The problem of inequality that is urgent in many economies around the globe, including Russia, relates not only to differences in income and wealth across wider social groups, but also to the concentration of wealth in a small ‘elite’ group. A number of assessments (Credit Suisse, World Inequality Lab, etc.) have found that Russia is among the world’s leaders in terms of the concentration of income and wealth in a 1% group (and to an even greater extent – in smaller subgroups), the level of which is extremely high.

Thus, Credit Suisse and UBS report that the proportion of wealth held by the richest 1% of Russians equals 56.4% and Russia tops the world’s list by this indicator. As measured by the Gini coefficient for wealth, Russia (86.9) shares 10th place with the United Arab Emirates among the 164 countries surveyed behind several African countries, as well as Sweden and Brazil.

According to the 2022 data released by the World Inequality Lab, the proportion of wealth held by the top 1% of Russia’s super-rich is estimated somewhat lower, namely at 47.7% (for reference: 34.9% in the USA, 32.6% in China, 26.4% in Germany, and 24.0% in France). Among the 169 economies surveyed, Russia ranks 8th in terms of wealth concentration among the richest 1% of its citizens. Other economies topping the list are predominantly African countries, as well as Mexico, Brazil, and Chile.

So, who controls this large portion of aggregate wealth in Russia today and how does the composition of this group change over time? Russia’s super-rich are almost inaccessible for sociological surveys. Nevertheless, some estimates can be made through the analysis of the socio-economic and demographic characteristics of the Russians put on Forbes’ list of the richest Russian businessmen.

The list has been published since 2004 on an annual basis. It included 100 businessmen before 2011 and was then expanded to 200. Forbes collects the information about wealth based on (link in Russian) the estimates of the value of assets, real estate, and personal property. Undoubtedly, these estimates might be incomplete, and the rating might contain some inaccuracies. Nonetheless, this rating helps to outline the ‘visible wealth’ group who are the object of our research.

With regard to all the Russians who were included in the list at least once over the period from 2004 through 2021, we collected publicly available information on a number of socio-economic and demographic characteristics.

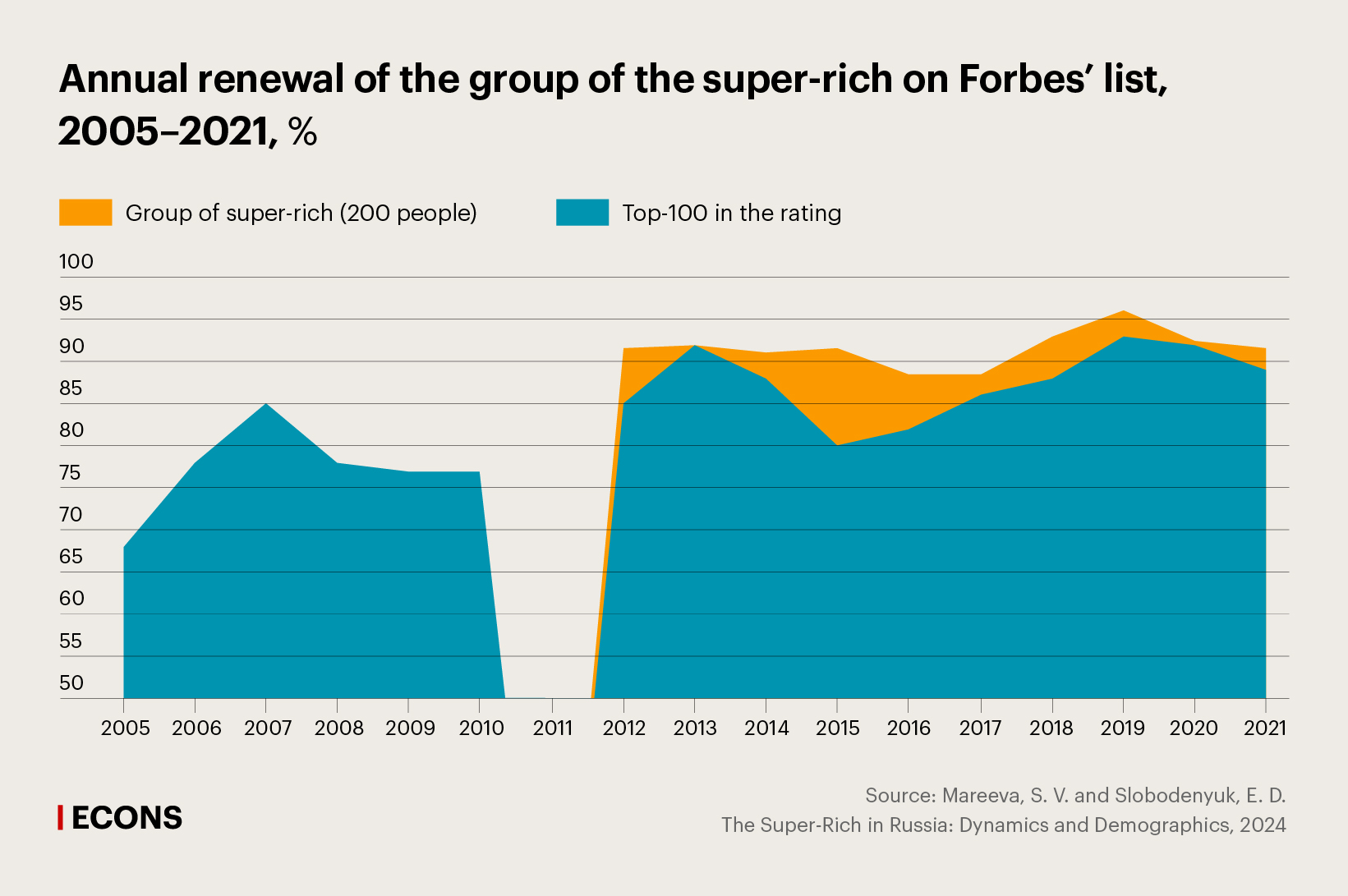

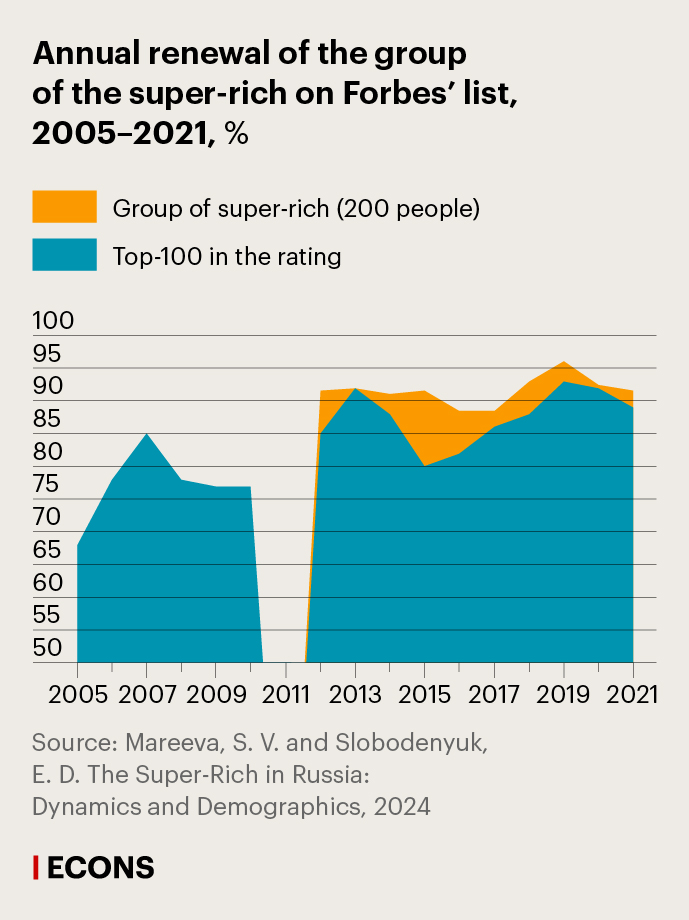

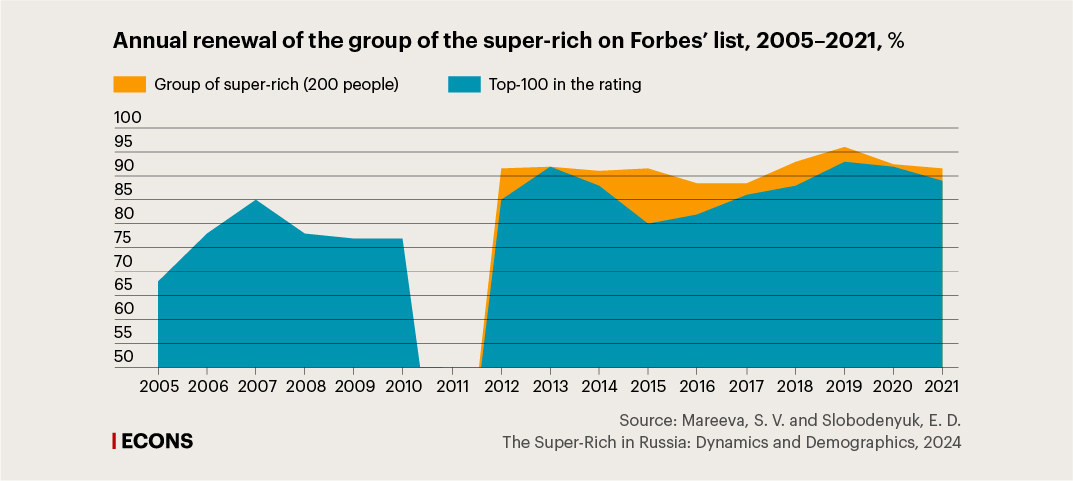

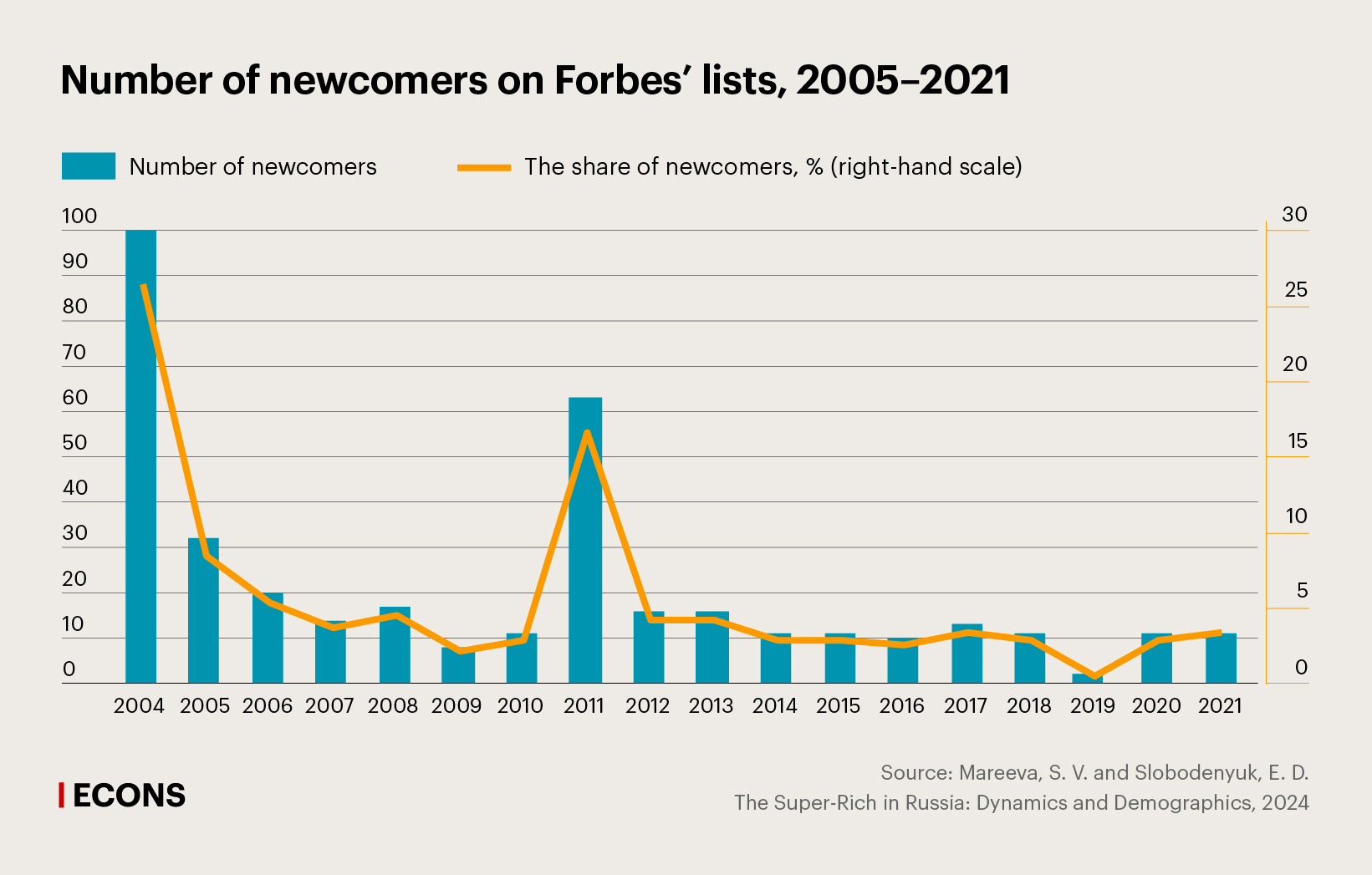

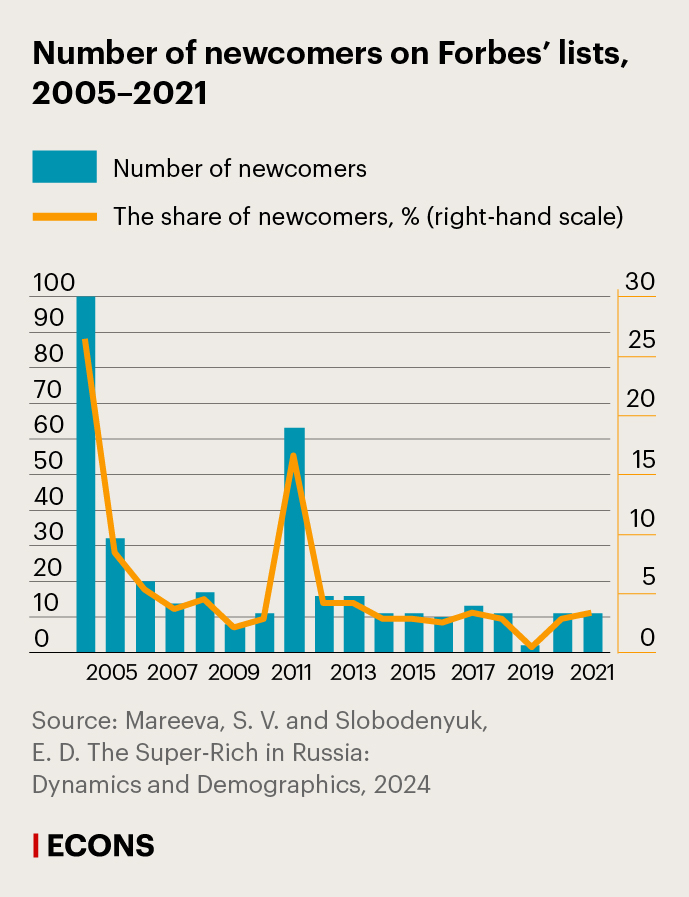

The first conclusion is that the group of Russia’s super-rich is sufficiently steady: year by year it reiterate more than 90% of its composition; while, over the entire period from 2011 through 2021, the group retained over 60% of its representatives.

The group is not totally closed and is accessible to both independent businessmen and their relatives who are already on the list. However, the composition of the group was changing quite slowly. This is qualitatively different from the dynamics of the 1990s when the composition of the group was changing very fast (link in Russian) as did its profile.

Notably, this immutability among the super-rich is fundamentally different from the precariousness in larger high-income groups of the population (link in Russian), that is, mass prosperity.

Although the group is as small as 200 people put on the list, the wealth in it is distributed very unevenly. Thus, in 2021, the wealth of the richest people on the list averaged $3.3 billion, whereas the maximum in the group was 53 times higher than the minimum. Compared to 2011, inequality in the group decreased, but only slightly.

The group of Russia’s super-rich is characterized by strong gender inequality as it includes mostly men. The situation remained nearly the same over the 15 years, although the number of women in the group edged up (overall, nine women emerged on the list over the period under review). The reasons why they were put on the list differed. This could be the result of their own business, or the receipt of capital from their male relatives (fathers, ex-husbands), or the overall effect of both.

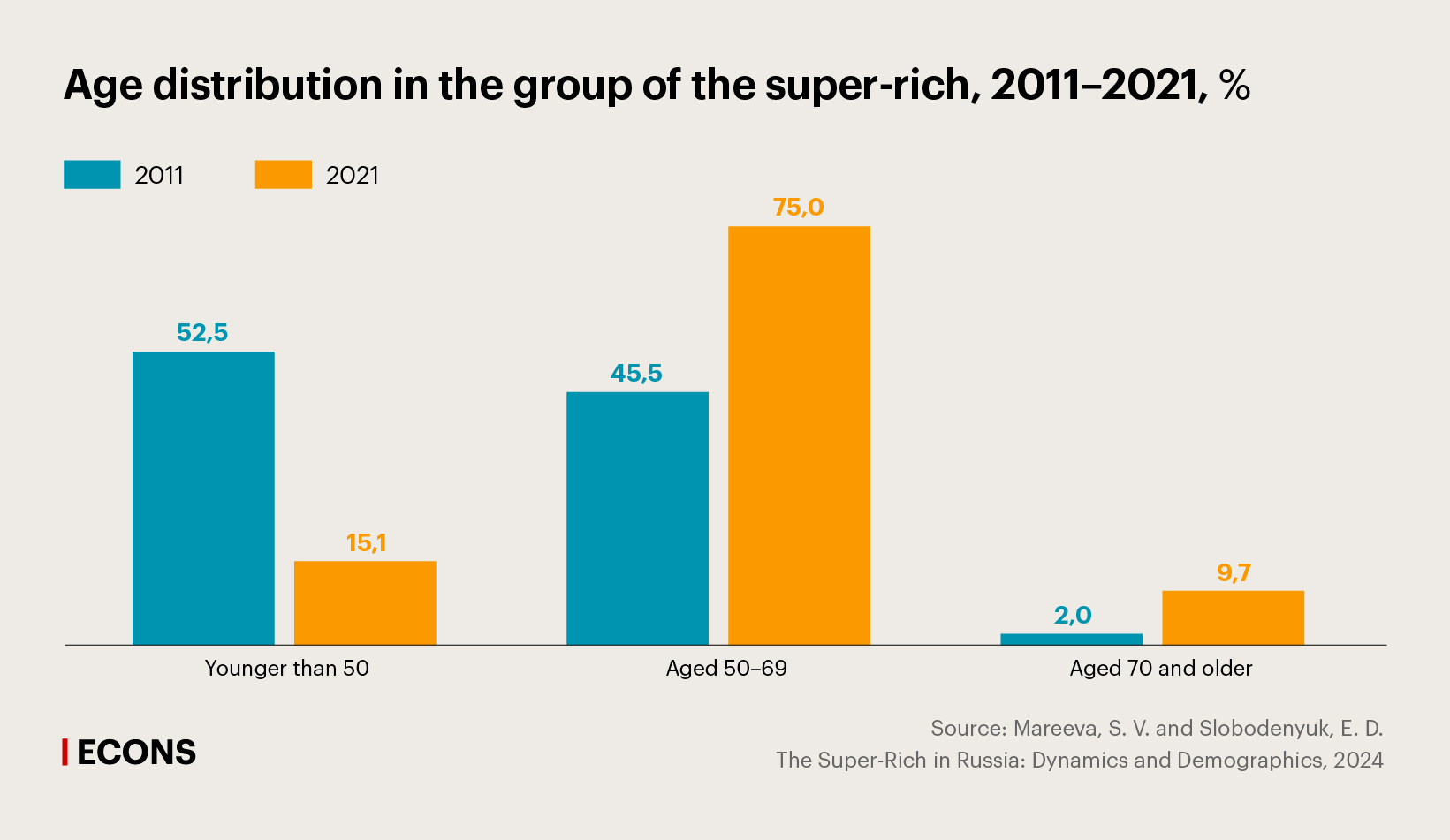

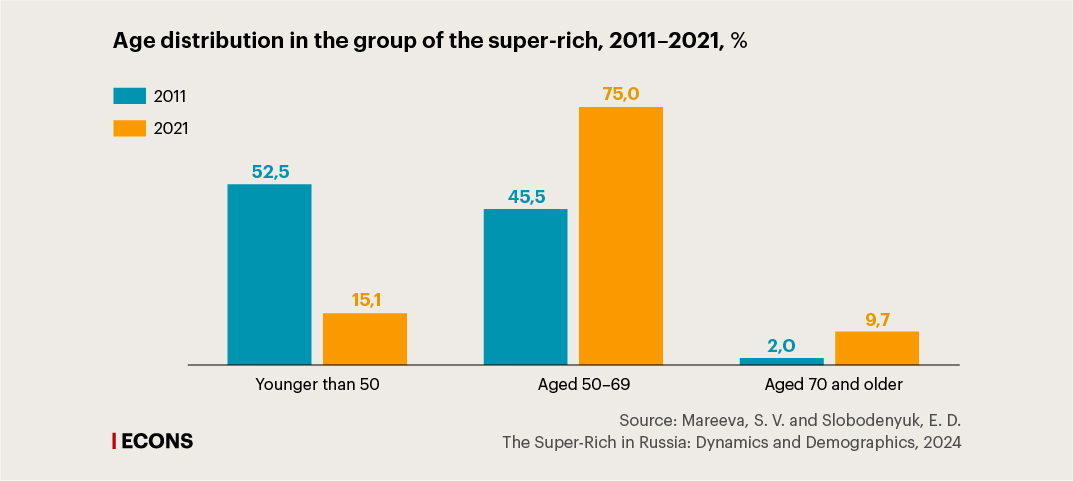

Older Russians could then access the group if they were part of the establishment, whereas younger people could take advantage of new market opportunities. However, today, the latter path is apparently almost closed. It would be reasonable to assume that the average age in the group will decrease through other processes such as succession and inheritance. Nevertheless, it is still unclear how these processes will unfold.

Education and social background

Today, the richest are very well-educated compared to other people. The absolute majority of the super-rich have higher education, with nearly 30% have education beyond higher one. As the social and economic context changed, a second university degree or research degree received in Russia was gradually substituted for foreign education in various forms.

Two-thirds of Russia’s super-rich received higher education in Moscow or Saint Petersburg. However, not all of them were born in these two cities. Many of them consciously preferred educational mobility as their life strategy – they moved to the capitals to receive the education they wanted and/or to socialize and establish connections while studying at universities.

The social background of the super-rich is particularly difficult to study as there is little publicly available information about their parents, especially mothers. Among other reasons, this is because the richest people are mostly not young. Nevertheless, the information collected (although it is not comprehensive) suggests that many super-rich businessmen come from highly educated families where both parents worked, mostly as knowledge-based experts or highly qualified specialists. Their social background should not be underestimated as a factor of their success.

A key change of the past decade in the industry distribution of the super-rich was a growing number of those engaged in computer technology, IT and communication business. However, the three sectors that continue to lead in terms of the number of super-rich are finance, the industrial sector, and the fuel and energy complex, just as ten years ago. Career paths leading to super-wealth varied significantly: in their first job, the richest people were sometimes employed as specialists with or without higher education, as bosses, or as workers. As to those who started their careers in small businesses or their administration, their percentage in the super-rich group increased over the last decade, namely from 18% in 2011 to around 25% in 2021. Noteworthy, only a third of the richest people started their careers in the private sector: half of them had their first jobs in state-owned enterprises or publicly funded organizations.

Dynamics of the group

The dynamics in the wealthiest group reflect the general changes in the country’s economic structure, with the concentration of opportunities in the capital cities, the growing importance of higher education, and the development of new industries. On the other hand, the group’s profile, due to its immutability and the low percentage of newcomers, is now dominated by those businessmen who started their careers quite long ago, even before the market reforms. Hence, the group’s profile changed only slightly over the ten years under review, although there were some signs of new trends: the percentage of women was gradually growing, the relative significance of a second university degree or research degree was decreasing compared to foreign education, and the group was steadily becoming more homogeneous in terms of the places of birth and education increasingly shifting towards the capitals. Overall, Russia’s super-rich were becoming more similar to their foreign peers.

It remains to be seen how the group’s dynamics and position might change because of the few newcomers of as late as the 2020s who took advantage of then-available opportunities and how stable their place in the group will be. Possibly, the period of new turbulence will also open up new opportunities for creating super-wealth. That said, just as in other countries, the group’s composition will be increasingly renewing through family ties and inheritance.

Read the full text of the study in the journal Universe of Russia, No. 1, 2024 (link in Russian).