‘Price Stability Forever’: Central Banks’ Words and Goals

Central banks are still quite new to public communications: for most of their history, they have operated behind closed doors. ‘For most central bankers, communication with the public is like landing on a strange planet; many have not yet landed there at all,’ wrote Alan Blinder, former vice chairman of the Federal Reserve System and one of the world’s most influential economists, and his co-authors in their paper on the complexities and outcomes of central bank communication.

Why do central banks need to get to know this ‘strange planet’, and how is the Bank of Russia doing it? Which is the better: direct or indirect communications (e.g. through the media)? Does understanding always mean trust, and which is the more important? When is it better for the central bank to remain silent? These issues were the subject of an online discussion hosted by New Economic School on April 15. The event was part of the Educational Days (link in Russian) in memory of Gur Ofer, a founder of NES.

‘On a strange planet’

Inflation targeting, currently being implemented by many central banks, involves central bank transparency: for this policy to succeed, it is critical for the central bank to be able to speak, and to speak clearly. Over the past ten years since the Bank of Russia began inflation targeting in 2015, its communications have also changed dramatically.

Alexey Zabotkin, Deputy Governor of the Bank of Russia, looks back to the time before 2014, when the Bank of Russia’s only communication on monetary policy was one-line of a press release stating whether the refinancing rate had changed at all or not.

‘A monetary policy decision now comes with a very detailed set of information: it includes a press release at 13:30 on the day of the meeting, a press conference at 15:00 on the same day with a statement from the governor and a Q&A session. Ten days after the meeting, we publish a summary of the discussion, outlining the nuances of the participants’ views. In addition, we conduct regular meetings with the analytical community, the media, and business representatives, including through our regional branches, and we maintain an active presence in social networks,’ Zabotkin enumerates.

Transparency is essential for the central bank to bring home the idea that the key goal of monetary policy is nothing but low inflation and price stability. The central bank can deliver on this goal through consistent efforts to explain, first, the importance of maintaining price stability and achieving low inflation, and second, the method for the central bank to achieve these goals, Zabotkin explains. ‘The better all economic agents – financial market participants, businesses and households – understand the rationale behind central bank action, the more rational economic decisions they make in everyday life’.

Russia’s case is special because of a long history of high inflation: the hyperinflation of the 1990s was followed by a decade and a half of double-digit inflation with short-lived dips to 7–8%. Then came the four years of low inflation in 2016–2019. However, the coronavirus pandemic and the subsequent geopolitical shock triggered the comeback of high inflation – not as high as before the inflation targeting regime but above the target level of 4%. In 35 years, there were barely five years of little to no change in prices. It is only natural that in the minds of consumers and businesses these years are at odds with the concept of price stability, Zabotkin admits: ‘What is price stability? It is when expectations about future price changes do not impact the decisions of households and businesses.’

The very short period of such stability that people remember explains the high and unanchored inflation expectations. And high and unanchored expectations make it imperative to strengthen the monetary policy response to recurrences of high inflation. Ultimately, the price of insufficiently anchored inflation expectations is the higher interest rates and the higher cost of capital in the economy.

Therefore, the main thing central banks strive for in their public communication is ensuring that households are confident in the intention to achieve low inflation. This is even more important than public awareness (link in Russian) about a central bank target for inflation; what ultimately matters is public confidence that the central bank is safeguarding low inflation, Zabotkin emphasises. The first priority is to rule out any doubt that current monetary policy is centred on the goal according to which money remains money, that is, it is a policy ensuring the purchasing power of the national currency is predictable and changes little over time.’

Low inflation enables predictable conditions for businesses and makes it easy for households to plan savings and spending not just for the next 3–6 months, but over a much longer term. The Russian issue of long-term lending availability, no less relevant than before, is largely determined by savings. People who build up savings should be confident in low inflation, explains Zabotkin: ‘Otherwise, long-term interest rates will never be low.’

Trust is like a lever: if it is up, central bank action brings higher returns; if down, the returns are much weaker, adds NES rector Anton Suvorov.

Talk or action

Communications should not be understood as an alternative to action, warns Oleg Shibanov, director of Finance, Investments and Banks and Masters in Finance programmes at NES. Shibanov thinks that the famous remark by Ben Bernanke, the Federal Reserve’s chairman in 2006–2014, that monetary policy is 98% talk and 2% action is just a joke.

Talk usually includes forward guidance – a system of statements about the future direction of monetary policy. This communication tool gained currency in the 2010s, a time of very low inflation (link in Russian) in advanced economies, which left the central banks without room for a further rate reduction to stimulate the economy. However, it was critical to retain the ability to shape inflation expectations and avoid their excessive decline (and prevent the economy plunging into a deflationary spiral, when consumers buy less in the expectation of a further drop in prices and businesses reduce their output and staff as demand declines). This is why central banks switched to forward guidance, or statements of intent, relying on this tool to reduce future uncertainty and explain their action.

‘For example, the US central bank said: look, we will keep rates low for a long time because inflation is low and unemployment is high. We need to somehow fix this, and we will fix it by all the available means,’ Shibanov explains.

Communication is therefore needed precisely to ensure that the central bank explains its actions, rather than substitutes them with words. Shibanov believes that the fact that the largest central banks, including the Federal Reserve and the ECB, delayed (link in Russian) their rate hikes in 2021 and inflation was a 40-year high in 2022 may well be the result of their attempts to ‘talk down the problem’ and substitute action with words.

‘I can only agree that specific decisions of the central bank are considerably weightier than communication. Yet communication is a very important additional tool to increase the effectiveness of central bank decisions,’ adds Zabotkin. Communication cannot replace, for example, monetary tightening, but it can help the effects of this tightening, all else being equal, emerge more rapidly and hereby potentially reduce the amplitude of the interest rate cycle. The central bank’s clarifications help financial markets, companies and households better understand its decisions and future actions and ultimately adjust their own decisions ahead of such further actions.

Zabotkin cites the Bank of Russia's experience in June–July 2024 as an example. In 2024, the June meeting of the Board left the policy rate unchanged at 16%. However, the Board mentioned that it was open to increasing the key rate should incoming data confirm the concerns about persistently rising inflationary pressures. Starting from the June meeting, market interest rates including both credit and deposit rates, grew until the July meeting where it was decided to raise the key rate by 2pp. But the market had already priced in this increase. ‘This is what we call forward-looking communication, which allows economic agents to adjust their behaviour to monetary policy as the data emerge to which monetary policy responds,’ says Zabotkin. In 2022, when both price and financial stability were at risk, the prompt and compelling public communication, together with a steep rise in the key rate to 20%, made it possible to head off financial stability risks in a matter of several days.

Narratives and Macro-Telegram

Economists tend to trust actions more than words. Indeed, it seems that actions should overall play a more important role, although a large body of research suggests that words carry a great weight, Anton Suvorov objected. Narrative economics (link in Russian) became the focus of a book by Nobel Prize laureate Robert Schiller, who looks into the way stories, i.e. words, spread like a virus, changing people’s economic behaviour and shaping markets. One study found (link in Russian) that narratives also drive the business cycle – their influence is responsible for some 20% of the US fluctuations since 1995.

Research confirms that people’s inflation expectations are quite sensitive to incoming information, Suvorov says. As a rule, these studies draw on randomised experiments in which participants are given different forms of information, and the result is subsequently compared. For instance, in an experiment (link in Russian) in Germany, one group of participants was shown a numerical inflation forecast of the ECB, and the other a numerical forecast with ECB explanations. Once this information was received, both groups showed a decrease in their inflation expectations, but the decrease in the second was more substantial.

Some studies show that communication affects not only expectations, but also actions. In one of the papers the authors conducted a six-month experiment, observing the participants’ spending. It turned out that the actual spending of the participants was quite sensitive to the information they received in the experiment.

When we talk about which communication is more effective – direct or indirect (through the media and analytical community), global experience makes the case for multi-layer communication. The main thing is to ensure that the central bank’s messages distributed through various channels are consistent (link in Russian) with each other.

For the Bank of Russia, it is important to convey its views and intentions through the media, says Zabotkin: ‘For many years, we have held training events for the journalist community, including the regional media. These events are held each and every year, and it is now obvious that the quality of comments on monetary policy and macroeconomics in general in the media is slowly but steadily improving.’

Over the past three years, we have come across a new interesting phenomenon in Russia – an information field called Macro-Telegram, says Zabotkin. This is a collective name for Telegram channels of professional, academic economists, investment strategists, investment bank macroeconomists and brokers. Their views are often different, they argue with each other and present real-time opinions across the spectrum, including related to monetary policy. ‘It is important for us that this information field accommodates a correct understanding of what we want to say. Macro-Telegram with its instant feedback capability enables us to clarify our signals faster than when this kind of information field did not exist,’ he says.

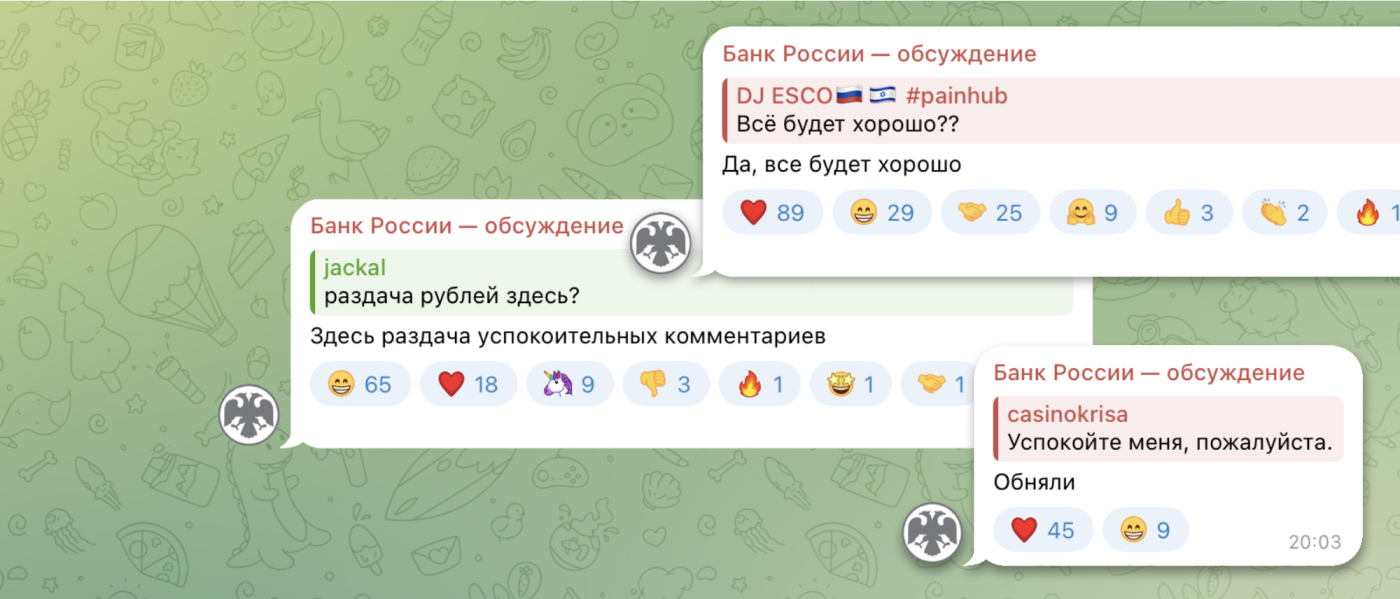

Direct communication tools include our own, the Bank of Russia’s Telegram channel, and its format is quite non-standard for government agencies, notes Zabotkin: ‘Given that it enables discussions and [subscribers’] comments, it is probably a unique practice for an official body. Before too many participants joined the channel, our social media support experts answered questions in almost real time. It is now impossible because of the rapid expansion of subscribers, and we have changed the format to providing a selection of answers to the most frequent or interesting questions. In my opinion, readers appreciate this as the validation of transparency and readiness for dialogue.’

Questions and doubts tend to be recurrent, Zabotkin says, but the central bank should not become tired of repeating the basic principles it is guided by: ‘The result is not immediate, but over a longer horizon we have it. Our horizon is price stability forever.’

Recently, communication with the academic community in Russian regions – in addition to Moscow and St. Petersburg – has become another priority channel of direct communication for the Bank of Russia. ‘We will interact more actively with academia in both educational and research institutions to maintain a broader dialogue with those who teach the next generation of economists. This is important in terms of quality of economic policy over a long-term horizon,’ says Zabotkin.

The main message of any central bank in inflation targeting is that the central bank will respond to any changes in conditions in such a way as to maintain or return inflation to target, Zabotkin emphasises. The Bank of Russia puts this message in several formats: simplified – for households and a detailed description of the logic behind monetary policy transmission as well as analytical and research materials – for analysts. On the Bank’s website, there is a special section about forecasting and modelling, which outlines methodologies and describes the model-based approach the Bank of Russia’s experts rely on in building their forecasts and which is the basis for the monetary regulator's decisions. Furthermore, it is extremely important to keep in mind that the rate path forecasts published by the central bank are not a commitment to a certain trajectory no matter the circumstances. The path announced depends on the assumptions behind the forecast, and a change in the assumptions triggers a change in the forecast, Zabotkin highlights.

AI in communications

Artificial intelligence (AI) has been extensively tested at central banks (link in Russian) including in analysis of communications (link in Russian). For example, in one of the most famous studies on the subject, Yuriy Gorodnichenko of the University of California, Berkeley and his co-authors use a neural network to analyse the emotional tone (link in Russian) of written and verbal statements of Federal Reserve chairs; they then compare the identified emotions and the market reaction. They find that a more positive tone from the central bank head statement sends the market upwards, lowering volatility and inflation expectations.

For all its good performance at structuring press releases, AI is hardly a good assistant for communication, including due to the lack of emotional intelligence. Disruptive communication technologies are likely to emerge at the junction of artificial and emotional intelligence. That is, maximum potential is to be found in cross-subject research that harnesses the methods of cognitive psychology, behavioural economics, and AI, Alina Evstigneeva of the Bank of Russia noted (link in Russian) in her column.

AI is good at highlighting themes and tones in press releases, but it is mainly an attempt to try something new, Oleg Shibanov believes. ‘Its findings must not be relied on: AI often misses key things in the text [of press releases]. I would still view AI as an auxiliary tool.’

The capabilities of AI and LLM models are still beyond the scope of communication tasks, Zabotkin agrees. ‘An attempted instruction to an LLM to simplify the summary ends up with the expected result – the LLM removes all the most important and hotly debated nuances of meaning,’ he shared the results of his own experiments.

AI, an ‘average expert’ knowledgeable about a large number of facts, can downplay a topic – which is extremely relevant at the moment – for simple reasons of averaging its entire monetary policy knowledge base. Collective discussion is valuable in that a large number of people with different opinions take part in it, whereas an LLM cannot replace this large number of different people. ‘I do not think that AI is an effective way of writing texts that should reflect some generalised collective opinion or the course of the discussion’, Zabotkin says.

He believes that LLMs are more promising for testing new communications: for example, one can train LLM agents with certain views about the world and the economy and ask this group of robots to interpret Bank of Russia communications. This may bring quick feedback, showing possible improvements to materials and reasoning, so they are clearer and more easily understandable to various groups of people. ‘This is a promising line of research,’ concludes Zabotkin.