Green Deal: How Should Financial Institutions and Regulators Respond

In January 2020, Greta Thunberg addresses the World Economic Forum in Davos in her emotional speech urging major economies’ leaders to immediately divest from investments in fossil fuel exploration. US Treasury Secretary Steven Mnuchen parries sarcastically that the young woman should study economics at college first. Nobody knows yet that the coronavirus pandemic will break out in a few weeks. However, even the pandemic has not removed the issue of climate from the global agenda. On the contrary, it has become number the last on the global agenda over the last year and a half.

In April 2021, the group of countries committed to net zero greenhouse gas emissions by 2050 was joined by the USA. On 14 July, the European Union, considered a pioneer in climate action, released the European Green Deal comprehensive environmental action plan that aims to achieve a material reduction in greenhouse gas emissions as early as 2030.

What will be the impact of the global initiatives on Russia and Russian commodity exporters? What should their lenders be prepared for? What measures should be implemented by regulators?

Green transition risks

Climate risks are generally divided into transition and physical risks.

Physical risks involve possible financial losses stemming from natural disasters and gradual climate change (changes in temperature, precipitation, sea level, permafrost thaw, etc.). If physical risks materialise, this might cause asset depreciation and income loss, which decreases supply, pushes up prices, bankrupts companies, and undermines GDP.

Transition risks might cause financial losses in the course of the transition to a low-carbon economy. As consumers and investors alter their preferences and legislative authorities amend regulation (e.g. introduce carbon tax), various countries increase investments in green projects by cutting investment in brown industries. Carbon-intensive companies’ assets depreciate, and the structure of global trade costs changes. Credit institutions might face growing credit risks as a result of lower earnings of borrowers from vulnerable industries and depreciation of collateral under loan agreements.

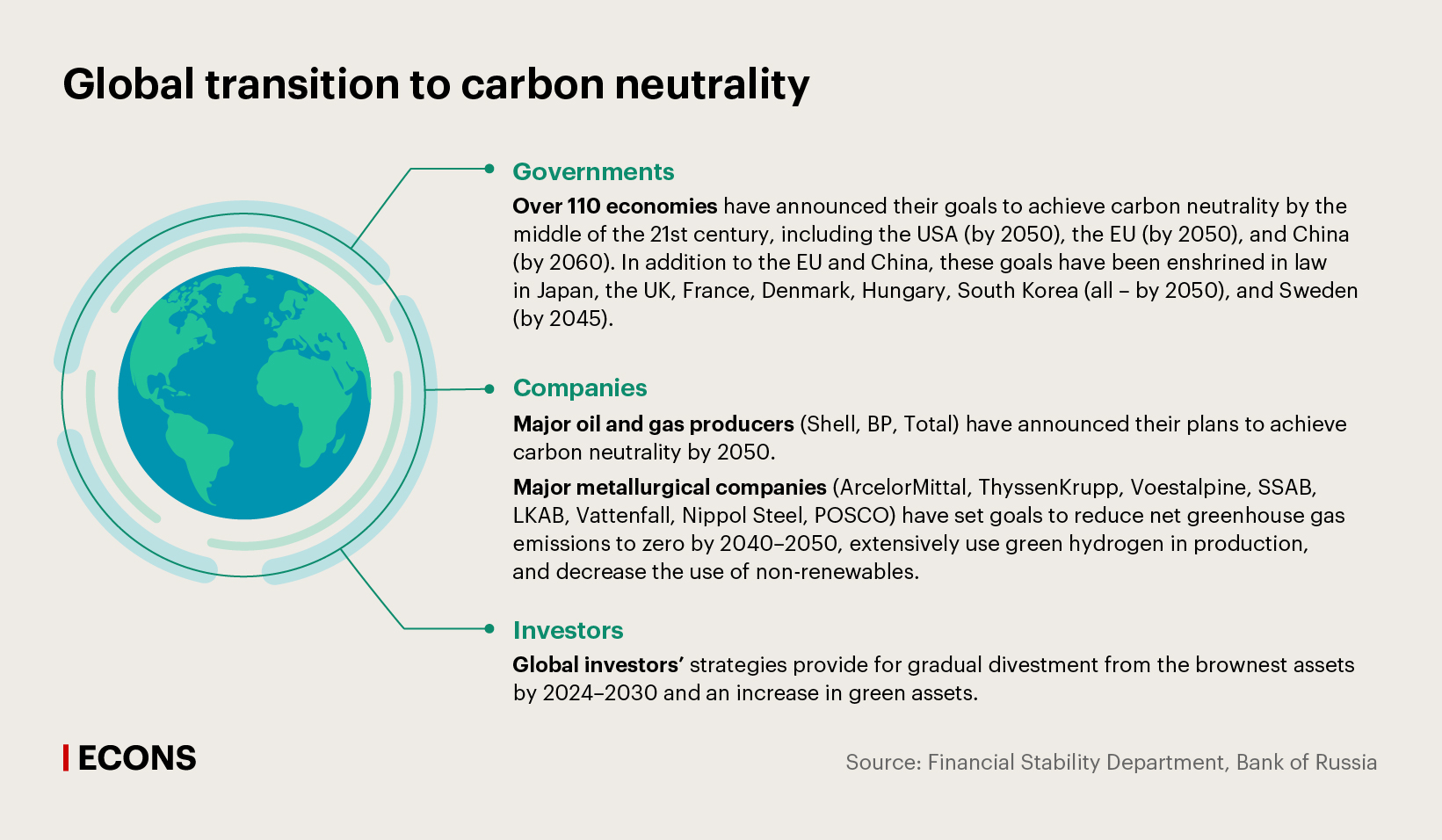

Today, the Bank of Russia and global regulators are more focused on the assessment of climate transition risk that is more acute in the short run than physical risk. Furthermore, the channels of its impact are clearer: there are three channels corresponding to the subjects making a green transition, including the state, the real sector, and investors.

As regards the first channel, transition risk is associated with the fact that the last two years governments have been actively developing national green strategies aimed at achieving carbon neutrality by 2050 (China – by 2060) and radically revising the power consumption structure. Countries’ action plans are becoming increasingly more ambitious as current decarbonisation rates are too slow to ensure fulfilment of the Paris Agreement.

The best example is the EU’s cross-border carbon regulation – the Carbon Border Adjustment Mechanism (CBAM). On 14 July 2021, the European Commission presented its Fit for 55 package aimed at counteracting climate change. The key goal of this package is to reduce net greenhouse gas emissions at least by 55% compared to 1990 levels by 2030. The EU member states are committed to make Europe the first climate-neutral continent by 2050. The EU’s climate package contains multiple provisions, but the key ones for Russia are cross-border carbon tax to be introduced in 2026 and plans to expand the use of renewable energy sources.

The package outlines five main groups of goods that are subject to regulation under the CBAM: cement, iron and steel, aluminium, fertilisers, and electric power. For the EU, Russia is the major exporter of iron, steel and fertilisers, and the second largest exporter of aluminium. By the end of 2025, the EU will introduce a transition period, during which the CBAM will be applied in the form of obligations to submit reports on export quantities to the EU, greenhouse gas emissions, and prices for carbon emissions in exporting countries.

The introduction of cross-border carbon taxes may increase the cost of Russian companies’ exports, affect their profitability, and intensify competition. The Bank of Russia carried out a stress test of the impact of carbon tax introduction on Russian exports. According to its findings, most exporters’ financial standing will remain adequate and banks’ financial losses due to higher provisions will be insignificant. Nonetheless, such estimates should not give a false confidence: if taxes do not make exporters change their policies as regards emission reduction, they will be raised further.

The CBAM will not be applicable for some time to the products of the oil and gas and coal industries, but they should nonetheless take into account other important measures implemented by the EU to achieve carbon neutrality: targets for reducing power consumption, review of energy commodity taxes, complete refusal from internal combustion engines since 2035, and an increase in the share of renewable energy in the EU’s energy balance to 40%. As a result, the EU’s demand for fossil fuels will plummet in the short run already.

Transition strategies implemented by companies and consumers of their products are the second channel of the impact of transition risk. Increasingly more companies are announcing their carbon neutrality goals, and a number of global oil producers (Total, and others) have already altered their strategies and position themselves as energy companies. An essential role in decarbonisation is played by the transport sector accounting for nearly a quarter of all greenhouse gas emissions worldwide. Their reduction through transport electrification is an important clause of the Paris Agreement. The development of the electric vehicle industry actively encouraged in many countries across the globe will significantly contribute to the decarbonisation of the economy. Furthermore, a considerable expansion of the electric vehicle market boosts the demand for raw materials needed to manufacture batteries, namely lithium, nickel, cobalt, graphite, and rare earth metals.

Global investors’ strategies are the third channel of the influence of transition risk. Major global investors have already started to extensively integrate ESG factors into their strategies aiming to progressively stop investments in the brownest assets by 2024–2030 and build up their investments in green assets (see the Box).

This might affect the cost and affordability of financing for Russian carbon-intensive companies. Brown enterprises might face problems with external debt refinancing, due to which they might be forced to raise funds in the Russian market. This will augment the risks of the banking system and other financial institutions (non-governmental pension funds, insurers, etc.), which will increase even more the share of brown assets in their portfolios.

Global coordination

What should be done by financial institutions and regulators? If brown companies default, these will be banks and other financial institutions who will incur major losses. Banks generally have more mature risk management systems, and their top-priority task is to properly assess their risks associated with the transition to a green economy.

In recent years, climate has become a central topic on the global regulation agenda. Countries have managed to align their efforts as a result of the global coordination achieved in financial regulation after the 2007–2009 financial crisis at the level of the G20 and the Financial Stability Board. Furthermore, central banks established a new organisation – the Network of Central Banks and Supervisors for Greening the Financial System (NGFS). International organisations and national regulators have been taking extensive efforts to improve the financial sector’s awareness about climate risks.

The key elements of this work are disclosure of climate-related information, risk assessment, supervision, and regulation (regulators also take efforts to develop the market of green instruments, taxonomy, etc., but this article is rather focused on the issue of risks).

Disclosure of information on risks

The essential basis for such assessment is the disclosure of information on climate risks by companies (first and foremost by commodity exporters, and later on by banks). There are voluntary standards for disclosing information on climate risks developed by the Task Force on Climate-related Financial Disclosures (TCFD). They are already now used by many companies. The Bank of Russia released its recommendations for companies that are based on the TCFD standards.

The next step of the world community is to establish a global, universally recognised standard for disclosing information on climate risks, which is currently being developed by the IFRS Foundation and is expected to be released next year. On 30 December 2021, Russia will bring into force the law (link in Russian) limiting greenhouse gas emissions which, among other things, obliges companies responsible for large emissions to submit relevant reporting.

Risk assessment

Banks have long-established approaches to assessing conventional risks, including credit, market, liquidity, and operational risks. However, climate risk is a totally new area. For instance, how should banks assess the risk of a coal company that currently earns high revenues, has an acceptable credit rating, and seems to be sufficiently creditworthy, but is forecast to face a 90% decrease in the demand for coal in a number of countries in ten years? Models based on historical data will not help assess these risks. Nonetheless, we might try to make a long-term forecast and estimate how further developments might impact standard banking risks, primarily credit risk. To this end, increasingly more banks carry out stress testing which has long proven to be efficient for analysis amid high uncertainty.

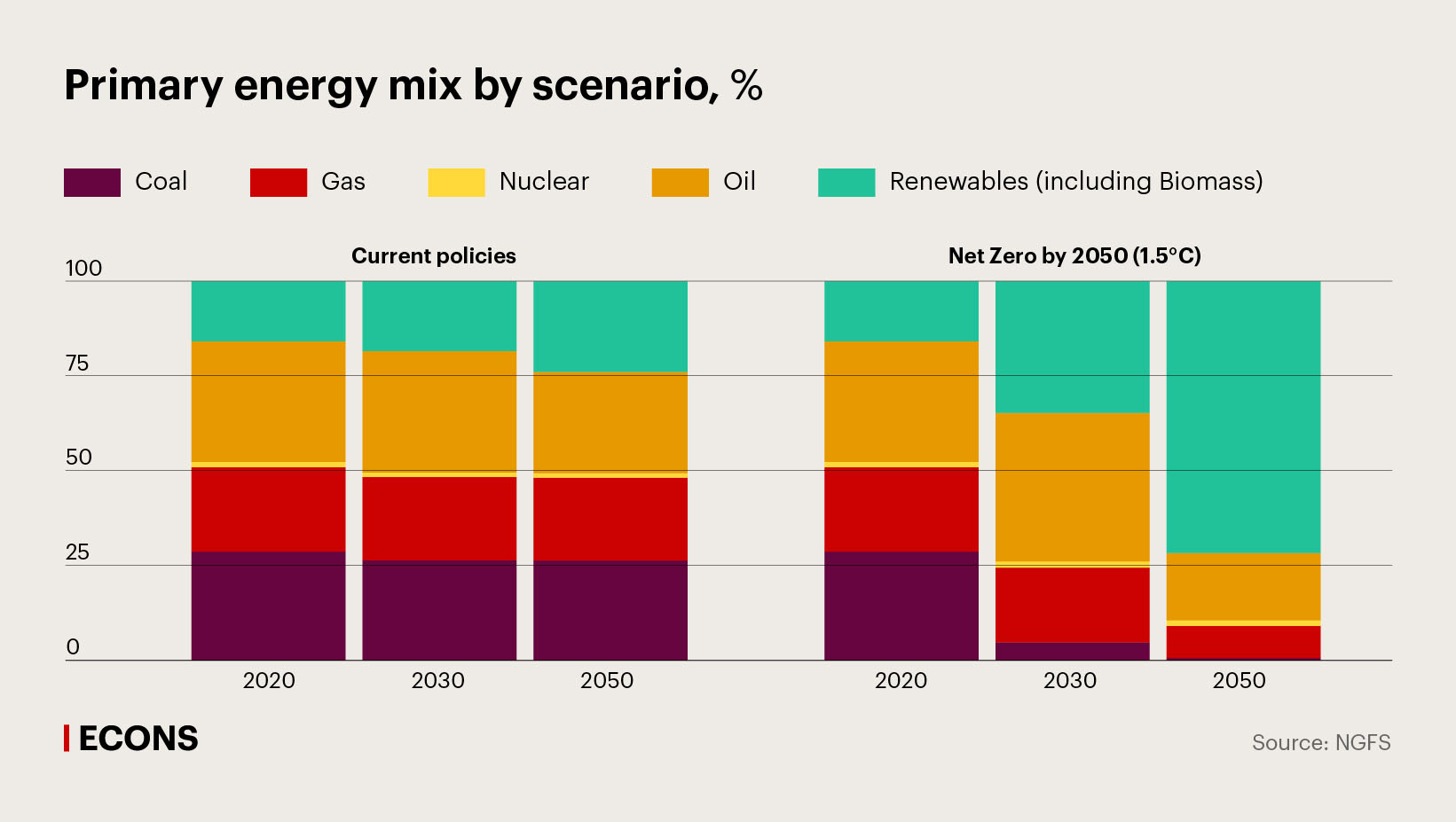

Climate risk stress testing is typically carried out over a long-term horizon in order to encompass expected changes (including both the impact of taxes and changes in the demand structure). In 2020, the NGFS designed scenarios that correspond to various paths of moving towards a low-carbon economy and are applied by many central banks. Based on these scenarios, central banks determine macroeconomic indicators and then use their conventional model-based approaches to connect forecast macroeconomic variables and credit quality indicators and measure the impact on financial institutions’ capital adequacy.

In June 2021, the NGFS presented its updated scenarios which now:

- take into account physical risks;

- consider climate goals stated by countries in their strategies;

- provide forecasts for individual countries.

Six scenarios for the future

The NGFS explores six plausible scenarios of the materialisation of climate risks which are classified into three main groups: orderly, disorderly and hot house world scenarios.

Orderly scenarios assume climate policies are introduced early and become gradually more stringent. Both physical and transition risks are relatively subdued:

- Net Zero 2050 limits global warming to 1.5°C through stringent climate policies and innovation, reaching net zero CO2 emissions worldwide by 2050.

-

Below 2°C gradually increases the stringency of climate policies, giving a 67% change of limiting global warming to below 2°C by 2050.

Disorderly scenarios explore higher transition risks due to risk-limiting policies being delayed. Climate policies implemented are more stringent than under orderly scenarios: - Divergent Net Zero reaches net-zero by 2050 but with higher costs due to divergent policies introduced across sectors, which will ultimately lead to a quicker phase-out of oil use.

-

Delayed Transition assumes global annual emissions do not decrease until 2030, which will require strong policies to limit global warming to below 2°C.

Hot house world scenarios assume that some climate policies are implemented in some jurisdictions, but global efforts are insufficient to halt significant global warming. This leads to severe physical risks and irreversible impacts (like sea-level rise): - Nationally Determined Contributions includes all policies currently pledged by jurisdictions even if not yet implemented.

- Current Policies assumes that only currently implemented policies are preserved, leading to high physical risks.

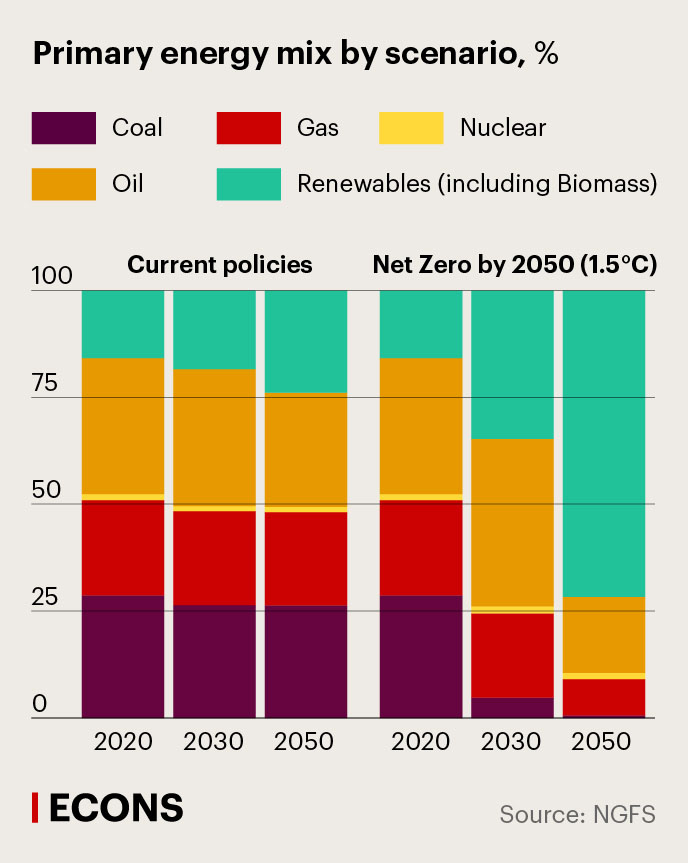

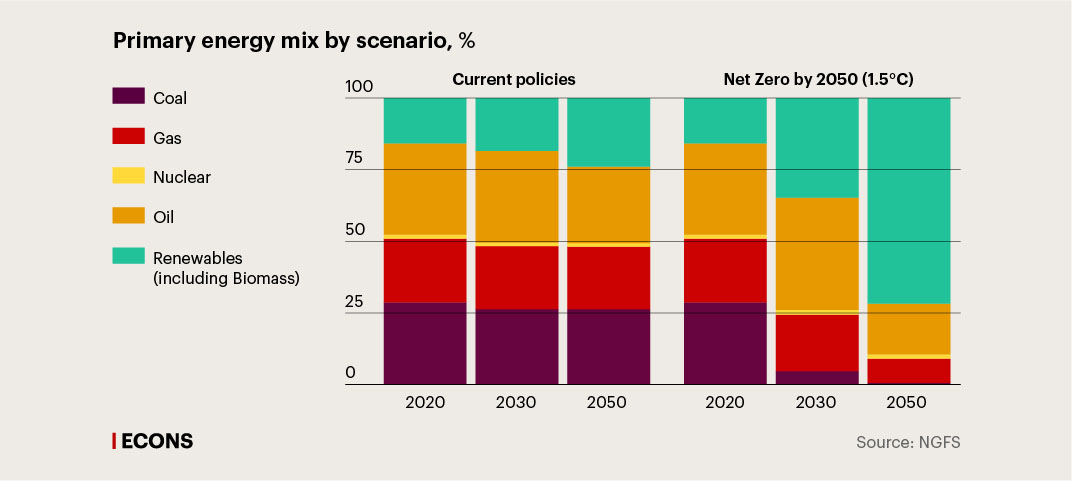

More stringent policies to be implemented in response to climate change involve higher prices for carbon emissions. Specifically, the Net Zero 2050 scenario assumes that by 2030 the price for one tonne of carbon emissions should reach $160 (according to the IMF and the OECD, 55% of emissions in the OECD and G20 countries are currently not subject to taxes); renewables and biofuels will cover 68% of global needs. The Current Policies scenario is totally different, assuming that fossil fuels remain the dominant source of energy, even despite current technological trends.

More than 15 regulators, including the ECB, the Bank of England, the Bank of France, and the Bank of Canada, are already using the NGFS scenarios to carry out their stress tests, which ensures comparability of results. In addition, the NGFS scenarios might be adjusted considering climate policies pursued in particular jurisdictions and include data received from independent climate experts (this approach is applied by the Bank of England).

At the beginning of 2021, the Bank of Russia carried out a stress test of the impact of cross-border carbon tax and presented general findings in its Financial Stability Review. Today, the Bank of Russia is developing a longer-term stress test based on several NGFS scenarios to be able to estimate long-term implications for the Russian financial sector.

Global commercial banks are also extensively using the NGFS scenarios as a basis for internal analysis and strategic planning, or to comply with relevant inquiries from their regulators.

Regulation and supervision

In recent years, the NGFS has developed several guides on how financial institutions should integrate the assessment of climate risks into their operations, and how supervisory authorities should organise their work:

- It is recommended to identify how climate risks affect the financial sector and the economy and how significant these risks might be for supervised financial institutions.

- It is essential to develop a clear strategy, ensure proper organisation, and adequately allocate resources to address climate risks.

- It is crucial to assess potential risks of supervised financial institutions sensitive to climate risks and their potential losses if these risks materialise.

- It is advised to work out a transparent prudential approach to climate risks.

- Supervised financial institutions should organise appropriate management of climate risks, and where necessary, take action to eliminate these risks.

However, these are only recommendations, and there is still no special regulation of climate risks at the moment. National regulation also does not set any differentiated requirements for green, or to the contrary, brown companies.

Nonetheless, standard setters (the Basel Committee on Banking Supervision, the International Association of Insurance Supervisors, and the International Organization of Securities Commissions) are currently carrying out work to take into account climate risks in their regulatory rules. A key challenge is that regulation is generally risk-sensitive, and risk ratios reflect historical data on default probability and loss given default. However, there is currently no such information on climate risks. There is no quantitative evidence that green project risks are lower or that special risk ratios should be applied in relation to green, transition, or brown borrowers. However, such work is being carried out globally, and the NGFS is expected to release its report on this issue in December 2021. The Basel Committee on Banking Supervision also plans to publish its report covering possible regulatory and supervisory approaches in December.

Regulatory design

What regulatory requirements might be designed to take into account climate risks? What are the hypothetical options?

On the one hand, considering that countries have achieved significant progress in stress testing, there is a naturally arising idea to apply this very instrument, since it has long been used to take into account other risks within internal capital adequacy assessment processes (ICAAP). In the EU, the USA, and other jurisdictions, banks failing to pass supervisory stress tests are required to build up their capital (or reduce assets at risk). For instance, interest rate risk on the banking book is not taken into account in standard capital requirements. However, if a bank has an excessive maturity mismatch, supervisory authorities may require it to cover this risk with additional capital.

At the moment, no additional capital requirements are imposed following climate stress tests, but this might change in the future. Within its climate risk stress test announced in 2021, the Bank of England requests banks already now to assess climate risks and strategies for transforming major borrowers. In recent years, Russia has also been actively developing ICAAP supervision. However, at the moment, banks are not required to increase capital based on stress test results.

On the other hand, climate transition risks are universal. They affect not only individual banks, but also the financial sector as a whole. Risks might materialise in relation to both large loans and supposedly diversified investments in a securities portfolio. This proves that climate risks should be taken into account directly in regulatory requirements for capital or loan loss provisions, to avoid regulatory arbitration.

In this case, there is also a dilemma: should these requirements be established within a micro- or macroprudential approach? Climate transition is obviously an example of systemic risk involving clear effects of interconnections and potential contamination. For instance, an insufficient transformation of brown companies in the case of an accelerated energy transition might drastically worsen their financial standing and entail systemic consequences for the financial sector and the economy in general. These risks have always been taken into account through macroprudential policy mechanisms. The common logic of regulation implies that expected (statistical average) loss should be covered by provisions, whereas unexpected loss with a certain probability should be covered by capital. Macroprudential risk-based buffers in capital adequacy requirements improve banks’ resilience to systemic risks and discourage risky lending.

What systemic risks should be included in regulatory requirements related to climate risks and at what level should these requirements be established? If authorities opt for the most conservative scenario and oblige banks to form additional capital for loans issued to brown companies, this might cause problems in their operations, reduce financing of projects aimed at the transformation of brown companies, and involve dramatic economic losses, which would be an even more negative equilibrium. To the contrary, if differentiation for green and brown projects and the efficiency of borrowers’ transformation are not considered at all, this might result in underestimation of risk and financing of futile businesses, and would delay the transition to a green economy. Therefore, the issue of future regulation should be studied in great detail.

Speaking of incentive-based regulation of green projects, it is essential to refer to the issue of greenwashing, when projects that are actually not green are presented as such in order to raise investment with more beneficial conditions. If regulatory incentives are introduced for such projects as well, this would involve the risk of green asset bubbles. A top-priority area for the G20 is to limit greenwashing risks and elaborate the regulation of methodologies for assigning credit agencies’ ESG ratings.

Climate risks and the Russian financial sector

In spring, the Bank of Russia surveyed financial institutions to find out whether and to what extent they consider climate risks in their operations. 39 institutions participated in the survey. According to its findings, over 60% of respondents take into account ESG factors in their operations. Furthermore, over a half of respondents referred to the E factor (the environment, including climate risks) as the least significant. More than 60% of respondents still have no plans to carry out assessments of the impact of climate change on their operations. The majority of the surveyed institutions only monitor ESG risks and have no plans to implement any measures to mitigate these risks. As little as 15% of respondents limit their investments in brown assets, or are going to do so.

Thus, the Russian financial sector is just at the start of this journey. We believe it crucial to ensure an adequate disclosure of climate information by companies and the integration of ESG factors into financial institutions’ business strategies and risk management. This will help develop an efficient risk management system at all levels of the economy and enhance the stability of the financial system considering climate risks.

It is especially important for the Russian economy to encourage not only green projects, but also (and possibly to an even greater extent) transition projects, in order to promote green transformation of brown companies. The efficiency of their transformation will determine whether the economy in general will be able to become greener.

The impact of cross-border carbon taxes and changes in major economies’ energy balance will already be noticeable in a few years. It is vital to use this time in order to adjust the Russian economy and financial sector to the coming changes. Banks should comprehensively participate in the transition to a low-carbon economy and contribute to the transformation of their clients.