Before the COVID-19 pandemic became the key item on the global agenda, the threat of irreversible climate change was the most widely discussed issue at the global level. In March 2019, the United Nations forecasted that, should the global temperature increase at the same pace that it had been, melting permafrost would become a threat to the planet by 2050. The main reason for the rapid global warming is believed to be the concentration of carbon dioxide in the atmosphere, which has been increasing with the growth of industrial production.

Climate change poses risks to companies and the financial sector: natural disasters are becoming more frequent (physical risks), while the measures countries take to reduce carbon emissions may of themselves cause financial losses for some companies (transition risks). In this regard, climate risks are a growing concern for regulators, as they may have a significant influence on the financial sector and on financial stability in general.

The pandemic and the pandemic-related reduction in economic activity have had a short-term positive effect on the environment: according to the IMF forecast, in 2020, global carbon emissions will decline by 4–7%. In the long run, however, the pandemic will have negative effects on the environment: the deteriorating financial standing of the real sector reduces its investment potential, including its capacity to finance the transition to a low-carbon economy. Moreover, lower oil prices make companies less motivated to become more energy efficient.

Under these circumstances, many countries are considering higher incentives for the transition to a low-carbon economy, taking into account the consequences of the pandemic. In the EU, for example, environmental measures are included in post-crisis recovery plans.

Among the measures planned by the EU is a carbon tax on imports, which will have a negative impact on many Russian exporters that operate in the EU market.

EU carbon border tax

At the end of last year, the European Union announced the EU Green Deal, aimed at making the EU economy climate-neutral by 2050. To achieve this goal, among other measures, the EU will impose a carbon tax on its imports.

The tax-related legislation is currently in progress, and the calculation methodology is still unknown. The calculation is expected to include the amount of carbon emissions generated during the production of imported goods.

The European Commission can rely on three major types of taxation mechanisms. The first is taxes at the border: differential taxation based on the industry of the importer and the emissions intensity of the imported products. The second involves importers’ being included in the EU Emissions Trading System ( EU ETS) and being able to buy allowances similarly to European producers. The third mechanism is a carbon VAT for all producers of carbon products, both foreign and domestic. Moreover, the tax should be in line with World Trade Organization requirements and the EU’s international commitments.

In drafting the legislation, the European Union has held public consultations with representatives of importing countries, consultants, and international organisations. The outcomes of these consultations are to be published in the first half of 2021 along with the draft legislation. The coronavirus pandemic has had no effect on the EU's plans to introduce a carbon tax on imports: during the economic recovery, the demand for energy and carbon-intensive products is expected to increase; thus, preventing an extensive recovery from the crisis-driven by familiar technologies requires external incentives, in particular, the carbon tax.

The news about the border carbon tax has attracted a lot of attention, as the introduction of this tax will affect all levels of value chains: it will influence companies in various economic sectors in and beyond the EU. However, within the EU, this initiative is actively supported by manufacturers, many of whom have been paying similar costs since 2005, when the ETS system was introduced. By 2018, the ETS had helped the EU reduce its carbon emissions by 23% compared to 1990. This system imposed serious restrictions that mainly apply to steel and chemical producers, depriving them of their advantage over cheap importers, who, to date, have not complied with these high environmental standards.

The tax can be considered a protectionist tool: if, as expected, it is calculated based on the carbon intensity of goods, it will discriminate against foreign producers with more carbon-intensive goods, which does not correspond with WTO principles (in particular, the most-favoured-nation principle, under which equal goods produced by foreign and domestic businesses should receive equal treatment: the WTO principles do not provide for comparison based on carbon intensity). In addition, European law provides for the free-of-charge allocation of emission allowances for a number of goods produced in the EU, including steel and cement; if this does not change, the carbon tax on imports will be blatant protectionism. As a result, we can expect tariff wars and violations of international trade law.

Given the size of the European market, the tax will put even more pressure on companies and governments around the world, forcing more and more countries to take additional measures limiting emissions and develop their own legislation. The EU’s opinion is that importing companies from countries that have their own carbon pricing schemes, such as Australia, Canada or Japan, could be exempt from the tax if their governments conclude new trade agreements with the EU or revise existing ones.

To determine which industries will be most affected by the additional tax, we can turn to Europe's cap-and-trade system. The most carbon-intensive industries are mining, oil and gas, iron and steel, chemicals, and pulp and paper. They produce the largest carbon footprint and accounted for 35% of European imports in 2019, according to the EU statistics service.

Changes in the structure of the European market (redistribution of shares) will be the most painful for commodity-based economies exporting a large proportion of their carbon goods to the EU.

Impact on Russian exports

Russia may be one of the countries most affected by the border carbon tax since the EU is its key export market. According to the Federal Customs Service, European countries account for 41.7% of Russia's turnover. Moreover, according to the OECD, in 2019, Russia was second-largest exporter of carbon-intensive goods to the EU after China. However, China has its own emission-limiting mechanisms which are similar to the EU ETS; this gives the country a competitive advantage over Russia, which is just developing its carbon legislation (currently, the corresponding legislation is under discussion).

The EU border carbon tax will be a serious challenge for Russian exporters, as it will primarily affect oil, gas, coal, and metal, i.e. the country's key export goods, which, according to the Russian Federal Customs Service, accounted for 73.8% of the value of goods exported to Europe in 2019.

The Boston Consulting Group (BCG) and KPMG, too, write about the negative impact of the border carbon tax on Russia.

According to BCG experts, if the tax is applied only to the goods and services that are included in the ETS (such as transport), the taxable base will be about 100–160 million tonnes of carbon-intensive exports, which will result in 3–4.8 billion dollars of additional expenses paid by Russian exporters each year, if the tax is applied to the total amount of emissions.

KPMG analysts believe that, in the pessimistic scenario, namely, if the carbon tax is introduced in 2022, the overall losses of exporters will reach 3.6 billion euros in the first year alone. Then, the amount paid in carbon taxes will increase every year, reaching 8.2 billion euros in 2030.

Decreased profits and higher competition in the European market will change the market situation and may have a negative effect on Russian exports to the EU.

In different industries, the structure of EU imports may change in various ways. On the one hand, given current oil extraction technologies, oil from Saudi Arabia, with its lower carbon footprint, could edge out Russian crude oil. The BCG analysts estimate that the oil and gas industry accounts for 45–53% of the total carbon emissions of Russian exporters, or 45–84 million tonnes of CO2, and from 2022 onward, companies will have to pay 1.4–2.5 billion dollars a year in carbon taxes.

If the tax is imposed on the total amount of emissions, Russian fertilizer producers and the pulp and paper businesses will also suffer negative consequences due to their significantly decreased competitiveness in the European market.

At the same time, some Russian steel producers with low production costs may increase their share of the European market, taking the places of competitors from other countries that leave the EU market, since the carbon tax will make their costs higher than the market value of their goods. BCG estimates that mining and metallurgical companies will pay 0.4–0.6 billion dollars in taxes each year because they account for 25–30% of export emissions.

Given the scale of the damage, the tax will have a negative impact on the financial performance of companies due to reduced export revenues and lost market share.

Impact on the Russian financial sector

Due to the close ties between the real and financial sectors, the border carbon tax will, then, impact Russian financial companies: the Russian private sector is characterised by highly concentrated corporate debt with a small number of major borrowers (including the key exporters of carbon-intensive goods) accounting for a large share of debt.

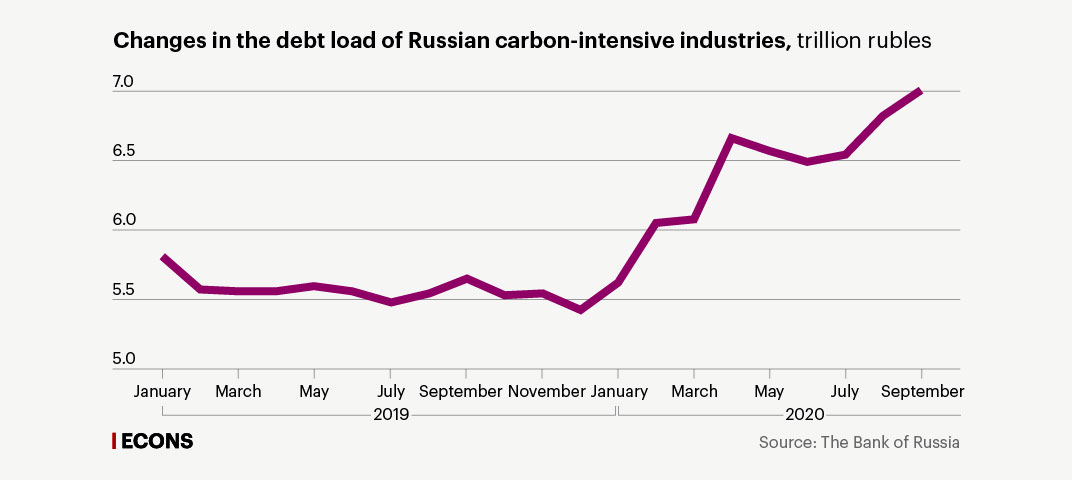

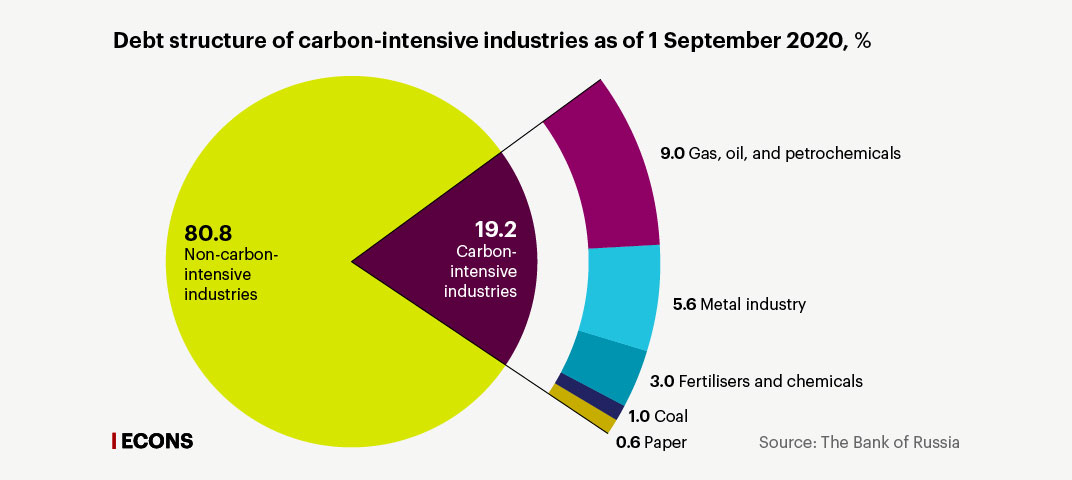

As of 1 September 2020, Russian oil and gas, mining, and pulp and paper companies accounted for 7 trillion rubles in bank loans or 19.2% of the total corporate debt portfolio. Oil and gas companies account for the largest share of debt (9%).

The growing debt load of carbon-intensive industries, along with the additional expenses associated with exporting to the EU and the reduced income of borrowers, may make it tough to maintain financial stability and solvency. During the post-coronavirus economic recovery, this will put even more pressure on banks and leasing companies (according to Expert RA, in the first half of 2020, carbon-intensive industries, i.e. oil and gas, iron and steel, and energy, accounted for 4% of new leasing property in the total leasing portfolio of new business). Consequently, this will increase the likelihood of credit risk occurrence for the Russian financial sector.

Moreover, the border carbon tax may affect the market value of companies, reducing their investment attractiveness and capitalisation, thus resulting in the realisation of market risks for the financial sector, including banks, insurance companies, and investment and pension funds which own shares of carbon-intensive companies in their portfolios.

Given that the European Union may exempt importers from countries with their own carbon pricing schemes from the carbon tax, a domestic Russian mechanism regulating the carbon market could be a solution. This could entail a domestic carbon tax or a cap-and-trade system accumulating carbon money in the Russian budget. Otherwise, similar mechanisms adopted by other countries may potentially also affect the competitiveness of the Russian private sector.

Tools reducing carbon emissions

In December 2015, about 200 countries signed the Paris Agreement, aimed at reducing carbon emissions in order to keep average global temperature growth below 2 °C over pre-industrial levels and limit global warming to no more than 1.5 °C. The Paris Agreement does not establish standards for emissions reduction, and each country sets its own targets.

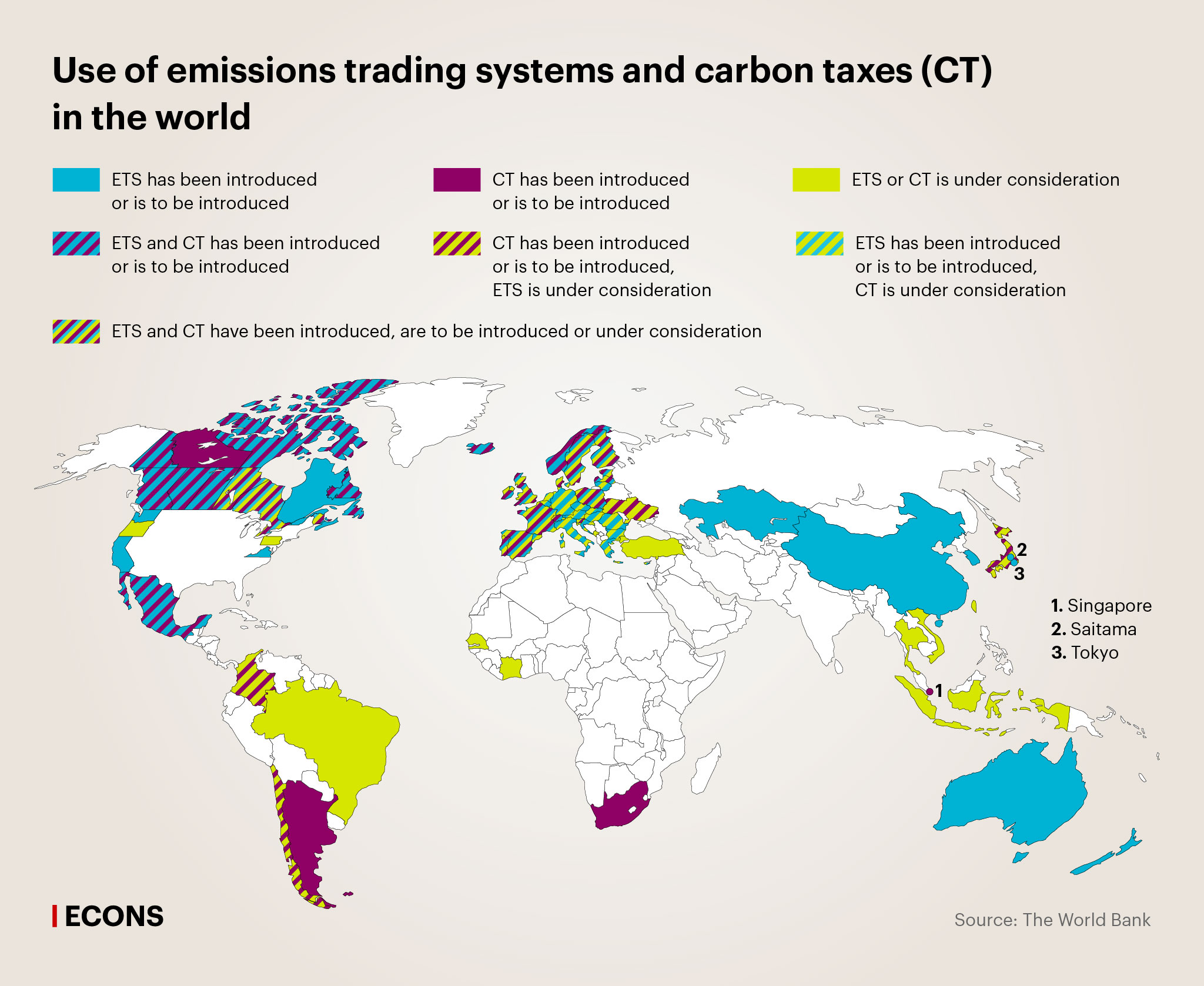

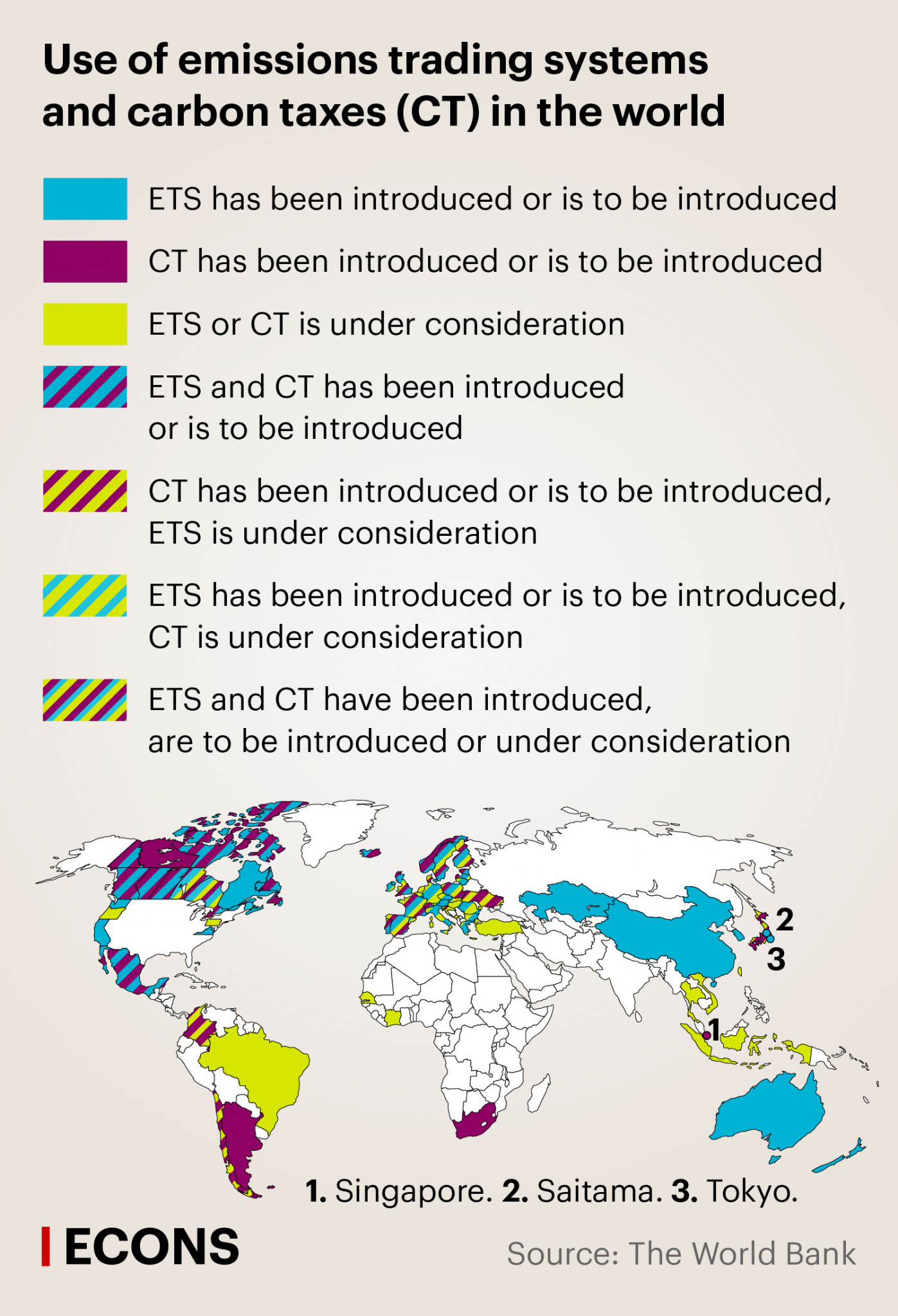

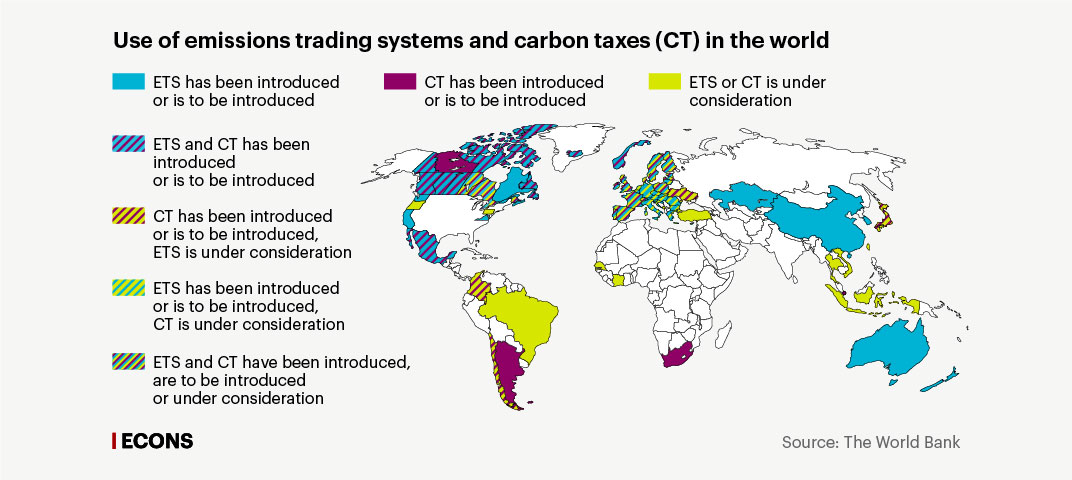

The key ways to stimulate the reduction of carbon emissions are emissions trading systems (ETS) and carbon taxes. These two tools are not mutually exclusive: in some jurisdictions, both are applied simultaneously (for example, in Mexico, some Canadian provinces, Finland, Sweden, Norway, Denmark, Iceland, and in a number of other European countries).

According to the World Bank, 61 initiatives aimed at reducing carbon emissions (31 of them are ETS and 30 imply the introduction of a carbon tax) have already been implemented or are to be implemented around the world. However, these initiatives cover only 22% of global greenhouse gas emissions, and the cost of emissions is still too low to meet the goals of the Paris Agreement.

The scientific community has noted that creating national independent bodies to control carbon emissions and minimise the influence of lobbies could accelerate global progress on this issue.

International initiatives may also help achieve sustainable development. At its 2020 summit, which took place on 21–22 November, the G20 endorsed the Circular Carbon Economy Platform (CCE) aimed at promoting energy efficiency in all sectors of the economy, which is based on four elements: emissions reduction, reuse (transforming emissions into primary industrial products), recycling (neutralising emissions, such as through the use biofuels and bioenergy), and removing emissions from the atmosphere (carbon capture and storage).

An emissions trading system involves emissions limits for certain industries. In these industries, companies must hold a permit for each unit of emissions.

National ETSs have already been introduced or are to be introduced in Australia, New Zealand, Brazil, China, Kazakhstan, in most European countries, and some states of the United States (Washington, California, Virginia). There is currently no global emissions trading system. The Kyoto Protocol potentially provides for one, but a single ETS uniting regional and national ones requires that these systems be compatible and that a single limit for emissions be established: the linked emissions trading system of the EU and Switzerland, entering into force on 1 January 2020, may serve as an example.

The EU Emissions Trading Scheme launched in 2005 is the first and, to date, the largest in terms of coverage (about 4% of global greenhouse gas emissions and about 45% of the emissions generated by the EU energy and manufacturing sectors and air transport within the European Economic Area). The EU ETS can be considered quite effective: in 2018, greenhouse gas emissions in the sectors covered fell by 29% compared to 2005; the goal is to make them 43% lower in 2030 than in 2005.

In the U.S., 10 northeastern states have adopted a joint ETS: energy companies are required to buy emissions allowances at auction. In 2015–2017, the ETS caused a 45% (compared to 2006–2008) drop in the average annual emissions generated by the sectors included in the programme. Since 2011, China has been testing different ETS designs, and it plans to launch a National Emissions Trading System in 2021: it is expected to be the world's largest in terms of the share of global greenhouse gas emissions covered.

In Kazakhstan, a cap-and-trade system was introduced in 2013, and it currently includes 129 companies.

Nevertheless, the efficiency of an ETS in terms of capping carbon emissions is limited. ETS helps to set clear emissions limits, but the price of carbon emissions is not fixed and depends on the demand for allowances: when demand is low (for example, during a crisis), the cost of allowances will be low and the ETS will not provide sufficient incentive to reduce emissions. A stability reserve can reduce the volatility of emissions prices by allowing the state to buy allowances, stabilising prices when demand is low. For example, after the global financial crisis, the EU created the Market Stability Reserve to stabilise the price of allowances.

A carbon tax, on the other hand, is a tax rate set by the government per unit of emissions or per unit of emissions exceeding the limits. Carbon taxes have already been introduced or are to be introduced in Argentina, Chile, South Africa, Japan, and many European countries. Unlike an ETS, a tax sets a fixed price for carbon emissions but does not guarantee a certain level of emissions.

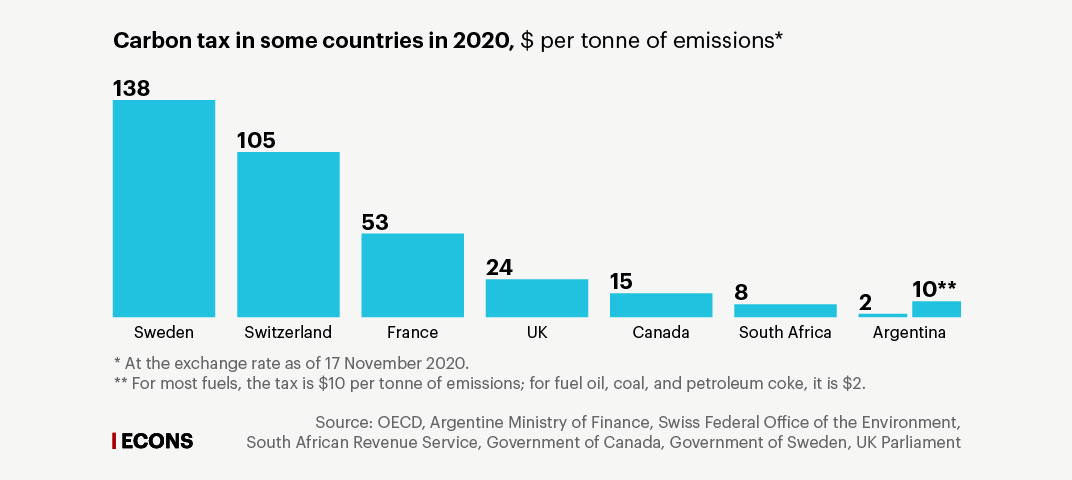

In Sweden, the carbon tax was introduced in 1991 and is still the key policy to combat climate change, covering about 40% of greenhouse gas emissions in the country. Sweden has the highest carbon tax in the world: in 2020 it was 1190 Swedish kronor ($138) per tonne of emissions. This carbon tax was part of a sweeping tax reform that also included state support measures for middle- and low-income households to offset the rising cost of energy due to the carbon tax. From 1990 to 2007, Sweden's GDP increased by 78%, while greenhouse gas emissions decreased by 26%. By 2045, Sweden plans to reduce its net greenhouse gas emissions to zero.

In 2013, the UK introduced a carbon tax of 18 pounds ($24) per tonne of emissions. This has caused a significant reduction in the consumption of coal, which is the most carbon-intensive energy resource: from 2013 to 2019, the share of energy produced by burning coal dropped from 40% to 3%. Argentina introduced a carbon tax in 2018, and Canada and South Africa did so in 2019.

How to reduce risks

In a world transiting to greener technologies, systemic measures are needed to support the competitiveness of the Russian economy both at the state level (a regulatory framework and standards of reporting and disclosing carbon emissions, emissions regulation mechanisms; support for industries that have to adapt to the economy in transition) and at the enterprise level (mechanisms for measuring the carbon footprint, evaluation of the possibility of reducing carbon emissions through the modernisation of production).

Some major Russian exporters from the oil and gas and iron and steel industries have already recognised the threat of climate risks: it is reflected in their annual reports and sustainable development reports with carbon emission trends and strategies aimed at switching to less carbon-intensive technologies. However, such programmes often exist only on paper, and in many cases, the risks of a carbon tax are not assessed. To achieve sustainability and emissions reduction goals, companies will need structural changes and probably additional financing, which may have a negative impact on their debt load.

Some government measures are already being implemented: nationally targeted Sustainable Development Goals (SDGs) and climate goals have been set, and they have been adapted for and included in the national development goals for 2030. Steps have been taken to facilitate the financing of the SDGs: in May 2019, the Ministry of Industry and Trade launched a programme to subsidise coupon payments on bonds issued as part of investment projects aimed at the adoption of the best available technologies. The Ministry of Economic Development has created a Green Bond Market Concept and is drafting a federal law on the disclosure of non-financial information related to sustainable development factors in the business activities of private entities.

The Bank of Russia is also paying a lot of attention to the green economy and climate risk analysis. It is now developing ways to ensure access to information and promote responsible investment, is investigating methods of incorporating climate risk assessment into stress testing, and is analysing systemic credit risks in the banking sector. The Bank of Russia is working with the government to support the development of a green bond market—more about all these measures can be found in the Financial Stability Review. The Bank of Russia is also involved in international work aimed at identifying risks associated with climate change and developing recommendations to address them, having joined the international Network of Central Banks and Supervisors for Greening the Financial System (NGFS) in December 2019.