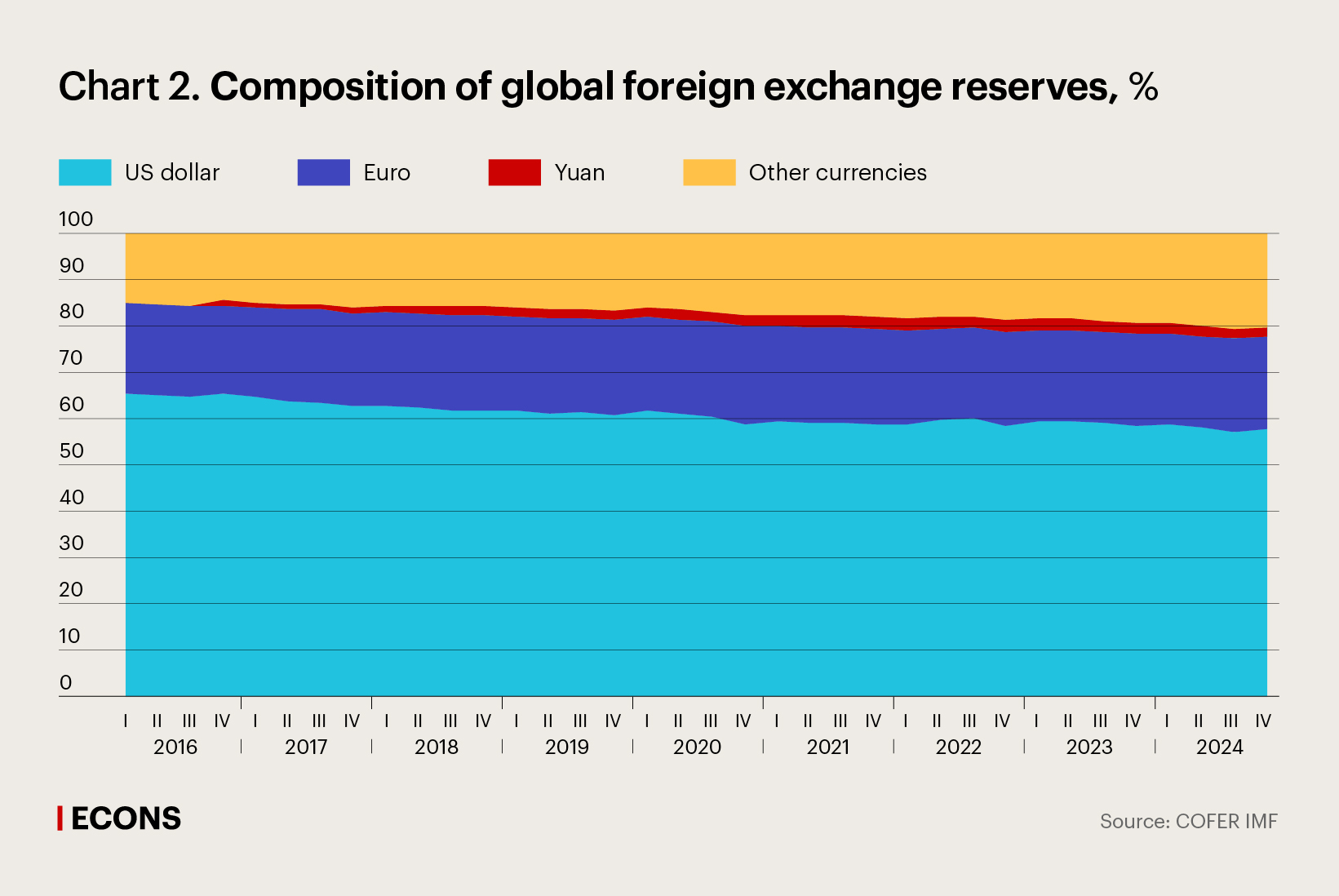

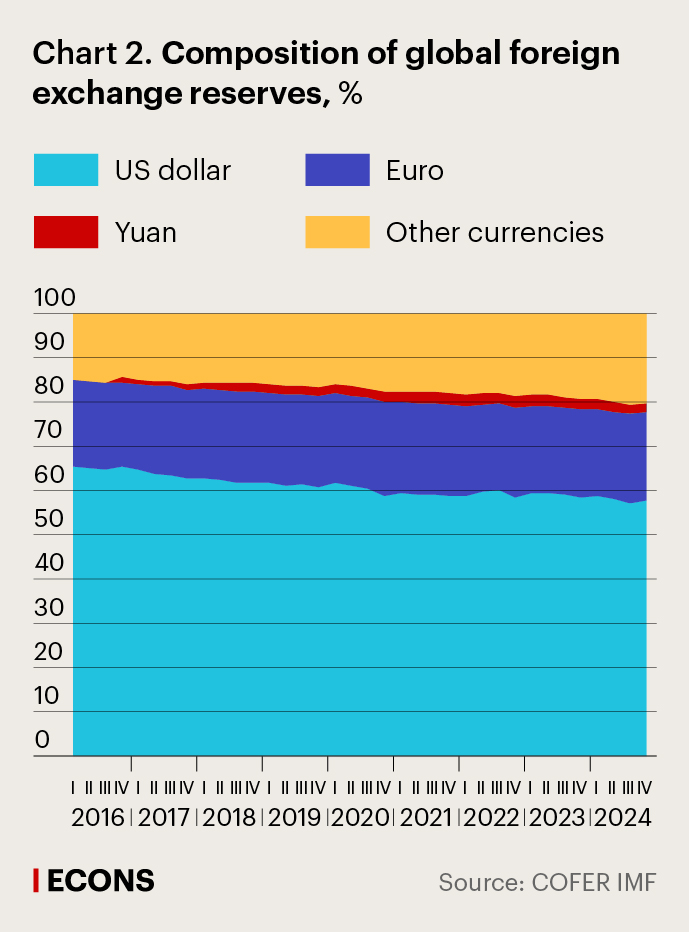

The global financial system remains US dollar-centric: as of mid-2025, the US dollar accounts for around 56% of world reserves and a half of international settlements. This dependence on a single currency not only entails systemic risks for individual countries outside the US economic power, but it also creates global macroeconomic imbalances.

BRICS countries began studying alternative approaches to the international financial architecture as early as 2009, discussing the expansion of settlements in national currencies. Over recent years, the issue of dedollarisation and a broader use of national currencies has come to the fore.

There are both economic and geopolitical reasons behind this trend. On the one hand, BRICS countries are seeking to reduce dependence on the dollar infrastructure, which is vulnerable to sanctions, amid intensifying geopolitical tensions. On the other hand, modern technologies enable international settlements in national currencies (including in digital form) without the fees charged by banking intermediaries.

Introduction of a single BRICS currency is a rather unrealistic scenario, due to differences in economic structures. According to the theory of Optimum Currency Areas (OCA), to ensure successful functioning of a single currency, a region should meet several key criteria: high labour mobility, high trade integration, similarity of shocks and cycles and availability of fiscal transfer system. BRICS countries depart from these criteria significantly.

Taking steps to develop settlement mechanisms in national currencies and reserve tools, as well as advance bond funds in local currencies, is a more realistic scenario.

Four roles of global currency

The dominant role of the US dollar in the global economy is often analysed from a macroeconomic or a geopolitical perspective. However, the global financial system is based on microeconomic decisions of individual firms, financial institutions, and households.

In international relations, currency plays four main roles: invoice currency, vehicle currency, reserve currency, and currency as a financial asset. Different incentives may prevail when choosing a currency for these roles.

- The invoice currency is used for pricing goods and services. In this role, currency acts as a measure of cost.

- The vehicle currency – currency used to invoice transactions. The vehicle currency may differ from the invoice currency. In this role, the currency takes the function of payment.

- The reserve currency is used for accumulating reserve assets, for example, by central banks. In this role, currency acts as a store of value.

- Currency as a financial asset. This is the currency in which financial assets (direct and portfolio investments, borrowings, and development aid) will be denominated.

Trend towards dedollarisation of settlements

Еconomic agents may choose a producer’s or a buyer’s currency as the invoice currency. At least, specifically these assumptions were made in the most cited mainstream studies of the second half of the 20th century (1; 2; 3). However, an empirical data analysis has showed that international settlements are more complex in nature.

First, researchers assessed the exchange rate pass-through, i.e. the change in prices for goods within a country in response to movements of the national currency’s exchange rate. If prices for goods were always fixed in a producer’s currency, the exchange rate movements would be fully passed through to prices in the importer’s market. If prices were set in a buyer’s currency, there would be no exchange rate pass-through. Findings showed a 50% exchange rate pass-through, suggesting a pricing environment that is, in some cases, consistent with the currency paradigm of the buyer, and in others, with that of the producer.

According to the latest empirical data, firms choose one of the dominant currencies – primarily, the US dollar as the invoice currency. Moreover, the exchange rate of the national currency against the US dollar substantially affects price changes in a country: the more extensively the US dollar is used by the country in settlements, the greater the said effect.

At microlevel, producers choose an invoice currency based on exchange rate risk, i.e. the extent to which their revenues may fluctuate when the exchange rate changes. Therefore, the choice of a currency depends on the currency in which production costs are denominated. To avoid the exchange rate risk, it is prudent to choose the same currency: that of the producer or the US dollar. Specific features of the producer’s market also influence the choice of a currency. If demand for goods in this market is susceptible to price movements, the producer is likely to choose the currencies used by its competitors – the local currency, or the US dollar (1; 2).

For the invoice currency, as well as for the vehicle currency, the transaction costs a firm incurs when making international settlements are a critical consideration. This factor significantly bolsters the US dollar’s role as the key invoice currency, creating a self-reinforcing cycle: the more firms use the US dollar, the greater the liquidity of its market is and the lower the transaction costs associated with its use are.

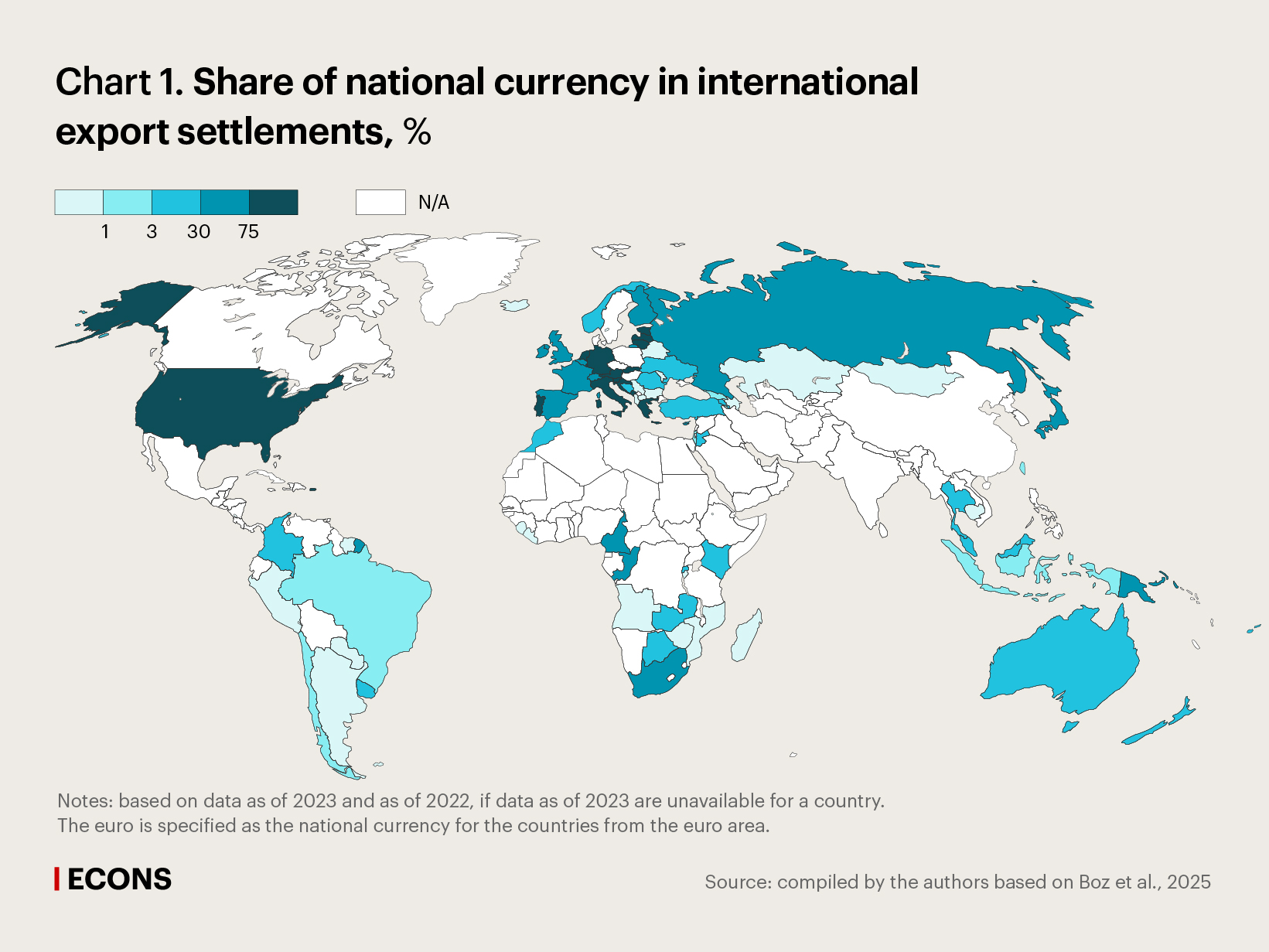

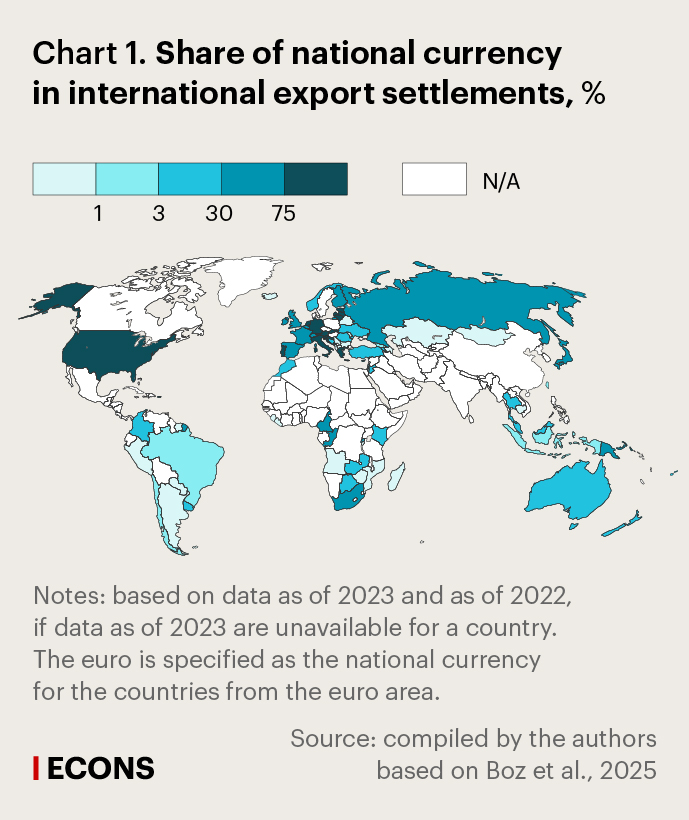

The US dollar dominates international settlements. It is used in 40% of international transactions, although exports to the US account only for 10% of global trade. The euro is rarely used for settlements outside Europe but makes up a fairly large portion of European settlements.

Geopolitical changes in 2022–2023 have had an insignificant impact on the average share of the US dollar in international settlements so far. However, a regional trend towards moving away from the US dollar in international settlements has started to emerge over the past decade. Not only Russia and China are actively using their national currencies in settlements, but also other countries taking measures aimed at the dedollarisation of the economy (Tanzania, Thailand, Indonesia, and Malaysia). For instance, since 2010, Russia has recorded a rise in the share of settlements in national currency from 5% to 38% in 2023; China – from around 0% to almost 50%; Macao – from 27% to 38%, and Thailand from 8% to 16%.

In Russia, the trend towards using national currencies was boosted by sanctions. As of 2024, the share of the ruble in both export and import settlements involving Russia exceeded 40%. The yuan dominates trade between Russia and China. In 2024 it accounted for 90% of settlements between the countries.

China is making every effort to internationalise the yuan, which includes entering institutional arrangements to use national currencies in trade and creating supporting mechanisms, including the Chiang Mai Initiative, a currency swap arrangement between ASEAN countries and China’s bilateral currency swap lines (link in Russian).

In the future, this trend may be bolstered by the fast advancement of digital technologies, which involves development of central banks’ digital currencies and the establishment of systems enabling international settlements using the said currencies. Such projects are already being developed, for instance: Cedar – a project of Singapore and the New York Innovation Center to facilitate the exchange of currency pairs; Mariana – a project of the Bank of International Settlements and the central banks of France, Singapore, and Switzerland; mBridge – a project uniting cross-border payments between China, Hong Kong, the UAE, Saudi Arabia, and Thailand; and BRICS Bridge. Furthermore, systems for international settlements in national currencies may operate without using central banks’ digital currencies.

Trend towards dedollarisation of reserves

When reserves are formed, a currency’s reliability and liquidity are crucial. Apart from being widely used in international settlements, the US dollar also dominates as a reserve currency, i.e. the currency used by central banks for accumulating reserve assets.

The choice of a reserve currency depends on which role of international reserves is more critical for a central bank. For example, if a country targets the exchange rate, the target currency should account for a significant share of international reserves. If foreign exchange reserves are used primarily to facilitate trade transactions and settle external debt, greater emphasis will be placed on the currency composition of its trading partners and the currency structure of its debt. There are other economic factors influencing the choice of the reserve currency: its reliability, liquidity, depth of the financial market, and if possible, the ability to generate profit.

Barry Eichengreen, a world-renowned specialist in currency reserves, identifies (link in Russian) economic factors driving the choice of a reserve currency as the ‘Mercury hypothesis’, which is a strategy based on trade and financial ties. However, there are geopolitical reasons for the choice of reserve currency – the

‘Mars hypothesis’, whereby countries tend to adopt the currency of their political and military allies as the reserve currency.

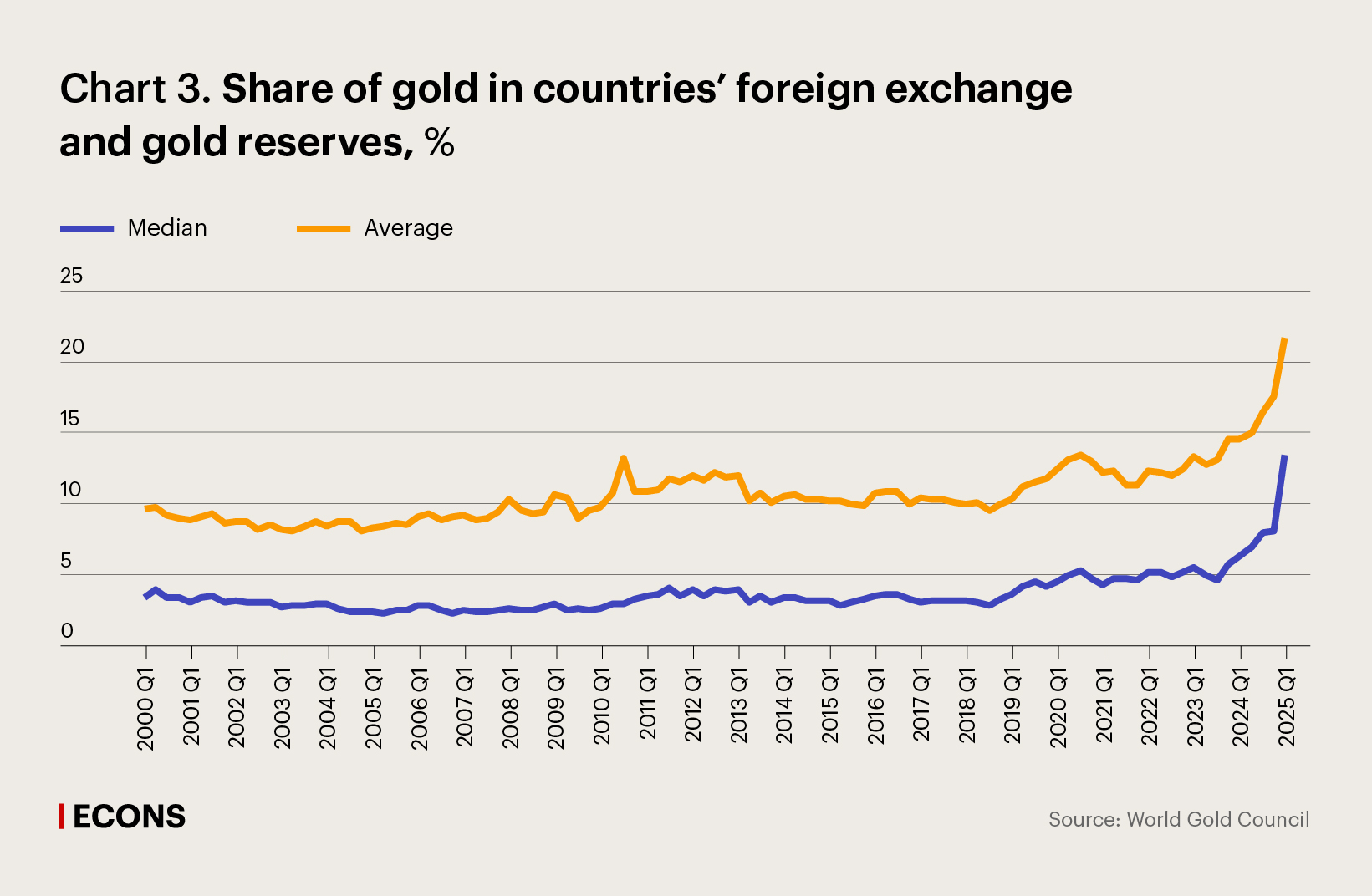

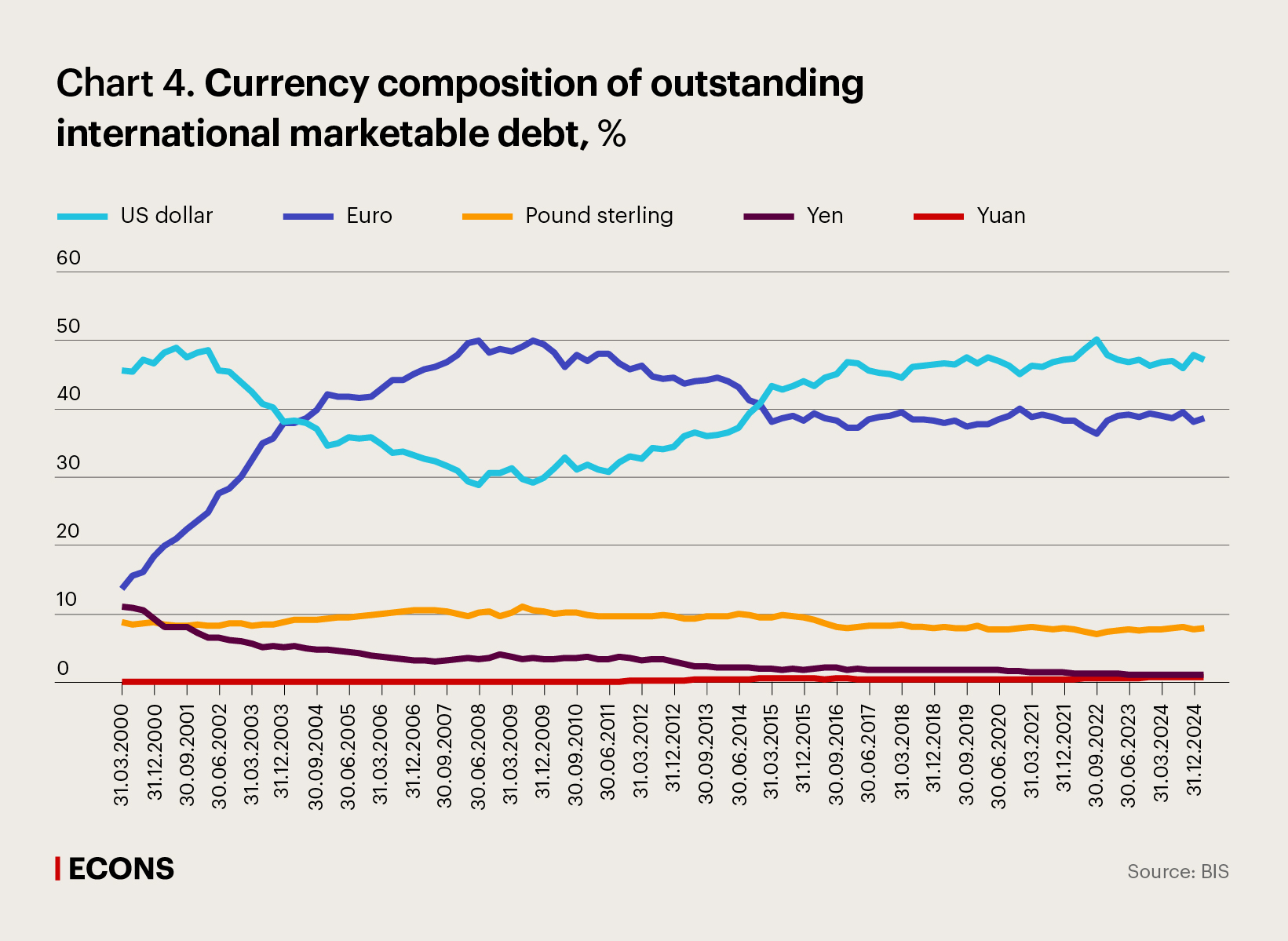

The US dollar’s dominant role as the core reserve currency is a result of a combination of factors, including its frequent use as a target currency, and deep financial markets, among others. However, its share in global foreign exchange reserves has been declining over recent decades. This trend commenced when the euro was introduced and continues towards the diversification of foreign exchange and gold reserves, including due to geopolitical factors. Furthermore, the composition of foreign exchange and gold reserves is not shifting towards a certain alternative currency: the proportions of gold, the yen, and the Australian and Canadian dollars are expanding. The share of the yuan has surged significantly as a result of China’s efforts to internationalise the yuan through using swap lines, financing the One Belt One Road initiative, and developing a digital currency.

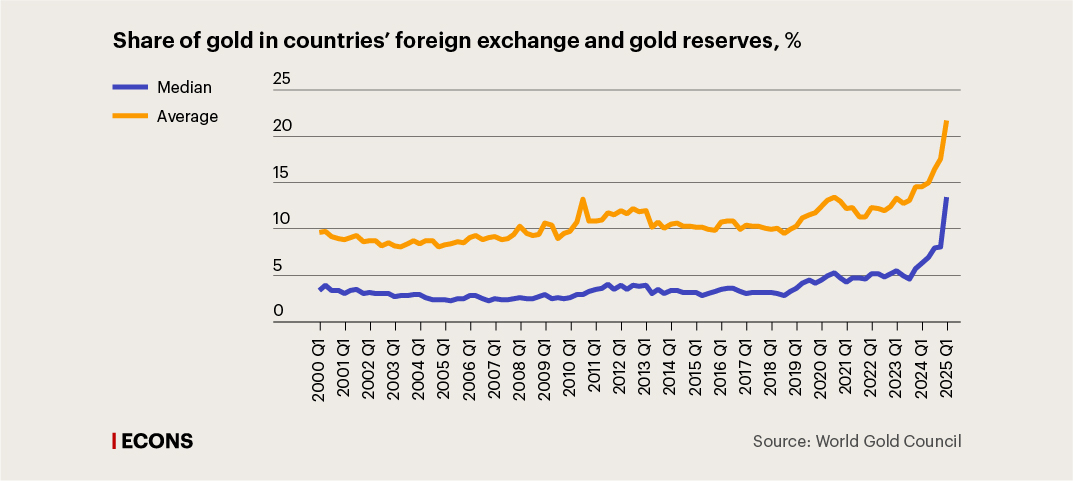

As global uncertainty is growing, the share of gold in foreign exchange and gold reserves is also rising, due to both central banks’ decisions (link in Russian) and passively due to surging gold prices.

The need for a reliable non-US dollar asset drives the search for institutional mechanisms capable of performing part of reserve assets’ functions. For example, in 2014, BRICS countries created a Contingent Reserve Arrangement (CRA), which is an emergency liquidity assistance mechanism for the BRICS member states. The aforementioned Chiang Mai Initiative can also be regarded as a similar mechanism.

The choice of a currency of financial assets (direct and portfolio investments, borrowings, and development aid) is also underpinned by the economic factors listed above, i.e. the depth of financial markets, currency liquidity and volatility, and transaction costs. The incentives behind it are similar to those driving the choice of the invoice, vehicle, and reserve currencies, albeit with varying degrees of influence. For example, investors buying the debt of developing countries are less preoccupied with the currency’s reliability if they are ready to undertake foreign exchange risks, while attaching great importance to currency liquidity.

Many studies are dedicated to developing countries’ inability to borrow in their national currencies, which is referred to as the ‘original sin’ issue (link in Russian). The ‘original sin’ hypothesis was first formulated by Barry Eichengreen and his co-authors, whose paper disproves all intuitive reasons of this issue, such as high inflation, fiscal imbalances, unstable monetary policy, and concludes that the only statistically important factor impacting borrowings in the national currency is the country’s size.

The ‘original sin’ entails unfavourable consequences for developing economies, which are primarily associated with currency mismatch, i.e. when a country’s assets are denominated in one currency and its liabilities are in another. This mismatch often results in currency crises.

After the global financial crisis, some countries overcame the ‘original sin’ to a certain extent and substantially increased the share of borrowings in the national currency by developing financial markets. However, both the sustainability of this trend and the decrease of foreign exchange risks for these economies are questionable.

Speaking about institutional changes accompanying this trend towards a more extensive use of national currencies, it is worth mentioning the measures taken by regional development banks and associations of central banks. The Asian Development Bank issued the first bonds in Indian rupees as early as 2014. The BRICS New Development Bank issues bonds in yuan and South African rands, creating reliable instruments in the national currencies of the member states. Asian Sovereign Bond Fund (Asian Bond Fund 2) was established at the initiative of the Executives’ Meeting of East Asia Pacific Central Banks (EMEAP), which had a positive effect on the development of Asian national currency debt markets.

New equilibrium

All the four roles of currency are interrelated, which is illustrated by modern theoretical models and clear from empirical data. The advantages that a currency gains through its extensive use in one area (deeper financial markets and greater liquidity, lower transactions costs) make it popular in another one, due to network effects.

However, in theory, several dominant currencies can co-exist. For instance, one paper analyses the scenario, whereby the Chinese yuan is used as the third invoice currency, in addition to the US dollar and the euro. The author uses modelling to demonstrate that this scenario is possible if certain countries choose the yuan as the target currency. In practice, the euro is already treated as the dominant currency, albeit at regional level. Probably, the volume and elasticity of the supply of euro-denominated assets are insufficient for it to be used more broadly.

Current geopolitical events, coupled with modern financial technologies, may drive the transition to a new equilibrium, once new regional dominant currencies emerge and the US dollar’s role diminishes. However, it is still not possible to speak about the abandonment of the US dollar as the dominant currency in the near future.

The parameters of the new equilibrium may, to a certain extent, be shaped by institutional initiatives of developing countries, i.e. the aforementioned infrastructure within BRICS and ASEAN, and the development of capital markets in these countries, as a currency’s liquidity and market depth determine how it will be used in all the roles.

The full text of the article is published in the journal Voprosy Ekonomiki (Economic Issues), No.11, 2025.