The Power of Bad News: How Mass Media Influences Inflation Expectations

In calm periods, most people are generally not very interested in the economy. Moreover, the more developed a person’s country of residence is, the more they can choose to ignore news about the economy. They incur nearly zero cost as a result of not possessing generally complicated and knowledge-intensive economic information: as the economy has functioned so well for decades, they have nothing to worry about. Science labels this behaviour ‘ rational inattention’ (link in Russian).

However, things change drastically if the economy is experiencing rough times in which people are unsure of the future of their wages, jobs, and prices even over a horizon of a couple of years. Then, economic news rises to the top of news aggregators. People begin to overreact even to scarce or insufficiently confirmed reports, and they may even rely on such news when making serious financial decisions or stocking products for the year ahead. This overreaction is specifically characteristic of developing countries.

Understanding the way society perceives inflation and the rationale behind decisions to spend or to save is perhaps one of the key tasks for an inflation-targeting central bank. And this is not some abstract theoretical task: inflation largely depends on inflation expectations. This means, it is people’s intentions to spend or save that mostly shape inflation.

But on what grounds do people make these decisions? There exist two schools of thought that answer this question differently.

The first school believes that people form their ideas of inflation on the basis of their daily shopping, meaning that their ideas of future prices are based on yesterday’s retail prices. Conventionally, these expectations may be called ‘backward-looking’ or adaptive. Such consumer behaviour patterns are well described and substantiated in dozens of papers. For example, one paper published in 1981 notes that, after a price surge in Sweden, women’s inflation expectations were extremely high, as women are usually the main shoppers in families. Almost 40 years later, in 2019, research based on US data showed (link in Russian) that consumers’ personal food shopping was the individuals’ key source of information about inflation (this is why women, who shop more often than men, have higher inflation expectations on average).

The other school holds that agents’ expectations are rational. In 1995, economist Robert Lucas received the Nobel Prize in Economics for developing the theory of rational expectations. Lucas was convinced that economic agents are not inclined to passively expect changes in economic direction. The other school holds that agents’ expectations are rational.

Since the early 2000s, economists have begun to pay increasingly more attention to the role of the mass media in the perception of inflation. In 2003, Christopher Carroll a professor of economics at Johns Hopkins University proposed an ‘epidemiological’ model, according to which opinions about future inflation spread like a ‘virus’ in the information environment.

Modern methods for handling big data and algorithms for natural language processing enable the almost real-time monitoring of the ideas dominating the media field. Theoretically speaking, these new opportunities may help researchers answer the question of the extent to which the theory of rational expectations is valid compared to the theory of adaptive expectations. The answer to this question may well be different in different countries. In our work, a preprint of which is published on the Bank of Russia website, we attempt to answer the question of what kind of news affects the inflation perceptions in Russia.

Key fears

As input for research, we collected a database of Russian news items. The algorithm used to collect and filter the news is available in our project’s repository on GitHub. Our database includes 7,779 pieces of news from 28 key Russian media sources for the period from January 2014 to August 2022.

Our hypothesis is based on the premise that individuals may form inflation expectations on the basis of general news about the economy and on news with a negative bias, and therefore we decided to select only news items that were ‘too expensive to be ignored’.

When formulating this hypothesis, we considered the findings of recent papers in this area, in particular, that different types of news items influence inflation expectations differently, that inflation expectations can be based on non-inflation news, and that negative news has a more powerful impact on inflation expectations.

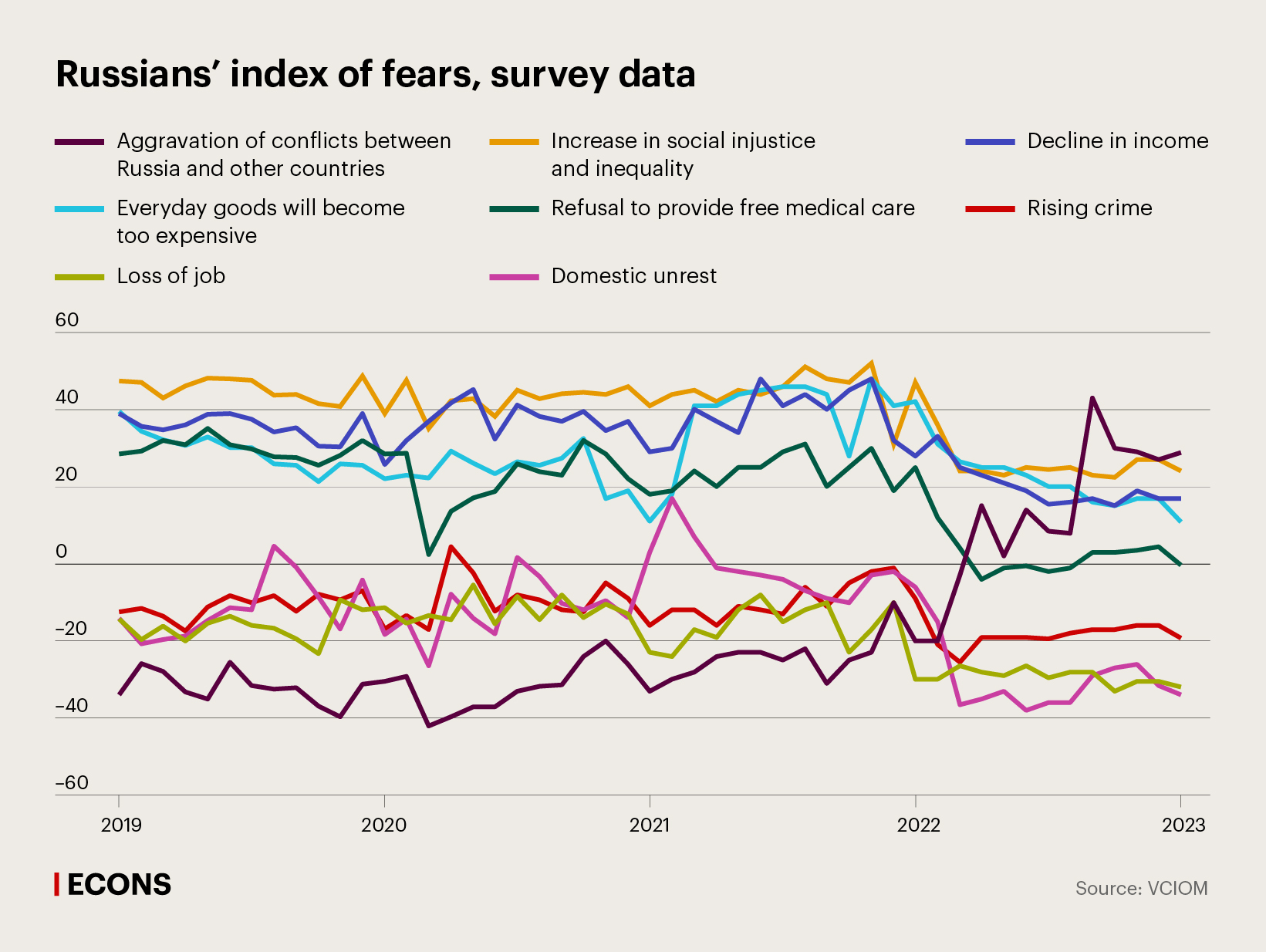

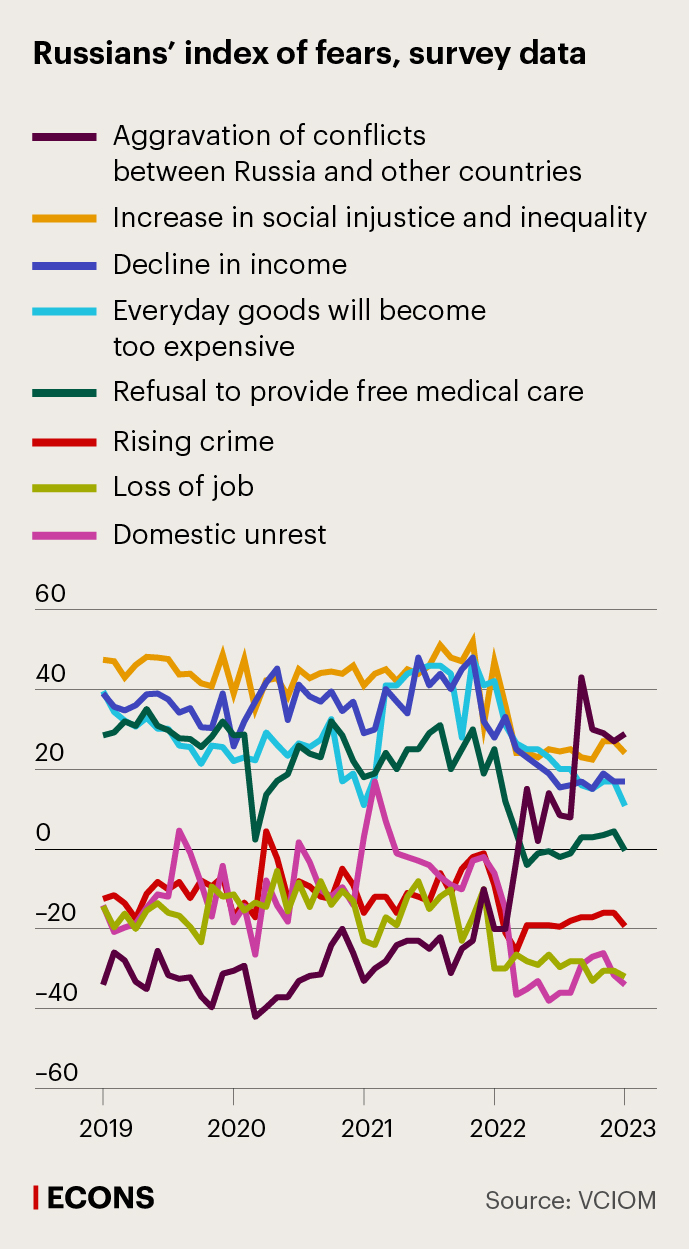

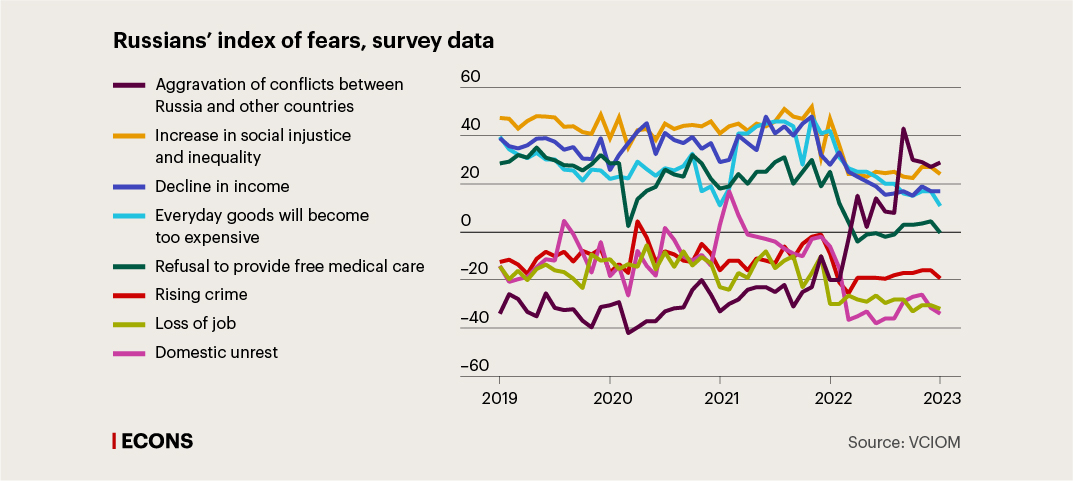

To identify such news as accurately as possible, we used data from Russian Public Opinion Research Centre (VCIOM) polls about Russians’ ‘index of fears’ (link in Russian) and processed them using a controlled algorithm trained to match particular words in the text with pre-selected topics (model Guided LDA). We used only the part of the general dataset which included economic topics.

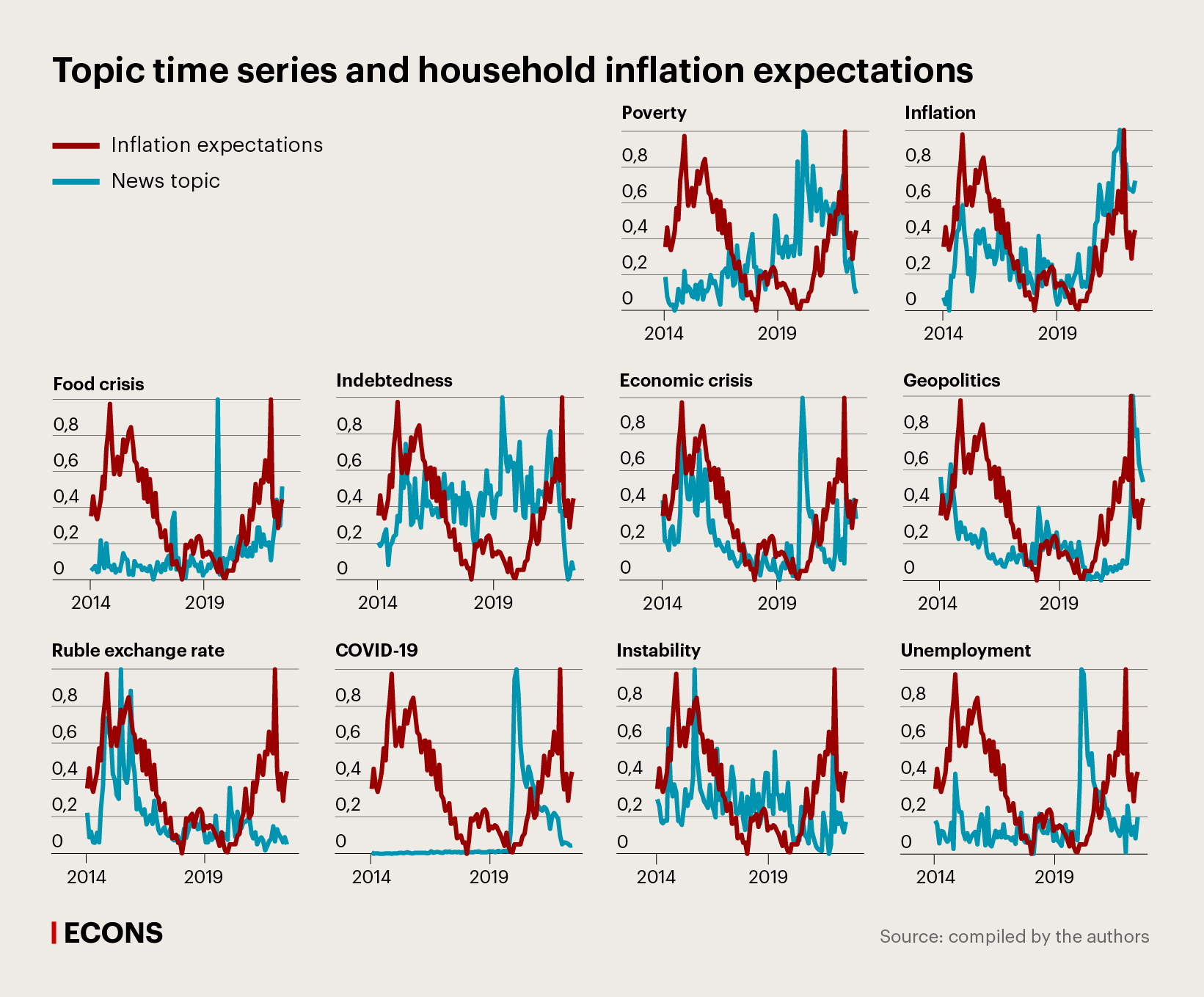

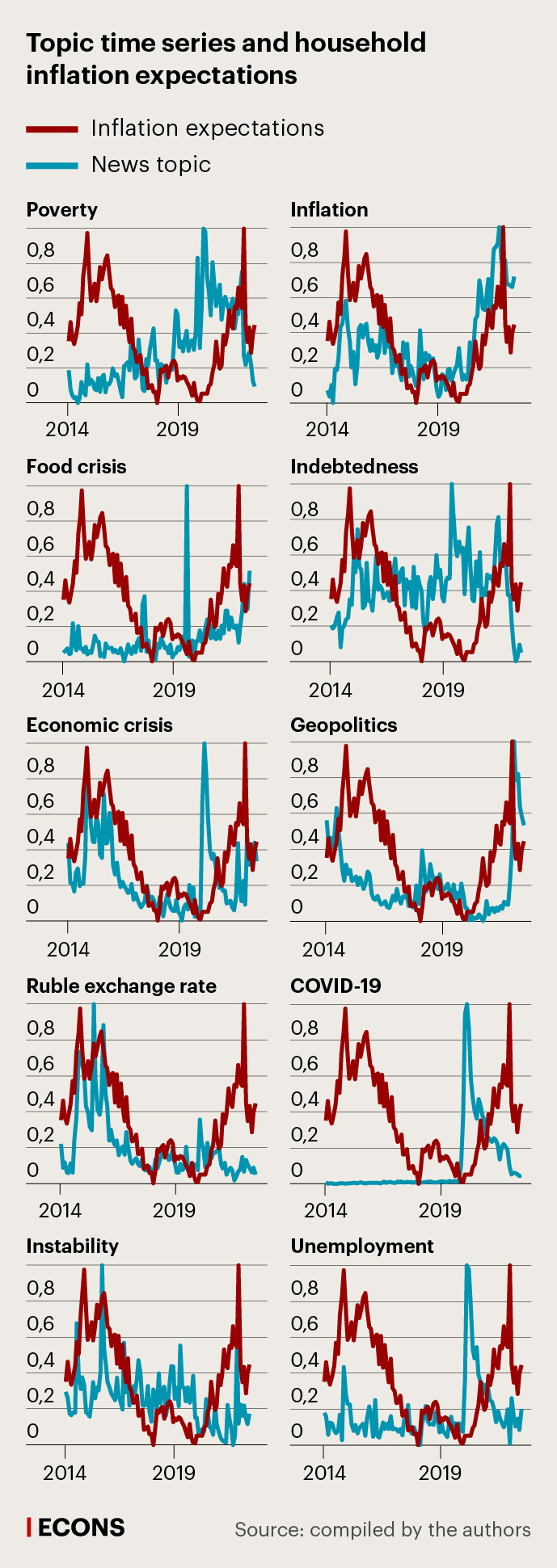

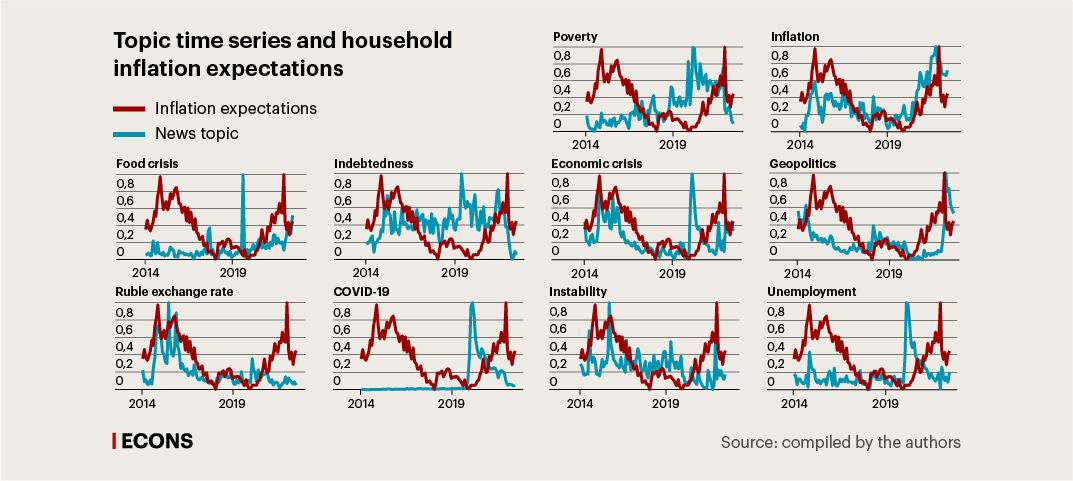

As a result, we compiled a list of 10 topics with a probability distribution of words for each topic: poverty, inflation, food crises, indebtedness, economic crisis, geopolitics, ruble exchange rate, COVID-19 pandemic, domestic instability, and unemployment. After that, we estimated the frequency with which each of the topics appeared in the Russian news and obtained time series.

Bad news and price perceptions

If we plot news patterns on household inflation expectations (information about them is collected by FOM (link in Russian) for the Bank of Russia on a monthly basis), we may notice certain similarities between a number of them (see the chart below). For example, the trends in inflation expectations most noticeably correlate with the trends in news about inflation, the economic crisis, the ruble exchange rate, and geopolitics.

To answer the question of which news items are most likely to influence the population’s perception of inflation, we chose four models: Lasso; two very popular machine learning algorithms, Random Forest and XGBoost; and Bayesian Structure Learning, BSL, which has been widely used in recent years in areas like bioinformatics and medical science.

Despite the differences in the models, all four yielded similar results. The most ‘influential’ news topics were inflation, economic crisis, and the ruble exchange rate. At the same time, in the model for inflation expectations, the most significant news topics were the ruble exchange rate and inflation, while in the model for observed (current) inflation, inflation and economic crisis were most important.

The results of the BLS model deserve special attention. Unlike the other models, which simply ‘weigh’ the importance of various news patterns, the BLS model attempts to compose a more sophisticated data structure, identifying the existence or absence of relationships between the individual variables. According to the results obtained, there may exist significant differences in the formation of inflation expectations and perceived inflation.

When answering the question about future inflation, respondents may be more focused on a forecast for the economy as a whole (which, in their view, may be more related to external factors and the ruble exchange rate), while when answering the question about past inflation, they may recall news about prices or about standards of living in the country as a whole (news about poverty levels, domestic environment, and food security).

In other words, the theory of rational expectations may turn out to be more valid for expectations, while the theory of adaptive expectations may be more valid for price perceptions.

We also additionally checked for differences in perceptions of inflation between subgroups with savings and those without. We found that people without savings tend to pay more attention to news about geopolitics and the poverty level, while for the subgroup with savings, exchange rate movements are a more significant factor on average.

Our research findings suggest that negative news may dominate individuals’ perceptions of inflation and their inflation expectations. Most significant is news about inflation itself and about individual prices, exchange rate dynamics, and the economic situation in general. These topics may have the greatest ‘epidemiological power’ and can most easily overcome people’s inattention to events in the economy.