Monetary Policy for an Equitable Society

The inequality of income and wealth, or economic opportunities more broadly has gained prominence in policy debates over the past decades. Heightened awareness of this problem is due to a broad-based increase in economic inequality, a trend that the pandemic has exacerbated. Whereas inequality between countries (link in Russian) has been decreasing amid poverty reduction and faster income growth in emerging market economies, inequality within countries has been increasing. The Gini coefficient, which is a standard measure of the income distribution across a population (the closer it is to one, the higher the inequality), and the share of income of the wealthiest 10% of households have been growing since the 1980s in both advanced and emerging market economies. Wealth distribution has also become more unequal, and in many countries this has happened through an increase in the share of the top 1%.

Central banks started to focus on the problem of inequality relatively recently, after the global financial crisis of 2008–2009. In order to support economic activity, central banks have deployed policies featuring exceptionally low interest rates. Such measures have fuelled concerns very soon that such policies have benefited mostly the rich: extremely accommodative monetary policies boost prices for financial assets (held by wealthier people), and their growth exceeds the rise in wages (the main source of income for less wealthy people).

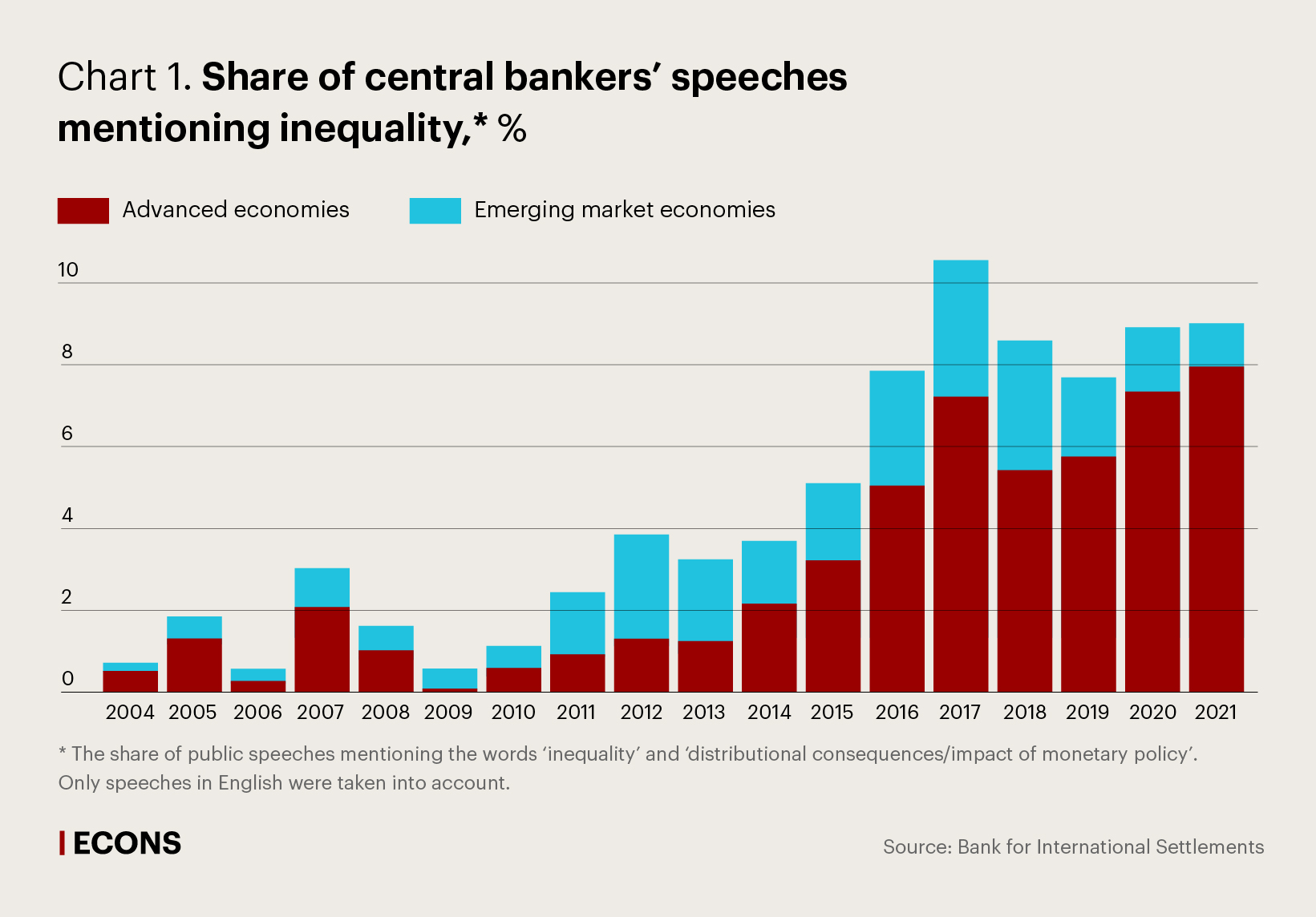

Central bankers’ greater attention to inequality concerns is reflected in the growing reference to ‘inequality’ in their public speeches (see Chart 1). An analysis of these speeches suggests that monetary regulators acknowledge how important the problem of inequality is and stress the relevance of policy measures, including their own, in addressing this problem, according to the Annual Economic Report of the Bank for International Settlements (BIS) that includes a separate chapter on distributional effects of monetary policies. Inequality has become a mainstream topic: it was discussed at the conference held on 12–30 July by the National Bureau of Economic Research (NBER), at the annual meeting of the Central Bank Research Association (CEBRA) that took place at the beginning of July, and at the recent International Financial Congress of the Bank of Russia.

Declines in poverty rates amid growing inequality reflect different concepts, according to BIS experts: poverty quantifies the distance of current income from a certain threshold, whereas inequality captures differences in income levels across segments of the population. This means that inequality can increase even when the economy expands if different groups of people benefit from economic growth to a varying extent. Conversely, when there is no economic growth, a society can be more equal in terms of income, but remain or become poor.

Over the past decades, technological progress and globalisation have become the main factors that have expanded economic opportunities and spurred economic growth, while simultaneously contributing to higher inequality. These are two main and mutually supporting forces, in BIS experts’ opinion: technological progress has increased the productivity of highly skilled workers more than that of their low-skilled counterparts, amplifying the income gap between the two groups, whereas globalisation has eroded low-skilled workers’ bargaining power and smaller companies’ pricing power.

Thus, long-term trends in inequality are not a monetary phenomenon, as stated by Claudio Borio, Head of the BIS Monetary and Economic Department, as they have been formed by factors that are beyond the reach of monetary policy. Both technological progress and globalisation reflect and can be influenced by government policies.

Nonetheless, there are also factors influencing inequality in the short run, and central banks can address these factors within their mandates. They are inflation and recession, especially those associated with financial instability, according to BIS experts.

Inflation and income

High inflation disproportionately hurts the disadvantaged in society: cash and bank accounts are most vulnerable to inflation – the typical savings vehicles held by the poorest segments of the population. Richer households that have access to more sophisticated financial instruments can both hedge their assets against inflation and transfer their assets abroad, thus shielding their wealth from depreciations of the domestic currency.

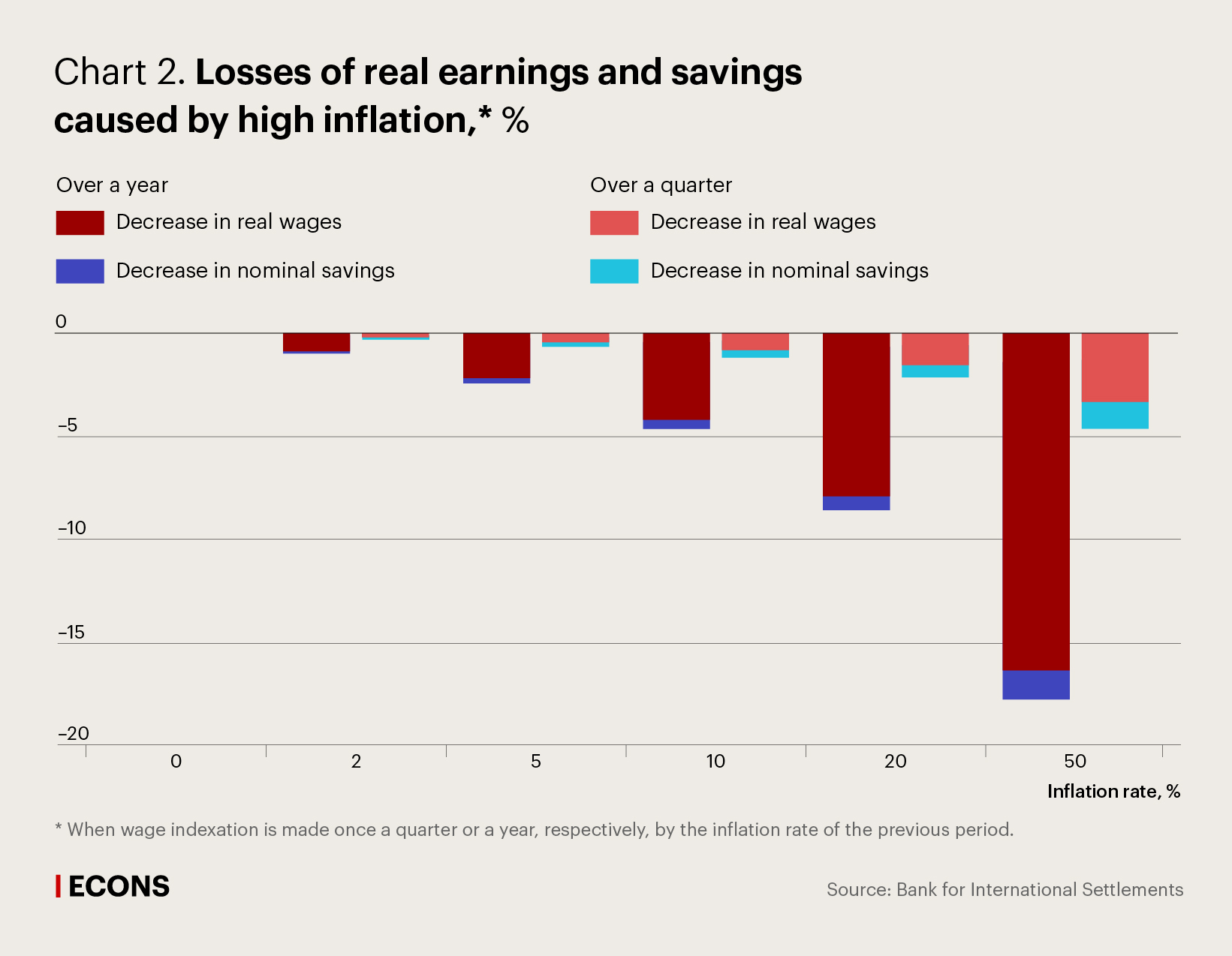

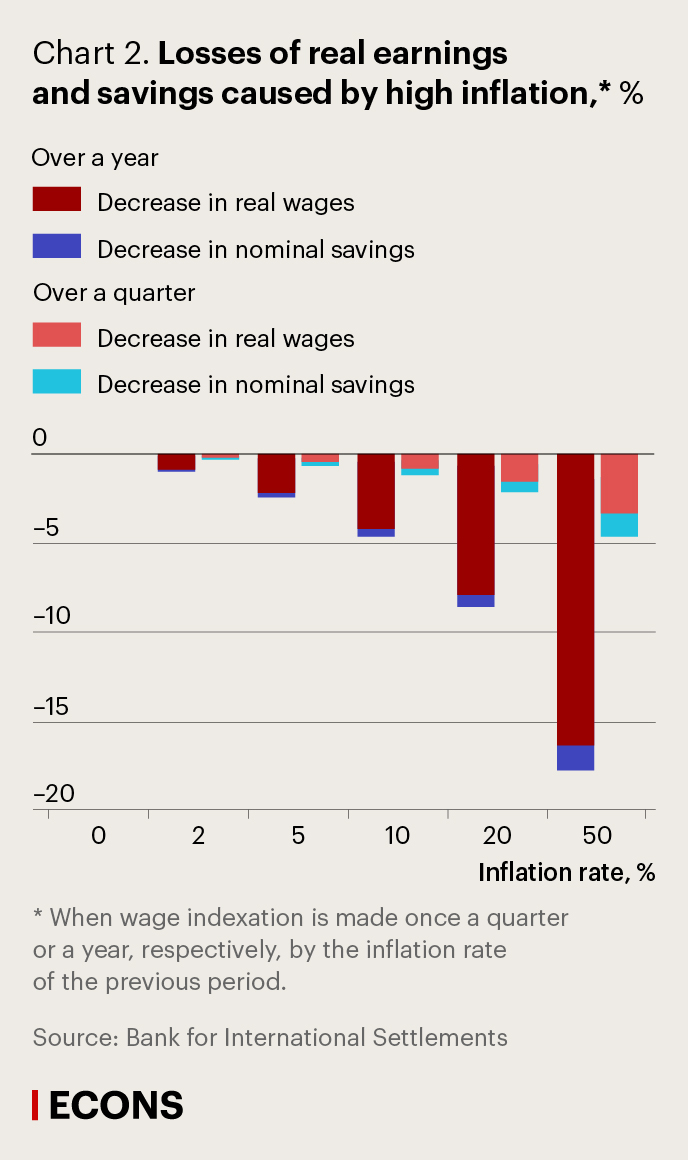

Wages and pensions – the main sources of income for poor households – are typically fixed in nominal terms and hence vulnerable to inflation. Indexation mechanisms adopted in many countries may fail to keep pace with inflation because the indexation is generally made post factum by the inflation rate of the previous period (previous quarter or year). The adverse impact of inflation on income depends on how high the inflation rate is. In particular, the effect is relatively small for an inflation rate of 5% (or less) per year. However, when inflation steps up to 20%, even if wage indexation is comparable, its cost for households might reach 8.5% of annual earnings by the end of the year when wages are adjusted once a year (see Chart 2).

As an illustration, it is sufficient to look at the 34 ‘conquests of inflation’ by central banks during the past 30 years: the Gini coefficient declined by two points in the seven to eight years after central banks reduced annual inflation to or below 5% on a sustained basis, according to BIS estimates.

Exchange rate fluctuations are an important factor strengthening the link between inflation and income inequality in EMEs: national currency depreciations fuel inflation. In turn, high inflation rates do not bode well for the stability of the domestic currency: when inflation was higher than 20% over the period from 1995 to 2005, the frequency of over 20% declines in EMEs’ real effective bilateral exchange rates during a particular year exceeded 16%. Where inflation was below 5%, this indicator was close to zero.

Recessions of the new wave

Recessions are particularly harmful for the most disadvantaged because unemployment tends to hit unskilled workers harder and for longer. The experience during the Covid-19 pandemic is a case in point: low-income earners were the first to be laid off.

Inequality, in turn, can intensify the scale of economic declines. Aggregate demand shortfalls during downturns appear to be larger when the income distribution is more polarised: low-income people who are the first to lose their income in a downturn generally have a higher propensity to consume. A higher degree of income concentration at the top-10% of the distribution is associated with a deeper and longer decline in consumption during economic downturns. Moreover, this effect is stronger where recessions are provoked by a financial crisis.

In turn, financial crises may also happen due to high inequality when low-income households have a larger need to borrow and, if credit supply becomes more ample, this could encourage them to become overindebted. This factor is considered as one of the triggers of the US mortgage crisis which prompted the global financial crisis.

More complicated trade-offs

Income and wealth distribution influences the transmission mechanism of monetary policy as well as the broader political and social context in which a central bank operates. On the other hand, monetary policy can influence inequality in the near term (within a business cycle), by seeking to keep inflation under control and to limit recession effects.

The central bank targeting inflation should understand the extent of households’ propensity to save and consume. If the economy is more focused on savings, people will not be happy with low interest rates. To the contrary, if they tend to consume more, low rates will be okay with them, Pablo García Silva, Board Member of the Central Bank of Chile, explained (link in Russian). Higher inequality (measured as the income share of the top 10% of households in the distribution) may weaken the transmission of monetary policy. Households at the bottom and at the very top of the income distribution exhibit low sensitivity of consumption to changes in interest rates: the former may be unable to take advantage of easier credit conditions due to tight borrowing constraints (despite their high propensity to consume), while the latter have a low propensity to increase their already high consumption.

In the short run, each time the central bank adjusts interest rates, any such adjustment redistributes interest income between debtors and creditors and influences asset prices (which, accordingly, reallocates income depending on holdings).

Bringing inflation under control will generally call for a monetary policy tightening, which can induce recessions and hence increase inequality. Example are the ‘Volcker shock’ in the United States – a drastic tightening of monetary policy which helped completely defeat inflation once and for all (at that moment, inflation had reached double-digit rates), while provoking the recession of 1981–1982, as well as the episode when the Central Bank of Brazil had to raise the policy rate by more than 10 percentage points between 2001 and 2003 to rein in a surge in inflation.

Sustaining a recovery in the aftermath of a recession requires keeping interest rates low, which can mitigate income inequality, on the one hand, raising employment among the lowest-income people, but might also increase inequality, on the other hand, boosting a faster rise in asset prices. Therefore, unconventional monetary policy measures that have become popular in recent decades, such as quantitative easing, might aggravate inequality. Research based on Japan’s data has shown that this happens because stock prices grow faster than wages. According to research based on Denmark’s data, lowering the policy rate by one percentage point increases the share of aggregate disposable income by around 3.5% for the top 1% of households over a two-year horizon and decreases it by almost 2% for the bottom income group. However, US data show that a long period of ultra-loose monetary policy helped decrease inequality (see the box): when unemployment goes down, the labour market tightens, strengthening workers’ bargaining power and their ability to agree upon higher wages.

Trade-offs between actions aimed at achieving monetary policy objectives over different horizons have always been present. However, changes in the nature of the business cycle since the mid-1980s have complicated those trade-offs. The root cause has been a shift from recessions mainly induced by a monetary policy tightening to keep inflation under control (a historical trade-off between price stability and employment) to recessions in which financial factors play a key role in business cycle fluctuations, according to BIS experts. With inflation lower and more stable, central banks’ monetary policy has not tightened much, but a major expansion of credit has given way to a subsequent sharp contraction, inducing a stronger and more prolonged monetary easing.

This has complicated intertemporal trade-offs even more, and among other things, raised the issue of a link between monetary policy and inequality. Protracted periods of easy monetary conditions can support the employment and income of the most disadvantaged, but may contribute to the slow build-up of financial imbalances, sowing the seeds of financial recessions further down the road. Recessions are extremely costly in terms of income inequality and require keeping interest rates low for longer, in turn prolonging any possible adverse impact on inequality.

BIS experts conclude that monetary policy cannot adequately handle these trade-offs on its own as they call for a more balanced policy approach in which other policies, notably prudential, fiscal and structural, also play a role.

Diversification of solutions

Addressing the structural trends in inequality is first and foremost a task for governments. They can avail themselves of the existing broad set of tools to tackle inequality, ranging from taxation to transfers as well as to policies aimed at improving education, property rights, health care, competition and trade. Moreover, governments bear the responsibility for achieving a desirable distribution of resources, BIS experts note.

Fiscal policy through support programmes (unemployment benefits and retraining) can help the most disadvantaged groups cope with adverse structural forces, whereas tax and transfer systems can be calibrated and targeted to redistribute income and wealth across different segments of the population. In advanced economies, such policies have indeed contributed to mitigating income inequality: the Gini coefficient is typically much higher for pre- than post-tax income. The difference is more limited in EMEs, one possible reason being the lower share of direct taxes in those jurisdictions.

Monetary tools, by their very nature, act primarily on cyclical developments. That is why they are well suited to achieving macroeconomic stabilisation objectives. Therefore, the best contribution central banks’ monetary policy can make to a more equitable distribution of income and wealth is to deliver on its mandate – ensure macroeconomic stability, for which price and financial stability are prerequisites. By keeping the economy on an even keel, central banks facilitate its sustainable growth, BIS experts explain. It would be counterproductive to gear monetary policy tools more squarely towards tackling inequality, as this might contradict the objective of maintaining price and financial stability.

Central banks can also contribute to a more equitable society using non-monetary measures. These are prudential policy and supervision (the global prudential reform Basel III was implemented after the global financial crisis in order to make the banking system more stable in an economic downturn and enable it to continue to support the economy). But many more are relevant in this context, as stated by BIS experts, including fostering financial development; furthering financial inclusion; protecting consumers of financial services; encouraging financial literacy and education; and overseeing payment systems.

Olli Rehn, Governor of the Bank of Finland, supported the BIS position at the CEBRA meeting, saying that the best contribution central banks can make to create an equitable society is to fulfil its mandate to maintain price stability as it promotes broad and inclusive employment growth. He noted that it is equally important to coordinate all policies. For instance, the coordination of monetary and fiscal policies during the coronavirus crisis has helped reduce job losses and company bankruptcies. Wages to workers are not only about labour productivity, but also about access to education and financial services, added Zeti Akhtar Aziz, former Governor of the Central Bank of Malaysia: central banks address financial inclusion issues, simplifying access to financial services for low-income groups of the population by deploying technology and developing financial products that this group of people need.

.png)