The aim of industrial policy is not just to support individual industries, but to make deep structural changes in the economy. In recent years, it has again attracted the attention of researchers and governments seeking to ensure sustainable economic growth and structural transformation. This trend is obvious both in emerging, catching-up, economies and in advanced economies. Governments are increasingly employing instruments of intervention to create competitive industries, stimulate innovation and enhance technological sovereignty.

Amid growing geopolitical tensions and the transformation of global value chains, the focus of industrial policy is also changing. In the past, its priority was to ensure the competitiveness of the domestic economy, whereas today the motivation for using industrial policy has expanded. According to 2023 data, the key drivers of industrial policy became strategic competitiveness (37% of all new measures), geopolitical interests and national security (19.7%) and supply chain sustainability (15.2%).

The volumes of industrial policy financing are significant, though exact figures across countries are sometimes difficult to compare due to differences in accounting methodology. Nonetheless, the available data demonstrate that the OECD countries spend on average about 1.4% of GDP on direct measures, i.e. grants, subsidies and tax incentives. Together with indirect instruments such as government loans, guarantees and capital investments, this figure rises to 1.8% of GDP. Almost 1.1% of GDP is spent on export finance programmes – an important tool for supporting the external competitiveness of domestic companies.

The scale of government support measures varies significantly across countries, from 0.3% of GDP in Brazil (of which only a quarter is direct support for businesses) to 1.5% of GDP in China (of which almost half is subsidies and tax incentives, implying a systemic approach to the development of strategic industries). This variability means fundamentally different approaches to the instruments employed and the level of government involvement in the economy.

Differences in the choice of industrial policy instruments do not mean purely technical nuances. On the contrary, they are a key factor determining which countries are strengthening their positions in high-tech segments of the global economy and which ones are facing the risk of being stuck in niches with low added value.

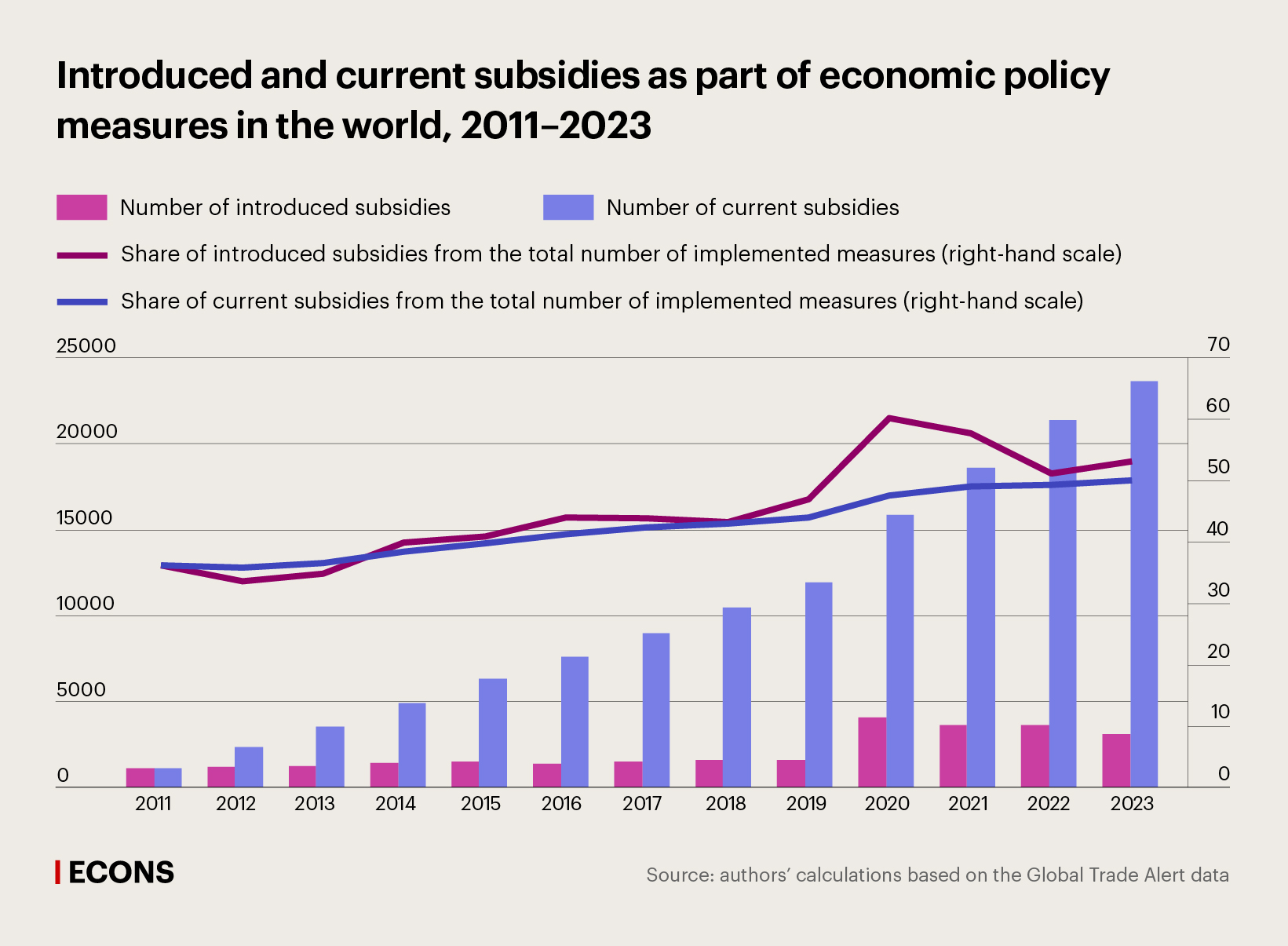

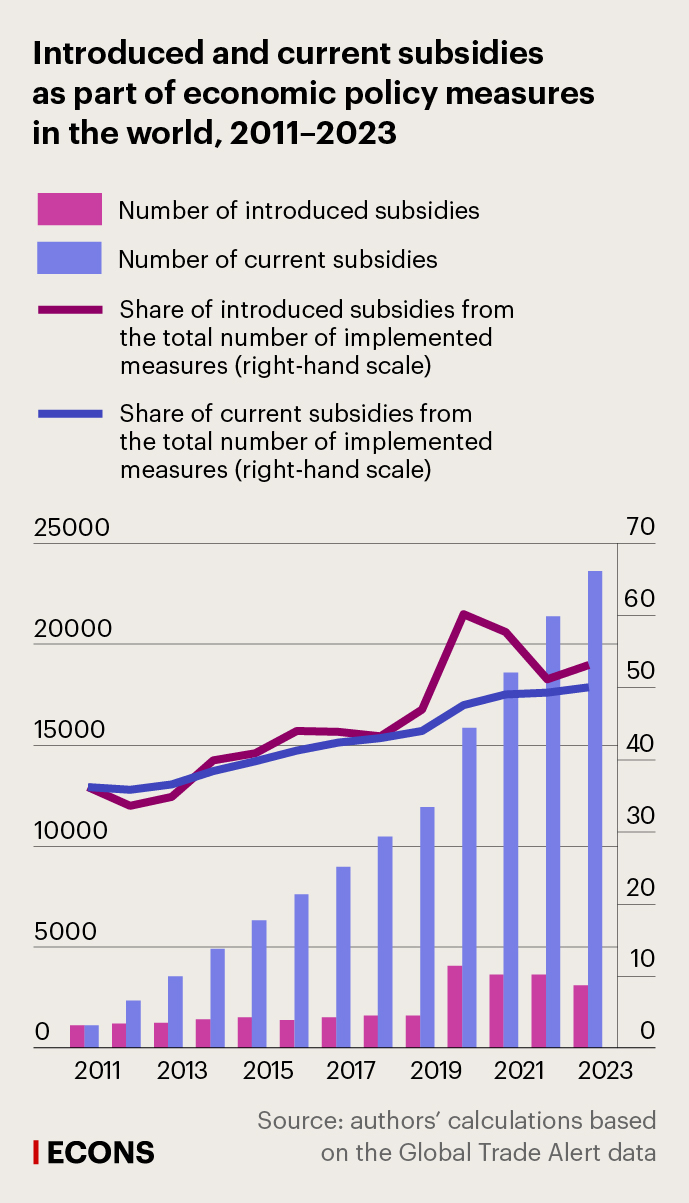

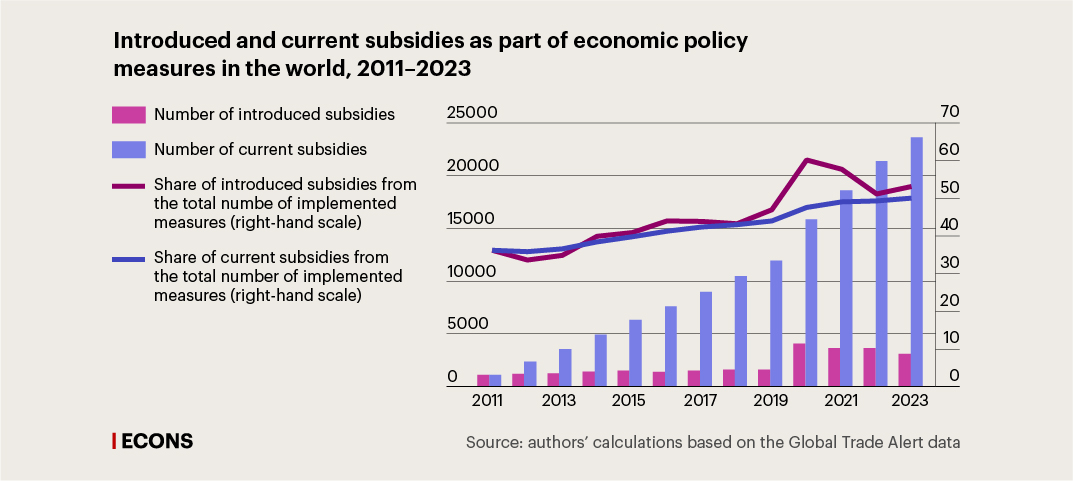

To identify the vector of countries’ industrial policies, our new study analysed more than 6,500 regulations from the Global Trade Alert database on corporate subsidy measures implemented by governments around the world. The study includes measures introduced between 1 January 2019 and 1 July 2023. This period makes it possible to see recent changes in industrial policy practices and covers a sufficiently long period to identify stable trends.

To assess the vector of state industrial policy, we calculate the economic complexity index of government financial support. It shows the average technological saturation across industries or product groups that are covered by financial support measures: the higher the index value, the more high-tech industries receive government support.

Technological priorities in industrial policy of various countries

Advanced economies are ever more often demonstrating the ability to increase the technological complexity of their production and exports, taking leading positions in cutting-edge industries – from microelectronics to biotechnology. Meanwhile, many emerging economies continue to rely on traditional forms of support, such as subsidies for commodity exporters or labour-intensive production, which limits their potential for structural growth.

The gap between advanced and emerging economies in technological policy is becoming increasingly apparent. It is manifested not so much at the level of ambitions, but in the scale, strategy and consistency of government support – especially in such critically important areas as quantum technologies, artificial intelligence, microelectronics and electric vehicles. Striving to achieve technological leadership, China has allocated more than $10 billion for quantum research and announced a programme to develop AI worth more than $70 billion by 2030. All this is not merely support for science – it is a large-scale restructuring of the technological base. Concurrently, for example, Singapore or Australia are implementing more modest, targeted programmes, focusing on the commercialisation of individual solutions.

Strategic horizons also differ. Japan is opting for long-term disruptive innovations – its Moonshot Research and Development Programme provides for the creation of a quantum computer by 2050. Germany, on the contrary, is focused on immediate tasks – its own quantum computer is to appear as early as in 2025. South Korea combines both approaches in the framework of its Digital New Deal, whereby it simultaneously invests $48 billion in the development of several high-tech areas.

Ever more countries are beginning to cooperate with public-private partnerships, involving various corporations (e.g. IBM, Google and TSMC) to accelerate technology introduction. Long-term initiatives such as the European Quantum Flagship or the American National Quantum Initiative Act show a systematic approach to achieving technological independence.

More significant differences can be seen in the support for microelectronics and electric vehicles. The US allocated $280 billion under the CHIPS and Science Act to restore the manufacture of chips on American soil. South Korea aims even further: with a budget of up to $450 billion, it is building a K-Semiconductor Belt, a large-scale cluster that will connect developers, manufacturers and suppliers of microchips to sustain the country’s global leadership in semiconductor manufacturing. At the same time, Israel and Singapore are pursuing more modest goals associated with key links in supply chains.

The forms of support also vary: from direct subsidies in China and Germany to the strategic involvement of external players, as in Japan, or the modernisation of domestic production, as in the US and the EU. Meanwhile, long-term programmes such as the European Battery Alliance set up to create Europe’s own battery production chain, starting from raw materials mining, differ from short-term incentives, e.g. India’s FAME II which provides financial assistance to support demand for electric vehicles in order to speed up their adoption.

Countries under external restrictions, including Russia, typically have narrower and more resource-limited initiatives, whereby support is aimed at quantum cryptography, basic AI solutions or localisation of individual productions. This is rather an attempt not to fall behind in the technological race than to lead it.

Economic complexity index of government financial support

According to current research, ignoring the level of economic complexity in the elaboration of industrial policy may deepen existing imbalances. Without a clear focus on advancing technologically intensive and complex industrial production, countries are facing the risk of reproducing structural traps, i.e. a distorted export structure, dependence on technology imports and limited potential for sustainable growth. This is why the choice of instruments and goals of industrial policy today is becoming not just a question of supporting business, but a strategic decision shaping the future of the national economy.

Our task was to identify the strategic priorities of modern industrial policy, compare the approaches of advanced and emerging economies in its implementation and understand to what extent government support is aimed at developing technologically complex and promising industries.

We constructed a special index for our analysis – the economic complexity index of government financial support (ECIGFS). It helps assess the consistency of countries’ efforts to invest in sectors with high technological potential that can become drivers of long-term growth. The higher the value of the ECIGFS, that we have constructed, the more the government financial support is targeted on high-tech sectors.

The index is based on the modern economic complexity theory, which studies a country’s development not simply through the prism of capital investment, but through the structure of its production capabilities and export potential. This theory links the structure of the economy, including export-focused industries, to economic development and assumes that more complex economy (and exports) structure translates into higher rate of economic development and living standards. This approach, formulated in 2009 by Cesar Hidalgo and Ricardo Hausmann of Harvard, is now widely used to analyse economic development trajectories, assess opportunities for diversification and build sustainable and innovative economies. It shows not just what money is spent on, but to what extent that spending can change the economic landscape in the future.

Our analysis is based on the GTA Corporate Subsidy Inventory 2.1 database, which records government financial support measures for companies worldwide. According to the generally accepted practice of the IMF and the UNCTAD, a subsidy is a non-refundable financial transfer that provides a certain advantage for the recipient. This paper considers only corporate subsidies, that is, measures aimed directly at supporting industries and individual enterprises. Subsidies targeted at final consumers (for example, benefits for housing utilities or transport fares) are excluded from the analysis. This places the focus of our attention on those industrial policy instruments that are directly targeted at the manufacturing sector.

The economic complexity of industrial policy priorities

Approaches used by countries when pursuing industrial policy differ significantly despite the similarity of declared objectives (security, competitiveness, localisation, reliability of value chains and technological sovereignty). Advanced economies tend to make greater use of direct financial instruments, i.e. grants and loans, whereas emerging economies prefer tax incentives, which may result from not only budget constraints but also uncertainties when identifying leaders in new sectors.

When considering the priorities of different countries in industrial policy implementation, we find certain common features among major advanced economies – the US, Germany and China. Their priorities are mainly related to ensuring technological independence (integrated circuits, electronic components), security (data processing systems) and the development of advanced technologies (lithium-ion batteries, static energy storage devices). In the US, one of the most complex economies, attention is paid not only to priority high-tech industries, but also to relatively simple, but politically significant and labour-intensive ones, such as metallurgy and agriculture. This is explained by internal political factors, lobbying and the need to support employment. China is focused on complex and promising industries – electric vehicles, renewable energy and artificial intelligence.

In emerging economies, the relative ECIGFS Index varies considerably. For example, under the international sanctions, Iran made a bet on the development of its own technologies; however, institutional constraints and isolation have limited the long-term impact of these measures. Mexico and Malaysia, despite being closely integrated into global value chains, are lagging behind in developing their own innovation ecosystems. The industrial policies of these countries have led to increased dependence on foreign capital and weak structural changes.

In Russia, despite the economy’s moderate level of complexity, government support instruments have a relatively high complexity. Russia differs by its focus on localisation (medical products and pharmaceuticals, automotive components), developing the digital economy (communication devices, fibre optic systems) and modernising basic industries (electrical components, energy converters).

The observed trend towards increasing selectivity of industrial policy and the use of direct financial instruments seems to be a result of the intensification of competition for leadership in the field of breakthrough technologies, strong regionalisation of global trade and higher external ‘offensiveness’ of economic policy. The deficit of time required to gain a competitive edge in the global economy amid rapid and hard-to-predict structural changes is becoming a critical factor. Competition between leading economies, especially in the markets of advanced industries, is combined with significant (sometimes radical) and fast changes in their positions, with a change in the model of presence in global markets (ideologist, component supplier, integrator).

As for support for small and medium-sized enterprises, governments tend to support such businesses in traditional or simple sectors despite the rhetoric of technological transformation. Apparently, the role of SMEs in ensuring social stability and eliminating inequality remains dominant.

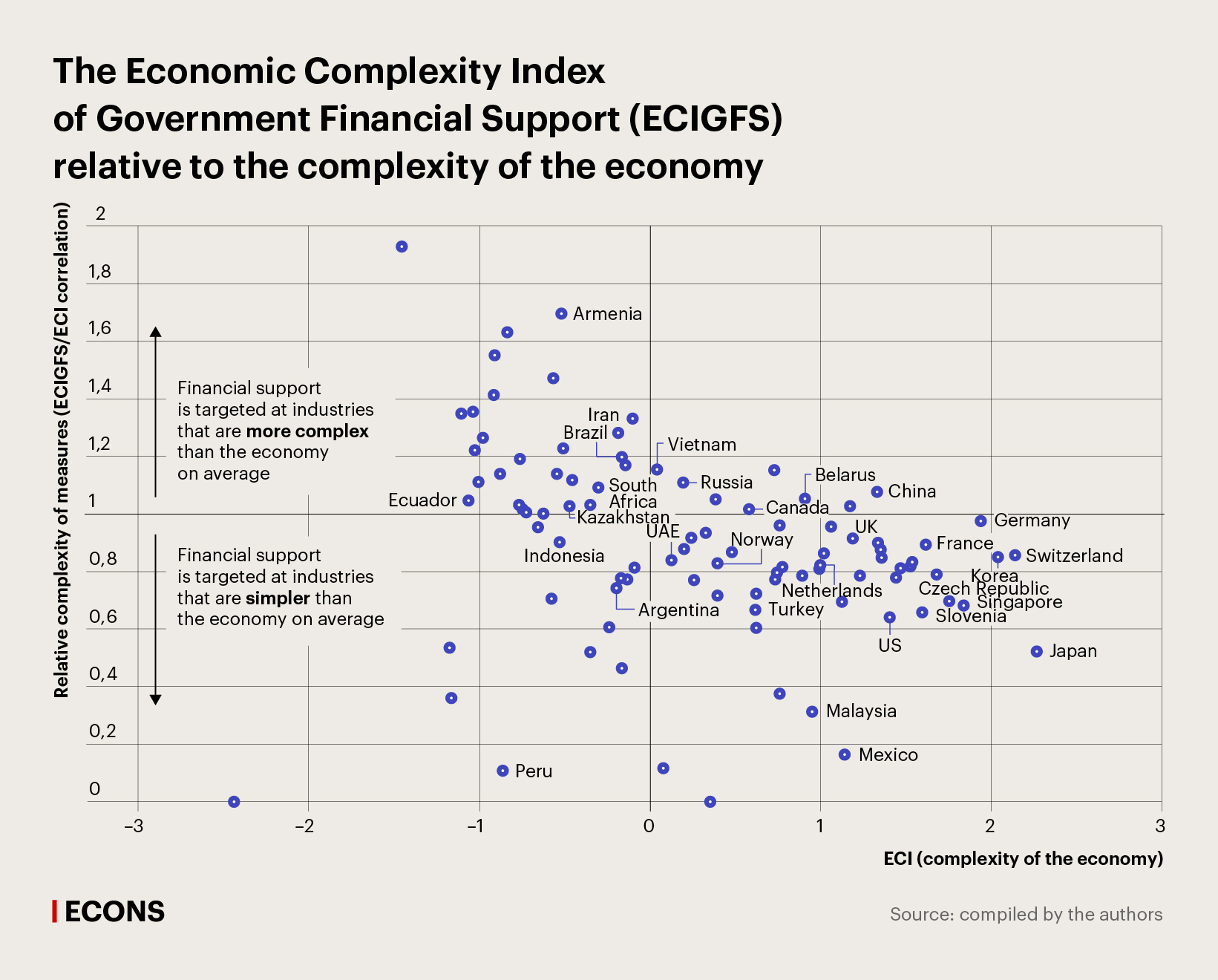

The complexity of the portfolio of support measures and the complexity of the economy are tightly interrelated: the correlation between the ECIGFS Index and the Economic Complexity Index (constructed by Hidalgo, Hausmann and their co-authors in 2014) is on average 0.58, meaning that economies that are more complex support more complex industries (see chart below).

However, when analysing the direction of financial support by country, we arrive at two conclusions. According to the first conclusion, which is intuitively expected, countries with more complex economies typically support industries that are more complex. By contrast, the second conclusion is less obvious and is based on a comparison of the relative complexity of industries in the context of the current level of development of the economy of a given country: advanced economies tend to support industries that are simpler relative to the complexity of their national economy, whereas catching-up economies, on the contrary, support industries with a higher relative complexity compared to the current level of development of their economies.

It suggests that advanced economies redistribute the benefits of technological leadership for the convergence of industries to maintain economic and social stability. Emerging economies are trying to identify new sectoral and technological opportunities for rapid growth to escape the middle-income trap and reduce the gap between them and leading players.

In conclusion, it should be noted that the study has limitations despite the informativeness of the data used. The number of recorded subsidies does not always reflect the actual volumes of funding; the data cover only corporate subsidies, excluding consumer subsidies and hidden forms of government support such as benefits through state-owned companies or indirect tax preferences. In addition, many measures are countercyclical in nature and are not directly related to industrial policy. Finally, the level of transparency varies: between 1995 and 2021, the share of countries informing the WTO about subsidies fell from 75% to 35%. This made it particularly difficult to analyse large economies like China. Therefore, the results need to be interpreted with caution.

The full text of the study is published in the journal Voprosy Ekonomiki, 2025, No. 8.