Russia's National Priority Project in Housing: Problems and Risks

The Russia's National Priority Project for Housing and the Urban Environment is a part of the official development program announced by the President back in 2018 on the day of his inauguration. The program includes six National Priority Projects, the one in housing intends house-building to reach a record high of 120 million sqm per annum by 2024 (+30% compared to the 2018 level). Implementation of these ambitious plans could face some constraints from both the supply and the demand side of the housing market, according to the analysis (in Russian) of the Bank of Russia Research and Forecasting Department.

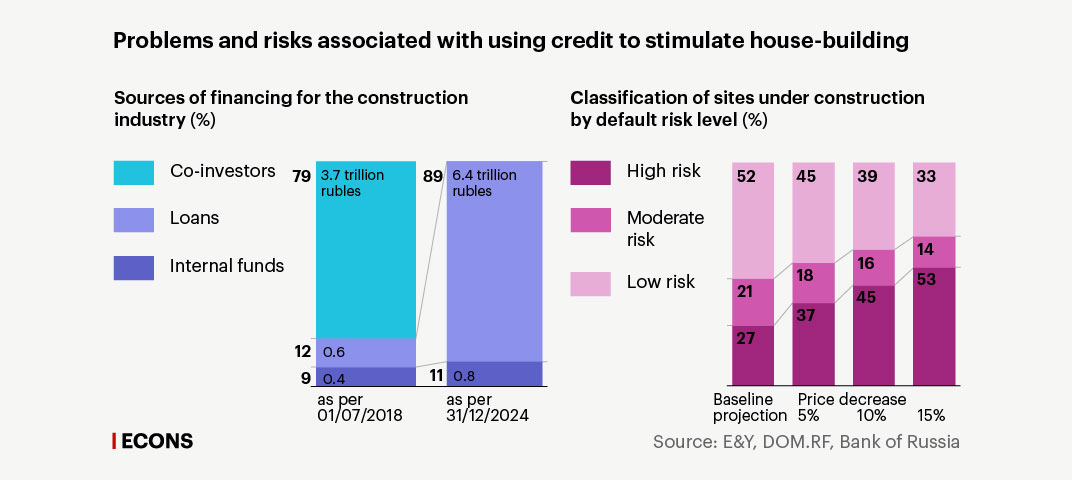

Problems and risks associated with using credit to stimulate house-building

Sources of financing for the construction

industry (%)

Classification of sites under construction

by default risk level (%)

Loans

Moderate risk

Co-investors

High risk

Internal funds

Low risk

39

52

45

33

79 (3.7 trillion rubles)

89 (6.4 trillion rubles)

14

16

18

53

21

45

37

27

12 (0.6 trillion rubles)

11 (0.8 trillion rubles)

9 (0.4 trillion rubles)

Baseline

projection

5% price

decrease

10% price

decrease

15% price

decrease

as per 01/07/2018

as per 31/12/2024

Source: E&Y, DOM.RF, Bank of Russia

Sources of financing

for the construction industry (%)

Classification of sites under

construction by default

risk level (%)

Co-investors

High risk

Moderate risk

Loans

Low risk

Internal funds

79 (3.7 trillion

rubles)

89 (6.4 trillion

rubles)

52

45

39

33

14

16

18

53

21

45

37

27

12 (0.6)

11 (0.8)

9 (0.4)

Baseline

projection

5% price

decrease

10% price

decrease

15% price

decrease

as per 01/07/2018

as per 31/12/2024

Source: E&Y, DOM.RF, Bank of Russia

Sources of financing

for the construction industry (%)

Co-investors

Loans

Internal funds

79 (3.7 trillion rubles)

89 (6.4 trillion rubles)

12 (0.6 trillion rubles)

11 (0.8 trillion rubles)

9 (0.4 trillion rubles)

as per 01/07/2018

as per 31/12/2024

Classification of sites under

construction by default

risk level (%)

High risk

Moderate risk

Low risk

33

39

52

45

14

16

18

53

21

45

37

27

Baseline

projection

5% price

decrease

10% price

decrease

15% price

decrease

Source: E&Y, DOM.RF,

Bank of Russia

Supply constraints

This house-building project is being launched at a time when the construction industry is shifting towards a credit-financing model aimed at resolving an important social problem by minimizing buyers’ risks in the primary housing market. This shift will push developers and contractors with poor financing out of the market, a process which is unlikely to be smooth, potentially resulting in medium-run supply contraction unless additional measures are taken to improve the industry’s efficiency.

Construction project financing might face credit constraints. Banks will have to increase housing lending by a factor of more than ten over six years. As a result, the construction industry will become banks’ single biggest borrower, and banks will bear the industry’s credit risks. Unless the industry’s financial condition improves significantly, credit injections might have a negative impact on the banking system’s stability and generate risks for depositors.

The low creditworthiness of the construction industry makes it difficult to increase house-building during adaptation to new sources of financing. In banks’ loans portfolios, loans granted to construction companies have the lowest credit quality: for example, on April 1, 2019, the arrears rate of loans granted to construction companies was 21.7%. DOM.RF estimates that only 64% of construction projects would meet banks’ loan requirements, while the rest have ‘poor’ or ‘fair’ creditworthiness (they account for about 40 million sqm of the 130 million sqm under construction). The shift to the new financing model will increase construction costs (by an estimated 10%), which could put 45% of construction projects at risk; its effect is therefore similar to the effect of price decrease (see the chart).

The planned increase in house-building is constrained by industry resources. The capacity utilization rate in construction reached its peak in recent years (64.8%) in 2015, when the multi-family housing delivery rate was at its highest since Soviet times, but since 2016, the delivery rate has been going down. 2017 saw the highest consumption of fixed capital by large and medium enterprises in a decade (52.1%). Given that the capacity utilization rate was at its highest in 2015, the potential increase in the delivery rate cannot exceed 50 million sqm a year, while the Priority Project assumes that the delivery rate will increase by 54.8 million sqm in 2019, 64.9 million sqm in 2020, and 80 million sqm by 2024. Construction growth can be achieved only through new capacity, which requires time and money.

If the supply of new housing plummets during the industry’s shift to new financing conditions while demand rises due to large-scale mortgage subsidy programmes, housing prices could soar.

Demand constraints

The Project’s goals presuppose a stable or even increasing mortgage growth rate. However, firstly, mortgages will primarily drive demand in the secondary housing market, rather than the primary one. Secondly, further rapid mortgage growth without accumulated financial stability risks and excessive household debt is achievable only if household income growth accelerates significantly at the same time as consumer credit growth slows and consumer credit interest rates decrease.

Mortgage boosting might lead to higher demand in the secondary housing market, rather than the primary one. For the 2024 goal for house-building financed by mortgage loans (53 million sqm) to be attained, mortgage debt would have to grow by at least 22–23% each year for six years, while one third of all mortgage loans would need to be granted to buyers in the primary housing market (28% in 2018). The National Priority Project intends that mortgage loans granted to buyers in the primary housing market will account for 50% of all mortgage loans. In fact, the share of these loans could remain the same or even shrink, as greater access to mortgages shifts demand to secondary housing. In 2018, almost 56% of real estate transactions in the primary housing market and 49% in the secondary market involved mortgage loans, but the share of such transactions in the secondary housing market is soaring: in 2018 it grew by 43% in comparison with 18% for the primary housing market.

Housing prices will grow faster than household income. This could create a natural limit on housing price growth. The National Priority Project assumes that housing prices will grow by 6% each year on average (and by 9% in 2019–2022), significantly more than the expected inflation and household income growth rates over the period. If housing prices grow faster than household income, some potential buyers will be unable to afford housing. For example, in terms of mortgage payments, the gains of a 1 p.p. decrease in mortgage interest rates (from 10% to 9%) would be offset by a 6% growth in nominal housing prices. Moreover, if housing price growth exceeds the inflation rate, mortgage down payments will become rather large.

Household debt might increase significantly. If the current mortgage growth rate stays the same or increases, aggregate consumer loan payments might rise from 10% of income to 11% in 2024 (if the number of non-mortgage consumer loans does not grow and the average interest rate for consumer loans decreases by 2 p.p.), thus exceeding the 2014 record, when household debt reached 10.2% of income. This will either result in even lower savings, or else harm consumer demand growth. To keep household debt at its 2018 level, in 2019–2024, real household income would have to grow by almost 4% each year on average, double the Ministry of Economic Development of the Russian Federation’s estimates.

The projected scale of housing acquisition financed by the buyer’s own means looks unlikely. The Project’s benchmarks suggest that the population’s own resources will boost house-building by 30% over the next 6 years. According to the Ministry of Economic Development of the Russian Federation, over the next six years (to 2024), cumulative growth in disposable income will amount to 12.7%. The projected growth of solvent demand for housing requires accelerated savings growth, which is hardly probable, especially given the projected increase in mortgage household debt, as mortgage debt servicing will reduce the population’s ability to save.

Effective demand for mortgages is on the decrease. In the first quarter of 2019, mortgage loans with low down payments (10–20%) accounted for 40.6% of all new mortgage loans granted, compared to 28% earlier. This suggests that mortgages are becoming accessible to less well-off groups.

On average, in 2018, the number of housing units exceeded the number of households, amounting to 1.1 housing units per capita without significant regional differences. This ‘excess’ in flats can be attributed to the underdeveloped rental market: it can take flat owners years to sell the flats they bought as an investment, during which time the flats stand empty, reducing the available housing stock. If the market was more developed and confidence in leases was higher, housing would be more effectively redistributed from those with surplus to those in need (including via mortgages) without generating additional demand in the primary housing market.

Boosting mortgages might exhaust demand for primary housing within the next seven to nine years. According to VCIOM and DOM.RF, in 2018, about 15 million households in Russia expressed interest in taking out mortgages to purchase flats within the next five years, while only 5.6 million would still have been interested if the mortgage interest rate was 8% (the Project reference rate). Given the projected housing delivery rate, demand for mortgage loans could be exhausted as early as 2026–2028. Without new sources of demand, housing prices and construction will slump when the National Priority Project comes to an end.

Demand for primary housing has some growth potential in regions where dilapidated and hazardous housing accounts for a large proportion of housing stock. Renovation programmes funded by subjects of the RF could support both demand and supply in the primary housing market, but the majority of Federal subjects do not have sufficient resources to fund these programmes.

It is crucial that measures are set out to mitigate both demand and supply constraints. Less regulatory pressure and easier access to infrastructure could have a significant impact on the financial stability and creditworthiness of the construction industry, as well as lead to lower construction costs and higher effectiveness for construction companies. As far as demand is concerned, structural policies must be successfully implemented and the investment climate significantly improved: as the report concludes, these two factors are key to higher economic and household income growth rates.