How the Corona Crisis Has Influenced the Russian Labour Market

The corona crisis has had a significant impact on virtually all aspects of economic and social activity. The labour market has been no exception: in 2020, we saw many changes in working conditions and the structure of labour supply and demand, and some previously emerging trends (especially in terms of digitalisation) have strengthened. Some of these changes are temporary, and an improved epidemiological situation, especially if mass vaccination is successful, will restore normal conditions. However, a number of the changes in the structure of the labour market and the economy as a whole will, in our opinion, persist and impact inflation. The central bank evaluates the state of the economy, including the state of the labour market, when making monetary policy decisions, and it is important for the bank to identify and assess the scale of these long-term structural changes in the labour market in a timely manner.

Judging by the way the corona crisis situation has been developing in Russia and other countries, we can highlight the following key changes in the labour market.

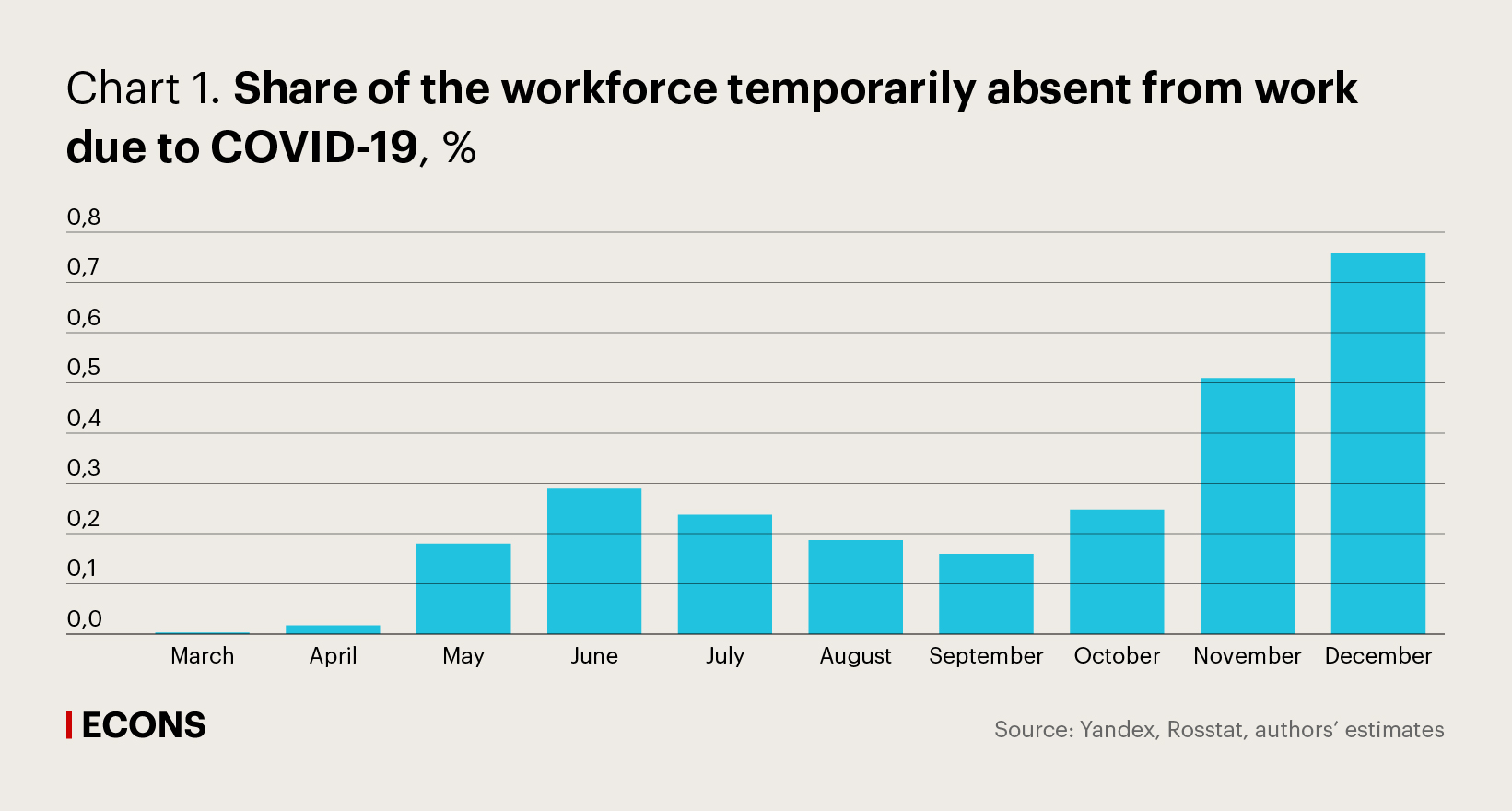

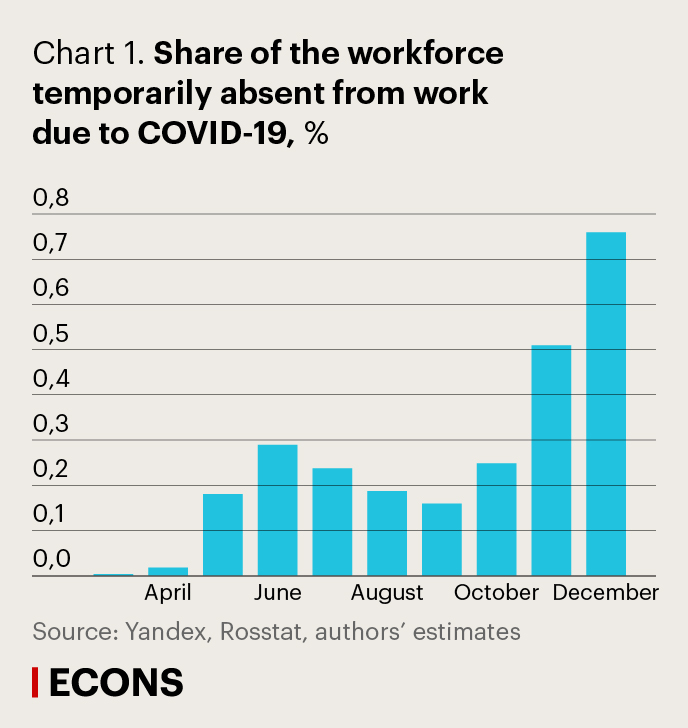

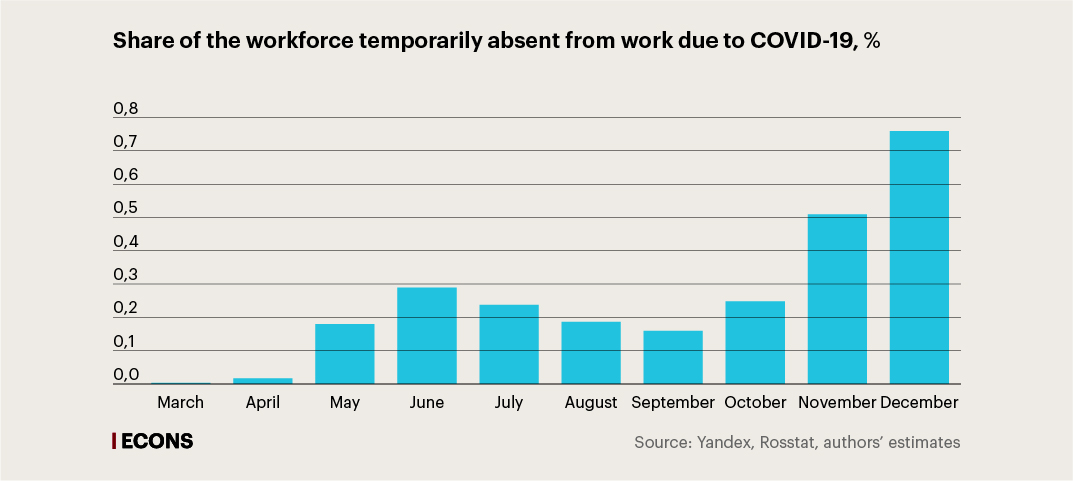

First, the direct negative effects of the coronavirus on labour potential are mainly related to the temporary incapacity of the employed population in cases of moderate or severe illness and during the subsequent rehabilitation period, which is also associated with reduced working capacity. Absences from work caused by the second wave of the pandemic in the autumn and winter of 2020 proved to be greater than those caused by the first wave (see Chart 1): we estimate that in Russia at least 0.2–0.3% of the population aged 20–65 were absent from work due to contracting COVID-19 during the spring wave of the pandemic, and by the end of 2020, this figure had increased to at least 0.7–0.8%.

Unfortunately, mortality of the working-age population could not but play its role. However, this effect was still relatively small in terms of lost labour potential, since the most severe cases of the coronavirus were among the population outside of the working age: thus, according to Стопкоронавирус.рф, the Russian website for all official data on COVID-19, the mortality rate at age 80+ reached almost 15%, at age 50–59 it was 1.3%, and at ages below 40 it did not exceed 0.2%. If vaccines are effective, all losses will be significantly reduced once mass vaccination is completed in the second half of 2021–2022.

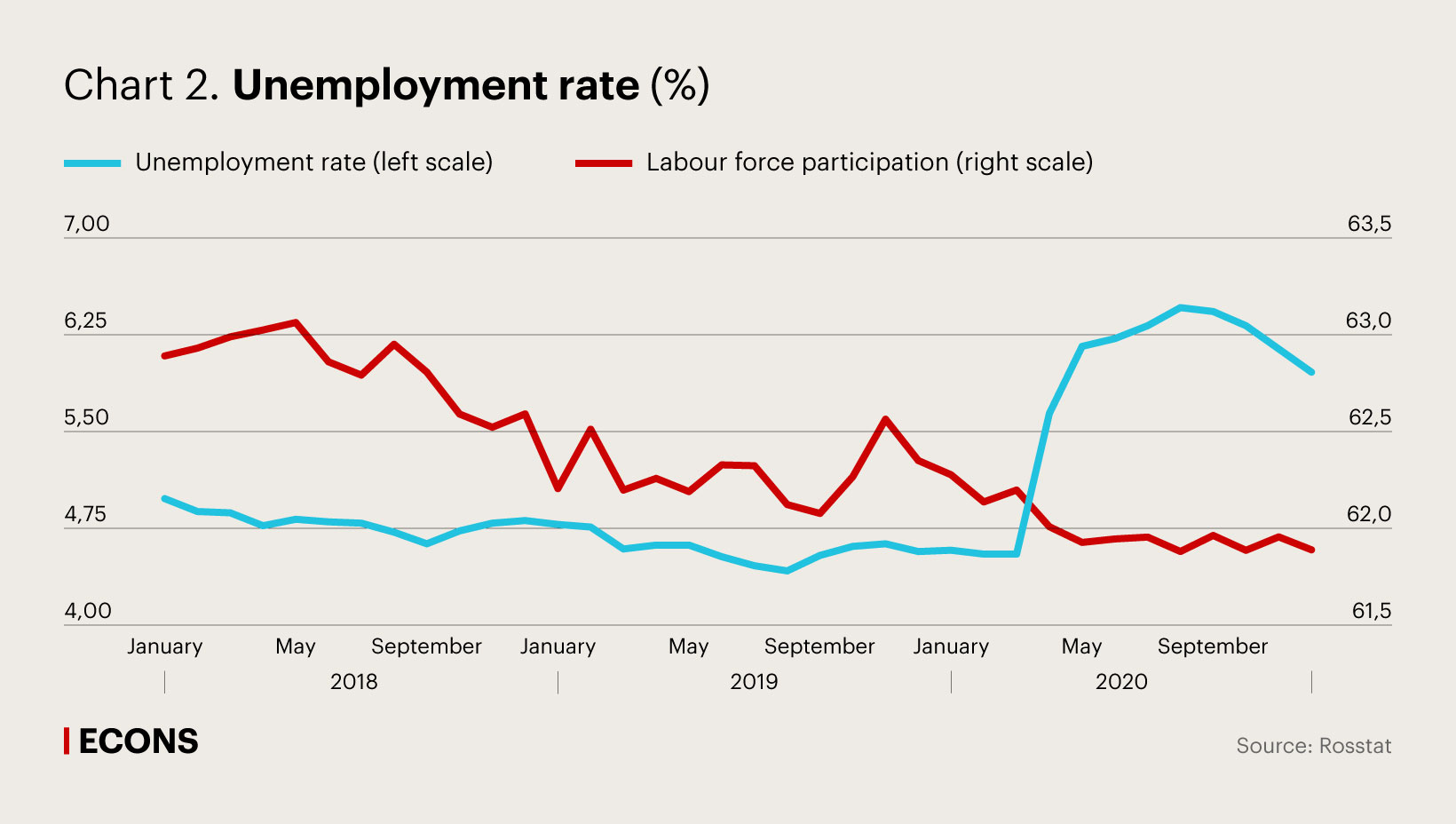

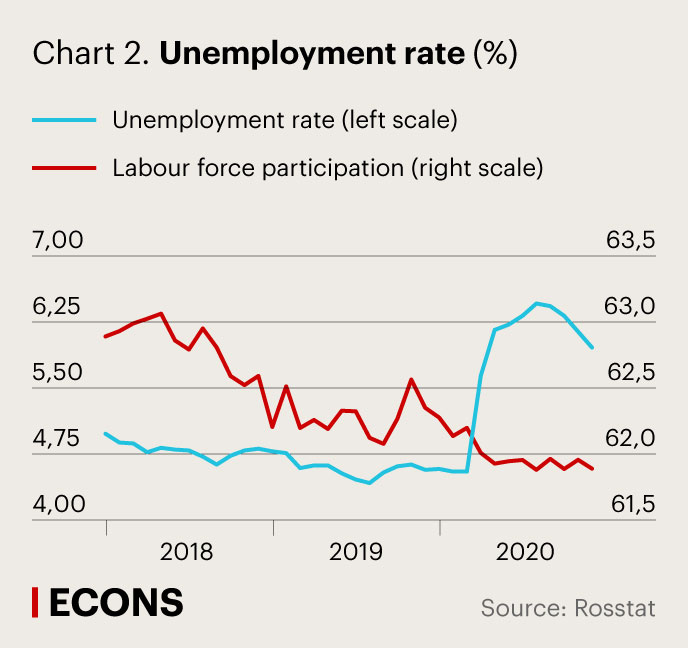

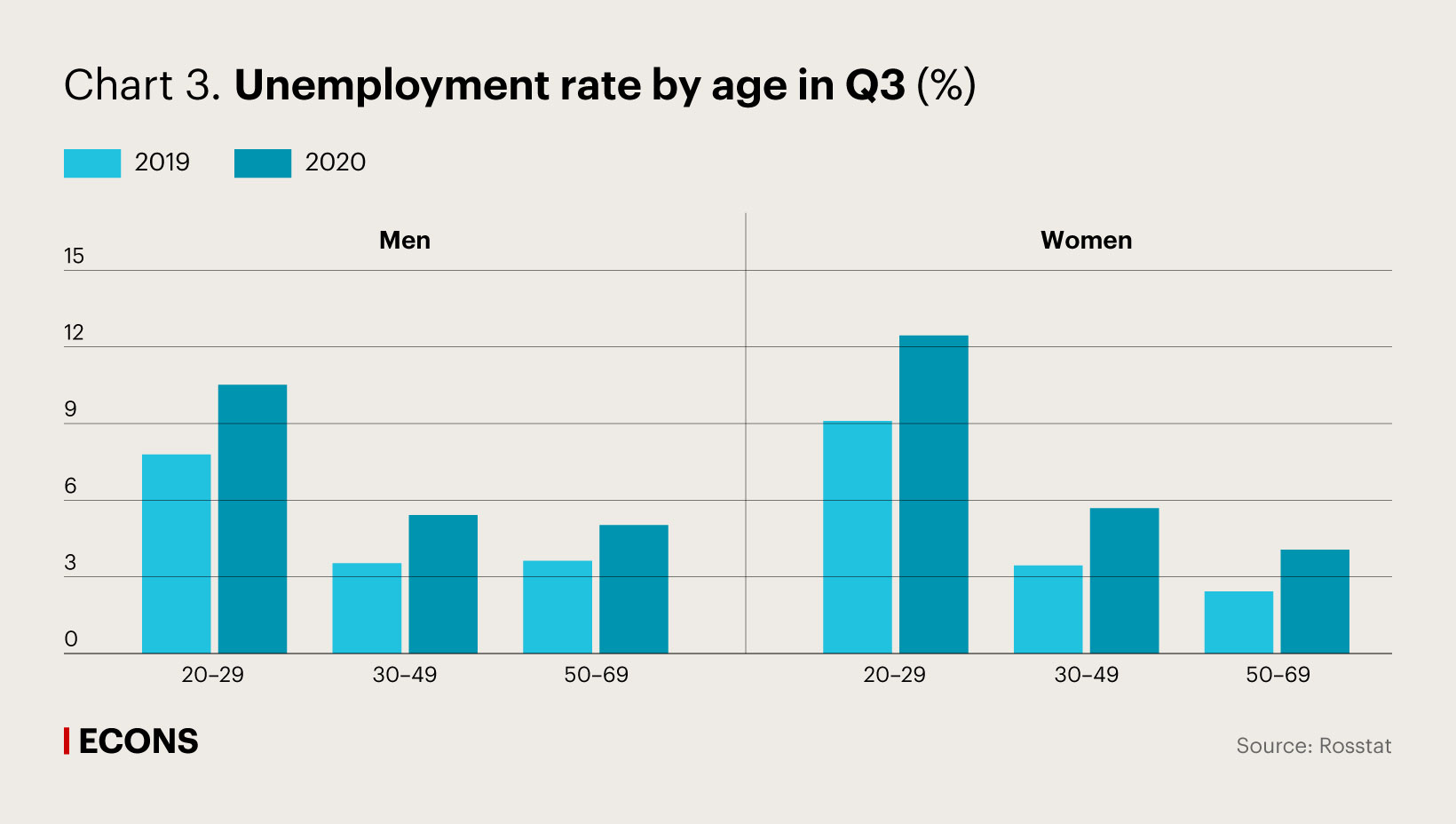

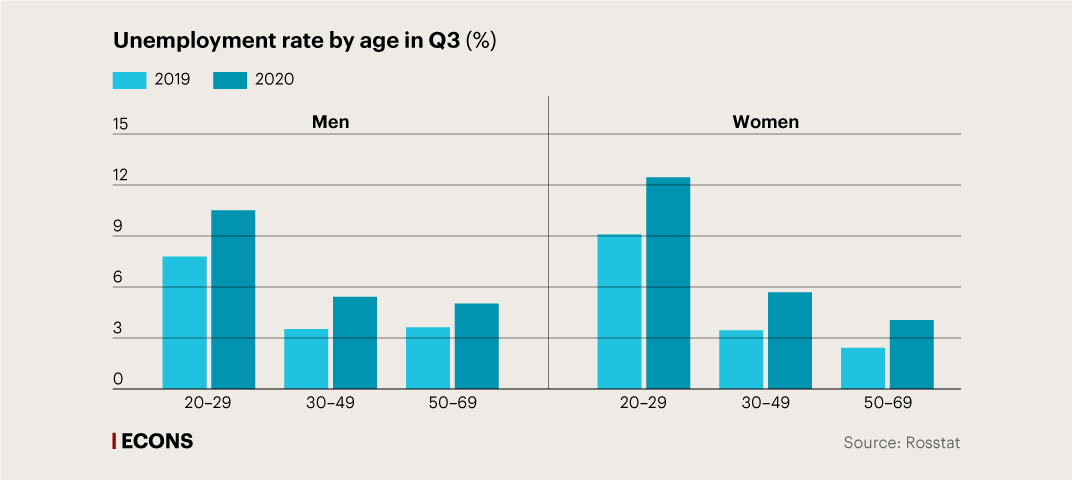

Second, the economic crisis caused by COVID-19 has increased unemployment and decreased labour force participation. In Russia, with its slight increase in overall unemployment from 4.6% in December 2019 to 6.4% in August 2020 ( 2020 record, publication via link in Russian), unemployment among young people (20–29 years old), which was already the highest among all age groups (see Chart 2, Chart 3), increased the most. A similar trend of higher youth unemployment has been observed in other countries, such as in the EU.

In Russia, unemployment has been gradually decreasing since September 2020, as the economy and labour demand have been recovering, but it is still higher than in previous years.

This slow decline in Russian unemployment after the surge in the middle of last year is due to at least a few structural reasons on the supply side of the labour market:

- Skills mismatch: people who lost their jobs in one industry do not have the qualifications to go into other industries with increased demand for labour;

- Lack of desire to retrain/upgrade skills or to look for work in other sectors in general;

- Restricted labour force mobility due to the difficulties associated with moving to other regions for new jobs (including decreased incomes that do not cover the costs of the intended relocation).

Hidden unemployment, the number of part-time workers and those who are not actively looking for jobs, has also dropped. The expanded unemployment rate, having increased by 2.8 p.p. in Q2 relative to the same period of 2019, showed a lower growth of 1.9 p.p. in Q3. At the same time, the share of part-time workers and those who are not actively looking for jobs but are willing to start fell to the level registered in Q3 of 2019.

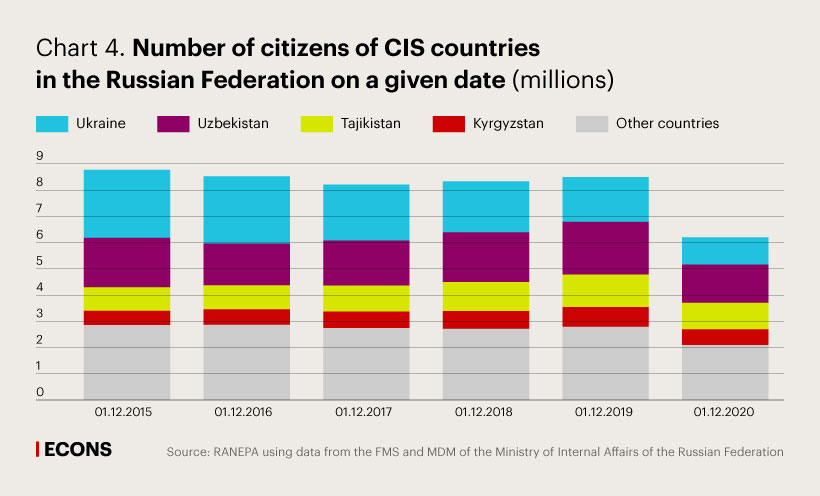

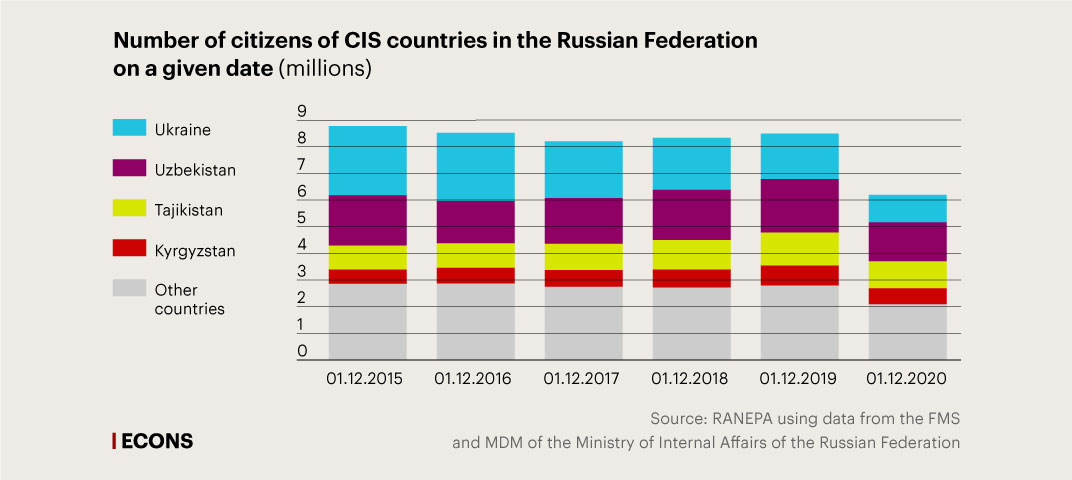

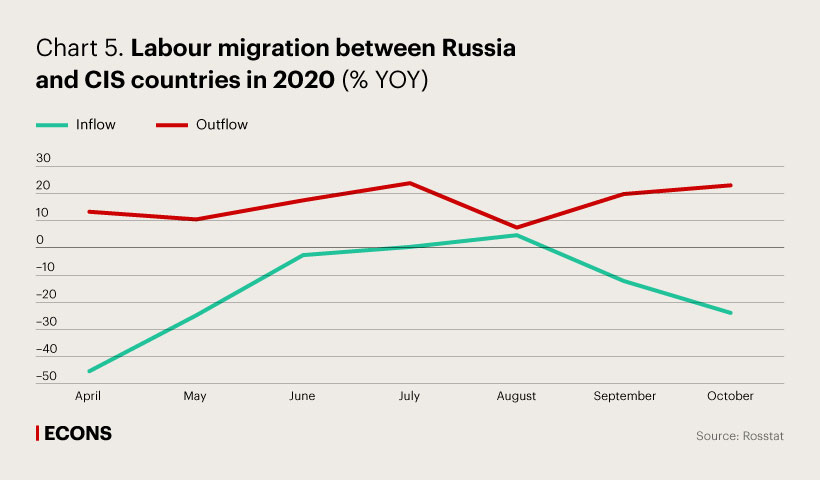

Third, restrictions on cross-border movement resulted in a sharp drop in the labour migration inflow to Russia in Q2–Q4 2020, while the outflow continued.

The decreased number of labour migrants from Central Asia, on the one hand, reduced the unemployment growth in the industries most affected by the coronavirus restrictions (see Chart 4). On the other hand, it caused a shortage of workers in industries that depend on migrant labour and which registered only slight declines or even increases in economic activity: for example, in construction, agriculture (especially during seasonal activities), and retail. At the same time, some migrant workers probably switched from construction to less ‘dusty’ jobs such as courier, sorter, etc., where demand increased sharply during the lockdown, as did the wages.

The recovery of migration inflows in Q3 was interrupted in Q4 by the second wave of the coronavirus, and the problem still persists. In addition, the virtually closed borders have made it difficult for higly qualified foreign professionals to come in order to service, repair, and adjust imported equipment, which has limited the production capabilities of enterprises and increased operational risks.

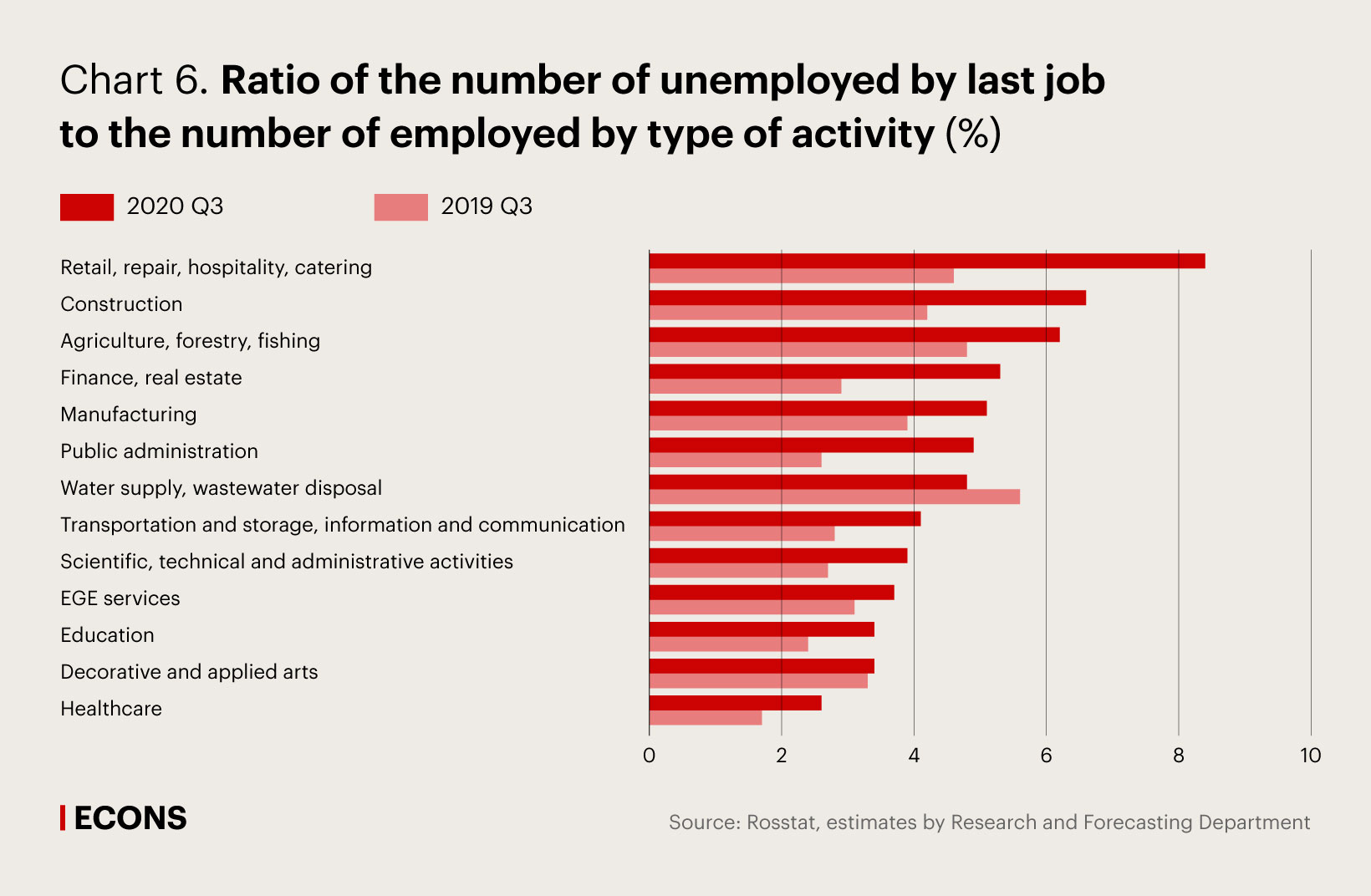

Fourth, the corona crisis has affected different sectors of the economy to different extents. There were both losers (the majority) and winners (the minority). As a result, a sectoral imbalance emerged or intensified in the labour market, manifesting itself, among other things, in the sectoral and overall wage dynamics.

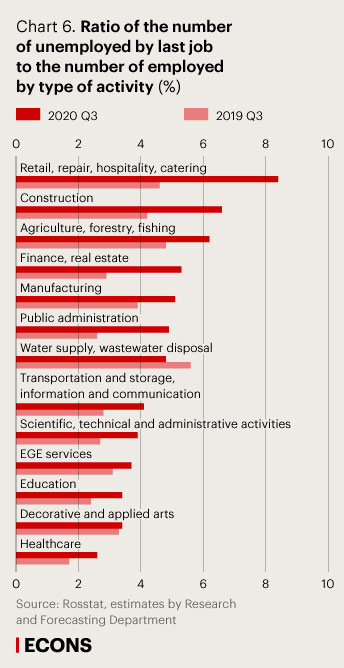

The hardest hit were the face-to-face service industries, which, with few exceptions, are characterised by high labour intensity, lower average wages, and a bigger share of informal employment and micro-businesses. Employment declined the most in this sector, although state support measures mitigated this effect. At the same time, there was also a decrease in average wages (for example, by 39.3% in inland water passenger transport, by 13.5% in travel agencies/tour operators, and by 9.5% in the restaurant business; all data is provided for Q1 Q3 of 2020 relative to the same period of 2019). The structure of unemployment by last job indicates a significant release of labour in these industries (see Chart 6).

In a number of Russian industries and sub-sectors, on the contrary, economic activity, wages, and employment grew as a result of the crisis (for example, in the manufacturing of drugs, medical goods, and antiseptics, and delivery, IT, and rental services). For example, wages and employment in the renting and lending of personal and household items increased by 75.2% and 305.9%, respectively, in software development by 94.0% and 250.6%, and in drug manufacturing by 6.6% and 9.2%.

Fifth, as a result of the particular nature of the corona crisis, the worst hit were those engaged in physical work with a generally low level of education and low wages. It is almost impossible for these workers to work remotely. Thus, the digital gap has increased.

Moreover, given that, with age, it becomes more and more difficult for people to adapt to new processes and technologies and the initially lower level of life digitalisation among those of older age, they end up more vulnerable in the labour market in this case.

Sixth, in many countries, the corona crisis has increased income inequality, in particular the income gap. The soft monetary and fiscal policies in most countries of the world have led to booming financial markets after the temporary collapse in March, which was also beneficial for higher-income groups with financial assets and a high savings rate.

At the same time, in 2020, general income inequality in Russia fell. In particular, according to preliminary Rosstat estimates, the Gini coefficient dropped during the corona crisis to 40.6 from its 2019 value of 41.1. Lower-income groups experienced a relatively larger income boost, generated by one-time social transfers, compared to higher-income populations. However, significant one-time social transfers are not expected to be the case in the future, thus, income inequality is likely to grow.

Seventh, the corona crisis also has gender specific implications. In many countries, the share of women among the ‘newly unemployed’ was higher than that of men, because of women’s predominance in face-to-face services and the urgent need for childcare once schools were closed. In Russia, this effect was also observed, but it was weakly pronounced (see Chart 3 above).

Eighth, large-scale state support for citizens and businesses has had debatable effects on employment. On the one hand, it preserved (at least temporarily) jobs in small and medium-sized enterprises and thus limited unemployment growth. It might also help minimise the growth of chronic (stagnant) unemployment in the part where it is not structural. On the other hand, direct payments to citizens and targeted payments to the unemployed contributed to the growth of unemployment (at least by increasing the number of officially registered unemployed), due to the emergence (or increase) of non-labour incomes.

The industries and occupations that benefited from the corona crisis, along with state financial support for employment, prevented Russian real wages from falling during 2020, sustaining consumer demand and regional budgets, whose revenues depend greatly on personal income tax.

Long-term effects

The more prolonged the period of state- and self-imposed restrictions due to the COVID-19 pandemic is, the more it will influence the habits and behaviour of economic agents. This will lead, among other things, to long-term structural changes in the labour market or to the acceleration of these changes, while giving employers and employees less time to adjust.

Thus, it is likely that some of the unemployed may stay out of the labour market for a long time, strengthening stagnant unemployment and increasing the ‘natural’ rate that corresponds to the definition of full employment.

An important feature of the labour market will become, on the one hand, its ‘sedentariness’, the rapid spread of fully or partially remote work, as well as the expansion of its boundaries associated with ‘sedentariness’, which makes transport accessibility less important. Greater ‘sedentariness’ saves workers’ time, improves the work-life balance, and increases workers’ efficiency (provided that remote work is well-organised, employees themselves are good at self-management, and remote work is coordinated with that on site). Therefore, in general, it will maintain the same productivity level and improve quality of life, which is the key to the sustainability of these changes. Reduced office rent expenditures and transportation costs will make up for the costs of additional equipment and maintenance of the ‘home office’.

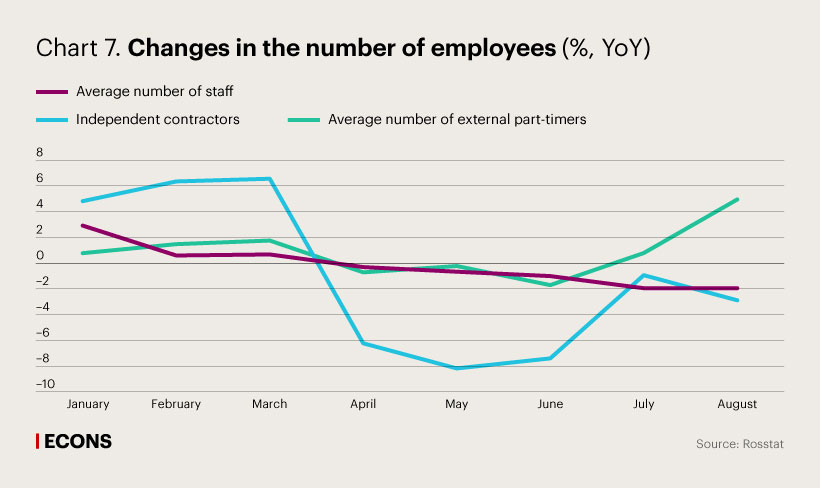

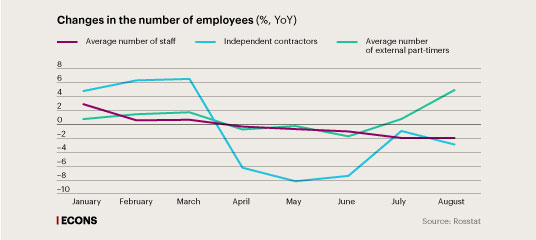

Expanding the boundaries of the labour market makes labour even more transnational, global, and flexible, giving employers and employees greater hiring opportunities. Moreover, remote working boosts demand (and supply) for freelance, flexible, and temporary labour contracts (see Chart 7).

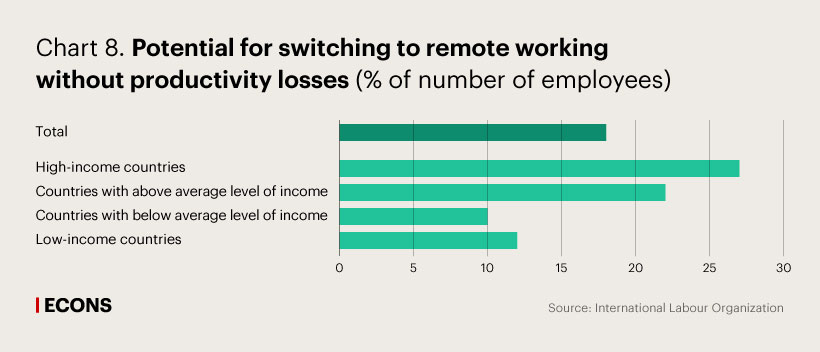

However, the potential for remote work varies greatly across countries. According to estimates, 27% of employees in developed countries can switch to telecommuting without significant productivity losses, this number is 22% in countries with emerging markets, and only 10–12% in low- and middle-income countries (see Chart 8).

The proliferation of telecommunication, including the use of video conferencing, will reduce the need for employee commuting, increase demand for remote control and identification systems, and enlarge opportunities (including financial) for virtual event organisation (exhibitions, conferences, trips, training, medical consultations, etc.). The development of augmented reality technologies and communication through new means (5G, 6G, space communication) will reinforce this trend. It is likely that lifestyles in general will become more ‘sedentary’, which will enhance the growth of online commerce and online services.

In terms of changes in the sectoral structure of labour, a sharp increase in the global demand for IT specialists of all kinds is evident; the corona crisis has given additional impetus to the use of robots and their involvement in those tasks and occupations that are easy to algorithmise.

There is a structural and sustained drop in demand in the sectors that produce a number of traditional goods and services: clothing and footwear, passenger transport, control and security services, catering, etc.

The surge in demand for sorters, couriers, and cab drivers caused by the lockdown is unlikely to persist. In the future, developing technologies will replace these workers with robots. This will reduce the need for unskilled labour, including migrant workers from developing countries.

Implications for monetary policy

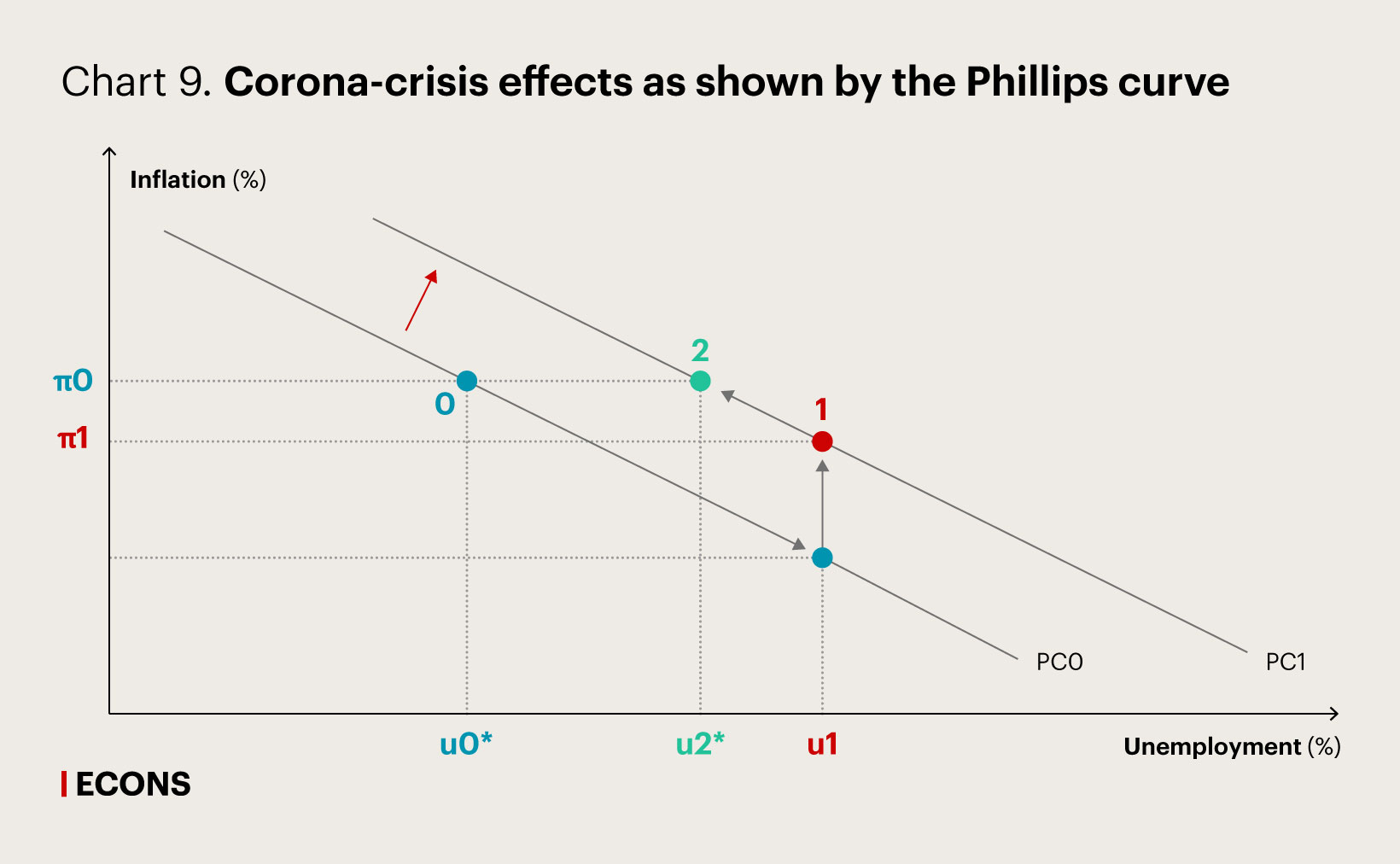

When making monetary policy decisions, central banks that target inflation evaluate the deviation of the economy from its potential and the associated balance of persistent factors that create risks of inflation deviating both up and down from the target level. The aforementioned impact of the corona crisis can be described in terms of the classical problem of choosing between inflation and unemployment, which is expressed by the well-known Phillips curve.

The corona crisis, like any economic crisis, led to a downward and rightward movement along the traditional Phillips curve (unemployment–inflation): that is, the reduction of aggregate demand in the economy due to rising unemployment created disinflationary pressure in late spring–summer of 2020. This allowed for considerably milder monetary policy.

At the same time, some of the changes that the Russian labour market faced in 2020 due to the pandemic are of a structural, long-term nature, which presumably increases the natural level of unemployment (i.e. the level that does not create excessive inflationary pressure). As a result, the disinflationary effect of unemployment growth decreases (see Chart 9: transition from point 0 to point 1). As the economy recovers and returns to a new, higher level of equilibrium unemployment, the disinflationary pressure on the demand side will disappear (transition from point 1 to point 2).

Underestimating this phenomenon may push monetary inflation above the target if monetary policy normalisation is delayed.

Over time, the structural reallocation of workers among economic sectors, combined with adverse demographic dynamics, will lower the equilibrium unemployment rate (u2* in the chart) bringing it closer to the initial level (u0*). This should further normalise monetary policy on the medium-term horizon at a lower pace.

In general, the short-term trend in the Russian labour market appears to be pro-inflationary. This is determined by a further decrease in unemployment as the Russian economy grows, while the structural imbalances remain in place. However, monetary policy should take into account other factors that may become disinflationary in this period, such as the recovery of labour migrant inflow. Moreover, structural (long-term) changes may lower costs and the price level (for instance, the switch to online education). This highlights, once again, the high uncertainty of economic developments, at least in 2021.

In the long term, a more ‘sedentary’ and digital lifestyle in general will contribute to lower costs through decreasing logistics costs of selling goods and some services, which, in addition, will become more accessible in different geographical locations. Therefore, the long-term effects of these changes are likely to constrain price growth. The speed of the monetary transmission mechanism is likely to increase as well, since price impulses will spread faster when the use of electronic marketplaces and reduced unit logistics costs will make competition higher.

The increased flexibility and adaptability of the labour market is an important factor in reducing equilibrium unemployment and increasing the potential growth rate of the economy.

Therefore, the ongoing structural changes in the labour market accelerated or caused by the corona crisis make it necessary to pursue a more active labour market policy, which should be aimed at eliminating existing barriers (for example, in terms of labour mobility and digital inequality), training and retraining focused on the digital economy, development of soft skills, and attracting highly qualified personnel from abroad on a temporary or permanent basis. Special attention should be paid to the training and retraining of senior citizens, especially given the increased retirement age. All of this requires more selective and targeted budget expenditures, rather than measures to support aggregate demand in the economy.