Investors have been using cryptoassets as additional insurance (link in Russian) to diversify their portfolios, but now cryptoassets are becoming increasingly similar to risky stocks. In the 2010s, it was believed that investment in Bitcoin might help diversify a portfolio due to the low correlation of this asset with the international capital market, whereas in the 2020s, major cryptocurrencies have been demonstrating a high level of market risk (the so-called beta coefficient reflecting the dynamics of the profitability of a certain security or portfolio vs the market average) relative to the S&P 500 Index. In fact, cryptoassets now resemble a ‘lottery ticket’ in an investment portfolio, given their altered risk profile.

Downside risk in the case of a market decline

Due to the accumulation of more data on cryptocurrencies, economists now have a better understanding of this investment instrument’s factor risk model. According to the research, three main risk factors can be identified that are associated with: 1) the overall portfolio of cryptocurrencies, 2) the capitalisation of particular cryptocurrencies, and 3) the current momentum (which characterises the change in the value of a financial asset over a certain period of time). These three risk factors explain why certain cryptocurrencies can have different average return. As a rule, the higher beta coefficient of a cryptocurrency relative to the risk factors, the higher the expected return.

Some researchers also highlight another risk factor associated with a stronger reaction of this investment instrument to changes in financial market conditions, namely a ‘downside beta’. When deciding to invest in a particular financial asset, investors consider the expected return as a compensation for higher risk and the probability of a larger decline in the value of the asset. This approach is common in the stock market: for example, if the beta coefficients of security A and security B are equal, but, when the market goes down, the value of security A declines more than that of security B, investors require a higher expected return of security A. The same trend can be observed in the cryptocurrency sector of the market.

One of the latest IMF studies shows that the dynamics of cryptocurrencies have come to resemble traditional capital markets, especially in terms of increasing sensitivity of Bitcoin to macroeconomic news, such as changes in the policy rate or the level of unemployment. As a result, prices of crypto assets are synchronised with the general dynamics of the capital market, losing its specificity of a niche product.

In two studies carried out at NES jointly with graduates Anastasia Sergeeva and Sergey Korsunov, we analyse the extent to which the risks of cryptocurrencies are transmitted to the stock market and how strong the reverse reaction is. By analogy with the research by Oleg Tsyvinsky, a visiting professor at NES, with co-authors and Victoria Dobrynskaya, HSE, we checked how important the returns of Bitcoin and Ethereum (a cryptocurrency and the eponymous platform for creating decentralised blockchain-based online services) are to the US stock market and how this affects investment priorities.

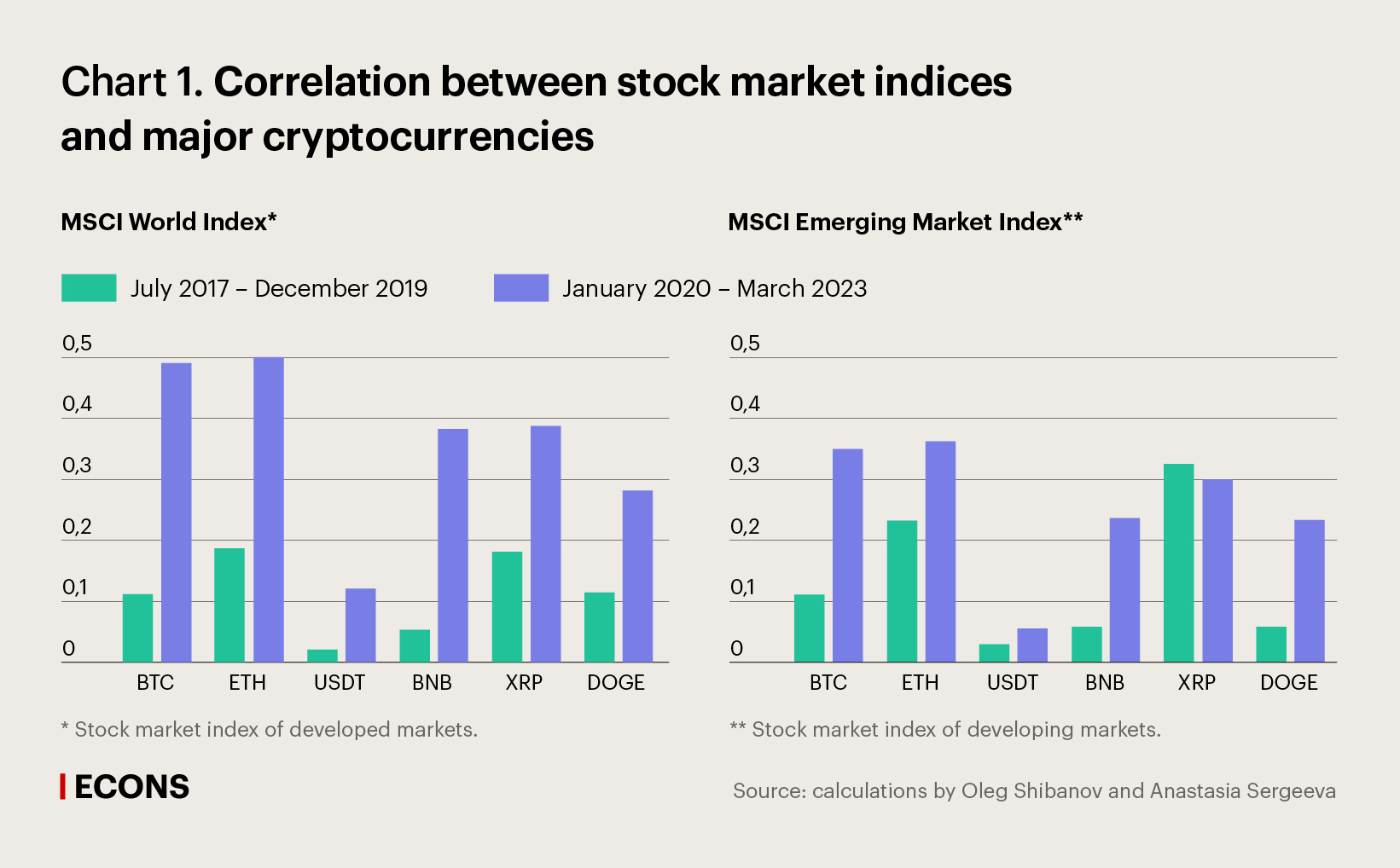

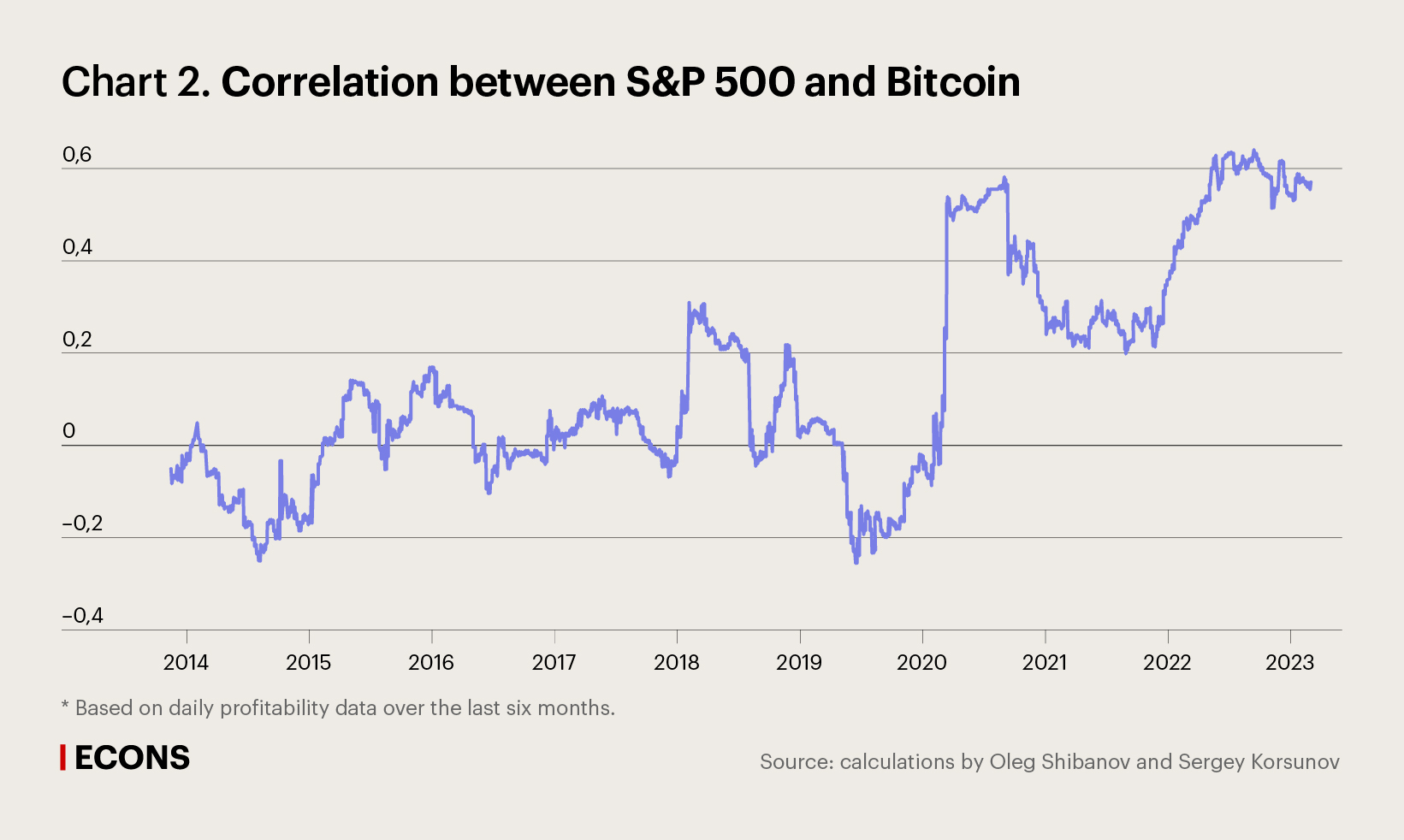

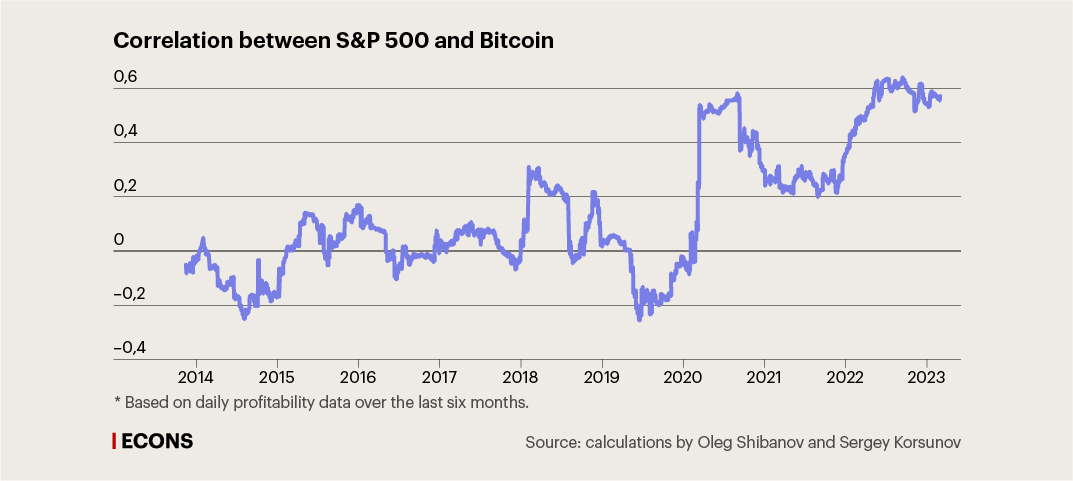

The study finds that the overall correlation between investment in the cryptocurrency and stock markets has surged since the early 2020s (see Chart 1). However, there have been few periods of a stable correlation during this time due to high volatility of the cryptocurrency segment. Besides, it should be taken into consideration that high volatility of cryptocurrencies was characteristic of not only the 2020s, but also previous periods (link in Russian) (see Chart 2). Our research also shows that cryptocurrencies can both increase and decrease the diversification of an investment portfolio over different periods of time.

Based on the data we analysed, it follows that Bitcoin was responsible for significant portion of risk for the US stock portfolios until 2020 and, starting from 2020, that has been Ethereum. The increase in risks is, probably, also associated with a surge in investment through online brokers and crypto exchanges accessible to all individuals in the USA. This spurs a rapid transfer of investments and related risks across various segments of the financial market, in particular, from the stock market to the cryptocurrency market and vice versa.

Cryptocurrencies as investment portfolio insurance

Is it fair to say that, due to the growing correlation of the dynamics of cryptoassets with the stock market, risks of cryptocurrencies for an investment portfolio have become different? Logically, high cryptocurrency volatility should increase the beta coefficient of cryptoassets relative to the stock market, which in turn should reduce the benefit from the diversification through investment in cryptocurrencies.

In research carried out jointly with Sergey Korsunov, we analyse (link in Russian) the effectiveness of investment diversification by asset type using factor analysis to identify the correlation between the stock and cryptocurrency markets more accurately. The research shows that, first of all, cryptomarket volatility had been gradually decreasing. For the convenience of calculations, the whole time period is divided into two intervals: from 10 March 2016 to 11 March 2020 (before the pandemic) and from 12 March 2020 to 28 February 2023. In the first interval, the average cryptocurrency volatility was close to 70% in annual terms. In the second interval, it decreased to nearly 58%, which is considerably above the average volatility of stocks (approx. 30%) and the S&P 500 Index (approx. 16%).

Secondly, even taking into account the control of risks that should be considered as standard, the cryptocurrency index is characterised by substantial growth of the beta coefficient compared to stocks. The beta coefficient of cryptocurrencies relative to the stock market increased from 0.4 to almost 1.4, which significantly differs from the risk level of previous periods. A similar effect was observed in the so-called quartile portfolios that divide cryptocurrencies by class: in this case, the beta coefficient rose to 0.5–1.2.

The calculations show that cryptocurrencies have become an even less attractive asset for the average investor's investment portfolio due to higher systemic risk.

Our research leads to several important conclusions. The first one is that inherent risk factors of cryptocurrencies are similar to those of the stock market. Secondly, systemic risks surged since 2020: this is confirmed by significant growth in the beta coefficient of cryptocurrencies relative to the same indicator of the stock market. Thirdly, the mutual impact of the risks of the cryptocurrency and US stock markets increased from 2020, including because individuals had the option of simultaneous trading in all market segments. This implies that, for a strategic investor, cryptocurrencies are no longer a profitable asset for diversifying risks, as they used to be at the earlier stages of the development of crypto assets.