Peculiarities of National Banking: the Banking Markets of Russia, Kazakhstan, and Belarus

Russia’s banking market stands out among the banking markets of the three largest CIS countries in terms of GDP per capita, Russia, Kazakhstan, and Belarus, for its larger number of players and relatively lower entry barriers with a significant number of banking licenses revoked each year. State-owned banks play an important role in the Belarusian banking sector: they contribute to the implementation of public policy, including through the issuance of directed loans. In Kazakhstan, private banking prevails.

The financial infrastructure of Kazakhstan and Belarus is largely shaped by foreign organizations such as international rating agencies and auditing companies, while in Russia, rating and auditing markets are dominated by domestic players.

All three countries strive to implement the banking supervisory guidelines issued by the Basel Committee on Banking Supervision, including the most recent ones calling on regulators to ensure that lending to the real sector does not stop during the pandemic.

Competition in the banking markets

Despite a more than tenfold difference in the number of players in the banking markets of the three countries (less than 30 entities in Kazakhstan and Belarus and almost 400 in Russia), these markets seem to have similar structures at first glance: as of January 1, 2020, in each of the countries, one of the largest banks accumulated about one-third of all assets in the sector, and the share of the five largest banks ranged from 63% to 73%.

If we include the ten largest banks in the estimate, we will find the ‘anti-leader’ in terms of market concentration: in Belarus, the top ten banks account for 93% of all assets in the banking sector, while in Russia and Kazakhstan, this figure is 80-85%. The Herfindahl-Hirschman Index (HHI) that measures the market shares of all participants of the banking market and its concentration (in case of absolute monopoly when there is only one player in the market, the index equals one) confirms this observation. The HHI shows that the Belarusian market can be considered highly concentrated, with the Russian and Kazakh markets being moderately concentrated. At the same time, Kazakhstan’s banking system provides the most favorable environment for competition.

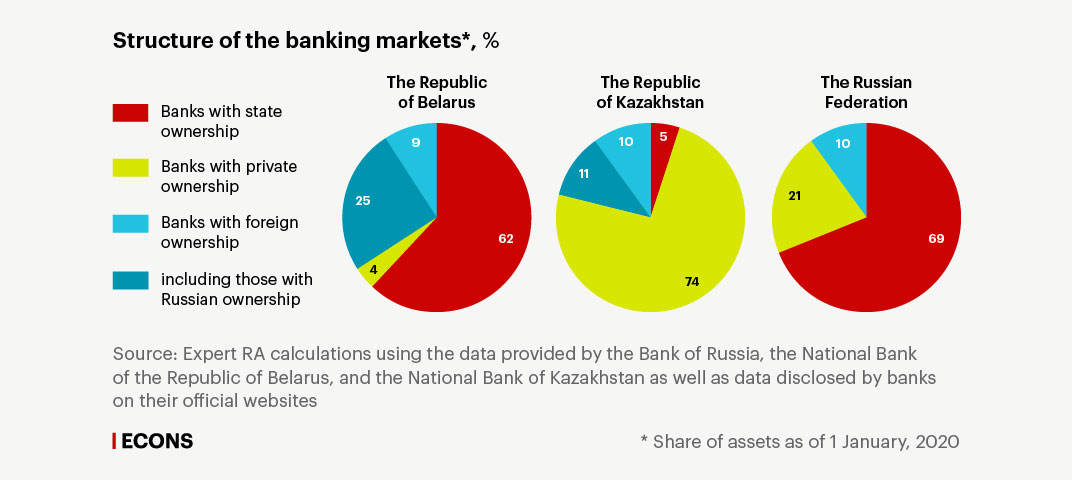

When comparing market shares of banks with state, foreign, and private ownership, one can see even more differences in the structure of the three banking markets. For example, in Belarus and Kazakhstan, foreign banks have rather significant market shares (about one-third and about one-fifth of the market, respectively). That said, when subsidiaries of Russian banks are excluded from the estimate, banks with foreign ownership account for about 9-10% of the markets in all three countries.

Private banks account for almost three-quarters of Kazakhstan’s banking market, which is in strong contrast with the Belarusian and Russian markets where banks with state ownership have the strongest competitive edge. At the same time, even under a less formal approach that considers the largest private bank in Kazakhstan a state-owned one (given the close economic and other ties between its owners and the government), the private banking sector in the country is still in a stronger position than in Russia and Belarus.

When speaking about the dominant market position of Belarusian state-owned banks (more than 60% of the banking market), it is worth noting that this is largely the result of the so-called state-directed loan programs implemented by the two largest banks in the country. As of January 1, 2019, the outstanding debt on these loans reached about 50% of the amount of loans issued to clients of Belarusbank and Belagroprombank and about 17% of all assets of the banking system. Now, Belarus is reducing annual limits of directed lending (for instance, from 2016 to 2020, the annual limit of directed lending has decreased by more than three times) but has not completely abandoned this tool.

Regulatory environment

The common past of the three countries, including former banking legislation, and shared aspiration to implement the guidelines issued by the Basel Committee on Banking Supervision make the modern approaches of their central banks by and large similar and comparable. However, each country has its peculiarities.

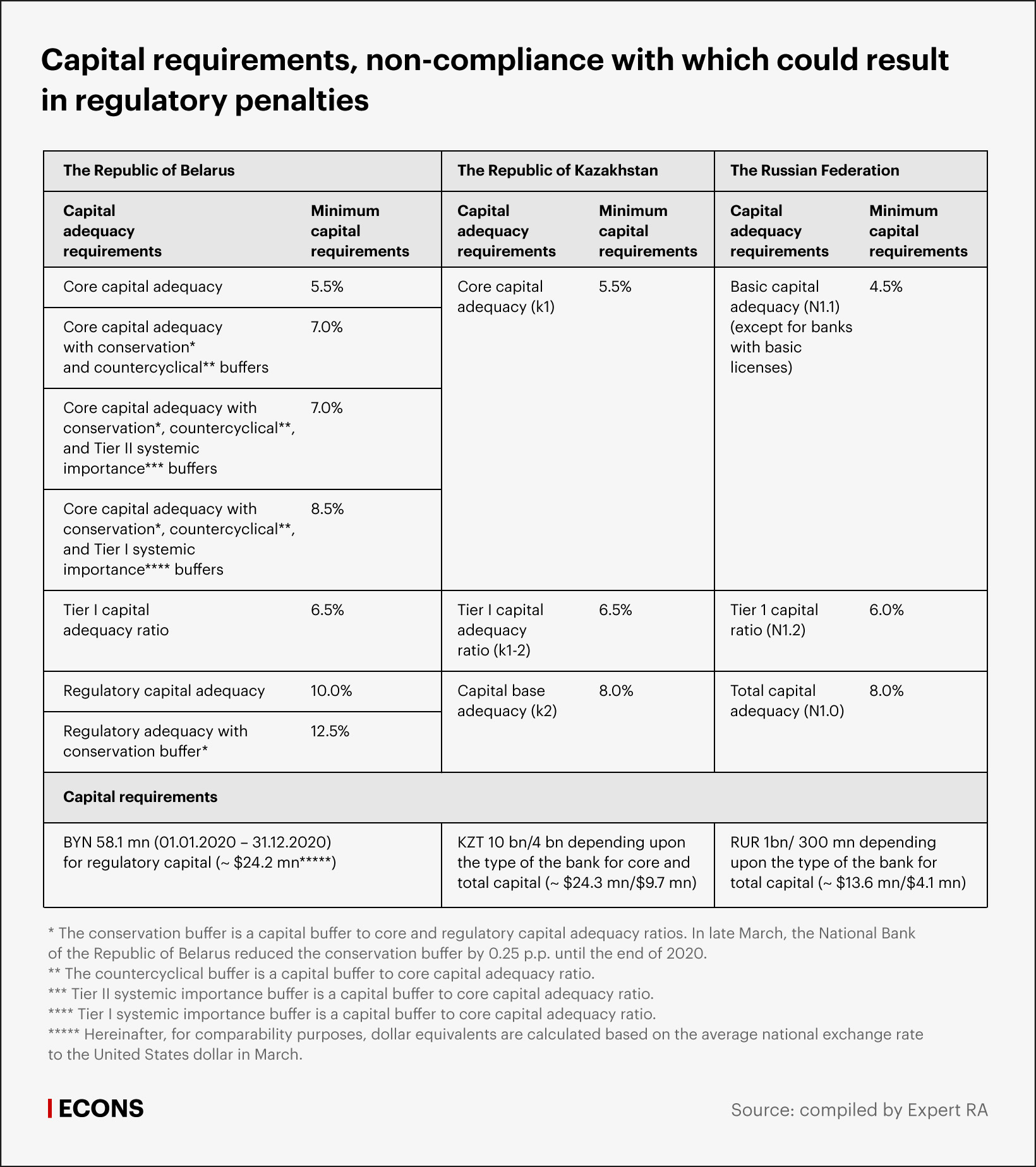

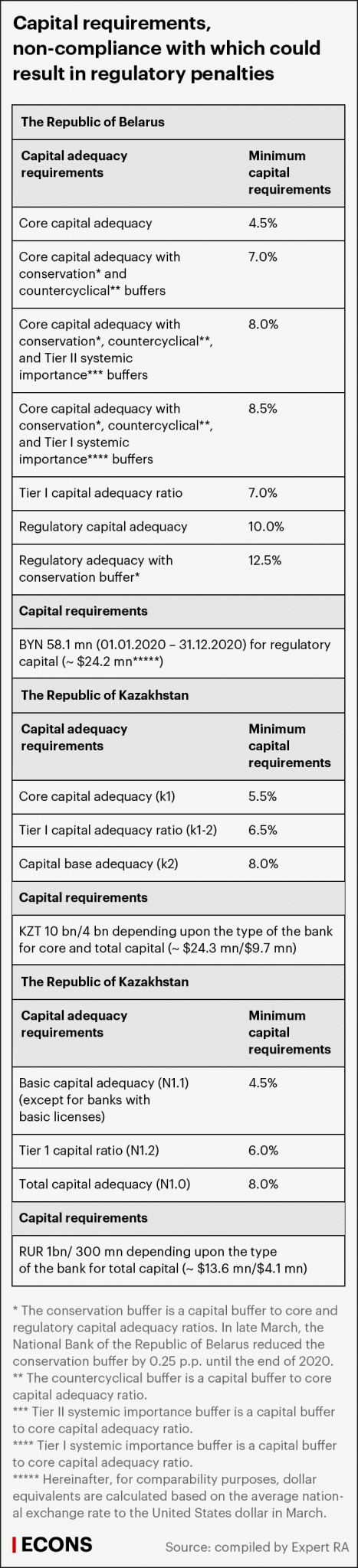

For example, the Belarusian regulator imposes the most stringent capital adequacy requirements. Its minimum requirements are generally 0.5-2 p.p. higher than those in Russia and Kazakhstan. Moreover, of the three countries, only Belarus includes capital buffers mandated under the Basel guidelines directly in its regulatory policy, i.e. breaching capital requirements with buffers can lead to restrictions on banking activities including license revocation. However, in Russia and Kazakhstan, such a breach can result only in an inability to distribute profits.

As to the minimum capital requirements, the Russian banking market has the lowest barriers to entry: to start a bank (for most banks) in Belarus or Kazakhstan, one needs almost twice as much capital to start a bank with a universal license and almost six times as much to start a bank with a basic license as in Russia (which is implicitly reflected by the number of players in the markets of the three countries).

The Basel Net Stable Funding Ratio (NSFR) and Liquidity Coverage Ratio (LCR) are also applied in different ways. All three countries apply both ratios in full (except for LCR in Kazakhstan: the country is in a transition period, which should end with full implementation of LCR by July 2021).

A hallmark of each market is the way the Basel ratios are applied to individual members of the banking system and coexist with national liquidity ratios. In Russia, NSFR and LCR apply only to systemically important lenders, while other banks have to keep following national standards. In Belarus and Kazakhstan, NSFR and LCR apply to all banks (except for the Development Bank of the Republic of Belarus, which does not have to calculate LCR); at the same time, the Kazakh regulator keeps using some national liquidity ratios concurrently, while in Belarus, the new ratios have completely replaced the national ones.

‘Cleansing’ in the banking market

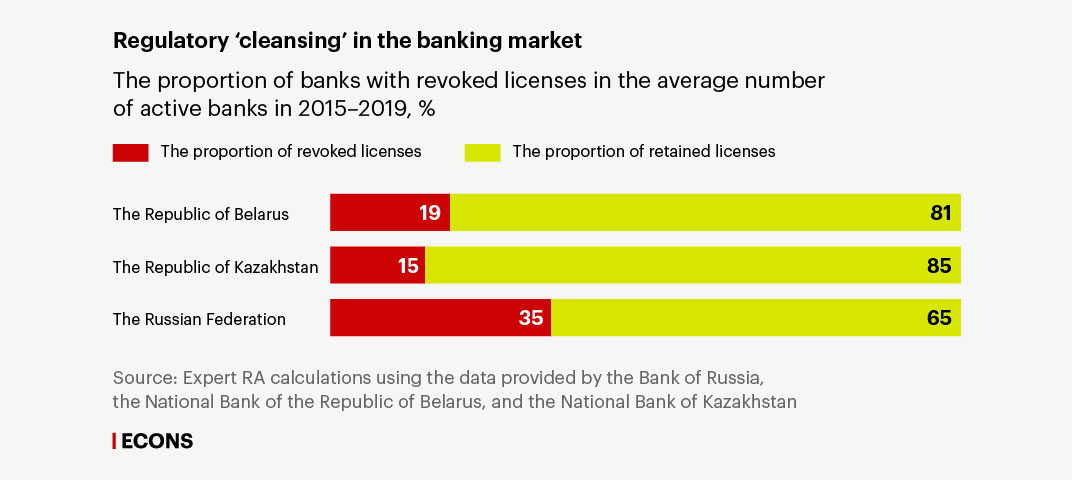

Despite more lenient capital requirements and some ratio standards, the Russian regulator takes extreme measures, i.e. revocation of banking licenses, more often than the national banks of Kazakhstan and Belarus. Over the last five years, only five entities in Belarus have lost their banking licenses, all prior to 2017. In Kazakhstan, licenses were revoked more often (in 2016-2018, at least one banking license was revoked each year) but 2019 saw no licenses revoked.

However, it is better to assess the intensity of cleansing in the banking market by the proportion of banks that have forfeited the right to engage in their core business activities over the last five years rather than by the number of revoked licenses (given the incomparable number of market participants). Thus, in Kazakhstan, one in seven banks has had to cease operations, in Belarus, this proportion is one in five and it reaches one in three in Russia.

In Russia, banking licenses can be revoked for a number of rather diverse reasons, with the most common being a high-risk lending policy, violation of anti-money laundering rules, or capital problems.

In Belarus, it was insufficient capital (when bank owners refused to change the legal form to a nonbank credit institution) that caused the revocation of the majority of licenses.

In Kazakhstan, in addition to insufficient capital, reasons for license revocation were non-compliance with prudential regulations and failure to fulfill payment obligations to counterparties. At the same time, the National Bank of Kazakhstan can suspend some banking licenses (usually for accepting deposits from individuals and legal entities) before revocation (sometimes repeatedly) and is obliged to announce these decisions on its website. The Bank of Russia's range of measures, too, includes prohibition on accepting client funds but until 2020, these decisions were not made public.

An important difference among the three banking markets is the procedure of fulfilling obligations to depositors after the license is revoked. In Russia, for example, only deposits of no more than RUB 1.4 mn are subject to mandatory reimbursement, while in Kazakhstan it is KZT 15 mn, or almost twice as much. In Belarus, all deposits are reimbursed in full, including accrued interest, whatever the sum is.

Russia has the most significant experience in bank resolution: its banking history has seen resolution carried out by individuals, credit institutions, and the government itself. In Kazakhstan, banks are resolved under government supervision and with public money and can be sold to new private investors only after rehabilitation. Belarusian law does not provide for bank resolution, and one of the reasons, probably, is that the country’s state banking sector dominates the private one, and state banks are supported through other means, ranging from direct capital injections to purchasing troubled assets by specially created entities. Nevertheless, in the near future, this should change, as the National Bank of the Republic of Belarus has announced its plans to create a national body for troubled bank resolution with technical assistance from the World Bank.

Sector transparency

Over the last decade, the banking markets of the three countries have made significant progress in terms of transparency of financial and other relevant information on business activities and the standing of market participants. Russian banks disclose the most diversified information on various areas of banking activity most regularly, while Kazakh and Belarusian banks disclose only limited information on a monthly basis, and some types of regulatory reports are not made public.

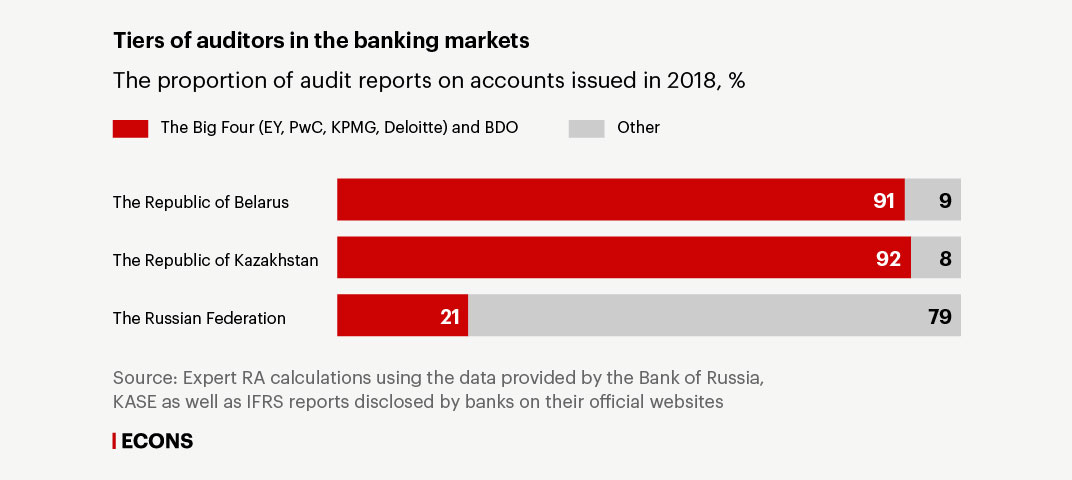

In Belarus and Kazakhstan, the majority of banks, including small entities in terms of assets, are audited by large international companies, the Big Four or BDO. The most popular bank audit firm in Belarus is BDO; in Kazakhstan, it is EY (by the number of audit reports on accounts issued in 2018). In Russia, EY has also been most popular among large banks but in general, due to domestic firms being in higher demand, the market share of the Big Four and BDO has been limited to one-fifth of the banking market (by the number of audit reports on accounts issued in 2018).

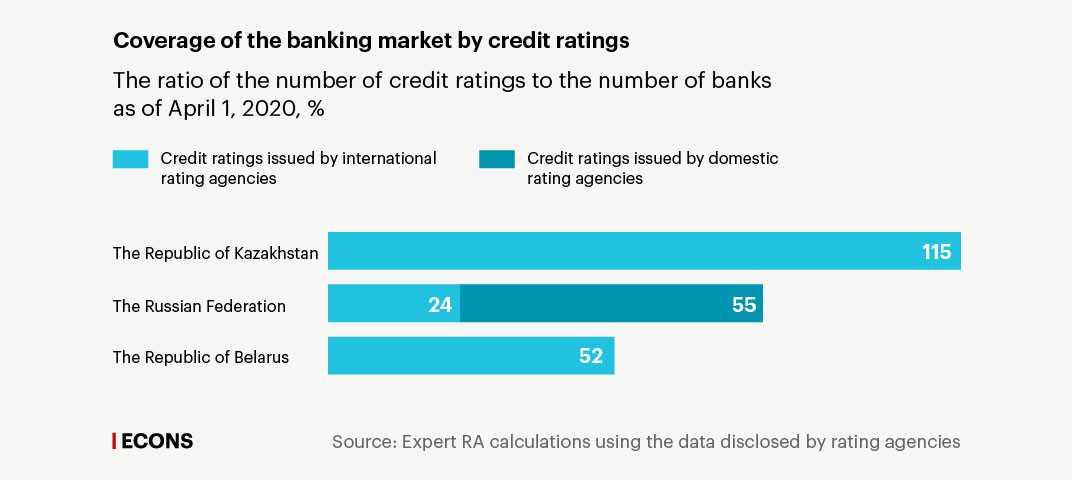

Another possible way of assessing the financial standing of players in the banking market is credit ratings. Since in Kazakhstan, many banks cooperate with two or three rating agencies, the ratio of the number of ratings assigned to the number of banks exceeds 100% (as of April 1, 2020). In Belarus, too, some banks are assigned several credit ratings (usually the top 5) but the majority of the banks are not rated at all.

Russia is the only country studied that has a mature domestic credit rating market. Belarus is just starting to establish domestic rating agencies and develop corresponding regulations. In Kazakhstan, domestic rating agencies have existed for quite a long time but the growth of demand for their services is hindered by the fact that regulatory requirements do not include credit ratings.

In Russia, the high demand for credit ratings is attributable to the fact that credit ratings issued by accredited agencies are extensively used in regulatory documents. This was made possible by the industry reform launched in 2014, during which the regulator established clear rules for the credit rating market. As of April 1, 2020, the number of credit ratings issued by just one of the largest domestic rating agencies in Russia (Expert RA) is 1.5 times higher than the total number of ratings issued by all international agencies of the Big Three (Fitch, Moody's, S&P).

Anti-pandemic measures

During the pandemic, the stability of banking sectors of all countries is under threat. The sudden decline in borrowers' income cannot leave their payment discipline unaffected. In usual times, higher risks and, accordingly, increased reserves for these loans are reflected in banks’ reports, and banks impose penalties on overdue payments and enforce collateral. During crises, this approach can stall lending amid sharply falling bank capital.

Under these circumstances, the Basel Committee considers it a priority that banks lend to the real sector of the economy, which can be ensured either through direct government support in the form of guarantees or incentive payments or through technical amendments to regulatory capital requirements. The regulators of Russia, Kazakhstan, and Belarus are following this guidance in one way or another.

The Bank of Russia has announced a wide range of measures to support various sectors of the economy, including the banking sector. Among the measures taken, there are both technical (notably, foreign currency transactions will be taken into account when calculating capital requirements at a retrospective rate, and securities can be evaluated at a fair price on a retrospective date) and direct ones (for instance, the preferential lending program has been extended to cover small and medium-sized enterprises, and the Bank of Russia has announced and launched liquidity support mechanisms). Russia’s central bank has also changed some regulations: it has softened requirements for irrevocable credit lines when LCR requirements are met.

The Belarusian regulator has reduced the maximum risk per debtor to 35%, by 10 p.p., and frozen the minimum regulatory capital for banks at its level on March 1, 2020 (earlier, the amount was regularly adjusted for inflation).

In February, the regulators of Russia and Belarus lowered their key rates by 0.25 p.p. almost simultaneously. On March 10, the National Bank of Kazakhstan increased its key rate from 9.25% to 12.0% and reduced it to 9.5% on April 4.

All countries have chosen to ease reserve requirements for loans that had to be restructured due to the crisis and grant ‘repayment holidays’ subject to a set of conditions.

The crisis has clearly shown that national regulators have different understandings of buffers to capital adequacy ratios. The Bank of Russia reminded banks that they can use the buffers to provide credit to the economy, while postponing payments to top management, and did not change the capital adequacy requirements in place. In Belarus, where buffers are subject to mandatory compliance, the regulator had to reduce one of the buffers (until December 31, 2020, the conservation buffer will be 2.25 p.p. instead of 2.5 p.p.), thus, softening the regulations. So far, the measures taken by the National Bank of Kazakhstan to support the financial sector boil down to easing lending conditions for individuals and small and medium-sized enterprises.

.jpg)