Benchmark Interest Rate Reform in Russia

Global benchmark interest rate reform affects Russia as well, since Russian entities lend both at LIBOR and EURIBOR, enter into cross-border interest rate swaps, and issue foreign currency bonds. The new EU Benchmark Regulation, which is expected to enter into force in 2022, prohibits EU residents from using benchmarks that do not comply with the new standards. The new legislation requires an authorized benchmark, among many other things, to have an administrator and to be based on actual transactions. The EU Regulation has exterritorial effect.

Russia has faced fewer problems because, at the launch of the global benchmark reform in 2014, its money market indicators were already based on actual rather than indicative interest rates (Table 1). The new EU legislation affects mainly the MosPrime rate, which is used in cross-border interest rate swaps and just like LIBOR is based on quotes submitted by banks.

Key benchmark rates

In Russia, the key interbank interest rates are RUONIA, which is calculated by the Bank of Russia and is based on data from a group of large banks that carry out transactions on a regular basis, and MIACR, which is an actual interest rate on interbank loans offered by a wide range of Moscow banks. While RUONIA is an average indicator of the state of the interbank market “core”, MIACR is an average indicator that represents the state of the whole banking sector, including its “periphery”.

These two rates are accompanied by indicative ones that reflect the term structure of interest rates in the money market and are calculated by the National Foreign Exchange Association (NFEA) based on data from eight large banks. Moscow Exchange calculates two more ruble indicators: REPO rates with Central Counterparty for bonds and REPO fixing with Central Counterparty secured via General Collateral Certificates or RUSFAR (Russian Secured Funding Average Rate).

Table 1. Russian benchmark money market interest rates

| Benchmark | Definition | Administrator |

| MIACR (ON)** | a weighted average actual interest rate on interbank loans offered by Moscow banks* | Bank of Russia |

| RUONIA (ON) | a weighted average interest rate on overnight interbank ruble loans (deposits) offered by active banks with high credit-ranking | NFEA |

| MosPrime Rate (ON) | an indicative interest rate on interbank ruble loans (deposits) | NFEA |

| ROISfix (1W)** | an indicative rate (fixing) for interest rate swaps indexed to RUONIA | NFEA |

| NFEA Swap Rate (1W) | an indicative premium for USD/RUB swap transactions in the Russian market | NFEA |

| RuRepo (ON) | an indicative REPO rate in the Moscow interbank repo market for AAA-rated securities | NFEA |

| RUSFAR (ON) | Moscow Exchange REPO rates with Central Counterparty secured via General Collateral Certificates | Moscow Exchange |

| MOEXRepo (ON) | Moscow Exchange REPO rates with Central Counterparty for bonds | Moscow Exchange |

| Bank of Russia’s key rate (1W) | the reference interest rate, to which marginal weekly REPO and Bank of Russia’s deposit rates are indexed | Bank of Russia |

| MIACR (ON)** | ||

| Definition | a weighted average actual interest rate on interbank loans offered by Moscow banks* | |

| Administrator | Bank of Russia | |

| RUONIA (ON) | ||

| Definition | a weighted average interest rate on overnight interbank ruble loans (deposits) offered by active banks with high credit-ranking | |

| Administrator | NFEA | |

| MosPrime Rate (ON) | ||

| Definition | an indicative interest rate on interbank ruble loans (deposits) | |

| Administrator | NFEA | |

| ROISfix (1W)** | ||

| Definition | an indicative rate (fixing) for interest rate swaps indexed to RUONIA | |

| Administrator | NFEA | |

| NFEA Swap Rate (1W) | ||

| Definition | an indicative premium for USD/RUB swap transactions in the Russian market | |

| Administrator | NFEA | |

| RuRepo (ON) | ||

| Definition | an indicative REPO rate in the Moscow interbank repo market for AAA-rated securities | |

| Administrator | NFEA | |

| RUSFAR (ON) | ||

| Definition | Moscow Exchange REPO rates with Central Counterparty secured via General Collateral Certificates | |

| Administrator | Moscow Exchange | |

| MOEXRepo (ON) | ||

| Definition | Moscow Exchange REPO rates with Central Counterparty for bonds | |

| Administrator | Moscow Exchange | |

| Bank of Russia’s key rate (1W) | ||

| Definition | the reference interest rate, to which marginal weekly REPO and Bank of Russia’s deposit rates are indexed | |

| Administrator | Bank of Russia | |

* There are also benchmark interest rates calculated for banks with investment (MIACR-IG) and speculative (MIACR-B) credit rating.

** ON – overnight, 1W – 1 week.

The Bank of Russia introduced the framework of benchmark regulation in 2015 when the International Organization of Securities Commissions (IOSCO) issued its Principles for Financial Benchmarks. The Bank of Russia used these Principles as the basis for the voluntary accreditation procedure it developed for financial indicators and their administrators, describing the general requirements an indicator and its administrator should comply with.

Market participants can still use unaccredited indicators in their operations. Thus, the accreditation is just a kind of “quality seal” designed to uphold the reputation of the administrator and its benchmark.

Only three indicators were found to meet the requirements: Moscow Exchange’s currency fixing for USD/RUB (2016), NFEA’s MosPrime Rate (2017), and NFEA’s RUONIA (2018). The Bank of Russia has not received applications for accreditation of any other indicators.

Benchmarks for loans

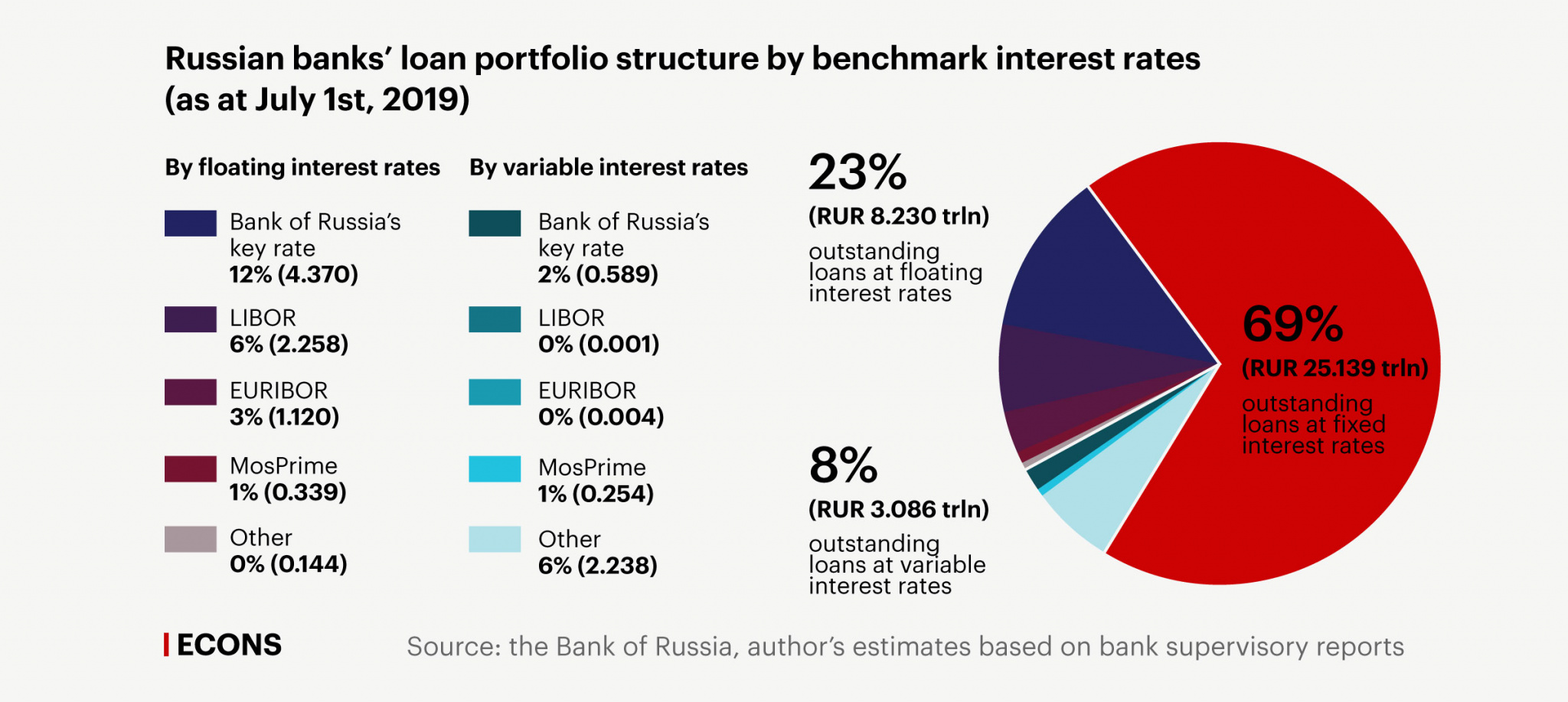

Benchmarks are used in pricing of one-third of loans in Russian banks’ loan portfolio (see Chart).

There are variable and floating interest rates. The hallmark of a variable interest rate is a trigger, which is usually an external factor that causes changes in the loan interest rate. Most of the time, the triggers are the Bank of Russia’s interest rate policy, inflation, and the borrower’s financial standing; if they change significantly, the bank revises the loan interest rate on a unilateral basis.

Russian banks’ loan portfolio structure by benchmark interest rates (as at July 1st, 2019)

23%

8%

(RUR 8.230 trln)

(RUR 3.086 trln)

outstanding loans

at floating interest rates

outstanding loans

at variable interest rates

Bank of Russia’s

key rate

12% (4.370)

Bank of Russia’s

key rate

2% (0.589)

LIBOR

6% (2.258)

LIBOR

0% (0.001)

EURIBOR

3% (1.120)

EURIBOR

0% (0.004)

MosPrime

1% (0.339)

MosPrime

1% (0.254)

Other

6% (2.238)

Other

0% (0.144)

69%

(RUR 25.139 trln)

outstanding loans at fixed interest rates

Source: the Bank of Russia, author’s estimates based on bank supervisory reports

8%

23%

(RUR 3.086 trln)

(RUR 8.230 trln)

outstanding loans

at variable interest rates

outstanding loans

at floating interest rates

EURIBOR

0% (0.004)

Bank of Russia’s

key rate

12% (4.370)

EURIBOR

3% (1.120)

Bank of Russia’s

key rate

2% (0.589)

MosPrime

1% (0.339)

MosPrime

1% (0.254)

LIBOR

6% (2.258)

LIBOR

0% (0.001)

Other

0% (0.144)

Other

6% (2.238)

69%

(RUR 25.139 trln)

outstanding

loans at fixed

interest rates

Source: the Bank of Russia, author’s estimates

based on bank supervisory reports

69%

(RUR 25.139 trln)

outstanding

loans at fixed

interest rates

23%

8%

(RUR 8.230 trln)

(RUR 3.086 trln)

outstanding loans

at floating interest rates

outstanding loans

at variable interest rates

Bank of Russia’s

key rate

12% (4.370)

Bank of Russia’s

key rate

2% (0.589)

LIBOR

6% (2.258)

LIBOR

0% (0.001)

EURIBOR

3% (1.120)

EURIBOR

0% (0.004)

MosPrime

1% (0.339)

MosPrime

1% (0.254)

Other

0% (0.144)

Other

6% (2.238)

Source: the Bank of Russia,

author’s estimates based on bank

supervisory reports

The floating rate loan portfolio is dominated by the Bank of Russia’s key rate. This became a widespread practice after the crisis of 2014-2015 when the Bank of Russia’s high key rate and amount of refinancing had a serious effect on the interest margin of banks. When the crisis was over, banks altered their pricing strategies and switched to floating interest rates, thus making their borrowers bear the interest rate risk. MosPrime is the second popular benchmark in this portfolio.

Overall, the interest-rate-sensitive loan portfolio amounts to RUR 11.3 trln. Its main price factors are the Bank of Russia’s key rate (44% of the portfolio), LIBOR (20%), and EURIBOR (10%). RUR 0.593 trln in loans (about 5% of the portfolio) are given at MosPrime-based interest rates.

Benchmarks for bonds

Russian bonds are more variable-rate dominated than loans. In mid-2019, variable coupon bonds accounted for 75% of outstanding debt securities (see Table 2).

However, variable interest rates in the bond market differ from variable and floating loan interest rates. It is a widespread practice among Russian bond issuers to fix the coupon rate until the beginning of the early redemption period as well as to fix the coupon rate for different periods. It is not a rare case that the coupon rate is fixed in some coupon periods and floats in others. Thus, in the Russian market, variable interest rates are quasi-floating. Benchmark-based coupon securities apparently account for about 50%.

Table 2. Benchmark structure of the debt securities issued in the domestic market (RUR trln as at July 1st, 2019)

| The Bank of Russia | ||

| Amount | 1.700 | |

| Fixed interest rate | 0.000 | |

| Variable interest rate | 1.700 | |

| Zero | – | |

| NA | – | |

| Lending institutions | ||

| Amount | 2.088 | |

| Fixed interest rate | 1.045 | |

| Variable interest rate | 1.034 | |

| Zero | – | |

| NA | 0.009 | |

| Insurers | ||

| Amount | 0.007 | |

| Fixed interest rate | 0.000 | |

| Variable interest rate | 0.007 | |

| Zero | – | |

| NA | – | |

| Other financial institutions | ||

| Amount | 2.888 | |

| Fixed interest rate | 1.093 | |

| Variable interest rate | 1.790 | |

| Zero | 0.000 | |

| NA | 0.004 | |

| Non-financial entities | ||

| Amount | 6.936 | |

| Fixed interest rate | 1.262 | |

| Variable interest rate | 5.668 | |

| Zero | – | |

| NA | 0.006 | |

| Non-resident entities | ||

| Amount | 0.103 | |

| Fixed interest rate | 0.022 | |

| Variable interest rate | 0.081 | |

| Zero | – | |

| NA | – | |

| Total | ||

| Amount | 13.722 | |

| Fixed interest rate | 3.422 | |

| Variable interest rate | 10.280 | |

| Zero | 0.000 | |

| NA | 0.019 | |

| Subsector | Amount | Fixed interest rate | Variable interest rate | Zero | NA |

| The Bank of Russia | 1.700 | 0.000 | 1.700 | – | – |

| Lending institutions | 2.088 | 1.045 | 1.034 | – | 0.009 |

| Insurers | 0.007 | 0.000 | 0.007 | – | – |

| Other financial institutions | 2.888 | 1.093 | 1.790 | 0.000 | 0.004 |

| Non-financial entities | 6.936 | 1.262 | 5.668 | – | 0.006 |

| Non-resident entities | 0.103 | 0.022 | 0.081 | – | – |

| Total | 13.722 | 3.422 | 10.280 | 0.000 | 0.019 |

Source: the Bank of Russia, author’s estimates based on the data on the state registration of issues of issue-grade securities

The major issuers of floating-rate bonds are state-owned. These bonds include Bank of Russia coupon bonds (COBRs) with their coupon rates pegged to the Bank of Russia’s key rate. Federal bonds with variable coupon rates issued by the Ministry of Finance are yet another example. The Ministry has made several offerings of ruble bonds with coupon rates pegged to a six-month average of the RUONIA rate estimated on a daily basis plus bond premium ranging from 0.3% to 1.6% depending on the issue.

Variable rate bonds are issued by non-financial entities. The distinguishing feature of this subsector is hybrid pricing shaped mainly by the Bank of Russia’s monetary policy and inflation. The largest player in this subsector, Rosneft, has issued bonds with coupon rates pegged to the Bank of Russia’s key rate plus spread, which generally is 0.1%. Another issuer, JSC Russian Railways, uses inflation rate plus 1%. FGC UES, too, favors bonds with coupon rates pegged to inflation plus 1%.

Benchmark interest rates and derivatives

Abroad, benchmarks are widely used in derivative pricing. Russia is no exception: according to our estimates, in mid-2019, underlying assets of over-the-counter interest rate derivatives amounted to RUR 8.9 trln.

These are mainly long-term interest rate swaps. The most common among them are dollar swaps that are used to hedge against fluctuations of LIBOR or the US Federal Funds Rate.

Ruble underlying assets of interest rate swaps account for 32% or RUR 2.8 trln. The most widely used benchmark in ruble swap pricing is MosPrime, to which at least 64% of ruble underlying assets are pegged. The second popular benchmark is RUONIA, while the third one is the NFEA’s Swap Rate.

Key in everything

Switching to the Bank of Russia’s key interest rate as a benchmark has its pros and cons. On the one hand, banks make their borrowers bear the interest rate risk, thus, stabilizing their interest rate margin throughout the business cycle. Moreover, the monetary transmission mechanism is becoming more effective and works faster. Many central banks dream of increasing the influence of their interest-rate policy in the financial market. For example, in August 2019, the People’s Bank of China announced a reform of its interest-rate system, which would result in its mid-term rates being the basis for prime rates.

However, using the official interest rate as a benchmark has its downsides. When rates are floating, banks become less of automatic stabilizers. Long-term borrower rates become more sensitive to the short-term one. The central bank’s short-term rate is more volatile than the long-term one. To combat volatility in the money and foreign exchange markets, the central bank can tighten its interest-rate policy for a certain period. For instance, in the 1990s, the Swedish Riksbank raised the interest rate to 500% in response to the assault on krona. In such cases, the momentary pass-through of the interest rate shock might be unwelcome, even if the indicator is calculated as an average over a period.

The use of the short-term rate in long-term instrument pricing hurts healthy interest rate dynamics. At some stages of the business cycle, the interest rate curve can be inverted, horizontal or positive. In other words, expectations of the economic agents can vary depending on the instrument term to maturity. It allows for investment and consumption planning with regard to performance over different periods. The use of the short-term rate in pricing of medium- and long-term loans might undermine informed decision-making. This problem is usually solved by using three- or six-month money market rates, which are more stable than the daily or weekly ones.

Interest rate champions

In the competition for the title of the key benchmark rate, two interest rates have turned the corner: the NFEA’s MosPrime and the Bank of Russia’s key rate. The key rate dominates ruble loans and is a bit less widely used in the ruble bonds market, while MosPrime prevails in the derivatives market.

This divergence is interesting as it creates the basis risk: the rate of interest-earning assets differs from the interest rate used for hedging purposes, i.e. derivatives bear little relation to hedging of the ruble loan portfolio.

The distinguishing feature of MosPrime is that it resembles LIBOR, which is the main cause of the global benchmark reform. This is an indicative rate calculated based on the rates submitted by several banks. Banks themselves usually do not lend at this rate. However, unlike RUONIA, which reflects the rate used in actual transactions, MosPrime is more favorable since it is calculated not only on an overnight basis but also on weekly and six-month ones. The MosPrime rate forms the basis for loan and derivative pricing.

This can be resolved in several ways: first of all, by changing the MosPrime calculation methodology and turning it into a rate based on actual transactions or by favoring other indicators over MosPrime. For example, Moscow Exchange promotes the risk-free RUSFAR rate and plans to have it accredited by the Bank of Russia. If no solution is found, the derivatives market is likely to tilt toward reliable indicators, i.e. the Bank of Russia’s key interest rate and RUONIA. However, the issue of vital three- and six-month interest rates will still be pending.