Research: Business Models in Russian Banking

Decreased economic growth has led to a profound transformation of the banking system over the last decade. As a result of the stricter regulatory and supervisory policies adopted by the Bank of Russia to push unscrupulous players out of the banking sector, a significant number of financial institutions have had to leave the market, while those that remain have had to adapt to the new economic environment, including by altering their business models.

Econs.online has analyzed the business models used by more than 1,000 banks from July 2007 to September 2018. Sberbank and VTB were not included in the analysis due to the strong influence they exert on the performance of the banking sector as a whole. The full text of the research and a description of the methodology used can be found in this PDF file (in Russian).

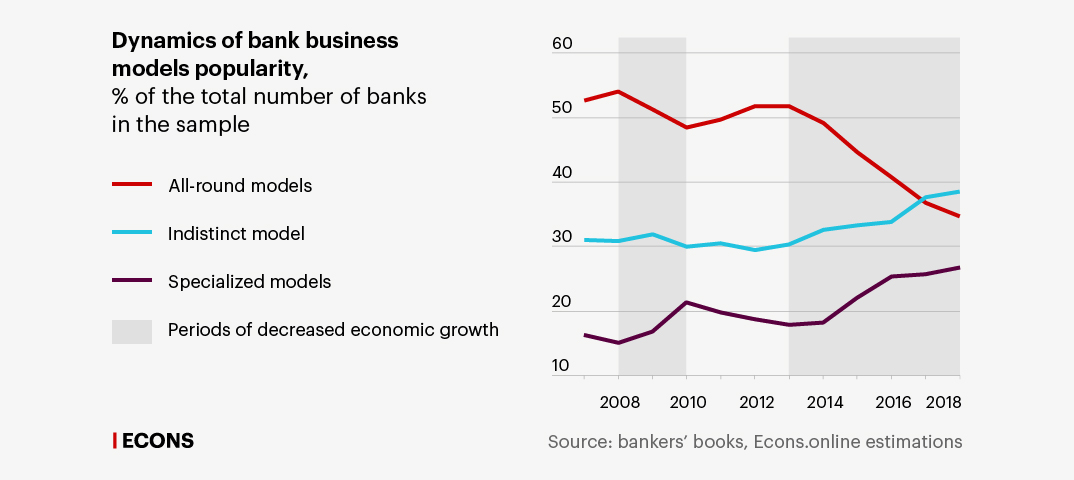

The essence of the transformation that the banking system has undergone in recent years is that the proportion of all-round banks is going down every year, while the proportion of specialized banks and banks without a clear business model is rising.

Bank business models

A business model is a bank’s product line as reflected in its balance sheet structure. If a bank offers a wide range of products to its customers, then it can be considered an all-round bank. However, banks can choose to focus only on specific operations; in this case, they are known as specialized banks.

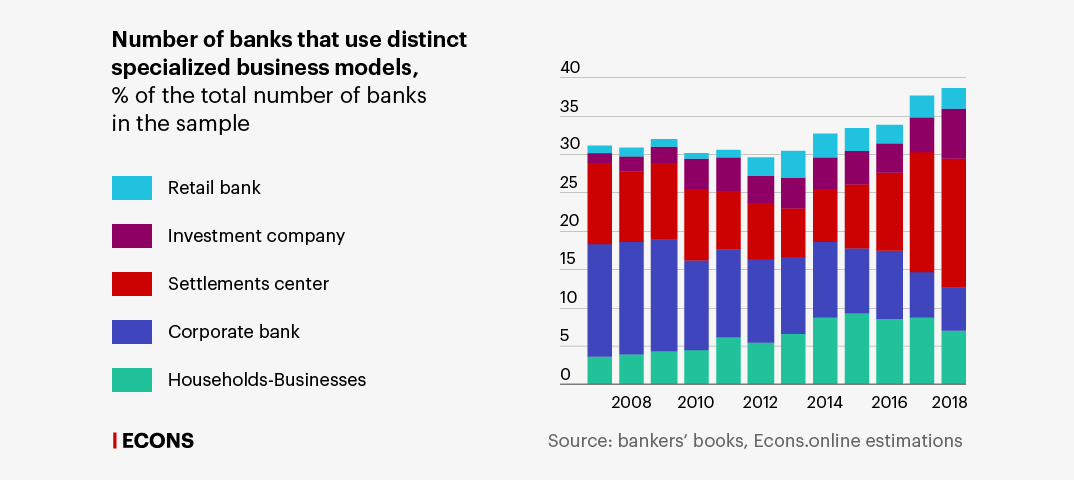

Specialized banks can be divided into five groups based on their business models:

Household-Business Bank: the bank’s borrowed funds consist primarily of household deposits, while its assets are mainly loans to businesses.

Corporate Bank: the bank’s liabilities are dominated by funds borrowed from businesses, while its assets consist mainly of corporate loans.

Settlement Center: the bank specializes in raising funds from businesses and transforming them into highly liquid assets.

Investment Company: the bank specializes in equity investments.

Retail Bank: the bank is active in the household deposits market and its assets are dominated by retail loans.

If a bank’s performance does not match any of the above models, it belongs to the third type of financial institution: those without a clear business model. This may mean that the bank has no regular clients or that it makes money from specific types of transaction (for example, foreign exchange transactions) and does not offer conventional banking products, such as loans and deposit accounts, to its clients.

Chart 1. Dynamics of bank business models popularity, % of the total number of banks in the sample

All-round models

Specialized models

Indistinct model

Periods of decreased economic growth

60

55

50

45

40

35

30

25

20

15

10

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Source: bankers’ books, Econs.online estimations

All-round models

Indistinct model

Specialized models

Periods of decreased economic growth

60

55

50

45

40

35

30

25

20

15

10

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Source: bankers’ books, Econs.online estimations

All-round models

Indistinct model

Специализированные модели

Periods of decreased economic growth

60

50

40

30

20

10

2008

2010

2012

2014

2016

2018

Source: bankers’ books,

Econs.online estimations

Shift away from all-round models

The all-round business model involves offering deposit accounts and loans to both households and companies. Demand for these products increases significantly when the economy is growing fast, but when it slows down, banks face the problem of borrower quality.

Since 2014, the decline in the number of all-round banks has accelerated rapidly. In 2007–2013, about half of all banks could be considered all-round banks, and the proportion of such banks remained more or less stable throughout the entire period (53% and 52% respectively). By 2018, however, only about one in three banks could be called all-round (35%). Some banks shifted to specialized models, but a larger number of banks continued to operate without a clear business model: in 2013, this was the case for slightly fewer than one in five banks, while in 2018, slightly more than one in four fell into this category.

Attempts to specialize

The proportion of banks operating according to specialized business models has risen from 30% to 39% over the last five years, and these banks have started to gain increased significance within the banking system as a whole. In this research, we use “significance” to mean the share in the total liabilities of the banking system (excluding Sberbank and VTB), which, in the case of specialized banks, has grown from one third in 2014 to almost half (48%) in 2018. However, not all of these transitions have been successful.

For example, after the 2008/2009 crisis, the Household-Business Bank model became particularly popular, perhaps due to the drain of corporate clients and banks’ attempts to replace business funds with household funds through aggressive marketing. However, in 2015–2017, the situation changed drastically as the licenses of many financial institutions that had been attracting household funds to provide low-quality corporate loans were withdrawn.

The Corporate Bank model has also proven unsustainable: over the last five years, the number of banks that use it has fallen by a factor of almost two, and by a factor of 2.6 over the last eleven years as a whole. However, such banks have, at the same time, become more significant: their share in the total liabilities of the banking system has grown from 9% to 22%. This perhaps suggests that this business model has turned out to be viable only for banks with large corporate clients.

Some of the banks that shifted away from the corporate model tried to move into retail, while others became “wallet banks”: since 2013, the number of banks using the Settlement Center model has more than doubled. In 2018, this model was the most widespread specialized business model.

Chart 2. Number of banks that use distinct specialized business models % of the total number of banks in the sample

Retail bank

Settlements center

Households-Businesses

Investment company

Corporate bank

40

2,8

35

6,5

0,9

30

1,3

3,5

16,7

10,7

4,0

25

6,4

20

14,6

15

10,0

5,6

10

9,2

7,0

5

6,5

3,6

0

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Source: bankers’ books, Econs.online estimations

Retail bank

Corporate bank

Investment company

Households-Businesses

Settlements center

40

2,8

35

6,5

0,9

30

1,3

3,5

16,7

10,7

25

4,0

6,4

20

14,6

15

10,0

5,6

10

9,2

5

7,0

6,5

3,6

0

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Source: bankers’ books, Econs.online estimations

Retail bank

Investment company

Settlements center

Corporate bank

Households-Businesses

40

2,8

6,5

0,9

30

1,3

3,5

16,7

10,7

4,0

20

6,4

14,6

10,0

10

5,6

9,2

7,0

6,5

3,6

0

2008

2010

2012

2014

2016

2018

Source: bankers’ books,

Econs.online estimations

Financial institutions with clear business models (either specialized or all-round) have also attracted clients from banks without clear business models. Despite the increase in the number of the banks without clear business models, their significance in the banking system has fallen by a factor of almost three in recent years, to 6.6%.

The smaller number of solvent clients hit small and medium-sized financial institutions the hardest, with many smaller banks completely unable to maintain sustainable business models as clients flocked to larger banks. The number of banks without a clear business model has soared by a factor of 1.6 in the middle-sized bank group, and by a factor of 1.3 in the small-sized bank group.