The Five Stages of Perception of the Pandemic

The coronavirus pandemic has drastically changed many areas of people’s life. As never before, the economy turned out to be closely interdependent with the epidemiological factor: the coronavirus response, such as lockdowns or closed borders, immediately affected household incomes, people’s state of mind and economic expectations. Since the onset of the corona crisis, FOM has watched the implications of the pandemic for Russians’ financial circumstances, behaviour and mindset. Measurements launched in April 2020 give a full picture of the economic implications of the pandemic for households.

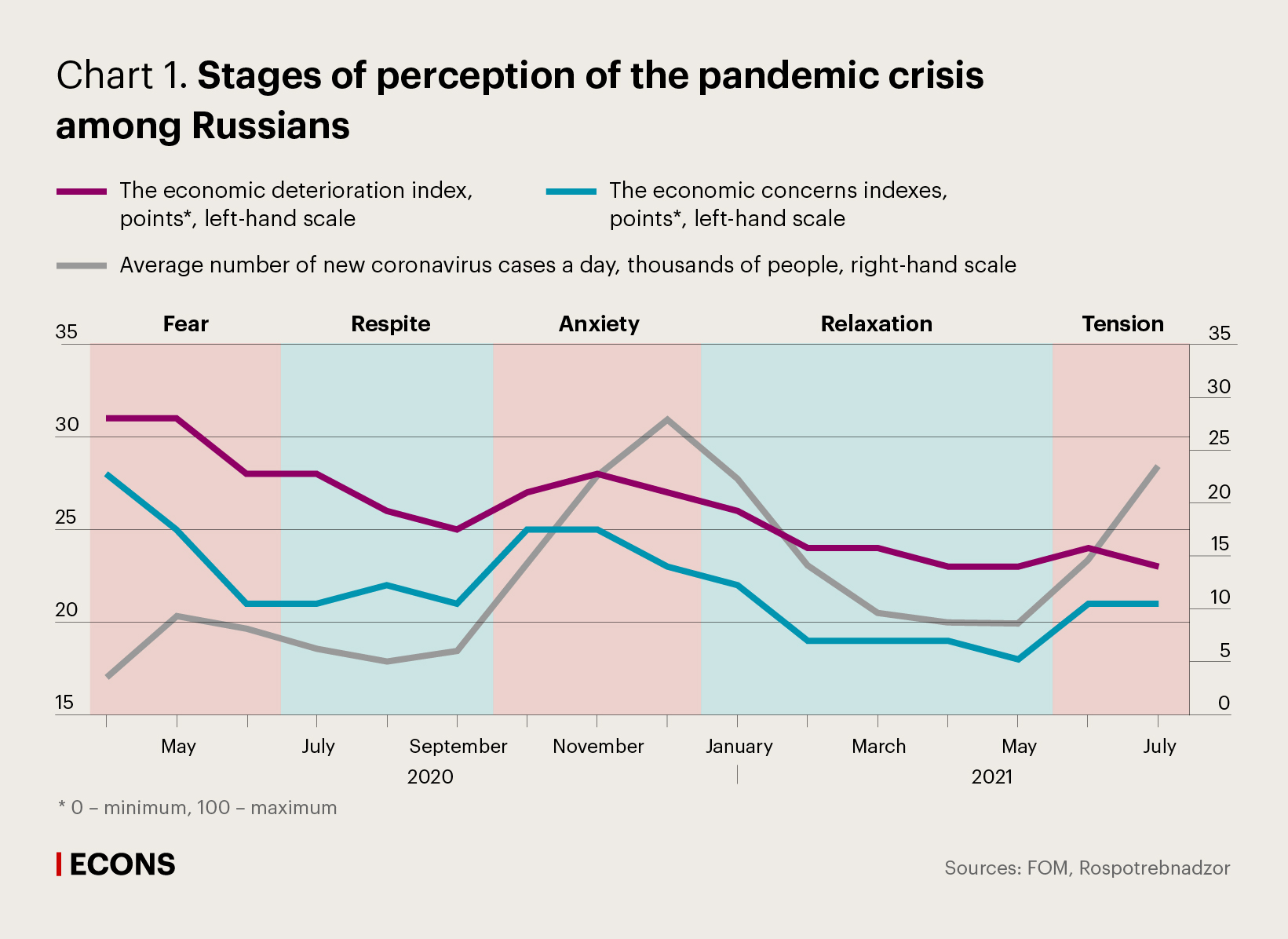

The external environment has changed substantially as the pandemic has unfolded over almost one year and a half, followed by the ‘sense of crisis’ among Russians. As of August 2021, five stages in public perception of the situation can be singled out (with the pandemic still ongoing, this is hardly final phasing).

Fear was the first phase (late March-May 2020), when negative outlooks and concerns about the future peaked. The economic deterioration and economic concerns indexes – FOM’s complex indicators measuring the pandemic’s fallout – (see the Box) hit 31 and 28 points out of 100 respectively.

Respite – the second phase – lasted from June through September 2020. Early last summer, signs of an epidemiological improvement emerged and triggered an immediate drop in the levels of anxiety. By September, both indexes had been down to 25 and 21 points respectively.

However, the respite phase quickly gave way to the third phase, anxiety – followed by a repeat of deterioration in estimates in October 2020 due to the second wave and accelerated inflation. As soon as January this year, however, anxiety was already declining: by May, the indicators had reached their lowest mark since the start of the pandemic, ushering in relaxation as the fourth stage.

The new, fifth phase, tension – set in amid the next wave of the pandemic in the second half of June 2021. However, the indicators have not yet reached the level of the anxiety phase, let alone fear, the first phase.

A drop in economic sentiment almost immediately follows a spike in infections; this decline however slows down slightly just before the pandemic reaches another peak (see Chart 1). For example, infection cases peaked in December 2020 and the indicators, having hit their local highs in November, had started to decline as soon as December. This picture is to a certain extent repeated in June and July 2021. Apparently, people are initially scared of the uncertainty that comes with a new outbreak of the pandemic, but they gradually get used to the situation, with stress declining.

Economics of the pandemic

In addition to the complex indicators, FOM has monitored the situation in three dimensions of the economic life of Russian households: financial circumstances, work and consumption. There are several important variations in the dynamic.

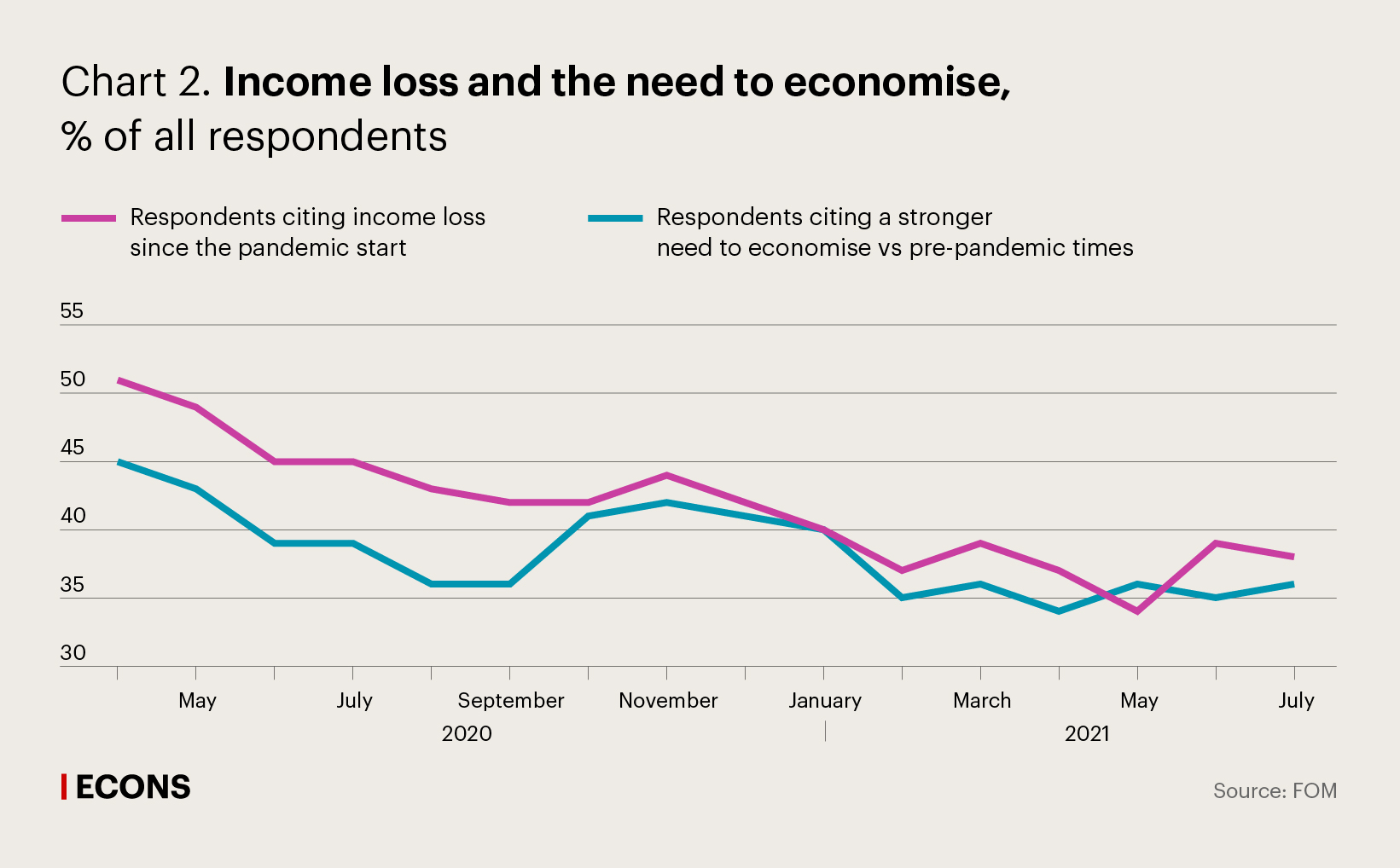

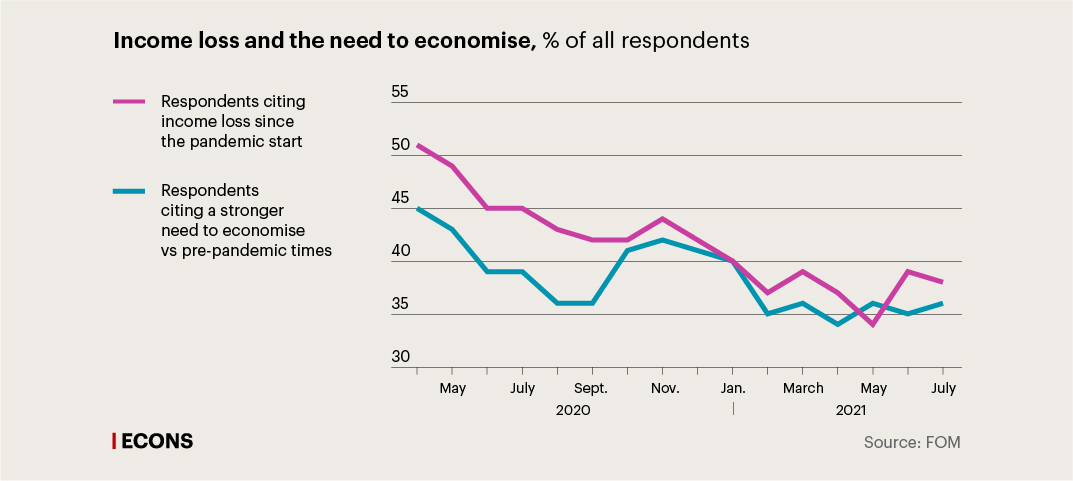

For example, money problems hit Russians worst in April 2020, when the pandemic began. It was then that the percentage of the population experiencing loss of income and the need to economise reached record high at 51% and 45% respectively. These figures probably reflect not only objective reality (the start of lockdowns and layoffs), but also fears about the unknown as the pandemic was in the early stages. Estimates declined thereafter, but surged again in the autumn 2020 as the second wave of coronavirus set in. Importantly, while growth in complaints about income loss was weaker than in the spring, complaints about the need to economise increased more significantly and approached their spring highs.

All the indicators reached their local lows in April-May 2021, and they rose again against the background of the new tension phase and the third wave, but not as acutely as in the autumn. In July 2021, slightly more than a third of Russians cited a decline in incomes and the need to economise, compared to nearly half at the beginning of the pandemic.

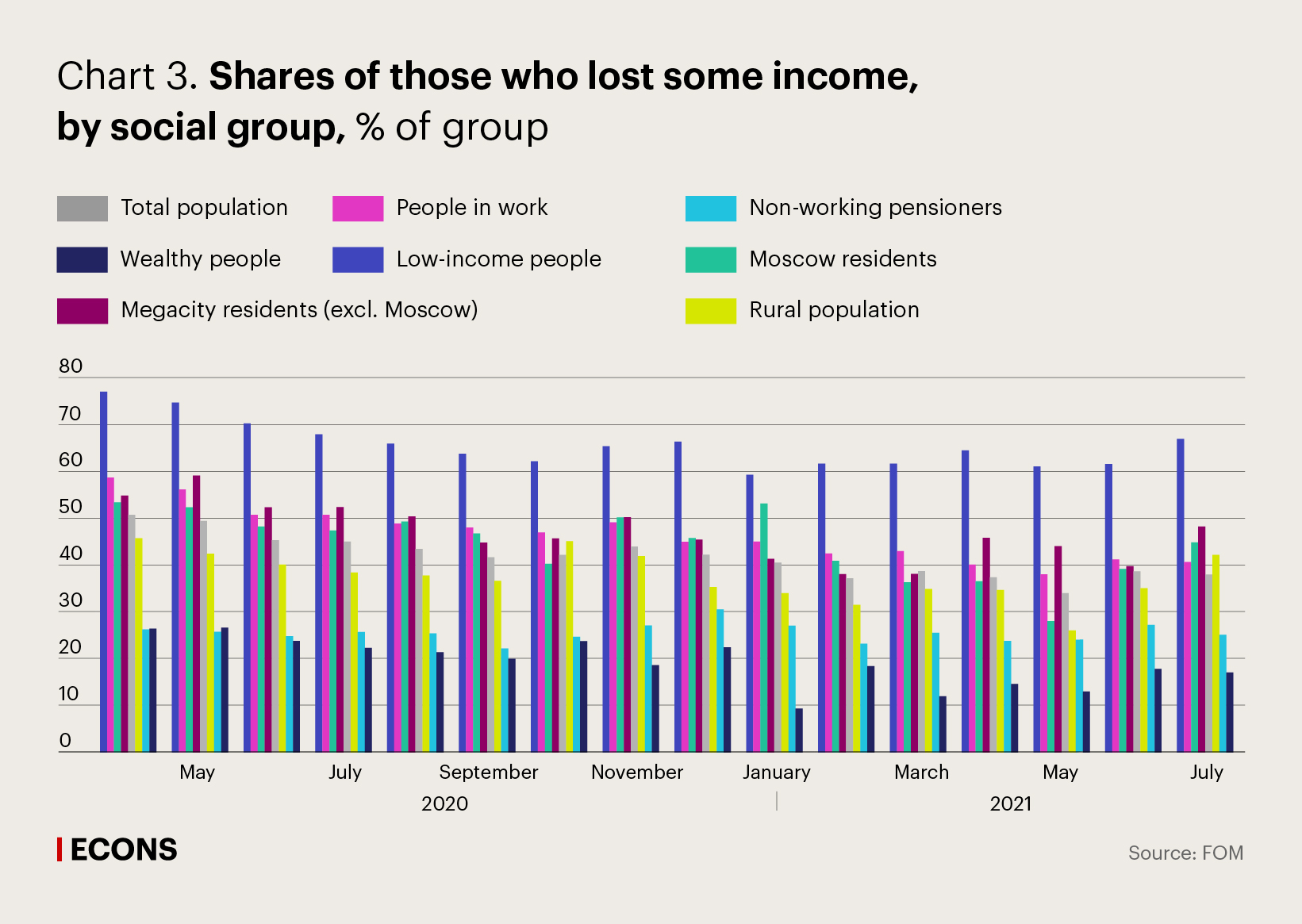

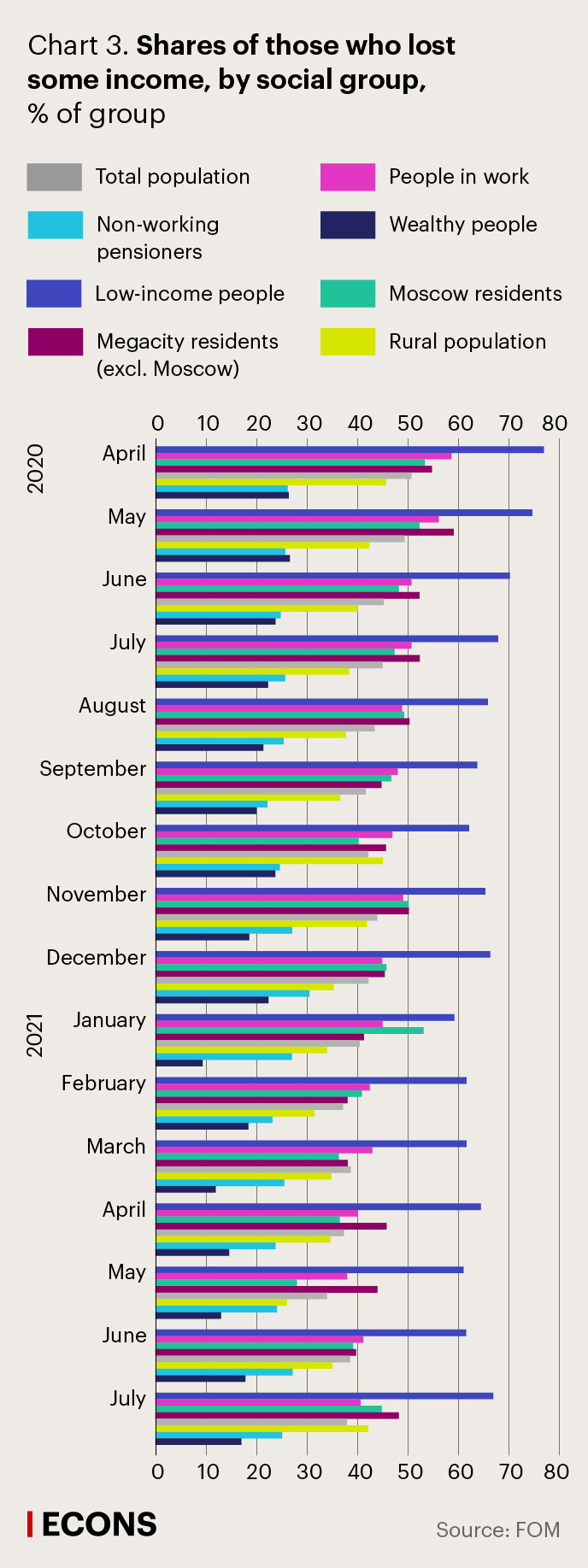

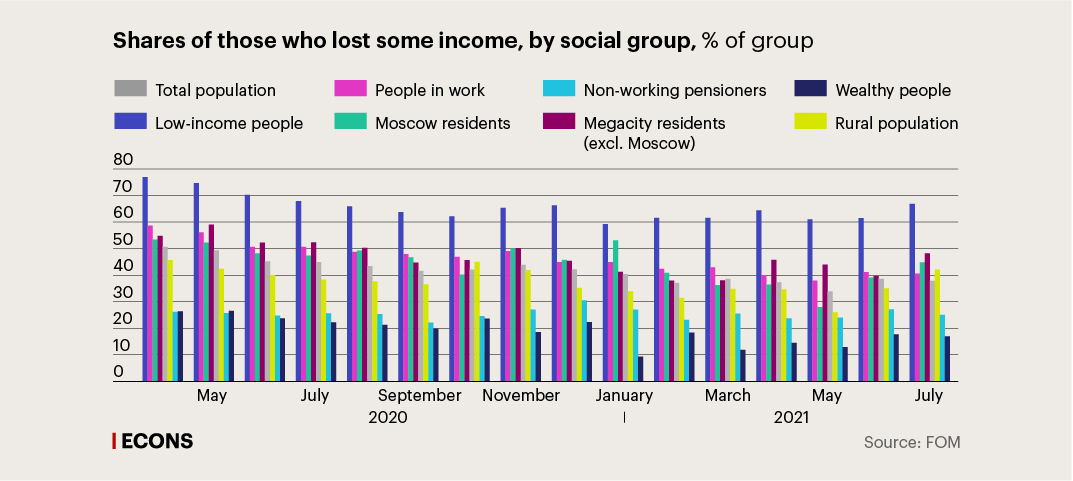

Another important observation is that the impact of the pandemic was uneven across social groups.

For example, segments of population hardest hit were the poorest, the overwhelming majority of whom complained about the declining income and the need to economise. Whereas for the entire population these estimates had settled at their local lows by the spring of 2021, almost two-thirds of Russians on low-incomes invariably said that they had lost some of their income. The poor were much slower to become accustomed to the consequences of the pandemic than more well-off people whose incomes were almost unaffected by the negative impact. This probably resulted in growing social inequality, among other things.

The pandemic hit working Russians harder than non-working pensioners: while the former were confronted with employment problems and dwindling wages, incomes of the latter, pensions, were fixed. Moreover, the corona crisis carried much stronger implications for urban than rural households – both epidemiologically and financially.

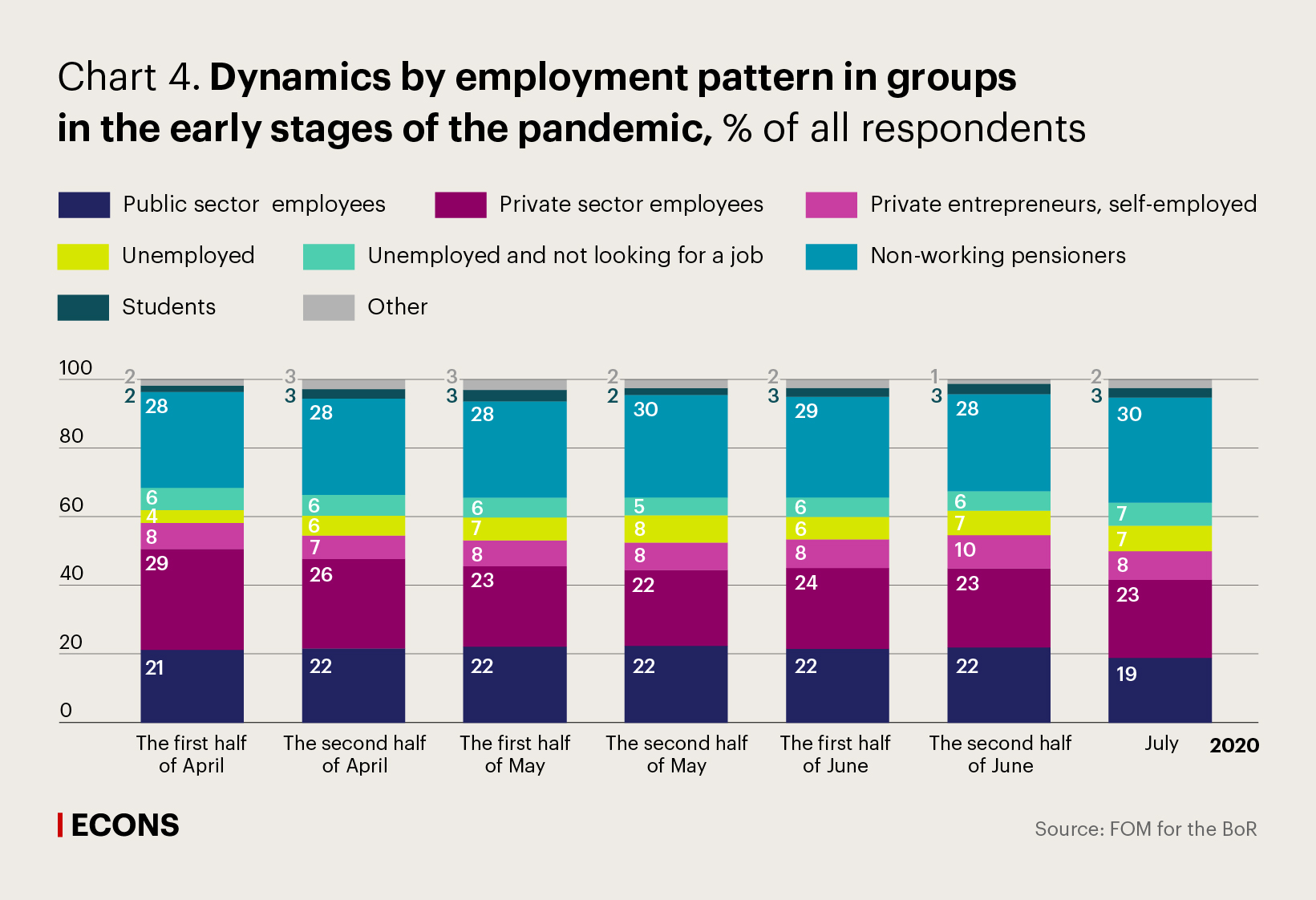

Work was the second key area of life to take a hit from the corona crisis. At the beginning of the pandemic, the restrictions put in place brought about a rise in layoffs. According to FOM surveys, the unemployed accounted for 4% of the total population in early April 2020, and by the end of May the number had grown to 8%. In November 2020, 6% of respondents reported that they were unemployed and looking for a job. The percentage of people who lost jobs due to the pandemic peaked in May 2020 (5%), but started to decline as early as July 2020. The least educated and least qualified workers lost their jobs more often than others.

Employees of private enterprises were the main victims of layoffs: while in early April 2020, the percentage of employees in the private sector accounted for 29% of the adult population (vs 22% of those employed in the public sector), it dropped to 22% by the end of May 2020, whereas the percentage of employees in state-owned enterprises essentially remained unchanged.

Also, private sector workers tended to lose more of their labour incomes. Specifically, 25% of them reported in July 2020 some reduction in wages and 17% cited a total loss of wages due to the pandemic, while 15% and 3% of public sector employees complained about this, respectively. Unsurprisingly, far fewer public sector employees cited financial hardships and the need to economise.

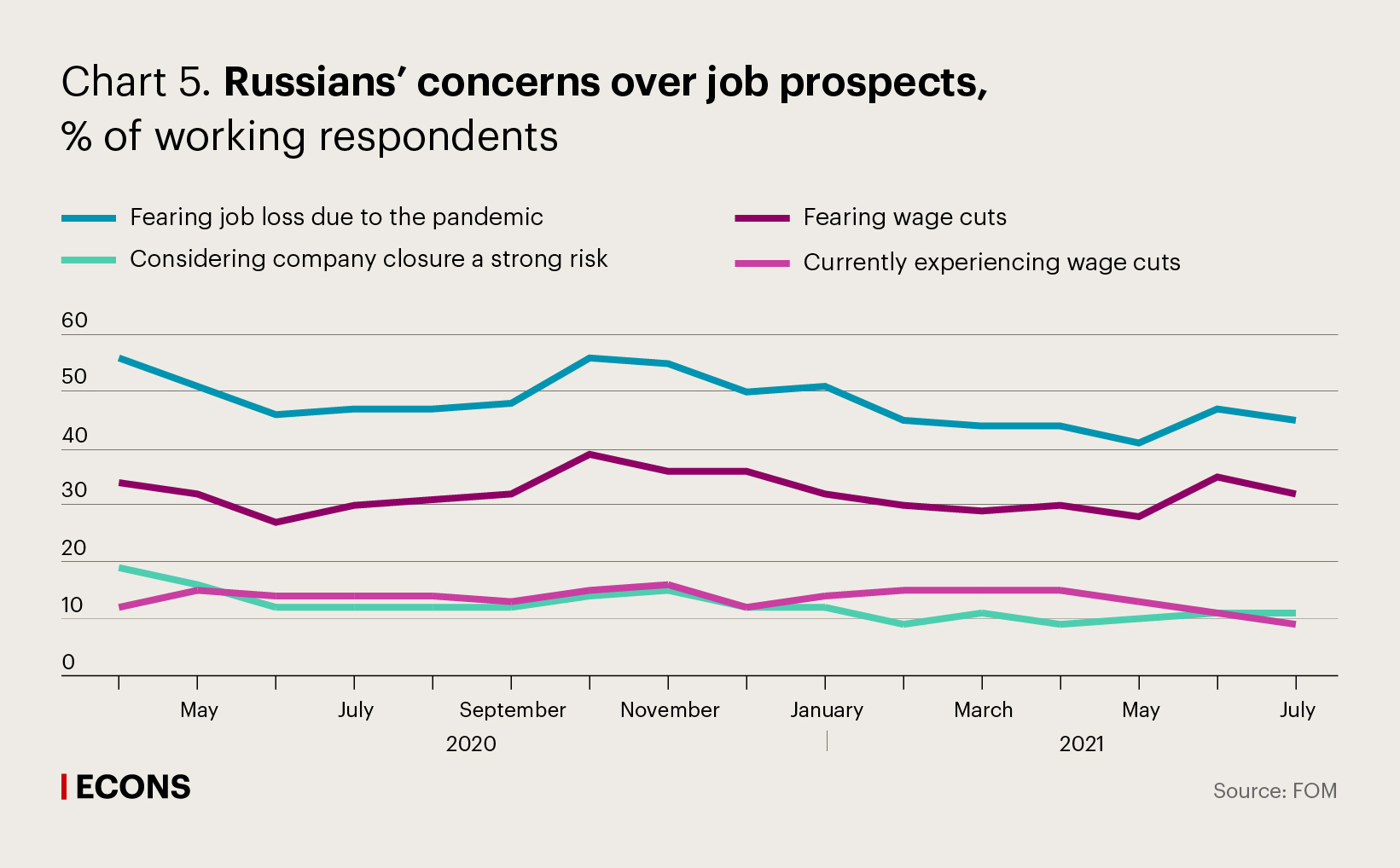

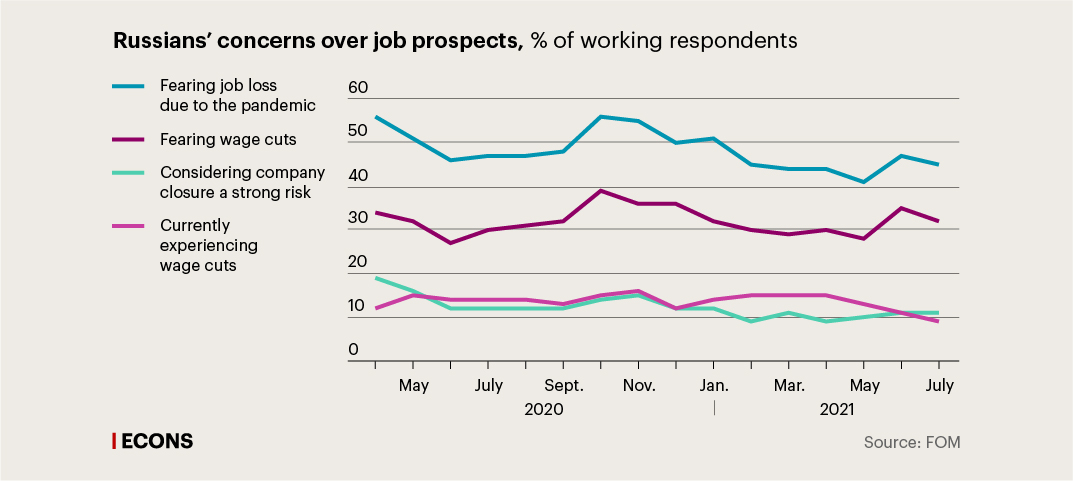

Although it was not the majority of employees who were affected by job problems, the level of public anxiety about possible job loss in the pandemic was, and still is, very high.

Similar to the other indicators, anxiety over possible job and wage loss reached its first peak in April 2020, with 56% and 34% of employees citing their fear of losing jobs and of wage cuts respectively. The second peak of anxiety – just as strong – was recorded in October 2020 (56% and 39% respectively). In December, when it became clear that there would be no new lockdowns, the percentage of people feared losing their jobs due to the pandemic dropped to an all-time low in May 2021.

However, in June 2021, the new pandemic rekindled these fears: nearly half (47%) of respondents are now afraid of losing their jobs, and more than a third (35%) are concerned about wage cuts. Overall, employment problems and deep anxiety about job prospects are characteristics of the pandemic crisis.

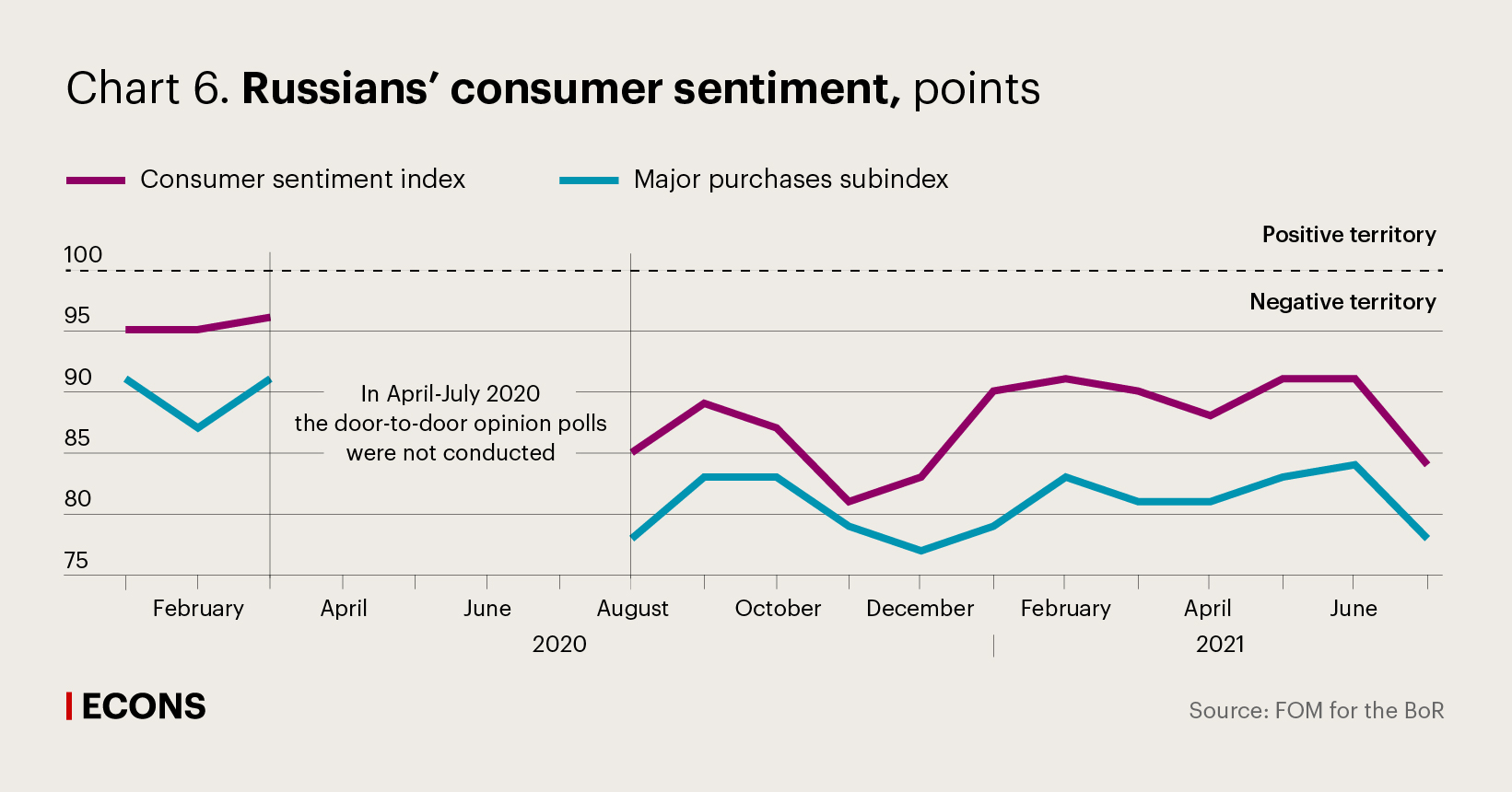

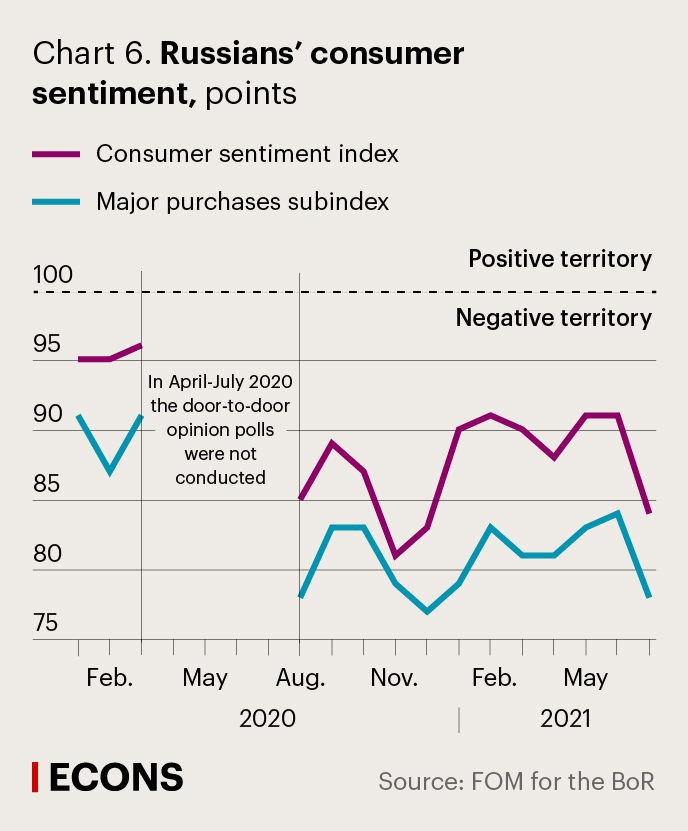

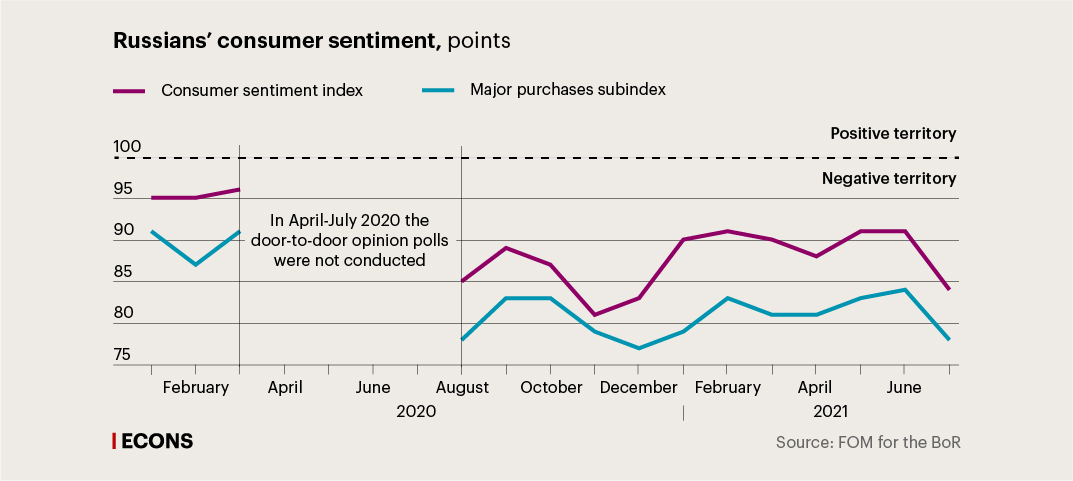

Consumption is another area of economic life to come under pressure from the pandemic. Just like anywhere else, Russians had never encountered a lockdown that put physical constraints on consumption of multiple goods and services. Analysts for the Sberindex Project recorded a one-third drop in consumer spending between late March and early April 2020 compared to 2019. A recovery in consumer spending was not to come until July 2020, when the numbers moved into positive territory, only to turn negative again when the second wave of coronavirus hit in November (the decline was 10.8% as of 1 November). It was not until the new year that Russians’ consumer spending returned to a pre-pandemic level and started to gradually grow above it – although it slightly declined yet again in May 2021.

Paradoxically, lockdowns, the shift to working remotely and the absence or needlessness of usual spending worked to some extent to mitigate the impact of falling incomes for households, especially the least well-off of them. More affluent groups were not only able not to save, but also to increase their savings, which is one of the factors behind the rapid inflow of households’ money into the stock market and real estate. This also fuelled demand for mortgage in the second half of 2020.

Having said this, there is no guarantee that consumer demand is set to become a driver of economic recovery in the near future. Household incomes are not growing, and consumer sentiment remains at record lows. As an example, the consumer sentiment index dropped substantially, as did other indicators, due to a new surge in COVID cases in July 2021 and hit 84 points out of the maximum 200, which is only 3 points above the lowest point of the second wave (81 points in November 2020). The major purchases index was also quite low at 78 points out of 200 possible; Russians are in no hurry to part with money and consume again.

Surveys bear out the significant effect of the pandemic on everyday economic realities of Russians, in rather varying degrees across social groups. The corona crisis worsened the position of less wealthy strata of the population, including people on low-incomes and low-skilled employees of private enterprises living in megacities and large cities. Although government measures to support families with children indeed prevented many low-income families from entering poorer groups, the pandemic resulted in increased inequality between the more and less affluent segments of the population.

As in the previous crises (2008 and 2014), these economic hardships put little pressure on non-working pensioners: the stability of regular pension payments together with reasonably low consumer activity helped them to maintain their living standards, which in 2021 are now increasingly under threat from high inflation (rather than from the economic fallout from the pandemic). People in work, especially in the private sector, had to deal with many financial hardships, but also with far more apprehensions and negative expectations. Limitations on consumer demand worked to cushion the impact on incomes for some, and opened up new financial instruments and horizons for others. Although people’s economic sentiment remains concerned overall and is still very sensitive to new spikes in infection rates, the level of anxiety is already notably lower 18 months into the pandemic than at the start. Society is gradually adjusting to the economic implications of the corona crisis.

.jpg)