Russian Labour Market: ‘A Perfect Storm’

A shrinking labour supply, a historic low in unemployment, a historic peak in job vacancies, sharply accelerated workforce turnover, and a prolonged stagnation of real wages form a unique combination that has emerged in the Russian labour market over the past three years. The shortage of workers is observed in almost all areas: there is no industry or occupational group in which the overhang of job vacancies is not growing, suggests a review by one of Russia’s leading experts on labour economics, Rostislav Kapeliushnikov, Corresponding Member of the Russian Academy of Sciences (RAS), Chief Researcher at the Institute of World Economy and International Relations (IMEMO, RAS), and Deputy Director of the Centre for Labour Market Studies at HSE University.

The crisis caused by the COVID-19 pandemic in 2020 gave initial impetus to explosive growth in the number of vacant jobs, and the 2022 sanctions crisis accelerated the process, Kapeliushnikov’s research (link in Russian) shows. The labour market has switched to a new mode of limited labour supply, which, due to its structural nature, is likely to last for long, shared Kapeliushnikov with Econs his view on labour market shift and its possible developments.

Trigger of ‘escalating vacancies’

The share of wages in GDP fell to phenomenally low levels in the early 2020s: in 2021, it was 40%, including under-the-table payments; in 2022, it was around 39%. This was a drop of almost 10 pp from the peak of 48.2% recorded in 2016, meaning that in recent years, labour has been rapidly cheapening in terms of output, resulting in a labour price lower than has ever been seen in the Russian economy, notes Kapeliushnikov.

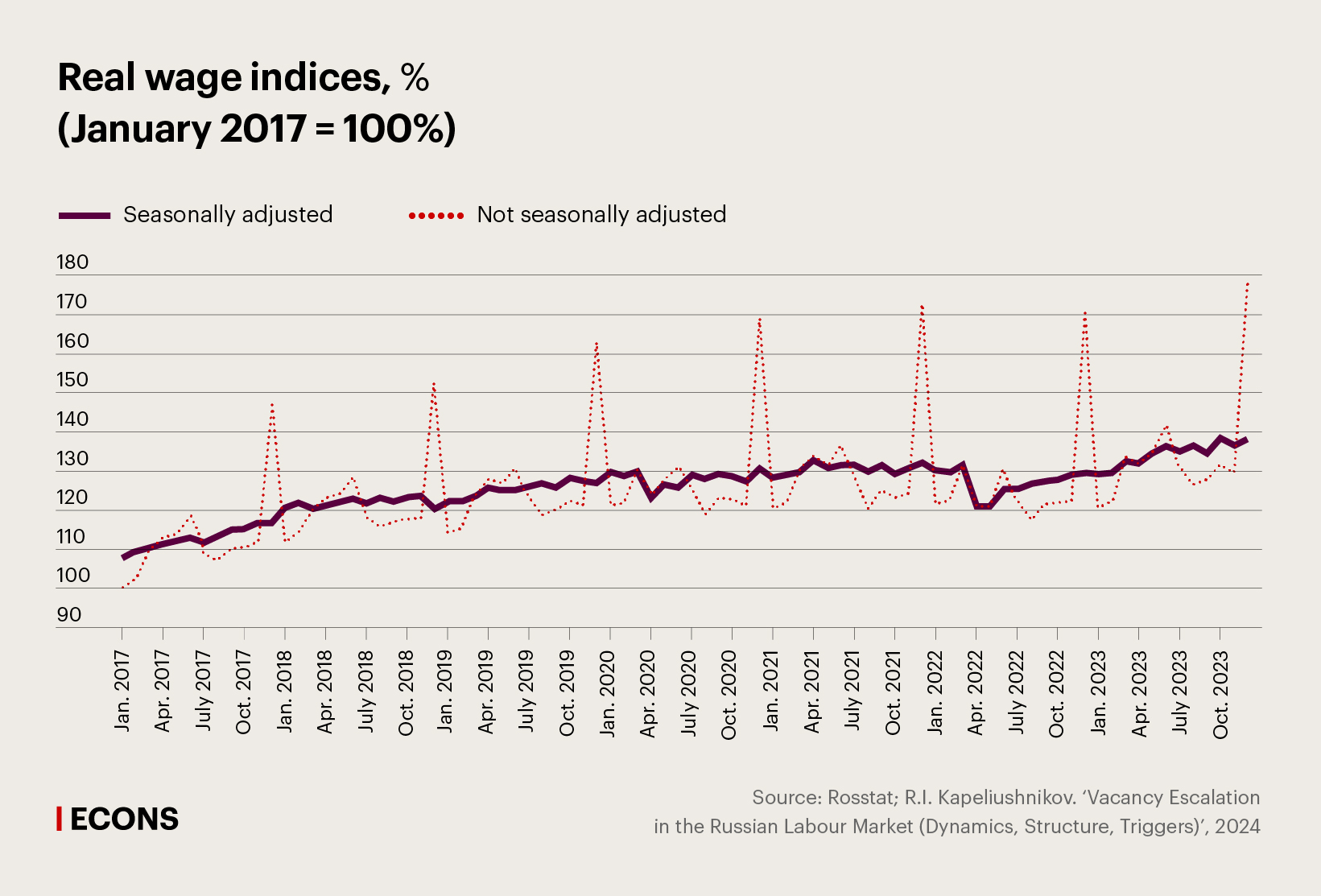

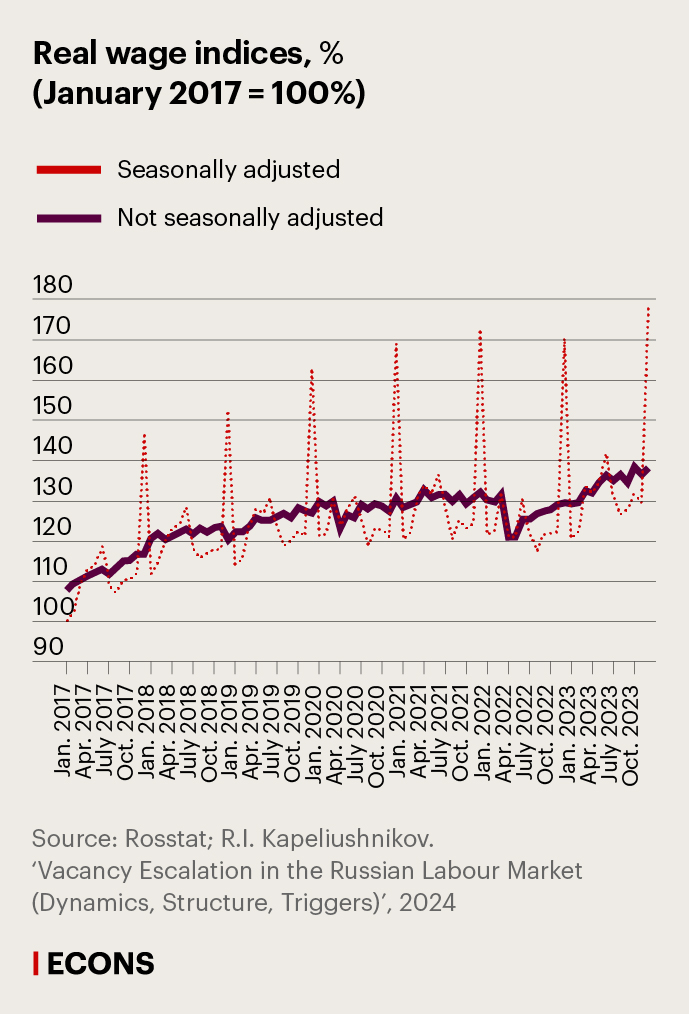

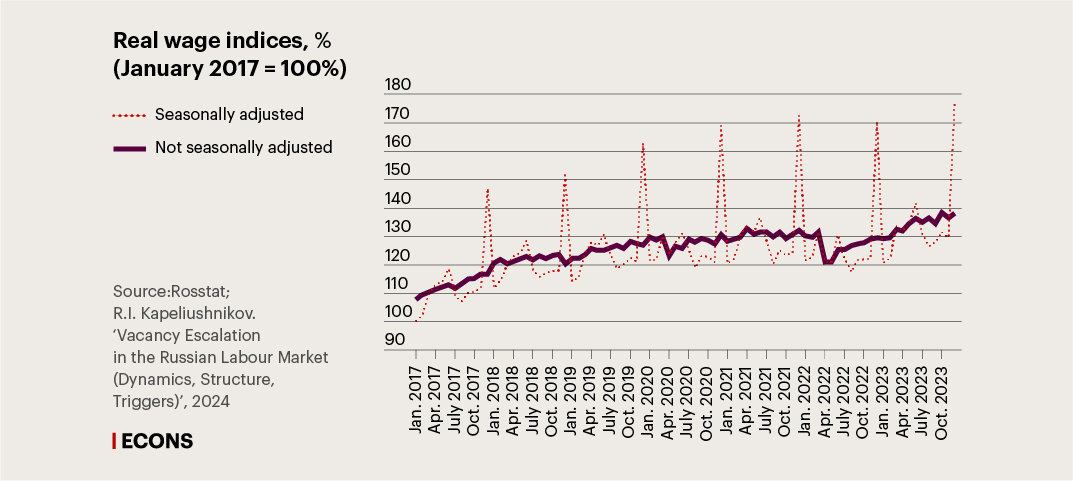

Real wages have been stagnating for three years, from 2020 Q2 to 2023 Q1. The reasons for this are rather obvious: the COVID-19 crisis followed by the second sanctions crisis should have sharply slowed the growth of wages. Nevertheless, even after the economy passed the lowest points of both recessions and began to recover, real wages still failed to surpass the level they reached prior to the pandemic in early 2020.

But from 2023 Q2 real wages went up sharply: their growth rate was 7.8% by the end of 2023. The growth in real wages was accompanied by a rapid drop in unemployment to 3.2% in 2023 and 2.9% in January 2024, which is not only a historical minimum for Russia but also unbelievably low by world standards.

The actual stagnation of real wages and the emergence of the massive overhang of job vacancies are interrelated processes. If companies hold onto an older view of wages, offering too little pay to entice potential employees, they will not be able to fill positions promptly. As a result, more vacances will emerge and remain unfilled for longer periods.

At the end of 2023, the job vacancy rate in the Russian economy approached a fantastic 7%: in the previous years, it was 2–3%, which means that Russia has never seen such a massive overhang of unfilled job vacancies as it does now. Depending on the data used (provided either by Rosstat or by the Federal Service for Labour and Employment), there were between 2.5 and 4.5 jobs per unemployed person in 2023.

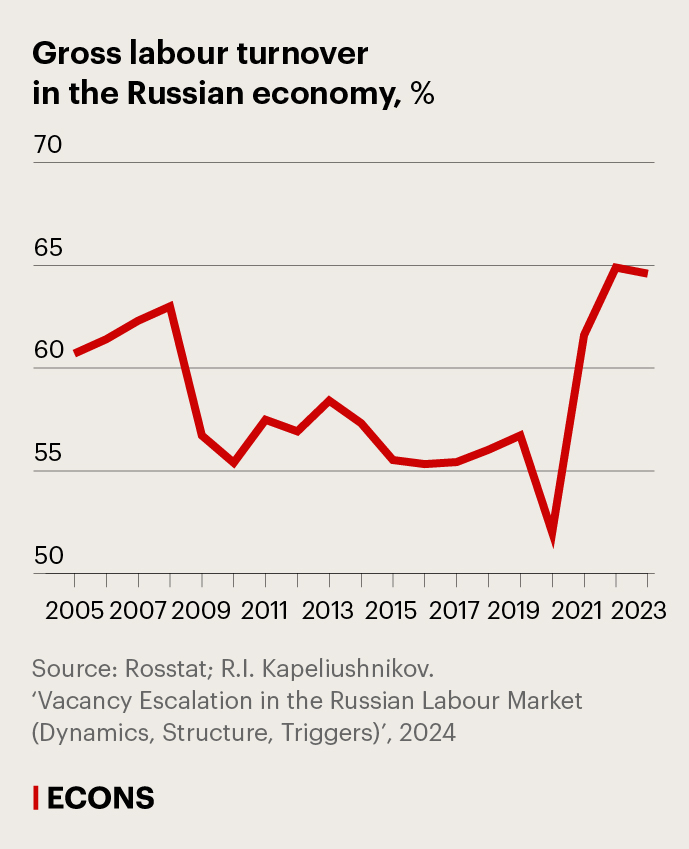

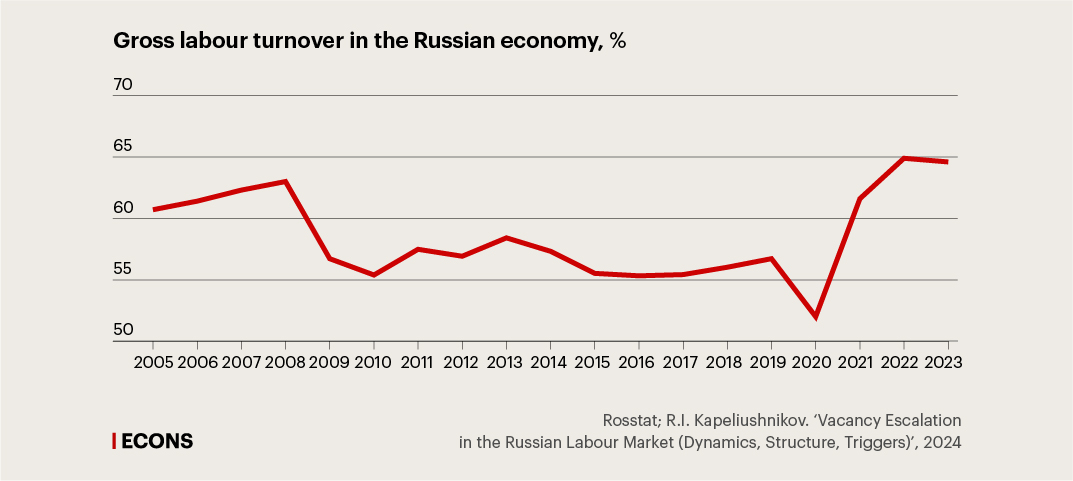

A sharp rise in vacancies emerged in 2020 Q2 at the peak of the COVID-19 pandemic, accompanied by an acceleration of gross labour turnover, which is calculated as the sum of the hiring rate (the ratio of the number of employees hired to the average headcount) and attrition rate (the ratio of the number of employees departing to the average headcount). Moreover, turnover accelerated through both hiring and attrition. In other words, employees have become more likely to leave their jobs and to change employers. In 2023, the gross labour turnover reached 65%, which is also a record high for the Russian economy: the last time it was close to this level was in the mid-2000s, and it had fluctuated around 55% since 2010.

This rise in job vacancies and acceleration of labour turnover in the Russian economy resembles processes also occurring in other economies, such as the US, the United Kingdom, Germany, and certain Central and Eastern European countries, suggesting that this is not a unique Russian phenomenon but rather a manifestation of a pattern common to the labour markets in a number of countries.

In the case of Russia, many date the start of this process to 2022, attributing it to the shift of the Russian economy to a paramilitary footing, along with the associated mobilisation, which entailed a contraction of the civilian workforce, and the so-called ‘relocation’ – surging migration outflows. In reality, however, the process was triggered by the pandemic. The relocation and mobilisation gave an even greater impulse to this already active trend but were not its root causes, Kapeliushnikov concludes.

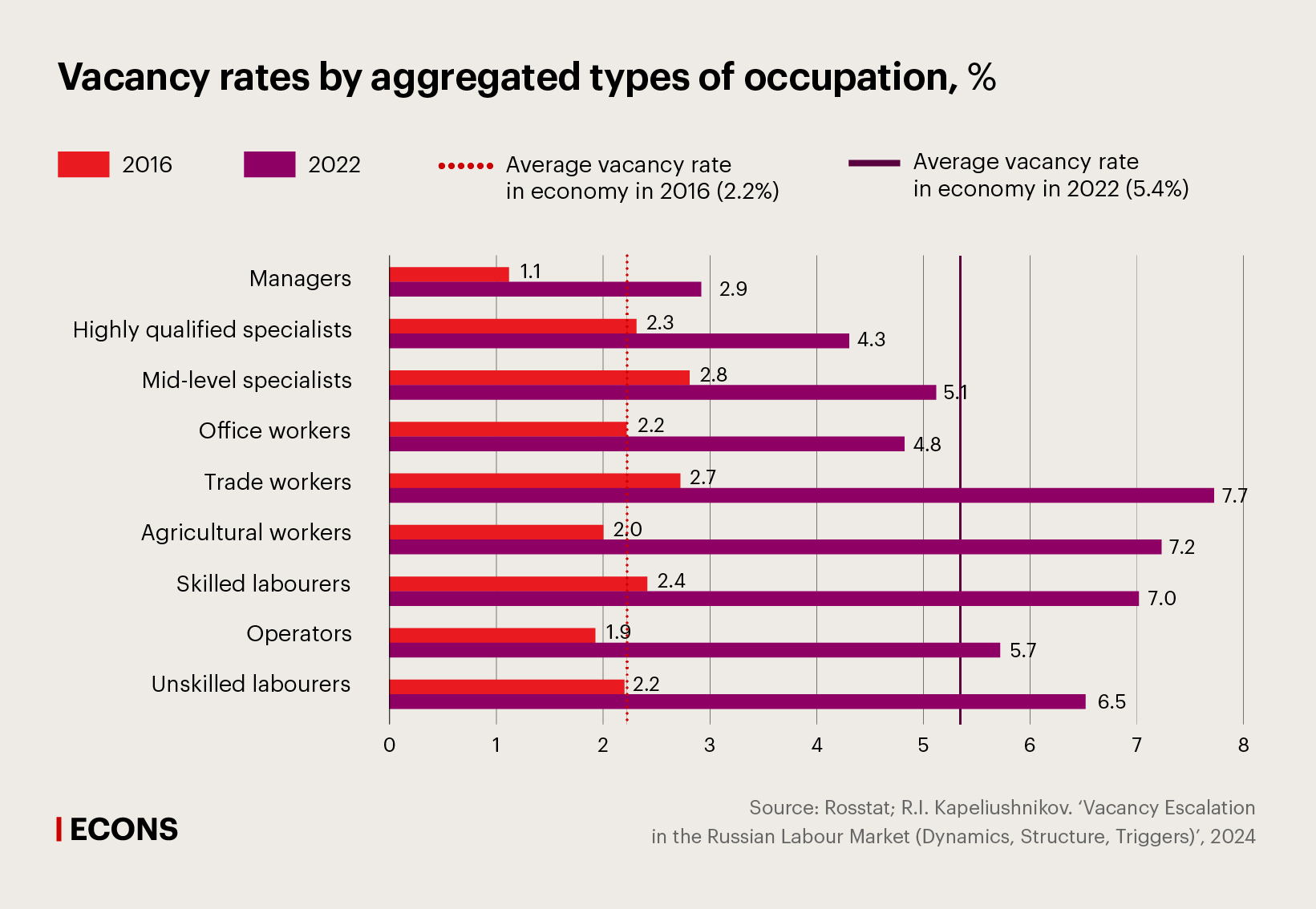

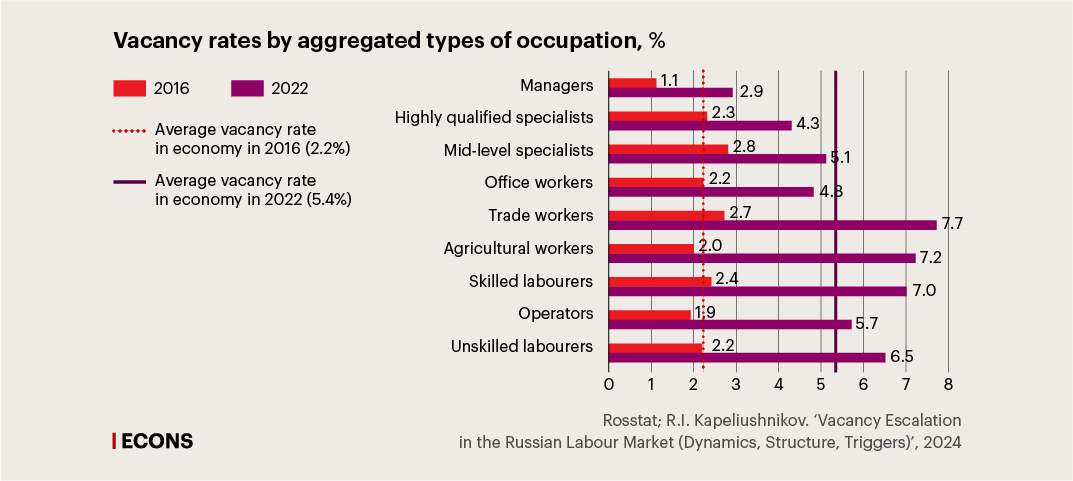

It is often assumed that staff shortages are concentrated in certain specific segments of the economy. ‘In fact, this phenomenon is utterly universal, as there is no industry or occupation where the number of job vacancies is not growing, and more often than not it is multiple growth,’ says Kapeliushnikov.

The sectors ranking highest in number of job postings are the hotel business (16.9%), real estate activities (14.8%), administrative activities (14.4%), public administration (12.1%), construction (9.7%), trade (9.9%), and publishing (10.7%). The lowest vacancy overhangs are in education (2.6%), the tobacco industry (3%), coke manufacture (3.8%), financial activities (4.2%), mining and quarrying (4.9%), manufacture of computers (5%), and manufacture of motor vehicles (5.1%).

Kapeliushnikov notes that the largest personnel shortages are experienced mainly by the service industry rather than the material production sector. However, even in the material production segments, where the number of vacancies is relatively small, it is 1.5–2 times higher than its pre-pandemic values.

Another misconception is that Russia is experiencing a shortage of only highly-skilled workers, as often follows from the comments made by representatives of recruiting agencies and HR officers, says Kapeliushnikov. In reality, he argues, there is a shortage of all types of workers – both skilled and unskilled, white collar and blue collar – which has been continuously growing across all categories since the post-pandemic economic recovery.

Reasons behind ‘escalating vacancies’

Kapeliushnikov notes that, theoretically, four factors, which are not necessarily mutually exclusive, could be the causes of the observed escalation in vacancies.

The first is a sharp downward shift in the aggregate labour supply curve, suggesting that there are fewer workers who would be willing to work for a given wage. For example, during the pandemic, many workers in Western countries took early retirement, working pensioners left the labour market and did not return to it at the end of the lockdowns, part of women who needed to stay at home with their children also left employment, etc. Additionally, migrant inflows stopped due to border closures. In the Russian economy, the processes associated with this factor include the relocation and mobilisation, which have contributed to the contraction of the labour supply.

The second factor is a stark upward shift in the aggregate labour demand curve, implying that more workers that companies would be willing to hire for a given wage are needed. During the pandemic, most governments actively dropped ‘helicopter money’ to households, which resulted in a huge amount of forced savings that households were physically unable to spend during the lockdowns. After the lockdowns were lifted, people started spending this money, which resulted in surging demand for goods and services. This boosted the demand for extra human resources, but the supply of labour could not respond as quickly.

Third, the mismatch between the structure of the labour force and the structure of jobs increased due to drastic shifts on the labour supply side. During the pandemic, many workers raised their bar for job quality and started to accept only remote job offers. Companies unable to offer telecommuting faced huge recruitment challenges, with jobs remaining unfilled for long periods of time, leading to an increase in overall vacancy rates. However, while this factor seems to have been very important indeed in certain developed countries, it could hardly be of real significance in Russia, since the level of remote employment in the Russian context has always been rather moderate, and currently stands at a ‘measly’ 1.5%, Kapeliushnikov says.

The fourth and final factor is the greater discrepancy between the structure of the labour force and the structure of jobs due to the sharp shifts on the demand side. According to Kapeliushnikov, this factor proved to be the determining one in the Russian context. The exceptional structural ‘shake-up’ that hit the Russian economy during the last two recessions required a large-scale inter-company, inter-industry, and inter-occupational redistribution of the labour force. Both the 2020 and 2022 crisis shocks were structural: they offered unprecedented opportunities for certain companies and industries while putting others in dire straits.

During the lockdowns, companies that were able to do business online received a strong impetus to expand production, while companies that did not have such an opportunity experienced severe stress and had to fight for survival. The second sanctions crisis benefited enterprises in the defence sector, parallel import operators, public construction companies, and agents who managed to occupy niches left by departed foreign companies, while those affected by the sanctions, such as companies with a critical dependence on foreign parts, found themselves in a disadvantaged position.

Fierce competition for the limited human resources began: companies started posting jobs in an attempt to lure needed workers from the outside, while others had to seek workers to compensate for the loss of staff caused by outflows. Vacancies escalated in both winning and losing sectors, which was the main reason for the huge pool of unfilled jobs that has emerged, Kapeliushnikov concludes. The explosive growth of job openings was predominantly triggered by stimuli for the large-scale reallocation of labour, which were introduced by the COVID-19 pandemic only to be strengthened by the sanctions crisis.

Two scenarios are seen as possible ways out of the situation, says Kapeliushnikov. In the first, a large contingent of additional workers will enter the labour market, and the bulk of jobs will be filled. However, this scenario is extremely unlikely, since in the Russian context, almost all reserves for replenishing the labour force have been exhausted.

The historically low unemployment rate means that increasing employment through the reduction of unemployment is almost impossible. Boosting employment by hiring young people would mean reducing their enrolment in higher education, which would have a negative impact on the accumulation of human capital. The economic activity of women with children is already high, and increasing employment among the elderly beyond what pension reform can achieve (a labour force increase of less than 1% (link in Russian)) is also unlikely. All this is further aggravated by an unfavourable demographic situation: according to the forecasts, the number of employed people may decrease by 5–10 million over the next few decades. The import of labour also has serious limitations, although even a 1–2 pp increase in the proportion of labour migrants in the total number of the employed will not compensate for the losses in the labour force expected in the coming decades.

The second possible scenario suggests that the accelerated growth of real wages that started in 2023 will continue, which should partially reduce the number of vacant jobs. Companies that can afford higher wages will be able to fill jobs, while those that cannot do so will have to abandon the effort to find workers and withdraw their vacancies. This would help to balance the labour market, bringing it to a new equilibrium. At present, this latter scenario seems the most plausible, concludes Kapeliushnikov.

The vacancy overhang is already being partially reduced in other countries. For example, in the US, real wages also remained virtually stagnant for almost three years and did not resume growth until early 2023. This immediately led to a decline in the job vacancy rate, although it still remained well above the typical pre-pandemic levels.

Cross-country experience suggests that in the 2020s, labour markets in almost all regions of the world have faced a complex interweaving of both long- and short-term factors. By analogy with the natural rate of employment, there also appears to be a natural rate of vacancies. The pandemic and its lockdowns shifted this natural rate of vacancies upwards, while the anti-recessionary monetary pumping of economies fuelled its additional rise. The Russian labour market, which was confronted with the combined effects of the COVID-19 pandemic and the sanctions crisis, was no exception. This has led to a situation in which the upward drift of the natural rate of vacancies, caused by the structural transformation of the economy, is coupled with the exceeding of this threshold, associated with its apparent overheating.

The new labour market regime is likely to remain in place for a long time as – at least for now – there is no foreseeable way out of it, Kapeliushnikov argues. This means that the Russian economy will, by all appearances, face the stressful conditions of a prolonged severe labour shortage, which is likely to be the main hindrance to its sustainable growth in the coming decades.