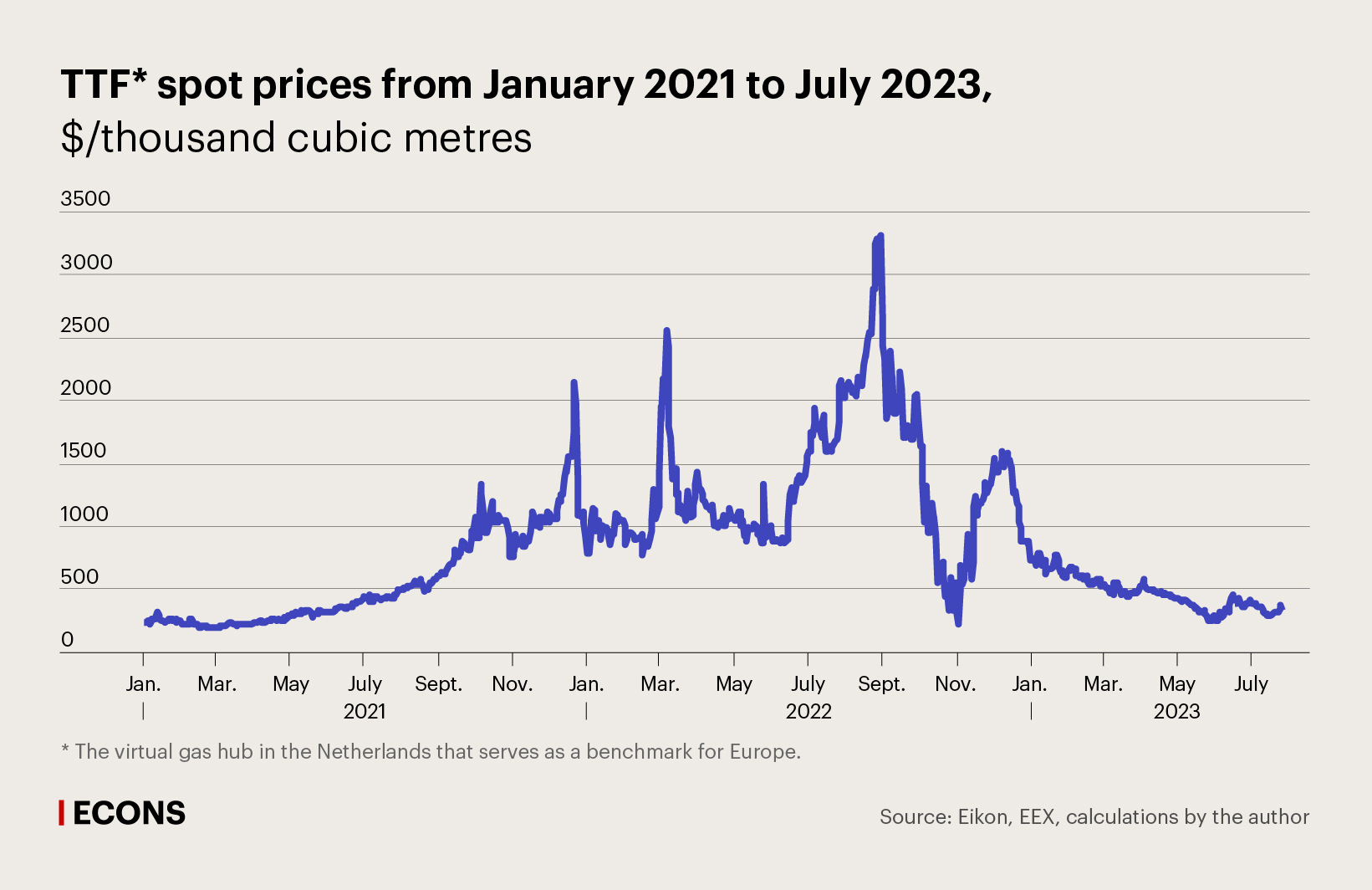

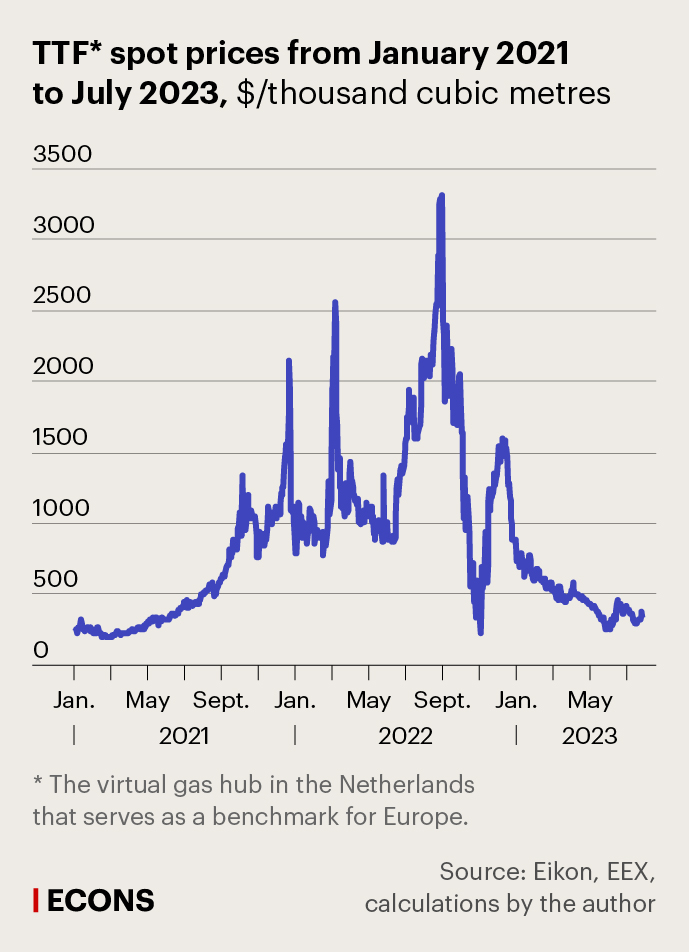

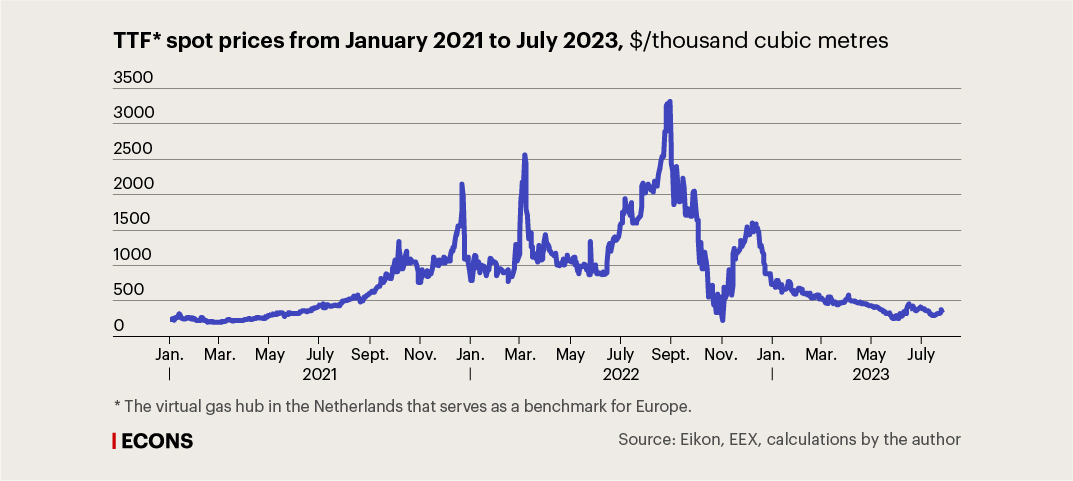

Spot prices for gas first reached a record level of $1000 per thousand cubic metres in the autumn of 2021, crossed the $2000 mark by the winter of 2022, and broke the $3000 mark in the autumn of 2022 amid concerns of a possible energy crisis in the European Union. However, the predictions of a severe energy crisis for the EU in the past winter’s heating season did not materialise: gas prices steadily declined from the beginning of 2023 and have remained at a relatively low level this summer. In July 2023, the cost of a thousand cubic metres of gas dropped to $290, which is approximately one tenth of the level of the same period in 2022.

This decrease in prices is occurring against the backdrop of a decline in the supply of Russian pipeline gas, which currently stands at around 2 billion cubic metres (bcm) per month, compared with supplies approximately 5–6 times higher in 2021. According to our estimates, pipeline gas deliveries from Russia to the EU in 2023 will amount to about 24–26 bcm, compared to 147 bcm in 2021. Thus, the decrease will exceed 120 bcm, which represents approximately 30% of the overall European consumption.

Drivers of decrease

How did the European market manage to adapt so quickly to the reduction in supplies from Russia, and how sustainable is the current price level?

The key reasons for the decrease in European gas prices in 2023 are connected with several factors. First is the demand factor. Many consumers began to reduce their consumption of this energy resource in response to last year’s price shock. Gas consumption in the EU was 13.4%, or 55 bcm, lower in 2022 compared to 2021. The decline in demand was particularly pronounced in October and November of 2022. This decrease in demand accounted for up to 70% of the replacement of Russian pipeline gas supplies to the EU in 2022 (around 73 bcm) and was a key factor in reducing the EU’s dependence on Russian gas.

The reduction in Russian gas supplies was also offset by the weather. October 2022 and January 2023 were the warmest months on record in Europe, and November 2022 was the third warmest November in 20 years. The winter of 2022–2023 was one of the warmest in several decades, second only to the winter of 2019–2020, which also contributed to the decrease in gas consumption by households and utilities.

Structural factors also played a role. A number of industrial companies in the EU have shifted to alternative energy sources, including fuel oil and liquefied hydrocarbon gases. Several major chemical and fertiliser producers, such as BASF and Yara, have announced plans to gradually close their production sites in the EU (though these plans may be reconsidered under new price conditions). Facing rising electricity and heating bills, households have also adjusted their energy consumption and invested in improving the energy efficiency of their homes.

Interestingly, the decline in gas demand continued in 2023 despite the decrease in prices. For example, in May 2023, gas demand in the EU countries was 22% lower than the average level of 2019–2021. The largest drop in demand was observed in households (25%), industry (25%), and the power sector (13%). This decrease in demand exerted additional downward pressure on prices this year. Ultimately, it was the strong demand response to the price shock that helped balance the market fairly quickly.

Second, there is the supply factor. The increase in the supply of liquefied natural gas (LNG) allowed for up to 30% substitution of the reduced pipeline supplies from Russia. In 2023 H1, European imports of LNG grew by 6 million tonnes and reached 44 million tonnes. Additional supplies from the United States accounted for about two-thirds of the growth, with the remainder primarily coming from North Africa.

The availability of additional supplies for Europe was partly due to the fact that gas demand in Asian markets also decreased by 1.6% in response to high prices, marking the first annual decline in demand in the region in the past 50 years. In most countries in the Asia-Pacific region, the decrease in gas demand occurred for the same reasons as in the European market: extremely high spot prices, producers refusing to increase supplies under long-term contracts, and mild weather. In China, in addition to these factors, strict anti-COVID restrictions and a shift in energy policy towards supporting domestic production, promoting coal consumption, and accelerating the development of renewable energy sources also contributed to the decrease in demand.

Thus, the EU economy was able to adapt rather quickly to the reduction in gas supplies from Russia due to a combination of structural and market factors. However, this does not mean that the current low prices are guaranteed in the medium term.

Long-term European price levels are likely to increase as gas demand recovers in China and other Asian countries, as well as in the event of a colder upcoming winter. Moreover, the high price volatility is expected to persist for the foreseeable future. The uncertainty surrounding the many factors that influence the gas market balance, along with the focus on spot deliveries, will continue to support the high volatility of gas prices.

For the European gas market, we believe that this ‘new normal’ means that price levels will fall within the range of $500–600 per thousand cubic metres. This is higher than the ‘old normal’, in which prices were in the range of $250–300, but significantly lower than the extreme levels of $2000–3000 seen last year.

Change in geography of supplies

In the near future, the European market will be forced to rely on LNG as alternative producers of pipeline gas, including Norway, Algeria, and Azerbaijan, will not be able to provide significant growth in supplies. In the coming years, the two major suppliers of new LNG, not counting Russia, will be the United States and Qatar. These two countries will meet the additional gas demand of the European market.

The fundamentally new long-term price level for the EU will be determined by the long-term marginal costs of the new supply. In other words, these prices will be close to the break-even prices of new US LNG projects, taking into account the prices at Henry Hub (the centre of spot and futures trading in natural gas in the United States and the American benchmark for gas prices).

The demand for gas in the EU will continue to decline steadily, albeit at a slower pace. This is because the most readily available possibilities for gas substitution have already been implemented in the past two years. However, due to the elevated market volatility and geopolitical risks, gas will remain a risky and volatile energy resource for consumers even at the more comfortable current price level.

.jpeg)