The Second Birth of RUONIA

RUONIA (Ruble Overnight Index Average) is a weighted rate on overnight interbank loans in rubles. It plays a special role in the Russian financial markets. It is considered one of the key indicators as the difference between RUONIA and the key rate reflects the effectiveness of the Bank of Russia’s interest rate policy. Moreover, a substantial proportion of debt is linked to RUONIA. For instance, the government bonds (OFZ-PK) issued by the Ministry of Finance are pegged to RUONIA and in early 2020 accounted for 1.7 trillion rubles or 18% of the domestic public debt in securities. Finally, RUONIA mirrors the liquidity situation in the interbank market.

The RUONIA rate was created in 2010 by the Bank of Russia and the National Foreign Exchange Association (NFEA), which became its administrator. In 2015, NFEA joined the National Financial Association (SRO NFA) transferring the RUONIA administration to it. On May 21, 2020, the Bank of Russia took over the administration of RUONIA.

RUONIA in monetary policy and financial markets

All central banks that target inflation practice the so-called operational targeting of the money market interest rate on a daily basis. Its purpose is to ensure that the interest rate stays within a narrow range.

These fluctuation limits are determined by the rates set by the central bank on liquidity provision, i.e. repo or loans, and liquidity withdrawal operations, i.e. deposits. If the rate remains within the corridor and does not exceed its limits, it provides stability that helps banks to plan liquidity management and to redistribute the liquidity effectively among themselves.

The Bank of Russia is no exception: RUONIA floats within the interest rate corridor set out in its monetary policy. When possible, the Central Bank seeks to reduce the difference between the RUONIA and the key rate.

RUONIA serves as the basis for the pricing of many financial products. For example, the Ministry of Finance is the largest issuer of bonds with floating interest rates pegged to RUONIA. They protect investors from inflation and interest rate volatility during times of financial instability. RUONIA is less common in the credit market because it is not a fixed-term rate and is inferior to MosPrime in this respect. RUONIA is used to hedge interest rate risk. Ruble interest rate swaps on RUONIA reach about 170 billion rubles in nominal volume. This is less than MosPrime swaps (471 billion roubles) but more than the key rate ones (155 billion roubles).

Thus, RUONIA is a classic benchmark interest rate. It is an aggregated index referred to in financial contracts. RUONIA miscalculation or interruptions in its publication can create systemic risks in the financial sector.

Besides RUONIA, there are several interbank benchmarks, each with their own peculiarities. They are either the comprehensive rates of the banking sector (MIACR), rates offered on a trading platform (RIBOR), or indicative rates (MosPrime). What sets RUONIA apart is that it reflects the situation among the largest banks that are the most active players in the interbank market.

Global benchmark rate reform

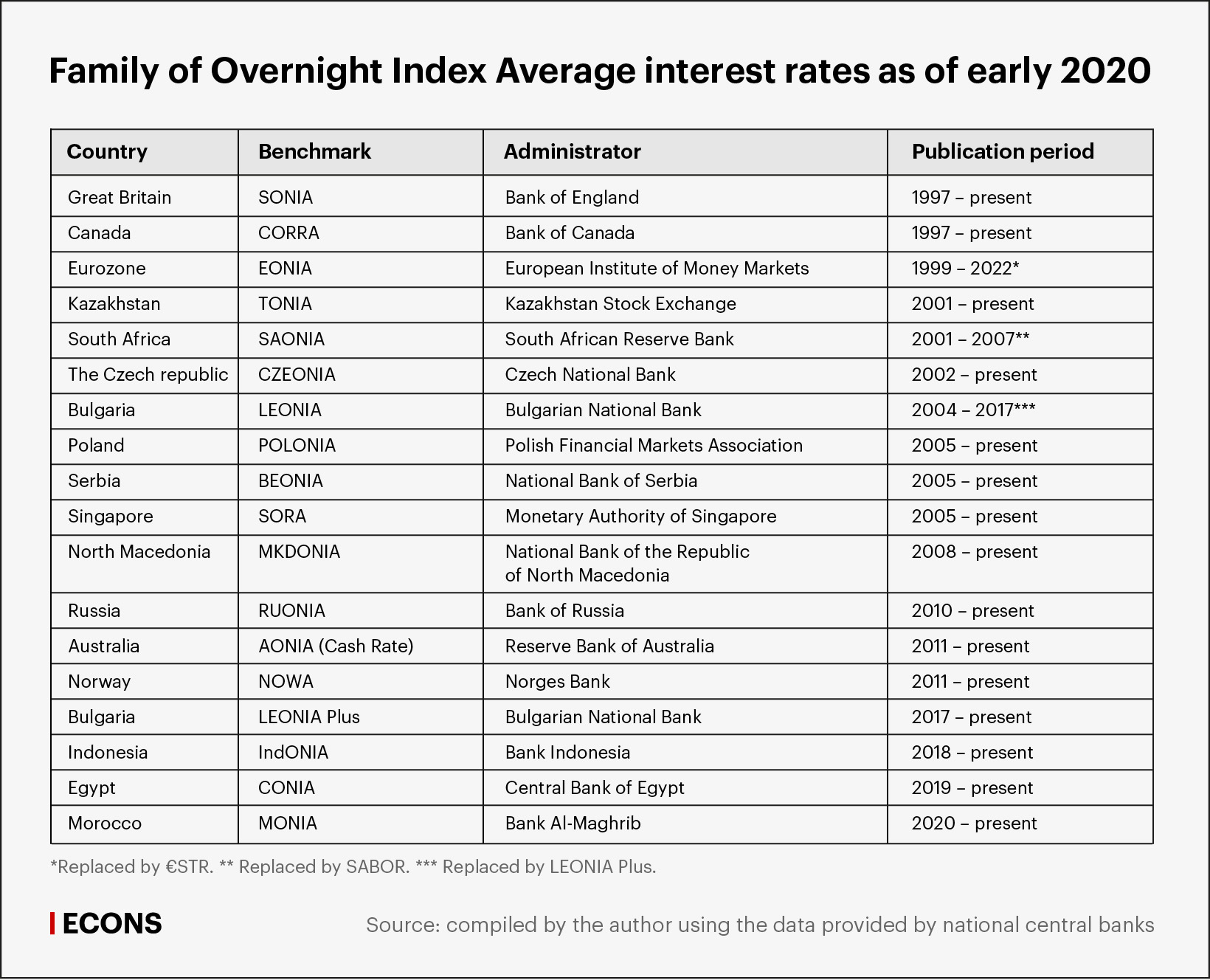

RUONIA-like indicators, i.e. Overnight Index Average (average overnight interest rates), are widely used around the world. The Sterling Overnight Index Average (SONIA) is considered to be the first indicator of this kind, which, according to its members, was first calculated in 1997 by the British Wholesale Markets Brokers' Association. This family of benchmark interest rates came into prominence after the introduction of the euro when the European Institute of Money Markets (EMMI) began to publish the EONIA rate, which represents the cost of unsecured interbank overnight loans in euros in the EU and the European Free Trade Association. Other jurisdictions with established money markets later followed suit (see table).

The global benchmark interest rate reform was a pivotal moment in the history of interest rates.

After the LIBOR scandal, international regulatory authorities decided to change the pricing principles in the global financial market. The reform implied a thorough benchmark reassessment and introduction of specialized regulation procedures to monitor benchmark administrators. In the course of the reform, some administrators and the method of calculation were changed.

The SONIA rate has undergone a complete transformation: it has turned into a money-market overnight rate rather than an interbank rate. The UK Financial Conduct Authority has become the regulator and supervisor of the SONIA administration, and the Bank of England has taken over the administration from the Wholesale Markets Brokers' Association.

The Norwegian krone NOWA has undergone similar changes. In 2020, the Norges Bank, the former NOWA settlement and publishing agent, became the new NOWA administrator replacing Finance Norway (mega-association of the finance sector).

EONIA will cease to exist in 2021 and will be replaced by €STR, which is calculated by the European Central Bank based on the reports of 50 largest Eurozone banks. Unlike EONIA, which was the interbank rate, €STR is the cost of borrowing for banks in the unsecured money market in general.

In 2019, Refinitiv Benchmark Services, a British financial markets data provider, relinquished the administration of the Canadian CORRA, the average overnight repo rate in Canadian dollars, to the Bank of Canada.

The global benchmark reform triggered the introduction of new money market benchmark rates. Thus, in 2014, the Federal Reserve Bank of New York started publishing SOFR, interest rates on repo transactions collateralized by Treasury securities. The Bank Indonesia, the Central Bank of Egypt, and the Bank Al-Maghrib have developed and started to publish local benchmark interest rates; in order to make its benchmark more representative, the Bulgarian National Bank was forced to expand the list of contributor banks to include all Bulgarian ones and all subsidiaries of foreign banks.

The new EU and UK Benchmark Regulation, which enters into force in 2022, prohibits EU and UK residents from using benchmarks that do not comply with the new standards. Among many other things, the new legislation requires an authorized benchmark administrator to be accredited in the EU or UK. The EU Regulation has an exterritorial effect; and since Russian benchmarks are used to determine interest rates on cross-border derivatives, loans, and bonds, the global benchmark interest rate reform directly affects Russian interests.

However, European legislation makes an exception for central banks. Many countries have taken advantage of this: central banks have taken over the administration of a large number of risk-free overnight benchmarks. The US Federal Reserve, the European Central Bank, the Bank of Japan, the Reserve Bank of Australia, etc. are now responsible for their administration. Private administrators, i.e. index companies, information-analytical agencies, and exchanges, have remained in charge of mostly time-bound indicators.

The new life of RUONIA

The Bank of Russia’s taking over of the RUONIA administration has three objectives. The first is to ensure that RUONIA complies with the principles of benchmark financial indicators defined by the International Organization of Securities Commissions (IOSCO is an organization that brings together the world’s securities regulators). The second is to adapt RUONIA to the new requirements of the respective legislation of the leading financial centers: London, Frankfurt, Paris, etc. Compliance with international norms and standards is necessary if Russian indicators are to be recognized in the global markets and used in cross-border transactions. The third objective is to ensure benchmark stability, since now in case of a mishap or lack of data, all the decisions are made by a sole entity, the Bank of Russia. With no aligning needed, the decision-making speeds up and allows for a rapid response in a critical situation.

Previously, SRO NFA determined the methodology of the indicator and compiled the list of contributor banks, while the Bank of Russia acted as a settlement agent and was responsible for publishing. The new agreement between the Bank of Russia and the NFA changes the way they interact: now, the Bank of Russia is fully responsible for the administration of RUONIA, it collects data, approves the methodology, makes the calculations, and publishes the benchmark rate.

To ensure compliance with international standards, the Bank of Russia will soon form the RUONIA Monitoring Committee, which will include representatives of the regulator and the NFA. The SRO NFA’s Expert Council on indicators and rates will perform methodology evaluations, analyze critical situations, RUONIA’s quality, and its source data, handle complaints from benchmark users, and review reports of the RUONIA Monitoring Committee and the external auditor. By the end of 2020, the Bank of Russia plans to have concluded an audit of RUONIA and its administration using an international auditor. All these steps are intended to guarantee the high quality of the benchmark interest rate, which serves as the basis for Russia’s monetary policy and public debt, for both Russian and foreign investors.