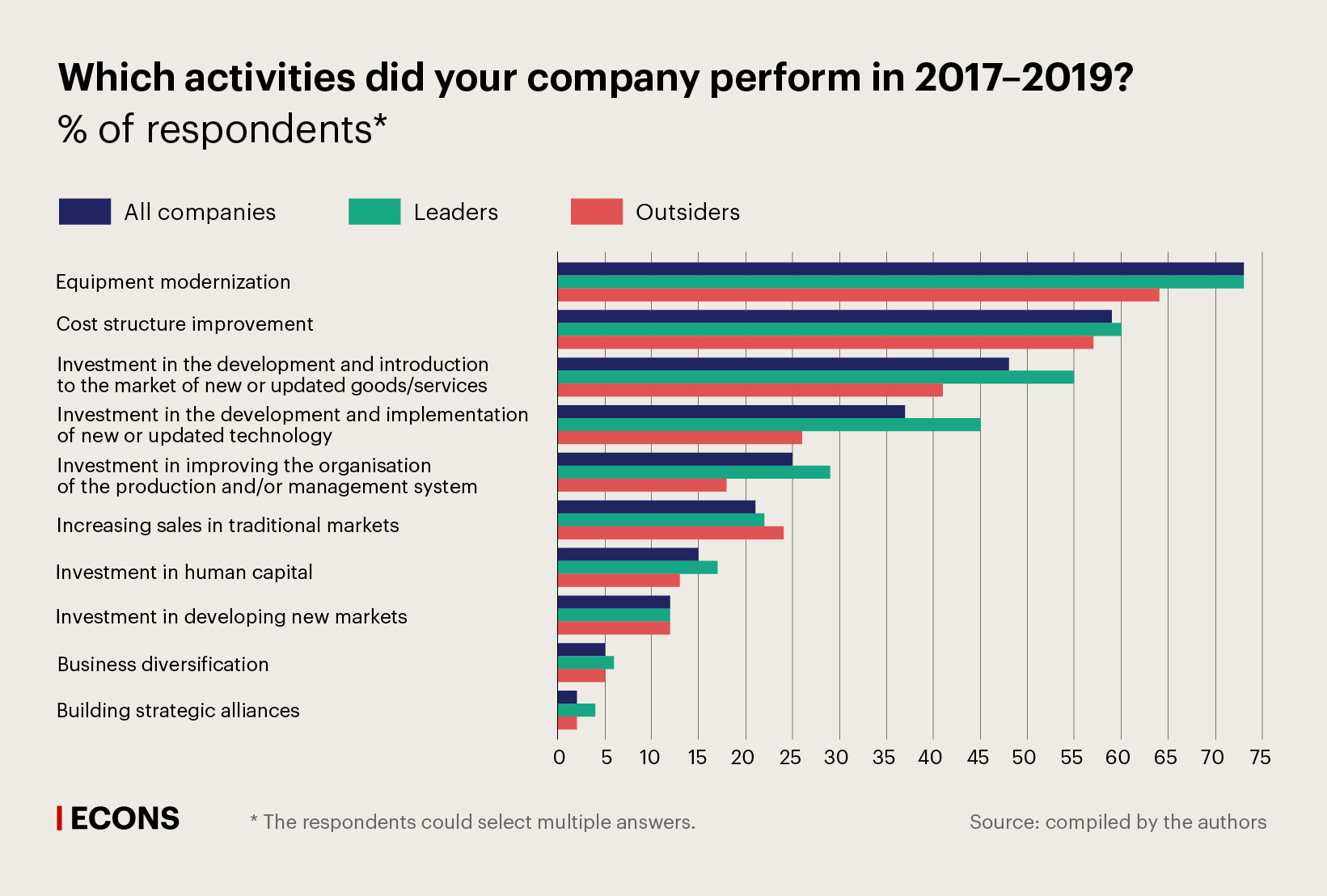

As research shows, another important factor for a company's sustainable competitiveness is investment in intangible assets: human and organisational capital (management methods, strategic planning). Based on the survey data, such investment was of less importance for Russian firms – both among leaders and outsiders. Thus, only 29% of leaders and 18% of outsiders invested in improving the organisation of their production and management systems, and in their employees’ knowledge, skills, and abilities: 17% and 13%, respectively.

In order to adapt to the market conditions of 2017–2019, the behavioural model of industrial enterprises mainly focused on equipment modernisation and cost structure optimisation (see chart below). Nevertheless, fixed capital renewal issues were equally acute for leaders (73%) and outsiders in terms of productivity (64%).

Obviously, modernising equipment increases the efficiency of production. However, such investments tend to be short-term rather than long-term competitive advantages. Cost optimisation to maintain current competitiveness levels, primarily based on low costs, was followed by 60% of the leading companies and 57% of the least productive ones.

Regression analysis showed that the role of factors related to innovative and organisational capabilities is not decisive in terms of giving a competitive advantage to Russian industrial enterprises. This indicates that companies are only slightly focused on strategies to sustainably improve their competitiveness through investments in innovation and organisational flexibility. A high proportion of the best-performing manufacturers pursue strategies to maintain their market position that does not ensure the sustainability of their competitive advantage over the long term. This behaviour may be related to the competitive environment and economic conditions.

Companies and competition

The survey found that there was no serious competition from imports in 2019. Russian firms were mainly competing with each other, which limited incentives to intensify production. Thus, a third of all respondents cited robust competition with other domestic companies (33% of the total sample, as well as 43% of leaders from the top 20% in terms of performance and 35% of outsiders from the lowest 40% in performance), another 48% rated it as moderate (42% among leaders and 46% among outsiders). Concurrently, competitive pressure from foreign manufacturers of similar products was either weak or non-existent – in relation to competition with firms from non-CIS countries, this was noted by almost half of all survey participants (45% of the total sample, 53% of leaders and 43% of outsiders), and with firms from CIS countries – by more than a half of respondents (54% of the total sample, 50% of leaders and 52% of outsiders).

The lack of significant competition from imports suggests that many industries cannot quickly replace imports withdrawn due to sanctions with similar or comparable domestic products, or this will require a significant change in consumer preferences in the absence of choice, such as lower requirements for quality, reliability, ease of use, etc. In such cases, it seems best to replace the withdrawn imports with other supplies by, among other things, parallel import channels, or importing goods from other countries.

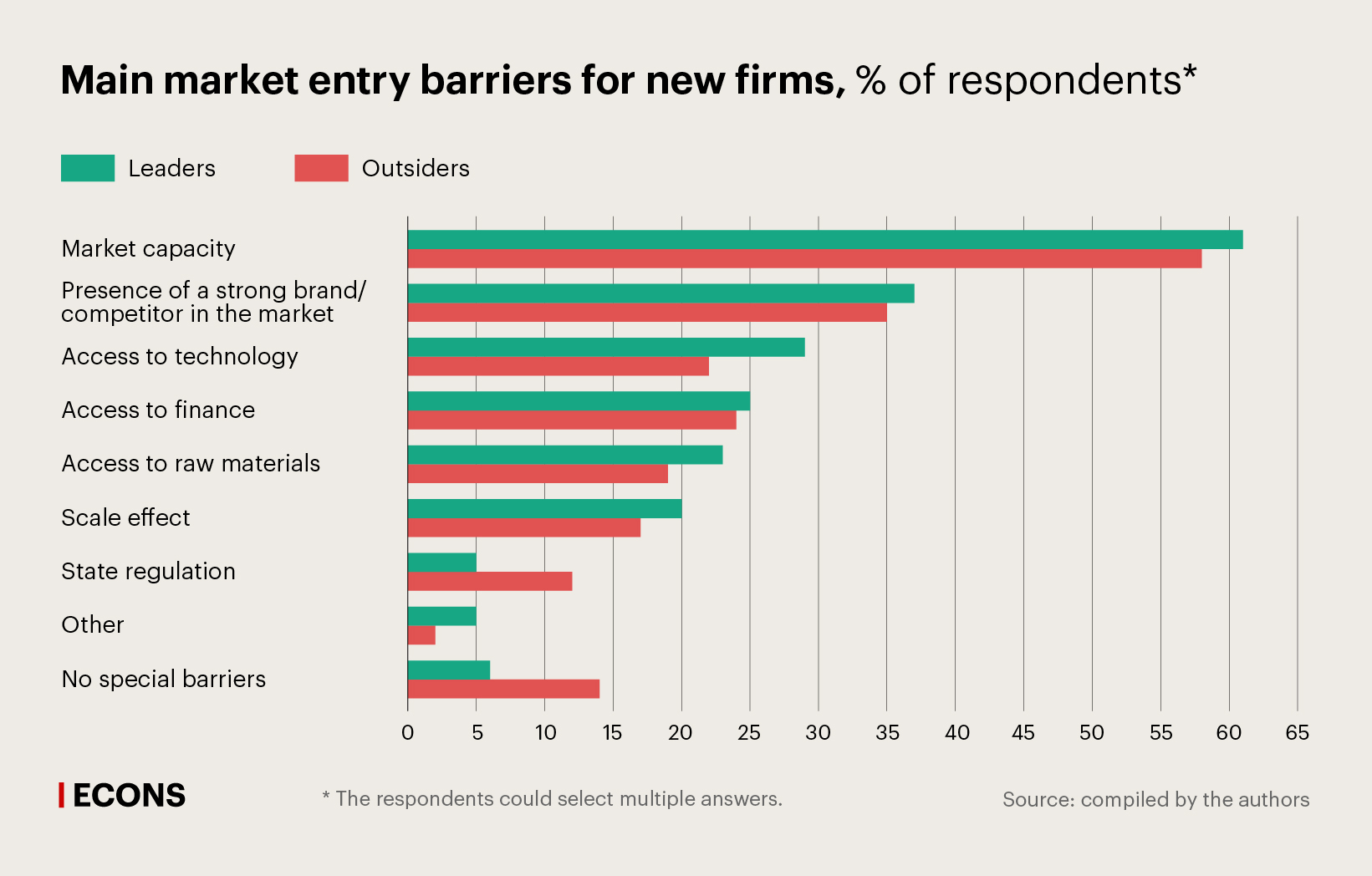

Almost all survey participants (90%) at the time of the survey believed that there were barriers to entry for new firms into the industry, with the ability of new firms to enter the market perceived by the most and least productive companies in much the same way. The companies cited market capacity as the main barrier to entry for new players (61% of leaders and 58% of outsiders). Since there is limited room for sales expansion, there is no incentive to improve productivity through technological and organisational innovation.

The presence of a strong brand or competitor in the market is the second most important barrier (for 37% of leaders and 35% of outsiders). Dominant firms typically have a cost advantage through access to resources and infrastructure. For all other companies in such situations, the main task is always to optimise their cost structure (in our case, this is one of the most common behaviour strategies for both leaders and outsiders). While this contributes to maintaining the current level of competitiveness, it does not guarantee long-term growth rates. Dominant firms in near-monopoly positions are not distinguished by investment dynamics either, and their high labor productivity is achieved due to price factors.

Barriers to entry for new firms can be seen to protect incumbents from competition by reducing incentives for innovation and long-term productivity goals and extending the life of underperforming firms.

Economic conditions

In addition to competition, companies face economic, political, legal, geographic, and other factors that influence their behaviour patterns. We asked survey participants to specify what external conditions they need to grow. The top three items included reducing the tax burden (37%), accelerating growth in the Russian economy (30%), and reducing economic uncertainty (30%). However, this has very different meanings to top performers and outsiders.

For development, high-performance enterprises needed, first of all, to accelerate their growth in the Russian economy (41%) and reduce economic uncertainty (33%). Some areas of development, such as creating and implementing new products and technologies, or developing new markets, typically require significant financial expenditures, so in the case of weak or unsustainable economic growth, companies are deterred from investing , it are deterred from investing in high-cost and long-term projects.

The economic uncertainty factor typically appears as one of the main obstacles to business growth in many Russian studies using business survey data. However, our survey shows that companies attach different meanings to the term “uncertainty.” High-performance companies associate uncertainty primarily with the impact on the economy of potential political and social instability (44%). Less competitive companies attribute uncertainty mainly to the deviation of actual results from business expectations (47%). However, these companies are less susceptible to foreign trade issues (sanctions, trade restrictions, etc.), as they are less involved in export activities and less dependent on imports for their supply of raw materials and equipment.

Rising geopolitical tensions in 2022 will therefore have a negative impact on business confidence, especially among the best-performing companies. These companies are expected to become leaders in structural change. But their waning entrepreneurial spirit against a tense geopolitical backdrop could lead to a significant slowdown in structural change in the Russian economy.

Negative trends in the years leading up to 2019 (2014 sanctions consequences, trade wars, and global market uncertainty, weak dynamics in key macroeconomic indicators) could affect the development strategies of the most productive companies. Companies were forced to focus on maintaining their market position instead of developing and displaying their internal competitiveness (innovation, improvement and better management) that could provide a basis for sustained productivity growth in the future.

Another business survey (link in Russian) conducted by the Bank of Russia in the spring of 2019 showed that the weak investment activity of businesses in 2016–2018 was associated mainly with non-financial factors, first of all, with increased uncertainty about future economic conditions. Companies sought to implement projects that would provide a quick return on investment, without paying due attention to long-term planning. Weak competition in the market is an additional factor that discourages companies from investing.

This explains the behaviour of leading companies, which, in the face of uncertainty and low competition, have reduced incentives for innovation and organizational flexibility, which provide the basis for future productivity growth and ensure the sustainability of competitive advantages over the long term. Conversely, high barriers to entry allowed outsiders to remain in the market, hindering the expansion of the most efficient firms.

The findings indicate that in 2017–2019 the behavioural models of Russian industrial companies were focused primarily on defensive strategies – upgrading equipment and optimising their cost structure. Even among the most productive companies, a high proportion (27%) are reluctant to innovate, having invested in neither technology nor new products in the three years surveyed. To a lesser extent, companies invested in new market development and human capital. This pattern of behaviour poses certain risks to the long-term sustainability of efficient producers and potential output in the future.

Inadequate attention by leading companies to the use of intensive growth factors occurred because a significant portion of them were in domestic markets with high enough barriers to entry to ensure protection from competition. This reduced incentives to be competitive, kept outsiders in the market, and prevented the most efficient firms from expanding. Another factor that reduced incentives to be more efficient was the lack of serious import competition, as Russian industrial companies competed mainly with each other.